A few stocks have a strangle-hold on profits, ride piggy-back on them

Some experts believe that investors should scour in the bushes and look for ‘hidden gem‘ stocks.

However, Saurabh Mukherjea, the authority on the doctrine of ‘Coffee Can Investing‘, is not amongst them.

Saurabh believes that it is better to trust stocks with a proven pedigree and winning track record and ride piggy-back on their broad shoulders rather than risk capital by trusting dubious newcomers.

In his latest article in Forbes India, Saurabh has rightly pointed out that only a handful of stocks call the shots in the economy.

“India is already an economy with extraordinary levels of profit share concentration in key sectors, with one or two companies accounting for 80 percent of the profits generated in their sectors,” he has stated.

The names of these stocks are well known.

Asian Paints and Berger Paints dominate the paints sector and everyone else has to dance to their tune.

Similarly, the biscuits sector is controlled by Britannia and Parle while the hair oil sector is managed by Marico and Bajaj Corp.

Nestle has a strangle-hold over infant milk powder while the adhesives segment is at the mercy of Pidilite.

It is elementary that this trend will continue and the unorganised and fragmented players will get booted out by the large organized players.

“Smaller players who don’t use technology optimally cannot build deep competitive moats, and cannot access funding at low cost will die,” Saurabh has warned in an ominous tone.

“The rewards for the winners are huge: They get the profits of the entire sector and market cap in excess of $10 billion,” he has added.

Junkyards stagnate in the Nifty, will be booted out soon

Change in the harsh reality of life.

Yesterday’s winners become today’s losers.

Obviously, the losers have no business to stay in the Index and deserve to be thrown out.

We can see a recent example of this in the AMFI’s revised list of winners and losers.

Junk stocks like Yes Bank, Vodafone, IndiaBulls Housing etc, which have squandered away investors’ confidence and their wealth, have been unceremoniously booted out of the prestigious list.

Their place has been given to winners like Adani Transmission, Info Edge, Muthoot Finance etc.

Here are the changes to the large cap list as per AMFI. pic.twitter.com/YUSMhbEfRG

— BloombergQuint (@BloombergQuint) January 3, 2020

23 stocks in the Nifty will be ejected soon

Saurabh has warned that as many as 23 stocks in the Nifty are past their prime and are living on borrowed time.

“If I look at the Nifty as it stands today, I can see a number of metals and mining companies, power and infrastructure companies, old-style conglomerates struggling with rational capital allocation, and public-sector banks,” he has stated.

“I find 23 such companies within the Nifty that will be out a decade hence,” he has added.

Saurabh has not named any stocks.

However, the culprits appear to be the old war-horses like Tata Steel, Cipla, Vedanta, Grasim, JSW Steel, Hindalco, Bharti Infrarel, Zee Entertainmant, Power Grid, SBI etc which have not contributed in any meaningful manner towards improving investors’ prosperity over the years.

“Ejecting these from your portfolio is likely to bump up your decadal returns from investing in large cap Indian companies,” he has explained.

Bet on potential incumbents and make massive gains when they are inducted

Saurabh has advised that we should be one step ahead of the regulators and try to second-guess the names of the companies which will be ushered into the Nifty.

This is because when these stocks are included in the Nifty, Index Funds will have no choice but to load onto them and add them to their portfolios.

The aggressive buying by the Index Funds will result in massive gains for us if we are already sitting tight on them.

“Had I been clever enough 10 years ago to predict the names of the 20 companies that have entered the Nifty in the interim period, my portfolio would have compounded at 40 percent per annum,” Saurabh has stated, implying that massive riches can be made and the exercise is well worth our time.

Winner stocks which will be inducted in the Hall of Fame

Saurabh has explained that three trends are likely to take place in the Indian economy.

These are:

(1) Formalisation of the economy and concentration of profit share;

(2) Financialisation of Savings and

(3) Formalisation of retail and distribution channels.

Going by these three trends, he has identified some top-quality companies that appear to be potential Nifty entrants over the next decade.

These stocks include Pidilite, Berger Paints, Divi’s Laboratories, Marico, Info Edge, Abbott India, Page Industries, ICICI Lombard, Dabur and HDFC Life.

Saurabh has also fairly disclosed that the first eight of these 10 stocks feature in most of Marcellus Investment Managers’ client portfolios.

Why not load onto the NIFTY Next 50 stocks?

Few are aware that the NSE has already prepared a succession plan to replace the old war-horses in the Nifty with their younger and energetic counterparts.

This succession plan is called the “NIFTY Next 50“.

NSE has also released a white paper titled “Capturing the performance of ‘Next 50’ blue-chip companies in large cap universe“.

