“Simple, simple mathematics” leads to BBTC giving magnificent 7-bagger gains

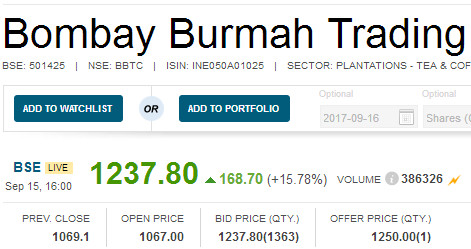

Yesterday, when Bombay Burmah Trading Corp (BBTC), the blue-chip holding company of Britannia, Bombay Dyeing etc, surged a massive 15%, everyone in Porinju Veliyath’s massive follower base of 3 lakh rushed to congratulate him for the magnificent recommendation.

However, a few also paid tribute to Varinder Bansal, the ace investigative journalist with CNBC TV18, for the pioneering work that he has done in highlighting the steep discount at which the stock is/was quoting.

“In simple, simple mathematics, BBTC’s market cap is only Rs. 3300 crore while the value of Britannia is Rs. 18,000 crore,” Varinder said in August 2016, reeling off the numbers with ease.

He also emphasized that BBTC has a standalone business of its own and also huge tracts of land which were completely missing from its valuation.

In fact, Varinder revealed that he had identified the stock as being investment worthy when it was languishing at a throwaway valuation of Rs. 1000 crore.

BBTC covered on "Did You Know" when its m-cap was 1000 cr and now 7750 cr…only on @CNBCTV18Live @ShereenBhan https://t.co/oVxaX6iRD2

— Varinder Bansal (@varinder_bansal) September 15, 2017

Presently, the market cap of BBTC is Rs. 8,600 crore which means that incredible gains of 700% are on the table.

Naturally, Varinder received rich accolades from his own army of fans.

OMG wow u r such a so knowledgeable person, really u r so visionary person , last month I reach Cnbc office but not meet with u .

— Ajay Rana (@Ajay2aarav) September 15, 2017

Impending IPO of Go Air is fuelling BBTC’s surge?

Prima facie, the surge in Bombay Burmah appears to be more than just a case of the valuations catching up.

Billionaire Nusli Wadia appears to be on a buying spree with a view to corner all the floating stock before the impending formal announcement of Go Air’s IPO.

The first indication of this came in June 2017 when the Billionaire came to Dalal Street to buy a big chunk of the stock.

Avanne Dubash, the charming and ever-vigilant research analyst with ET Now, had flagged the news at that time.

BOMBAY BURMAH

Nusli Wadia buys 7lk sharesNowrosjee Wadia buys 3.4lk shares

Edulji Estate buys 1.3lk shares

Archway Inv sells 12lk shares

— avanne dubash (@avannedubash) June 15, 2017

Porinju Veliyath delivers on promise of 100% gain from holding companies

Porinju makes predictions in such a casual manner that it is difficult for novices to take him seriously.

This happened in January 2017 when he predicted that the discount at which the holding companies are presently quoting would narrow and the stocks would give upto 100% gain.

I see few solid holding companies with over 75% discount. They will double in 2017 as the discount would narrow down to 50%, explore!

— Porinju Veliyath (@porinju) January 26, 2017

As usual, novice investors (including me) were dismissive about his prediction.

Porinju was not deterred by the lukewarm response that his prediction received. Instead, he laboriously articulated the rationale in the following words:

“I feel in the year 2017, some holding companies will go up by 100 percent because of the deep discounts they are trading at. Some of them are from good corporate houses and in many cases the companies which they are holding, those companies are also on a high growth path and they are doing well. I have talked about Bombay Burmah Trading Corporation (BBTC), Bengal and Assam Company, Vindhya Telelink, Kalyani Investment Company etc. So investors can look at these companies and sometime when market goes into panic and such companies are trading at 70-80 percent or 90 percent discount to the net asset value (NAV), it will be a good opportunity. Those discounts are going to shrink and reward investors in this year.”

