Purge of foreign stocks from portfolio

Mohnish Pabrai lives in California. However, his heart is in Dalal Street.

Mohnish candidly admitted to the members of his PMS Funds that he is smitten by Indian stocks.

“I love what we own in India. We’ll make a lot of hay from our Indian holdings in the years ahead,” he said.

At the same time, he was dismissive about foreign stocks.

“I don’t find the U.S. markets overvalued, but they aren’t obviously undervalued either. The pickings in the U.S. have been very slim.”

The result is that Mohnish has been slowly and steadily dumping the foreign stocks in his portfolio.

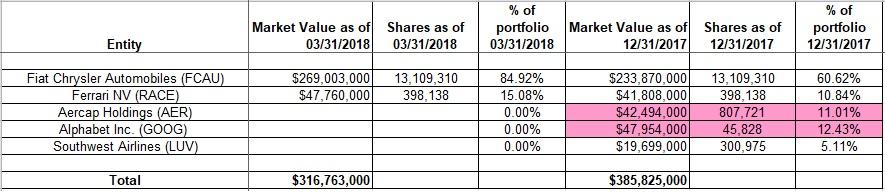

According to the sleuths of seeking alpha, Mohnish now has only two foreign stocks in his portfolio, namely, Fiat Chrysler and Ferrari.

Three stocks were put on the chopping block. These are Alphabet Inc., Southwest Airlines and AerCap Holdings.

(Image credit: Seeking Alpha. Click for larger image)

Due to this, the portfolio value has plunged from $386M to $317M.

It is anybody’s guess how long Fiat Chrysler and Ferrari will retain their coveted position in Mohnish’s portfolio.

We shouldn’t be surprised if one fine day he unceremoniously dumps these stocks as well!

Latest stock pick – Repco Home Finance – “No Brainer” HFC Stock

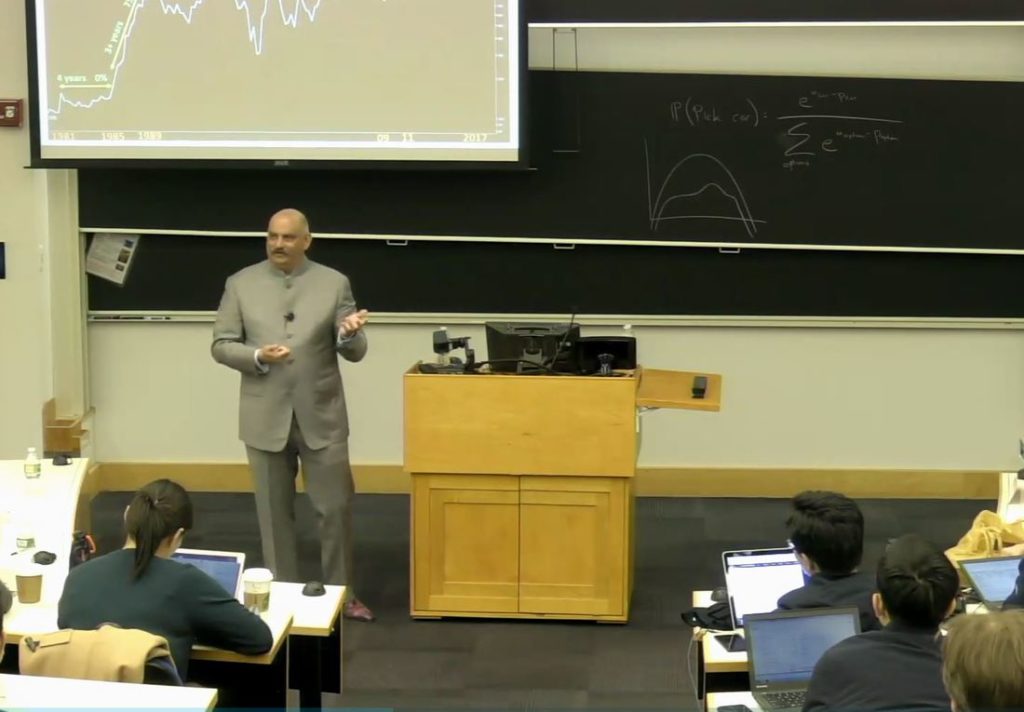

Mohnish recently delivered a talk at the elite Columbia University in which he described housing finance stocks in India as “no brainers”.

The logic was flawless:

“As India rises, it is a no-brainer that people will want good housing and it is a no-brainer that they will have to finance it because there is no way that they can just buy it with their income levels …..

