In September 2013, the headlines screamed that Mohnish Pabrai had “crushed the market” thanks to the superior investment performance of his hedge funds.

Today, the headlines are screaming about how Mohnish Pabrai is “getting crushed” thanks to a 20% loss suffered by his hedge funds.

Such is the nature of the stock market that yesterday’s hero can become today’s zero and vice versa. One can never rest on one’s laurels because one can never say when the tables will be turned.

Poor performance of Mohnish Pabrai’s hedge funds in CY2015

All three of Mohnish’s hedge funds named Pabrai Investment Fund 2, Pabrai Investment Fund 3 and Pabrai Investment Fund 4 have lost between 15% to 19% for the year.

This compares poorly to all three of the Benchmark indices being the Dow Jones, Nasdaq and the S&P 500 which gave a positive return ranging from 6.5% to 10%.

The surprising aspect is that one of the funds, Pabrai Investment Fund 4, has underperformed since inception. In the period from 1st Ocrober 2013 to 31st December 2015, the fund delivered an annualized return of 7.3% while the benchmark indices have delivered 8% to 10% in the same period. In fact, a sum of $100,000 invested in this fund would be worth $2,37,100 while the same amount invested in the Nasdaq would be worth $3,21,800.

| Period | DJIA | NASDAQ | S&P 500 | Fund | |

| PABRAI INVESTMENT FUND 2 (US Accredited Investors) Performance Summary: |

| 1/1/15-12/31/15 | +0.2% | +7.1% | +1.4% | -19.0% |

| Annualized | +5.8% | +3.1% | +4.4% | +12.9% |

| Cumulative | +136.8% | +58.4% | +91.6% | +535.2% |

| PABRAI INVESTMENT FUND 3 (Offshore/IRA Investors) Performance Summary: | ||||

| 1/1/15-12/31/15 | +0.2% | +7.1% | +1.4% | -16.7% |

| Annualized | +6.8% | +8.2% | +6.5% | +10.7% |

| Cumulative | +148.5% | +199.6% | +139.3% | +313.3% |

| PABRAI INVESTMENT FUND 4 (US Qualified Investors) Performance Summary: | ||||

| 1/1/15-12/31/15 | +0.2% | +7.1% | +1.4% | -15.4% |

| Annualized | +8.0% | +10.0% | +8.2% | +7.3% |

| Cumulative | +156.1% | +221.8% | +163.9% | +137.1% |

Horsehead Holdings Corp (ZINC)

The debacle is attributable to a company called Horsehead Holdings (ZINC). Mohnish’s hedge fund aggressively bought a treasure trove of 6.3 million shares of Horsehead. He called it a “classic Ben Graham net net investment” on the basis that it was trading well below its net worth.

In a newsletter of January 2016 to the investors of his hedge funds, Mohnish described the “major capex decisions and execution skills” of Jim Hensler, Horsehead’s CEO, as “flawless”.

Yet, Mohnish lamented in the same newsletter that “Horsehead’s stock is at an all-time low of 67 cents”. He explained that this was because Horsehead “ran into a number of cost overruns and ramp-up problems at the new plant” and “At the same time, zinc prices have gone down to levels last seen during the financial crisis”.

The double whammy meant that Horsehead, which was valued at $100 million in the beginning of 2015 was worth less than $5 million by the end of 2015.

“The company has run into severe liquidity issues with no easy prospects of raising capital” Mohnish added grimly.

“It is hard to predict where we end up with Horsehead, but the prospects are not good” Mohnish said in a prescient tone.

Horsehead is now bankrupt and the investment is worthless

The latest news is that Horsehead has filed for bankruptcy under Chapter 11 of the US Bankruptcy Act. According to reports, while the market cap is $18 million, the debts exceed $544 million which means that the shareholders will get nothing from the company.

Mohnish appears to have anticipated this dire situation because he observed in the newsletter “Even with a 100% loss on Horsehead, Pabrai Funds has plenty of other great irons in the fire and we expect to do quite well in the years ahead”.