Needless to say, we again missed out on an opportunity to pocket handsome gains which were handed over on a platter.

In less than eight months, the holding companies have delivered splendid gains as one can see from the chart:

| Name | Stocks held in | Price on 27.01.2017 | CMP (Rs) | Gain (%) |

| Rane Holdings | Rane Madras, Rane Brake Linings, Rane Engine Valve | 770 | 1813 | 135 |

| Florence Investech | JK Lakshmi Cement, JK Tyre, JK Paper, Bengal & Assam, Umang Dairies | 670 | 1480 | 120 |

| Bombay Burmah Trading Corporation (BBTC) | Britannia, | 565 | 1237 | 119 |

| Summit Securities | Ceat, KEC Intl, Zensar | 419 | 738 | 76 |

| Maharashtra Scooters | Bajaj Auto, Bajaj Finservce, Bajaj Finance | 1665 | 2845 | 70 |

| Vindhya Telelink | Birla Corp, Birla Cable, Universal Cable | 680 | 1130 | 67 |

| Tata Investment Corp | All Tata Cos + Blue Chips from all sectors | 576 | 928 | 61 |

| Rajapalayam Mills | Ramco Cements, Ramco Industries | 629 | 1030 | 60 |

| Nalwa Sons Investment | JSW Steel, Jindal Saw, Jindal Energy | 791 | 1265 | 60 |

| STEL Holdings | CESC, Philip Carbon, RPG Life Sciences, Saregama | 65 | 103 | 58 |

| Kalyani Investment | Bharat Forge, BF Utilities | 1324 | 1961 | 49 |

| Godrej Industries | Godrej Agrovet, Astec Lifescieces | 431 | 639 | 45 |

| BF Investment | Kalyani Steels, Bharat Forge, BF Utilities, Hikal, Automotive Axles | 151 | 219 | 45 |

| Bajaj Holdings | Bajaj Auto, Bajaj Finserv | 1930 | 2734 | 42 |

| Bengal and Assam Company | JK Lakshmi, JK Tyre | 1179 | 1670 | 41 |

| Williamson Magor | Eveready Industries, McLeod Russel, McNally Bharat Engg, Kilburn Engg | 58 | 81 | 41 |

| Ramco Industries | Ramco Systems, The Ramco Cements, Rajapalayam Mills | 202 | 264 | 30 |

| Kama Holdings | SRF | 2487 | 2750 | 11 |

| Alembic Ltd | Alembic Pharma | 36 | 38 | 6 |

| Balmer Lawrie Investment | Balmer Lawrie | 414 | 405 | (2) |

| McDowell Holdings | United Breweries, Mangalore Chem | 44 | 38 | (12) |

Nifty will surge to 12,000, investors can make 30-40%, in less than a year

“By next Onam, Nifty can be 12,000; but investors can easily make 40% return,” Porinju said, his eyes sparkling with excitement.

He knows by now that novices need spoon-feeding and specific stock ideas. Abstract advice flies over our heads.

“The hotels had a bad time in the last decade, I would say. They are now coming up. Companies like Indian Hotels or there are some mid-level companies like Royal Orchid. After decades of underperformance, some of these started moving. These are well-placed to create wealth in the next 5-6 years time,” Porinju said, implying that these two are fail-safe multibagger stocks.

D-Street’s hottest stock picker is here on @BTVI#MarketGuru @porinju @szarabi @Heeraal#PorinjuPicks#LIVE https://t.co/cRN0uQ7kqT pic.twitter.com/fcTYOL95Pz

— BTVI Live (@BTVI) September 15, 2017

The reference to Royal Orchid Hotels is very significant because the stock is also a favourite of Ashish Kacholia and Rahul Kayan, both of whom have an illustrious track record for finding multibaggers.

I have already conducted a detailed analysis of Royal Orchid Hotels and explained all of its salient points and merits.

What about Porinju Veliyath’s latest stock picks?

For some reason, Porinju has maintained a deafening silence about his two latest stock picks, Tata Coffee and Liberty Shoes.

