Healthy growth in Net Worth of PMS

First, we have to peep into the affairs of Equity Intelligence, Porinju Veliyath’s PMS, to check whether everything is ship-shape.

The results are quite encouraging.

As of 30th November 2016, the PMS boasts of a clientele of 1075 persons. Of these, 750 are resident individuals while 314 are non-residents. There are eleven corporate clients also in the roster.

The AUM has surged to Rs. 600 crore. The individual clients have pumped in Rs. 588 crore, which means that the average ticket size is about Rs. 55 lakh.

The 11 corporate clients have collectively pumped in Rs. 12.46 crore, which makes their average ticket size Rs. 1.13 crore.

When I last reported on the issue as of March 2016, the Equity Intelligence PMS had a roster of 782 clients and an AUM of Rs. 392 crore.

The increase in the number of clients to 1075 and the growth in the AUM to Rs. 600 crore make it clear that Porinju’s skill in attracting deep pocketed clients is still going strong.

The performance of the PMS is, however, disappointing. It has lost 10.39% as at the end of November 2016.

Presumably, the poor performance will continue in December 2016 as well given the savage correction that the markets have seen in the wake of the demonetization.

Q3 was full of negativism propagated by ignorants & vested interests, though the events were fundamentally positive for equity investing!

— Porinju Veliyath (@porinju) December 27, 2016

Performance of stocks recommended by Porinju & other luminaries in 2016

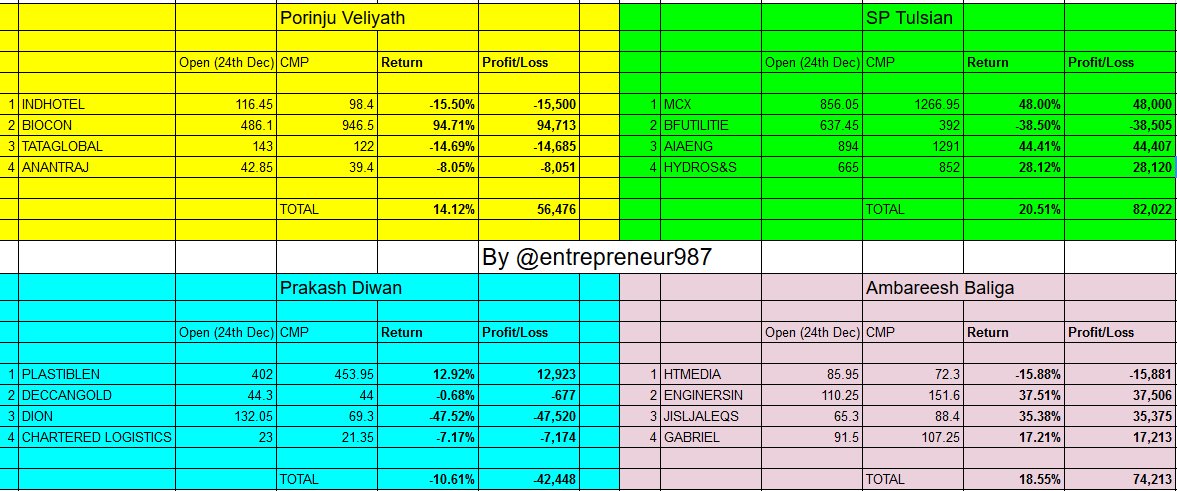

It may be recalled that in December 2015, Porinju Veliyath and three other luminaries being S. P. Tulsian, Ambareesh Baliga and Prakash Diwan had recommended 17 top-quality stocks to us with the promise that the stocks would bring riches to us.

This has partially come true. The performance of the stocks recommended by the quartet is as follows:

(Image Credit: @entrepreneur987. Click for larger image)

Final result of " 16 picks for 2016 " prog. by CNBC last yr by @_anujsinghal

1. @sptulsian

2. @ambareeshbaliga

3. @porinju

4. @P_diwan pic.twitter.com/jOTaNGoxXQ— Ankit Chaudhary (@entrepreneur987) December 30, 2016

As one can see, S. P. Tulsian is leading with hefty gains of 20.51%, followed by Ambareesh Baliga with 18.55%, followed by Porinju Veliyath with 14.12%.

All three have heavily out-performed the return of 2.2% notched up by the Nifty. The returns are also more than the gain of 1.60% and 7.40% reported by the BSE Small-Cap Index and Mid-Cap index respectively.

Lucky 13 stock recommendations for 2017

Now, we have to turn to the pleasurable activity of rummaging through the stock recommendations for 2017.

Avanne Dubash, the charming anchor with ETNow, nicely listed out Porinju’s recommendations.

.@porinju TOP PICKS

J Kumar

Sunil Hi

Texmaco

Titagarh

Talwalkar

FCEL

Orient Cem

Bombay Burmah

Bengal Assam

Saksoft

Datamatics

HSIL

TCI— avanne dubash (@avannedubash) December 28, 2016

As one can see, each one of the thirteen stocks is a powerhouse in its own right, with proven credentials for enriching investors.

Some of the stocks are presently in the doldrums owing to concerns that demonetization may have crippled the economy.

However, given that demonetization is a temporary phenomenon, there is a golden opportunity for us to load up on top-quality stocks at bargain basement prices.

Guys, don't miss this Year-end Sale to buy your favourite stocks at attractive valuations! Bullish on #ChangingIndia

— Porinju Veliyath (@porinju) December 27, 2016

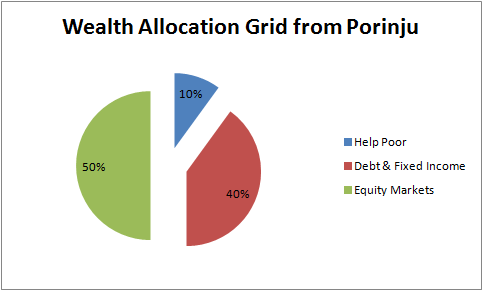

Porinju’s Wealth Allocation Grid

Porinju gave a glimpse of his charitable side by advising that all investors should share a part of their wealth with the underprivileged.

(Image Credit: ET)

“If you have one million rupees as investible surplus, keep 10 per cent of it to help the poor and underprivileged. Another 40 per cent should go into fixed income assets and the rest 50 per cent into equities,” Porinju advised.

“Calendar 2017 is most likely to see a bull market in equities …. Genuine long-term investors should not be disheartened by the bruises of demonetisation. It is part of a crusade against corruption and black economy”, he added.

“Short-term negatives of a great long-term business can be a good opportunity for smart investors”, he opined, echoing the wisdom of eminent investment legends who made a fortune by buying stocks in times of distress.

My top pick out of lucky seventeen is Bengal & Assam Scrip code # 533095

The top multi bagger idea Targets Price ₹ 2750.00

investors in Sunil Hitech sold their stake earlier. Is it still aconcern?

What about the recommendations from the rest for 2017? And 13 picks from one person is too high. Aren’t there top 4 – 5 from each?

What are the best range of prices to buy

It seems that it makes sense to pay more attention to SP Tulsian’s recommendation more seriously than others.

When blue chips are available at lower prices,go for them for certainly of returns.