…. The housing finance sector will grow at 3 or 4 times GDP growth. So, if India is growing at 7%, the housing companies may be growing at 20 to 30%”.

Prof. Bruce Greenwald, the eminent global authority on value investing, was one of the dignitaries on the dais.

While Prof. Greenwald may not be familiar with Indian stocks, he knows good value when he sees it. He vigorously nodded his head in affirmation of Mohnish’s theory.

(Click on image to view video)

Top-secret buying of Repco

Mohnish normally likes to come personally to Dalal Street and buy his entire quota in a bulk deal.

However, in the case of Repco Home Finance, Mohnish was keen to keep his buying a secret.

He roped in six of his funds named Pabrai Investment Fund II LP, Pabrai Investment Fund 3 Ltd, The Pabrai Investment Fund IV LP, Dhando India Zero Fund LP, Dhando India Zero Offshore Ltd, Dhando Holdings LP and Dhando Holdings Qualified Purchaser LP, to buy small bits and pieces of the stock so as to fly under the radar.

Of course, Mohnish’s attempt at secrecy was futile because it is not possible to keep anything a secret from the ace sleuths of the RJ Fan Club for too long.

We tracked down the official disclosure made by Mohnish to the BSE which reveals all details of his purchases.

As of date, Mohnish holds a treasure trove of 32,31,728 shares of Repco comprising 5.16% of the equity capital.

The investment is worth Rs. 184 crore at the CMP of Rs. 568.

Repco Home Finance will be a multibagger: Basant Maheshwari

Basant Maheshwari was the first discoverer of Repco Home Finance’s potential.

He recommended it as his “best pick for 2014”.

As usual, Basant’s analysis was crisp and to the point:

“Against its issue price of Rs172, the stock is currently trading at Rs 292, translating to 12 times estimated FY15 earnings per share of Rs 25 and at around 2.1 times projected FY15 book of around Rs 140.

Given the reasonable valuation and enough room for growth, the stock should do well in 2014 and appears to be a potential multi-bagger.”

Repco surged to an all-time-high of Rs. 725 on 8th January 2018, fulfilling Basant’s prophecy of multibagger gains.

It is presently resting at Rs. 568.

Basant has since shifted his allegiance from Repco to PNB Housing Finance.

However, this has no consequence because Basant regards stocks as “tickets to creating wealth” which are swappable with each other.

We learn with time & one learning is that most things are expensive for a reason.Though the returns of Page from our ‘exit’ is only 19% cagr it’s worth it as one didn’t lose sleep making that 19%. But if stocks are just tickets to creating wealth it’s ok swapping one for another. https://t.co/zutsy5FqrQ

— Basant Maheshwari (@BMTheEquityDesk) May 26, 2018

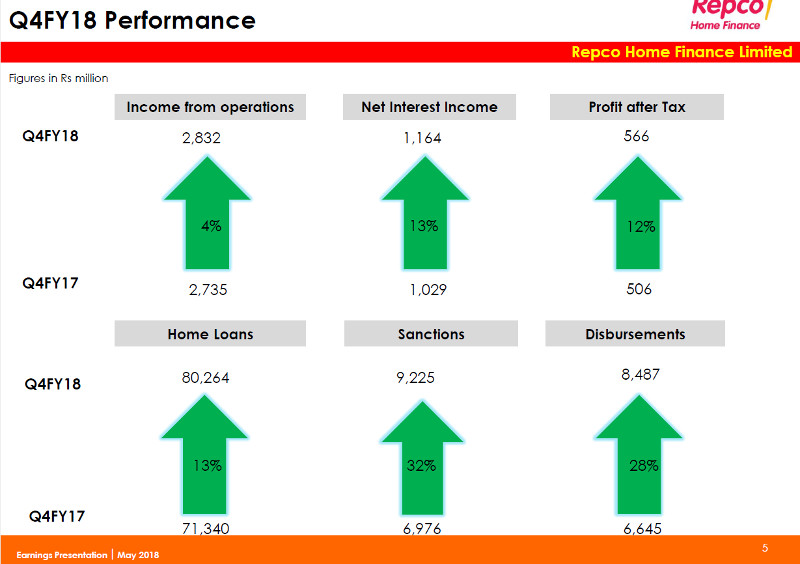

Tight leash on NPAs + hike in NIMs makes Repco a no-brainer

The latest investors’ presentation reveals that Repco is getting its act in order.