Lessons to be learnt from the Horsehead fiasco

There are important lessons to be learnt from the bitter experience that Mohnish Pabrai and his investors have suffered from the Horsehead fiasco.

Avoid commodity stocks like the plague

In his newsletter, Mohnish expresses surprise that “Nickel prices have collapsed to a multi-decade low” and calls it a “trifecta of low probability events in unison”.

However, the fact is that commodities are notorious for their unpredictability and fluctuation. They are so sensitive to macro events that even a slight change in some remote part of the Globe is sufficient to send their demand and supply patterns off course.

Basant Maheshwari delivered a talk where he mocked investors (@31.50) seeking to invest in commodity stocks by saying that if they understood commodity prices so well, they should trade on the London Metals Exchange and make a fortune instead of eking out a living on the stock market.

“The biggest crime is committed by analysts who do a DCF valuation of commodity stocks,” Basant said with his typical flourish.

Basant added that even if one is enamoured by commodity stocks, he can at no stage invest more than a small percentage of his wealth in such stocks. Commodity stocks are totally unfit for a concentrated position, Basant declared.

Investing in commodity stocks is contrary to Warren Buffett’s credo

Nikunj Dalmia asked Mohnish Pabrai (@19.18) why despite Warren Buffett’s aversion to investing in commodity stocks, Mohnish was willing to invest in them.

Mohnish replied that “commodity businesses are perfectly fine to invest in”. “The key is to find the lowest cost producer” he said.

In the same interview, Mohnish also disclosed that he had invested in Horsehead because it was “the lowest cost producer”.

Obviously, Mohnish’s theory that investing in commodity stocks which are low cost producers is “perfectly fine” is proved wrong.

Perils of a concentrated portfolio

Mohnish also revealed in the interview (@15.37) that his investment style is to make “selective” and “big bets”. In other words, Mohnish likes to maintain a concentrated portfolio.

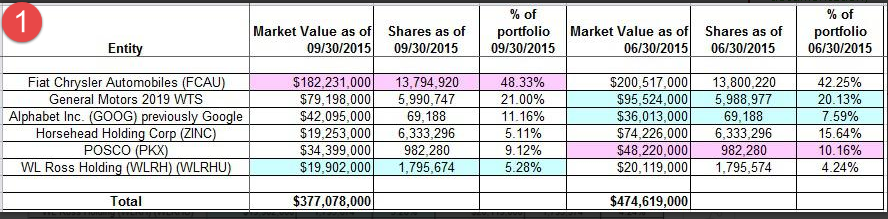

The portfolio (as of 30th June 2015) reveals only six stocks being Fiat Chrysler Automobiles, General Motors, Alphabet (Google), Posco and W. Ross Holding apart from Horsehead. Fiat Chrysler has been allocated a whopping 42.25% of the value of the portfolio. Horsehead has been allocated 15% of the value of the portfolio.

(Image Credit: Quora. Click for larger image)

The dangers of such a concentrated portfolio are painfully obvious. The failure of one stock has dragged the entire portfolio down considerably.

“Our entire 2015 loss of 15-19% is because of the decline in Horsehead. If Horsehead’s stock price had stayed flat, we would have ended the year flat” Mohnish revealed ruefully in the newsletter.

Bill Ackman also lost heavily because of a concentrated portfolio

It is worth recalling that Bill Ackman’s concentrated bet on Valeant Pharma was responsible for the crippling loss that his hedge fund, Pershing Square, suffered. Pershing Square has so heavily under-performed that experts are suggesting that even novice investors with rudimentary investing skills do better than Bill Ackman.

If Ackman has taught us anything, it’s that if you run a concentrated portfolio, don’t be wrong. https://t.co/G2uyydQRgk

— Irrelevant Investor (@michaelbatnick) August 3, 2016

Warren Buffett’s view on concentrated vs. diversified portfolios

Warren Buffett is credited with advocating the merits of concentrated portfolios with his classic quote “Diversification is protection against ignorance. It makes little sense if you know what you are doing”.

