Porinju Veliyath’s ‘Hawabaazi’ With Honey Bricks Foxes MMB Punters

“Nothing in it. Only hawabazi. Target 12/-,” a member named ‘guest’ proclaimed with the typical confidence that novice investors have about stocks.

“Agreed … no clue what happened,” intradayexp, a platinum member replied.

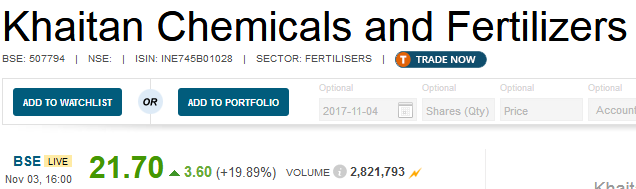

The punters’ comments were in response to a sudden surge in Khaitan Chemicals & Fertilizers, a micro-cap (Rs. 210 crore), whereby it tripped the upper circuit of 20% on two successive occasions.

We cannot fault the punters for their views because Khaitan Chemicals is otherwise a sleepy and sluggish stock, not known for exhibiting savage price movements.

However, the other punters at MMB were not convinced that there is mere ‘hawabaazi’ in the stock. Some dug deep and discovered an obscure website which reported that a company named Honey Bricks Property Management Pvt. Ltd, which is Porinju Veliyath’s investing arm, had bought a chunk of 500,000 shares of Khaitan Chem on 1st November 2017.

Honey Bricks was meant to be a realty portal

Honey Bricks was launched by Porinju with much fanfare in 2009 to act as a brokerage and “help customers to buy, sell and rent residential apartments, villas and commercial spaces”.

However, the realty brokerage business appears to have not taken off. Even the website is not operative.

It is now being put to better use as a stealth investing arm of Porinju, whenever he wants to fly under the radar.

This was also confirmed by Darshan Mehta, the investigative journalist with Bloomberg Quint.

Porinju (Honey Bricks Property) buys 5 lk shares in Khaitan Chemicals

— Darshan Mehta (@darshanvmehta1) November 1, 2017

| KHAITAN CHEMICALS & FERTILIZERS LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 210 | |

| EPS – TTM | (Rs) | [*S] | 0.14 |

| P/E RATIO | (X) | [*S] | 155.00 |

| FACE VALUE | (Rs) | 1 | |

| LATEST DIVIDEND | (%) | 5.00 | |

| LATEST DIVIDEND DATE | 14 AUG 2017 | ||

| DIVIDEND YIELD | (%) | 0.23 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 13.30 |

| P/B RATIO | (Rs) | [*S] | 1.63 |

[*C] Consolidated [*S] Standalone

| KHAITAN CHEMICALS & FERTILIZERS LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | JUN 2017 | JUN 2016 | % CHG |

| NET SALES | 88.39 | 77.34 | 14.29 |

| OTHER INCOME | 1.42 | 0.58 | 144.83 |

| TOTAL INCOME | 89.81 | 77.92 | 15.26 |

| TOTAL EXPENSES | 79.1 | 66.99 | 18.08 |

| OPERATING PROFIT | 10.71 | 10.93 | -2.01 |

| NET PROFIT | 0.24 | 0.15 | 60 |

| EQUITY CAPITAL | 9.7 | 9.7 | – |

Shyam Sekhar has stranglehold over Khaitan Chemicals

Shyam Sekhar’s PACs named Vijaya S and Koushik Sekhar collectively hold a massive chunk of 54,25,958 shares of Khaitan Chemicals comprising 4.47% of its equity capital as of 30th September 2017.

The investment is worth Rs. 11.93 crore at the CMP of Rs. 22.

The high holding implies that the stock is a high conviction bet for Shyam Sekhar.

It is worth recalling that Shyam Sekhar has declared in his latest interview that he focuses on “profitability, sustainability, management commitment and corporate governance” to spot a quality stock.

He also does a “360 degree study of risks” before buying a stock.

When I ideate an investment, I fit it to a theme, do a 360 degree study of risks, see the merit in its valuation & find a safe price to buy.

— Shyam Sekhar (@shyamsek) July 11, 2017

From this, we can confidently assume that Khaitan Chemicals has passed the rigorous tests laid down by Shyam Sekhar and is a safe investment from the perspectives of profitability, sustainability, management commitment, corporate governance and risk profile.

No stock left for novices to buy

However, the sorry state of affairs is that novices who desire to rub shoulders with Porinju Veliyath and Shyam Sekhar will be shown the door.

This is because there is not much stock left to be bought.

The promoters, being members of the Shailesh Khaitan family, hold the maximum permissible 74.99% of the equity.

The balance has been cornered by the ace investors including Suresh Kanmal Jajoo, who holds 21,40,958 shares.

Suresh Jajoo’s profile is not familiar to us. However, that he is a big-ticket investor is evident from the cases that he has fought against the income-tax department relating to the taxability of his massive capital gains.