The Q4FY18 results are quite impressive on all fronts.

In addition, R.Varadarajan, the MD & CEO, assured that the Company will reduce cost of funds and improve spreads. He also assured that the Gross NPAs will be brought below 2% in FY19.

Focussed on reducing cost of funds and improving spreads; We also aim to bring down Gross NPA to below 2% in FY19, says R.Varadarajan, Managing Director and CEO, Repco Home Finance to @tanvirgill2 & @nikunjdalmia pic.twitter.com/JYmK5eiTdG

— ET NOW (@ETNOWlive) May 24, 2018

Aim for 50:50 ratio of salaried and non-salaried customers: R .Varadarajan, MD & CEO of Repco Home Finance pic.twitter.com/0TN5wn3Q0R

— ET NOW (@ETNOWlive) May 24, 2018

What about Shyam Sekhar’s allegation that Repco HF is a “huge scam” and upto “dark deals”?

Shyam Sekhar shocked his followers by suddenly alleging that there is a “huge scam” in Repco Home Finance and that it is indulging in “dark deals”.

Huge scam in Repco home finance. Raids by CBI. I always knew this Co was upto dark deals.

— Shyam Sekhar (@shyamsek) October 8, 2016

Fortunately, the allegation turned out to be a false alarm.

The CBI gave Repco a clean chit and closed the FIR on the basis that there was a “mistake of fact”.

'Mistake of fact': CBI closes FIR against Repco Home Finance MD, 3 others https://t.co/hc6HPD6F2W@tenarasimhan pic.twitter.com/9gNtukD3nU

— Business Standard (@bsindia) February 15, 2018

In addition, Motilal Oswal has given cogent reasons as to why Repco Home Finance is a good buy.

#SolidResearchSolidAdvice Repco Home Finance – At the crack of dawn! Price correction provides a good entry point. A good opportunity to buy. Read more at: https://t.co/oViuQ0Nfzm pic.twitter.com/4buYVEfZ5x

— Motilal Oswal Group (@MotilalOswalLtd) December 11, 2017

Kaveri Seed, “Moat” stock in agriculture sector

Mohnish, like all other stock wizards, is bullish about the agriculture sector in India.

In an interview with Tanvir Gill, Mohnish stated that the Indian agricultural sector is a huge portion of the economy and has great potential.

Mohnish’s game plan is to tuck into agriculture stocks where there is “value addition”.

Agri stock 1: KRBL

KRBL is a textbook example of this.

The Company buys raw basmati rice from farmers at throwaway prices and sells them to affluent consumers under branded names like “India Gate” at exorbitant premium.

The huge profit margins made from the so-called ‘value addition’ has led KRBL to give magnificent 35-bagger gains to investors over the past ten years.

Mohnish bought a massive consignment of 64 lakh shares of KRBL for his Pabrai Investment Funds on 12th February 2018.

He has invested Rs. 381 crore into the stock.

Incidentally, Dolly Khanna’s portfolio has two spectacular agriculture stocks in it being GNFC and LT Foods (Daawat). Both are also mega multibagger stocks and are likely to enrich her further in the future.

Agri stock 2: Kaveri Seed Co

Mohnish bought 7.79 lakh shares of Kaveri Seed Co at Rs. 487.29 each. The sum invested is Rs. 38 crore.

Pabrai Investment Fund II buys 1.2% equity in Kaveri Seed at Rs 487.29 each. pic.twitter.com/LerJE4YxGW

— BloombergQuint (@BloombergQuint) May 23, 2018

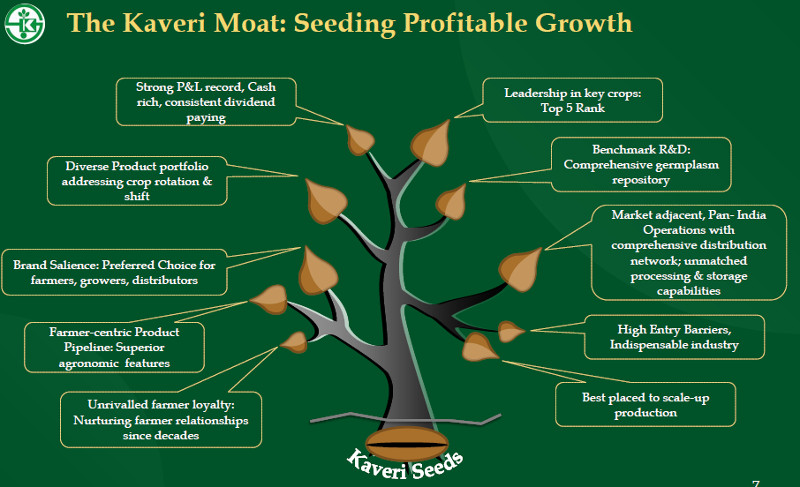

The best way to understand the prospects of Kaveri Seed is to peruse the latest investors’ presentation.

