Adani Transmission – ideal combo of security and growth

Mudar Patherya has given ten cogent reasons why Adani Transmission is the ideal stock with the security of a fixed deposit (assured returns) and the excitement of growth (higher incentives). These are as follows:

(i) Adani Transmission is the Power Grid of India’s private sector power transmission entity. It has achieved its 2020 capacity target three years ahead of schedule;

(ii) the returns on the assets — power transmission lines from one point to another — have been secured through long-term annuity revenue contracts with the government;

(iii) the business is marked by high profitability; the Ebitda (earnings before interest, taxes, depreciation and amortisation) margin was 92 per cent in the first quarter of this financial year;

(iv) the moment the company stops expanding, it can select to patiently draw debt down and become a cash cow — or keep expanding capacity, with a relatively stretched but secured balance sheet (which is what it is doing);

(v) it has reconciled two business models, the pass-through where the government provides a pre-agreed return of 18 per cent internal rate of return (IRR) equity, with all costs reimbursed (five projects) and a tariff-based competitive bidding (TBCB) model, where the lowest cost company wins (nine projects);

(vi) the business is largely de-risked the moment a transmission network is activated — a high penalty for delaying or defaulting customers ensures timely inflow for Adani Transmission;

(vii) as the government graduates an increasing number of projects to TBCB, Adani Transmission expects to flex its muscle, using cutting-edge HVDC lines that deliver network availability much higher than the mandated average;

(viii) the company has graduated to investment-grade rating, making it possible to raise low-cost global funds (the second biggest profitability driver). The company’s 10-year $500 million bond offering attracted ~35,000 crore of borrowing interest, translating into a premium;

(ix) the company possesses deep competence through senior managers who, in their previous jobs, commissioned an aggregate 25,000 circuit km, providing Adani Transmission with rich intellectual capital (in land aggregation and right of way), making it possible to commission faster and cheaper (huge edge in a TBCB environment), leading to a 18-19 per cent equity IRR return, around 400 basis points higher than what is assured by the government;

(x) the company has demonstrated it can acquire transmission networks with speed, which has helped eliminate risk and prepone revenue inflow.

High EBITDA

Mudar explains that Adani Transmission should be able to report an Ebitda of around ~Rs. 2,000 crore in the current financial year, which should increase by 50 per cent (estimate) once the acquired assets go on stream.

| ADANI TRANSMISSION LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 7,061 | |

| EPS – TTM | (Rs) | [*S] | – |

| P/E RATIO | (X) | [*S] | – |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | – | |

| LATEST DIVIDEND DATE | – | ||

| DIVIDEND YIELD | (%) | 0.00 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 19.47 |

| P/B RATIO | (Rs) | [*S] | 3.30 |

[*C] Consolidated [*S] Standalone

| ADANI TRANSMISSION LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | DEC 2016 | DEC 2015 | % CHG |

| NET SALES | 729.22 | 526.5 | 38.5 |

| OTHER INCOME | 5.21 | 2.78 | 87.41 |

| TOTAL INCOME | 734.43 | 529.28 | 38.76 |

| TOTAL EXPENSES | 257.83 | 51.69 | 398.8 |

| OPERATING PROFIT | 476.6 | 477.59 | -0.21 |

| NET PROFIT | 99.28 | 74.78 | 32.76 |

| EQUITY CAPITAL | 1099.81 | 1099.81 | – |

(Source: Business Standard)

Core infra company at rock bottom valuations

He also emphasizes that Adani Transmission is the largest private sector company in a core infrastructure segment and that it is available for a market capitalisation of only around ~Rs. 7,000 crore.

Increase in generation capacity has to be accompanied with increase in transmission capacity

Mudar argues further that the country’s transmission capacity needs to increase attractively if it is to match existing national generation capacity.

When generation capacity increases (as it will), the country’s transmission appetite will need to increase faster, providing long-term players like Adani Transmission a huge competitive advantage, he adds.

In addition to the points made by Mudar, the following salient points also require to be noted:

Billionaire Gautam Adani has a stranglehold over 75% of the equity

Gautam Adani is a first generation self-made Billionaire with a net worth of $7.1 Billion (Rs. 46,150 crore).

Nobody can dispute that Gautam Adani has brilliant business acumen and money making skills.

He and his family members hold 75% of the equity capital of Adani Transmission as of 31st December 2016.

This implies that Gautam Adani has very high conviction in the future prospects of Adani Transmission and that he is unwilling to dilute his stake.