The paper states that the pool has NIFTY Next 50 stocks that ‘aspire’ to be a part of the coveted league of NIFTY 50 stocks.

NIFTY Next 50 represents companies which are presently below the NIFTY 50 index constituents in terms of free float market cap and may be potential candidates for inclusion in NIFTY 50 in future, subject to index criteria, it is stated.

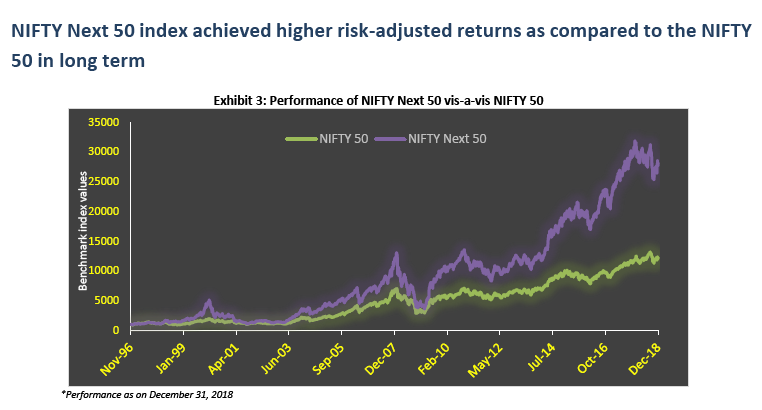

It is also pointed out that the NIFTY Next 50 has heavily outperformed the NIFTY 50.

ETFs gives ready-made package of NIFTY Next 50 stocks

The best way to tuck into the NIFTY Next 50 stocks is to buy their Exchange Traded Funds (ETFs).

According to the NSE, ETFs are simple investment products that combine the flexibility of stock investment and the simplicity of equity mutual funds.

ETFs trade on the cash market of the National Stock Exchange, like any other company stock, and can be bought and sold continuously at market prices.

Equity ETFs are passive investment instruments that are based on indices and invest in securities in same proportion as the underlying index.

Because of its index mirroring property, there is a complete transparency on the holdings of an ETF.

Further due to its unique structure and creation mechanism, the ETFs have much lower expense ratios as compared to mutual funds.

There are several ETFs available such as the Nippon India ETF Junior BeES, SBI – ETF Nifty Next 50, ICICI Next 50 ETF etc.

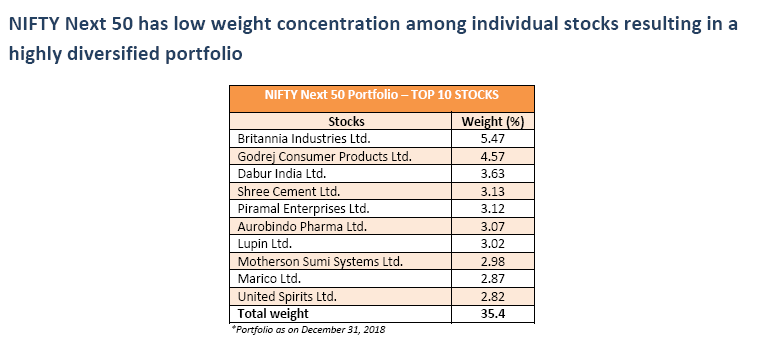

All ETFs have the following powerhouse stocks in their portfolios:

We can systematically buy these ETFs and be assured of riches when the underlying stocks get elevated to the Nifty!

My portfolio -small invested in 2008 has yielded 45% ÇAGR.FYI.POWER OF COMPOUNDING!

What are the stock you hold

How come. Not able to understand. Because no body has been able to get a CAGR of 45% unless you have purchased all your stocks at the trough/bottom price of 2008 crisis.

Yes indeed at rock bottom prices in 2008. I maintain separate portfolio tracker in equity master.com

STOCKS HELD SINCE 2008

CASTROL/GODREJ CONSUMER/GRASIM/GSM PHARMA/ITC/L&T/LMW/MARICO/P&G/PIDILITE/SIEMENS/TATA GLOBAL/RAMCO CEMENTS & THERMAX-AFTER TAKING INTO ACCOUNT BONUS &SPLIT IF ANY.FYI

Very good return. how you managing your portfolio or thinging process when stock fall more than 50%

“Had I been clever enough 10 years ago to predict BAJAJ FINANCE, my portfolio would have compounded at 80 percent per annum,”

Ha ha. Nice reply/satire.

My viewpoint

1.Do not go for the so called multibaggers.

2.CASH FLOW GROWTH is critical.

3.EPS growth is steady.

4.Debt to equity should be “almost zero”

5.REVENUE GROWTH should be at least “yoy” 15%-consistent.

6.Finally no red flags.

Buy review at all points of time.