That there is a massive and insatiable demand for branded and hybrid seeds is quite evident from the following data:

“Industry Overview

– The Agriculture sector commands the largest share of the country’s total land area at about 48% (or 156 million hectares) compared to USA’s 18% (or 158 million hectares) and China’s 15% (or 106 million hectares). While India has more arable land than China, its production is only half that of China

– The reasons for the lower productivity are low usage of high quality seeds, fertilizers, pesticides, lower farm mechanization, weak credit facilities, shortage of water and energy

– The organized Indian seed industry has been in existence since 30+ years; however the last decade has witnessed exponential and transformational growth

– The Indian Seed Industry is the 6th largest in the world in value terms accounting for about 4.5% of global industry preceded by the US (27%), China (22%), France (6%), Brazil (6%) and Canada (4.8%)

– In volume terms consumption has seen a CAGR of 8.4% from FY09 to FY15 to reach 3.5 million tonnes

– Use of branded seed and hybrid seed has been consistently increasing, Seed Replacement Rate (SRR) on the rise”

It is also claimed that Kaveri Seed has a “moat” and the same is depicted by this image.

Cash reserves of Rs. 500 crore

Kaveri Seed is not only debt-free but has a massive cash reserve of Rs. 500 crore.

According to the ET, the Company has an ambitious game plan of expanding its business in high-margin non-cotton segment that include rice, maize and vegetable seeds by buying the latest technology.

It is also aiming for at least 20-25% annual topline growth over the next three-five years.

C Mithun Chand, the ED, revealed that due to focus on high-margin non-cotton business, there would be an attractive profit growth of 200-300 basis points more than the growth in topline.

He also indicated that the company could surpass Rs 1,000 crore mark in annual revenues in the next couple of years.

What about Nath Bio-Genes?

At this stage, we have to note that Billionaire Satpal Khattar has loaded on to Nath Bio-Genes, Kaveri Seed’s arch rival in the genetic seeds business.

According to Mudar Patherya, Nath Bio-Genes is at the “cusp of unprecedented opportunities” and will shower incalculable multibagger gains upon investors.

Mudar has given sound logic in support on his assertion.

All that Mudar has said about Nath Bio-Genes prima facie applies to Kaveri Seed as well.

Nath Bio-Genes is also targeting 25-30% YoY growth in revenues and profits.

Nath Bio Mgmt: Tgting 25-30% YoY growth in revs & profits. see mgn expansion, on back of improved product mix. https://t.co/iYVNF7EfdI

— Ajaya Sharma (@Ajaya_buddy) October 17, 2017

Both of Mohnish’s latest stock picks are at the bottom of the barrel

One aspect that is worthy of note is that both Repco Home Finance and Kaveri Seed are presently languishing at the bottom of the barrel in terms of returns to investors.

They have grossly under-performed the benchmark indices.

Repco, owing to the surging NPAs, has lost 24% over the past one year and 15% over 24 months.

Similarly, Kaveri Seed, owing to its dispute with Monsanto over the royalty issue and other problems, has not performed well over the past couple of years.

This is a blessing a disguise because it means that there are no lofty expectations embedded into the stock and so there is risk of a savage sell-off due to a disappointment.

On the other hand, even a slight improvement in the operating metrics will be sufficient to send both stocks surging into orbit.

This makes both stocks a textbook example of the “Heads I Win, Tails I Don’t Lose Much” theory propagated by Mohnish Pabrai in all of his lectures to novices!

Wall street is better covered,more widely analysed ,hence it is definitely more difficult to find pocket of inefficiencies ,which is exploited to get investment returns. Hence mohnish’s steps seems quite logical.

Mohnish and Shyam never seem to be on the same page.Its strange because both are value investors and seek margin on safety!

Nath Bio Genes has a good run, though stock looks fundamentally strong technical are not supporting that strength. Therefore my confidence on it is low.

Credential and transparency level of management either create or destroy wealth of investors. In both condition promotes earn money. In Nath case it is doubtfull