However, Warren himself was at pains to clarify that his advice is not directed to novice investors. “Average investors should extensively diversify” Warren said. In fact, Warren propagated the merits of diversification to the extent that he advocated buying index funds and not even specific stocks!

Of course, Warren also added that professional investors who “know businesses” make a mistake by diversification.

However, as we have seen in the case of Mohnish Pabrai and Bill Ackman, the question whether one really “knows” the business cannot be answered with conviction until after it is too late to retrace steps.

Concentrated positions can pose a “catastrophic” risk

“Holding a large, single-stock position creates significant risk and increases portfolio volatility, which can have a catastrophic effect to an investor’s future financial security” Raymond James, a FII says.

Diversification is the only free lunch in investing

Kevin O’Leary, a fund manager who manages $1.5 Billion colourfully stated (@17.20) that “Diversification is the only free lunch in investing”. He said that “the basic lesson that he learnt and never varies from” is never to invest more than 5% of the portfolio in any one stock no matter how great the story is. Also, he ensures that the allocation to any one sector never exceeds 20%.

Mohnish admits to overexposure to the stock

Mohnish has candidly admitted in the newsletter that he overexposed his funds to Horsehead. He stated that looking back at all the available information, he would still have made the investment though he would have maxed out at $35 million and not gone the whole hog to $62 million.

Never buy a position so large it has to be reported

Mohnish Pabrai also says in the newsletter that buying Horsehead per se was not a mistake but buying more than 4.9% of its equity was a mistake. “There are obvious reasons why going over 4.9% is dumb” he says.

Mohnish’s explanation is that the huge holding made him subject to insider disclosure rules which made stealth selling impossible. The sale of even a single share has to be reported to the stock exchanges which means that the price would simply collapse making further sales impossible.

“If we owned less than 4.9% of Horsehead, it is almost certain we would have done tax loss selling in 2015 at significantly higher prices – and decided not to buy it back based on all the updated current facts” he said.

“We are going to endeavor to never ever go over 4.9% anymore on any stock in the US” Mohnish added in a tone of conviction.

Don’t be afraid to make mistakes. It is part of the game

Mohnish quotes Warren Buffett’s timeless wisdom “Rule No.1: Do not lose money. Rule No. 2: Do not forget Rule No. 1”.

However, he adds that one can make mistakes in investing and still end up with a profit. Or one can lose money and the bet would still have been the right one to make. If the odds of tails in a coin toss is 75% and pays 1:1, it is a very worthwhile bet to make, even though there is a 25% chance you lose the bet.

“We are going to lose some, even when we are ultra-vigilant and prudent. It is the nature of the game” he adds in a philosophical tone.

Mohnish also refers to the fact that even Sir John Templeton’s investment analysis was proved wrong about 1/3 of the time.

“Mistakes and losses are part of the investment landscape”, and “The goal is to always try to get realized losses to be as close to zero as possible” Mohnish advises.

If wealth is lost you lost nothing, if you lost health you lost something but if you lost character everything is lost.

Mohnish follows The most proven path of value investment, he follows the thought processes(philosophies) of the most proven track record holder warren buffett. he challenges tom peters (human psychology of not copying) and follows the cloning style of value investments. So if he fails still his probability is not negative I will understand as still the odds are in his favour (3.76:1 as mentioned inthe above link letter to his investors) although he might have lost in one or two investments as warren mentions of many mistakes that he might have done in investments (so as like RJ lost in companies like A2Z Maintenance but still he is the best in stock picking overall in India).

There are lot many chess board boxes Mohnish has to cross to reach 16th box where according to him the Warren Buffett is in terms of compounding wonders and co-relation to chess board example)

Lot and lot more to learn from Mohnish Pabrai unless he gets crushed in the chakraviyuh of investments as he explained in his book of Dhandho Investor.

I believe, he has been known for his investment in South Indian bank also.

Best lesson I learned from my failures is that you don’t only need an entry strategy but also the exit strategy to avoid big losses.