On 11th September 2017, Porinju and his entourage conducted simultaneous raids at the counters of the two small-caps and mopped up all the shares that were on offer.

By the EOD, Porinju had scooped up 10,00,000 shares of Tata Coffee at Rs. 150 each and 321,308 shares of Liberty Shoes at Rs. 235.48 each.

Porinju’s logic for buying Tata Coffee is easily understandable.

It is the same logic that earlier fuelled the purchase of Tata Global Beverages, namely, that the new dynamic leadership of N. Chandrashekaran coupled with the various value unlocking measures will cause all the Tata group shares to sparkle.

Porinju adverted to this when he hinted that the “next TCS and JLR” (both magnificent multibaggers) would come from consumer business stocks like Tata Global, Tata Coffee and Tata Chemicals.

It is worth recalling that Porinju is not alone in his bullishness for the Tata Consumer stocks.

Rajen Shah of TradeBulls has been repeatedly imploring us to buy into Tata Global Beverages on the basis that we may never get another opportunity to buy such a blue-chip at such “dirt cheap” valuations. In fact, he has described Tata Global as the “next Britannia” (see “Dirt Cheap” Blue Chip FMCG Stock Will Give Multibagger Gain After GST).

As regards Liberty Shoes, Porinju made it amply clear earlier that footwear is a business with no dearth of demand given that all humans have to have at least one pair.

His logic is/was as follows:

“One sector I feel very strong about is footwear. Leather that is a big industry in India we are big exporters. Bata is a stock which I have been always liking of course we are not holding Bata in our portfolio management or personally. But I am talking about a large company. There could be some smaller companies which I cannot name because of the regulator restrictions to protect the investors.

In the footwear and leather segment, around 60% to 65% of the business is in unorganised sector and that will change now and 40% organised business can grow to 70-75-80% in the coming years. That is a huge unprecedented jump in their business volumes and profitability.

India has 1.3 billion people and chappal and shoes and all items that are like wearable and consumables. There is a big potential for some of those big brands. Now Bata is quoting at around 7000 plus market cap. It is a very plain, very capable company with a strong management.

…The footwear and leather is one theme I would like to request investors to look for exploring further and see the comfortable valuations and consider how these companies are taking shape and growing for the future.”

Buying stocks in doldrums is a good investment strategy?

A careful study of all of Porinju’s past and present recommendations reveals a pattern which is that these stocks are/ were not in fancy and are fail-safe in terms of business model and valuations.

The holding companies are a textbook example of this.

They were quoting at such a steep discount (75%) to their intrinsic valuations that the question of a further downside simply did not arise.

This, coupled with their blue-chip stature, made them virtually fail-safe and the only direction they could move is upwards.

Prima facie, the same can be said for the other stocks referred by Porinju, namely, Tata Global, Tata Coffee, Indian Hotels and Royal Orchid etc.

Even in the worst case scenario, we are assured of getting our money back in one piece. In the best scenario, the stocks will turn into magnificent multibaggers and we will all become enormously rich!

What about Sanwaria Consumer Ltd?

Porinju deserves rich praise for his vision and the readiness to share it with investors. He has endeared the investing community with his total faith in India and our economy.

While some of the Holding Companies have run up too fast, some are still left with strong potential. Bajaj Holdings and Tata Invest Corp are the ones waiting for their place under the sun. Sanjeev Bajaj provides finest leadership to his companies. Bajaj Holdings trading at 2750, perhaps, has the potential to double from here.

So as Bengal & Assam…….

YES.

Has standalone business of Fenner Industries, which is equally good.

hello Dr, there is a VERY GOOD REASON why he shares his picks with investors! don’t be so naive! there are thousands of his own investors who pay management fees to him through EQUITY INTELLIGENCE, his company So why does he reveal his picks freely? now do some work and find out.

One cannot deny commercial angle of Porinju, as pointed out by Mahesh. However, one has to agree that Porinju is talented. And his popularity is growing by the day. Nothing suceeds like success.