As expected, Suresh Jajoo has emerged triumphant and secured a verdict that his capital gains are tax-free.

Clear signal that fertilizer and chemical stocks have to be bought on no-holds barred basis

Anyway, the bottom line of the entire episode is that all ace investors (including Dolly Khanna, Vijay Kedia, Kenneth Andrade etc) are making a beeline for agriculture stocks and we should too.

Even Billionaire Satpal Khattar, who lacked an agri stock in his portfolio, rushed to buy one a few days ago. Luckily for him, Mudar Patherya has confirmed that the stock is at the “cusp of big opportunities” and has mega multibagger potential!

There are three stages of bull run, first it start after bust and many good companies are available at discounted prices and market start moving up to fair prices. That stage is already over long back. Second stage is that good companies are at fair prices and stocks start moving to over pricing stage discounting future one two year prices and become over priced, we are at that stage.. Third stage is that to find returns people start going down quality, smart investors start doing it first and small investors come later. These junk stocks are then dumped to small investors and bull run come to end, with permanent loss of capital to small investors . Is this start of third stage, decide yourself.

In any case,POrinju has portfoilio worth 1000 crore and this investment is just 75lakh. So it clearly is small bet for him,with high risk.People dont understand this.

Luckily didnt made huge entry into this… Loss of few bucks only.

But KRBL was a big loss. Mohnish deal cancelled and the stock tumbled by 50%.

Its difficult to follow the aces.

One can also look at Daawat. Lot of marquee investor like porinju and rajeev have invested. It seems to be at an inflection point. When I go to stores here in US it is flooded with Royal brand.Considering the run up KRBl had its looks cheap.

Look at kolte and Sunteck these are real good real estate company.Monish has picked gem.These looks next rain industries.

with many stocks getting fully priced punters are going in for unknown names and poor quality stocks. Don’t get swayed by 45% return in 2 days and chase poor quality stocks… Stay invested in quality stocks.. Off late porinju is betting on unknown ultra microcap names .He has a different risk profile and you need not venture with these stunts

Meghmani Organics is another stock which has presence in chemical & fertilizer.

Vijay kedia sir tweeted that worst is over for small Pvt banks and this mean ktk bank will scale new high.As per him it should be valued at 2 times book which means a target price of over 320

Everyone here is commenting about their already owned stock. 🙂

No one talks about the stock on which the article is written.

I agree. We should make comments on the topic/stocks covered in the post. Only Kharb has made right comments. All comments are irrelevant to the post covered.

I fully agree with the comments of Kharb, on the stages of bull market. Retail investors should not ignore the fundamentals.. If the stock is fundamentally good, you are protected from savage downturns.

GNFC, Kiri Industries, Rain Industries, Visaka Industries. These stocks have run up but still appear solid bets. So is KTK Bank.

I agree with Kharb too this just look like a junk stock and may be the dividend yields are good. Just look like another ugly duckling that will fizzle out after the result .

Affordable prices with consolidating since years near book value and agro chem space….who will not buy and wait.After all every story starts with this…

When has fertlizer stock given return.They are just hoping story of sugar will repeat in fertilizer.Why will govt favor fertilizer companies ?Farmers are a different case.Eliminating middlemen should lower the fertilizer prices and not benefit the agro Chem companies.

Khaitan Chemicals has very high debt of 1.9x. ROE over last 3 years is 2%. Looks like a risky bet, better away from this one.

This only points to the fact that not every post given in ‘RJ’ site is worth following and it definitely calls for due diligence on the part of investors to do a thorough research before making a call on the basis of recommendations/posts on the site.

I m stuck in Balaji Tele @193 bcoz of following Porinju, stuck in JP Associates @25 bcoz of following Rakesh Jhunjhunwala

Learn your lesson. Stop following. Investing is about reading, assimilating, learning, then executing. All this does is minimise risk which in turn increase your percentage of success.

also look at khaitan electricals ace investor vaalabh bhansali holding it more than 2% just at yealy low rs 14-15

Shyam Sekhar has tweeted to me that he doesn’t own Khaitan Chemicals

https://twitter.com/shyamsek/status/927109936198205441

Thank you Basilieus for your tweet. So Shyam Sir does not own KC.

Vallabh Bhansali from Enam is a great investor and it seems he is also stuck with KC.

DMan1981 – I think you are right. Blindly following ace investors like Anil Goel, RJ, Vijay Kedia, Shyam Sekhar, Dolly Khanna, Sanjay Gupta is a big risk in itself.

I hv bought With such a low price now what should be the strategy now?

Stock ain’t really looking that good in fundamental front but there is also technical strength. There might be something going on about which we don’t have any good idea.

If price manages to stay above 23 till month ends then technically it would be buy position with monthly close based SL of 16.