The difference between a brilliant investor and an ordinary investor is that while the ordinary investor reads the news and does not react, the brilliant investor knows how to take advantage of the situation.

A few days ago, newspaper headlines blared that Ratan Tata and other marquee investors like Hillhouse Capital, Tybourne Capital and Sequoia Capital were pumping in millions of dollars into a car classifieds portal called “Cardekho.com”. Most people read the news with interest but did not react.

However, Porinju Veliyath’s mind was racing. It was clear to him that if Cardekho.com is valued at a mind-boggling sum of $300M or Rs. 2000 crore by savvy investors like Ratan Tata, then other car portals would also get re-rated. He rushed to find a listed car portal company.

He found what he was looking for in Logix Microsystems (also known as Izmo Limited), an ultra micro cap, with a market capitalisation of less than Rs. 50 crore.

Logix Microtech is (according to a research report by EquityMaster) engaged in providing “niche product portfolio of software and web solutions to automobile dealers”. It also runs a website called “carazoo.com”/ “motortrend.in”. The website contains articles on car reviews, most popular sedan under Rs. 25L, best mileage cars etc.

| Logix Microsystems Ltd – Financial Overview | |||

| Figures in Rs crore | 2014 | 2013 | 2012 |

| Net Sales | 29.07 | 32.79 | 33.45 |

| Operating Profit | 28.62 | 25.50 | 15.94 |

| Profit After Tax | 0.62 | 6.84 | 4.07 |

| Share Capital | 12.10 | 12.10 | 12.10 |

| Reserves | 165.09 | 163.28 | 156.44 |

| Net Worth | 177.19 | 175.38 | 168.54 |

| Loans | 16.37 | 16.62 | 17.98 |

| Operating Profit Margin (%) | 98.45 | 77.77 | 47.65 |

| Net Profit Margin (%) | 2.13 | 20.86 | 12.17 |

| Earning Per Share (Rs) | 0.51 | 5.65 | 3.36 |

| Dividend (%) | 0.00 | 0.00 | 0.00 |

| Dividend Payout | 0.00 | 0.00 | 0.00 |

The intriguing aspect about Logix Microsystems is that though it is an ultra micro-cap with a market capitalisation of less than Rs. 50 crore, it has attracted heavy-duty investors like Ashish Dhawan, N Jayakumar of Prime Securities, Fidelity India Fund, Morgan Stanley Asia (Singapore) Pte etc. Why such marquee investors would be interested in a piddling investment is a mystery. Ashish Dhawan and Morgan Stanley have exited the investment in the September / December 2014 quarter though the others continue to hold on.

Porinju did not need any more persuasion. Yesterday, he scooped up a chunk of 100,000 shares of Logix Microsystems at Rs. 36.4 each.

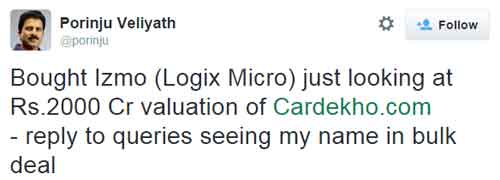

Porinju made his motive clear in a tweet:

“Bought Izmo (Logix Micro) just looking at Rs.2000 Cr valuation of Cardekho.com”

Porinju’s tweet created great excitement amongst his legion of followers. Everyone rushed to see what Logix Microsystems is all about and sent its stock price soaring 20%.

To understand Logix Micro’s prospects, we can turn to Cardekho’s website which promises that “there is immense potential in the automobile classifieds sector in India” and an “untapped market opportunity” in the “online auto classifieds space”.

According to a report in the ET, CarDekho competes with auto classified websites such as Tiger Global and Warburg Pincus-backed CarTrade.com and Carwale.com, as well as with multi-category classifieds sites, such as Naspers-backed OLX and eBay-backed Quikr. It also quoted Amit Jain, founder of Cardekho.com as saying “Given the adoption of the internet in India, especially through mobile, we’re targeting revenue of Rs 500 crore- Rs 600 crore, and a billion dollar valuation over the next four to five years“.

Now, whether Porinju’s dream that Logix Microsystems will also get re-rated like Cardekho comes true or not requires to be seen.

When I was looking for a used car, I found that gaadi.com had a better and more customer friendly approach than cardekho. Don’t know who owns it though.

interesting bet ..Porinju does take risks

He is gambling at this stage. Its real stupidity to justify the bet by comparing with competitors investment. Cardekho got investment of $300 Million but that doesnt mean cardekho generates $300 million.

better odds to make money at a casino. useless investment thesis. this is how bhangar wala people buy stocks.

Well Porinju does come up with interesting ideas…now what matters is whether his money is really following his words…

If the company is too good, why the promoter holding is so low… Do we have better knowledge than promoters

ITS NOT PORINJU THATS GAMBLING OR TAKING RISK , ITS SMALL INVESTORS THAT FOLLOW HIM & STRUCK AT HIGHER , PORINJU IS ALREADY ON PROFIT DUE TO BLIND FOLLOWERS

As wine consumption is increasing manifold so is freshtrop_ an exporter of grapes.pomegranate and fresh fruits.nil debt coming qtr.huge multibagger 30% cagr yoy.next generation.porinju can look into this