Big-ticket shareholders control major part of the equity

A major chunk of the balance equity of 25% of Adani Transmission is held by major institutional investors like EM Resurgent Fund (1.17%), Vespera Fund Limited (1.19%), Albula Investment Fund Ltd (1.66%), Emerging India Focus Funds (2.47%), Cresta Fund Ltd (3.83%), Elara India Opportunities Fund Limited (4.26%), LIC (2.55%) etc.

This implies that there is virtually no floating stock available for sundry mom and pop investors to buy.

According to experts, a shortage in the floating stock generally results in mis-pricing of the stock because desperate institutional investors are willing to pay a hefty premium to get their hands on the stock.

SP Tulsian gives green signal to buy Adani Transmission

SP Tulsian, the veteran stock picker, has given cogent reasons why Adani Transmission is likely to benefit handsomely in the foreseeable future and is an ideal investment candidate:

“Adani Transmission …. the kind of infrastructure in the T&D space … they have created and now with the UP going the priority of this government will be to provide 24×7 power to UP state.

T&D companies definitely will be helping the power generation companies as well as power financials. But T&D will be playing a very important role and that is what I have been saying for six months and we have been giving the buy call on the transformers space also. So the third would be Adani Transmission because that seems to be on a take off stage now having created a huge infrastructure in T&D space after Power Grid …”

Adani Transmission has “scarcity appeal”: Expert

R. Sree Ram, an expert with Mint, has opined that Adani Transmission enjoys “scarcity appeal” because it is one of the few listed stocks in the transmission sector which is known to offer steady earnings.

He has also referred to the opinion of three elite rating agencies, namely, S&P Global Ratings, Moody’s Investors Service Singapore Pte Ltd and Fitch, that Adani Transmission’s financials are ship-shape at present despite aggressive acquisitions.

“Three global ratings agencies have said that the deal will not affect the company’s current rating. With the assets operational and generating revenue, they do not expect the acquisition to weaken the current financial position of Adani Transmission,” R. Sree Ram has stated though he has cautioned that further aggressive acquisitions may change the situation.

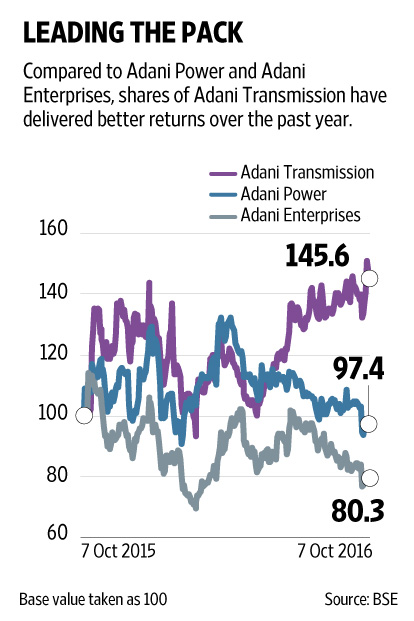

(Image credit: Mint)

The risk-reward ratio is good: Avinash Gorakshakar

Avinash Gorakshakar, the noted stock market expert, has opined that Adani Transmission makes a good investment candidate:

“On a fundamental basis, the transmission space has seen a lot of action and the coming Budget is going to give a lot of emphasis on power distribution. So, here I would presume that if one can hold Adani Transmission for the next 12-18 months, he/she could definitely get a good risk reward.

One should hold on to the stock for a longer period and at least for the next 12-18 months, to get decent good risk reward ratio,” he opined.

It is notable that Avinash Gorakshakar had earlier recommended Adani Transmission in August 2016 when it was languishing at Rs. 38 and had assured a target price of Rs. 55. That target price has been effortlessly breached by the Company.

Conclusion

Mudar Patherya has opined that Adani Transmission is a “go-to stock in troubled times” and that it is a stock to “retire on”. Prima facie, it does appear that he is right in his opinion!

I think only one big reason behind adani is Mr modi that is it

Adani, Ambani, and lots of other industrialists were billionaires when no one knew Modi outside Gujarat.

Request moderators not to pass such utterly irresponsible and irrelevant comments.

look at the huge debt this company has…..

It is into power utilities. Debt goes hand-in-hand in this industry.

What do you mean sir by saying debt goes hand-in hand? So what about interest and return of principal amount taken as loan?

Great! It is an out of the flavour chosen stock…

still regretting not buying it on time 🙁

bought at 85 rupees, 1000 stocks… CMP is 132 Rs. with 56% gains i.e., 47,750 Rs. Still holding and will hold for some more time. Thank you Muddar Pathreya and RJ stocks.