Porinju reveals earnings of PMS Fund in Q1FY19

Porinju’s statement in his letter to his PMS clients that he is “baffled” at the “extent of erosion of portfolio value in such a short period” sparked panic amongst his fans and followers that there has been a meltdown in the PMS.

All sorts of wild rumors were spread as to the extent of loss suffered by the PMS.

To allay the fears, Porinju has now revealed the performance figures of the PMS.

No strategy is evergreen, equity investors have to go through good and bad times to create long-term wealth. Sharing EQ performance on popular demand? pic.twitter.com/RhNaMlciKx

— Porinju Veliyath (@porinju) July 4, 2018

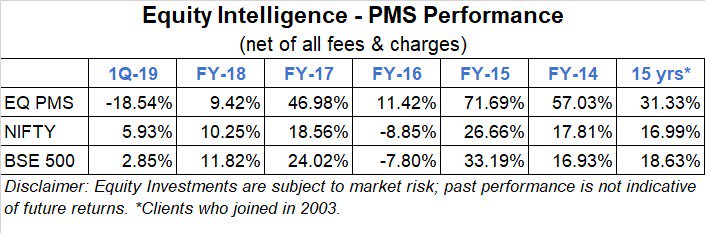

As one can see, the PMS has underperformed in FY18 and also in Q1FY19.

In FY18, the Fund was able to churn out only 9.42% while the Nifty and BSE 500 outperformed with returns of 10.25% and 11.82% respectively.

The underperformance is starker in Q1FY19 with the PMS Fund suffering a loss of 18.54% even though the Nifty and BSE 500 delivered gains of 5.93% and 2.85% respectively.

However, there is out-performance if one looks at the scenario over longer periods of time.

Prima facie, the reason for the present underperformance is the concentrated positions taken by Porinju in LEEL Electricals, Kaya and VA Tech Wabag, all of whom have lost big chunks of their valuation in the ongoing correction.

These stocks will have to surge significantly for the out-performance of the past to return to the PMS.

The heartening aspect is that Porinju’s PMS clients are not discouraged by the underperformance. Instead, they have pumped in more funds.

Retail investors are gaining wisdom & common sense! Equity Intelligence too witnessed net fund-inflow during the panic months of May & June. https://t.co/QGYXDp5CWi

— Porinju Veliyath (@porinju) June 29, 2018

Strategy of betting big on “chor” companies has backfired

Porinju candidly admitted that the reason for the underperformance in the PMS Fund is because his strategy that “chor” companies would reform and turn a new leaf has not fructified as yet.

“I have bet big on improving corporate governance in a structurally changing Indian economy; the strategy looks backfired as of now,” Porinju said in a rueful tone.

“It is true that many chor promoters still find loopholes during the transition period,” he added.

A Rule-Based Economy cannot be built overnight! Change is a painful and time-consuming process. It is true that many chor promoters still find loopholes during the transition period.

— Porinju Veliyath (@porinju) June 28, 2018

Forget high-quality blue-chip stocks. Even SSC pass can buy them

As far back as in Jan 2015, Porinju had made it clear that he is contemptuous about investing in blue-chip stocks.

“Buying a famous ‘performed’ blue chip stock, with great management, clean BS and excellent growth business, doesn’t need any skill,” he had said.

Buying a famous ‘performed’ blue chip stock, with great management, clean BS and excellent growth business, doesn’t need any skill.

— Porinju Veliyath (@porinju) January 5, 2015

Later, he made good his assertion by pointing out that while the so-called blue-chip stocks like HUL, Nestle, ITC and Colgate had languished and delivered paltry returns, FCEL, their desi counterpart, had delighted with magnificent multibagger gains.

'Indian Stock' is up 235% in 2 yrs, while #BlueChips #Bookish #Academicians #BuffettFollowers gained 22%. #IndiaGrowthStory We hold FCEL https://t.co/3k6ax5pRsZ

— Porinju Veliyath (@porinju) September 7, 2017

Porinju’s contempt with regard to investing in blue-chip stocks has not diminished with the passage of time and the underperformance of his PMS.

“Even a SSC pass can buy blue-chip stocks,” he said in a defiant tone.

He added that ‘improving corporate governance’ is still a theme to play for.

High-Quality BlueChip Investing has its merits & higher safety, and trust me, you don't need a fund manager or advisor/distributor for doing it – provided you have passed SSC.

— Porinju Veliyath (@porinju) June 29, 2018

Archies is perceived to be a “chor” stock

In July 2015, Porinju pointed out that Archies Ltd is perceived to be a “chor” management though it may be on the verge of a turnaround. He opined that the Company has a “lot of opportunity to expand business”.

Archies | 24 – perceived to be 'chor' mgmnt; can turnaround with its cute brand, neat BS and new initiatives??http://t.co/Y3oAVhuXmQ

— Porinju Veliyath (@porinju) July 8, 2015

PORINJU VELIYATH : See a lot opportunity for Archies to expand business

— ET NOW (@ETNOWlive) July 10, 2015

Aggressive buy of Archies Ltd

Porinju has been buying Archies Ltd in an aggressive manner.

On 20th July 2015, he bought 2,00,000 shares at Rs. 28.23 each in the name of “Sunny Veliyath Porinju”.

Thereafter, on 11th April 2017, he bought another chunk of 4,00,000 shares at Rs. 29.15 each in the name of Equity Intelligence.

Archies – Fund action

EQUITY INTELLIGENCE INDIA Pvt ltd BUYS 4 lk shares @ Rs 29.15/-

(Porinju Veliyath’s Fund)— SONAM MEHTA (@sonamcnbcawaaz) April 11, 2017

He has been on a further buying spree on dates which are not known.

What is known is that as of 30th June 2018, Equity Intelligence owns 8,30,000 shares of Archies Ltd, comprising 2.46% of the equity capital.

Will Archies Ltd turnaround and deliver multibagger gains?

Seshan Ranganathan, Archies’ CEO, has been making all the right noises with regard to the turnaround of the Company’s fortunes.

In April 2017, he assured that a “complete turnaround” is on the cards. Several loss-making stores will be shut down as part of the restructuring process, he said.

The management also assured that in FY19 the turnover would grow by 15% while the EBITDA margins would surge to 12%.

Archies Operational Turn Around

Net Profit at 23 LK vs Loss of 1.2 Cr

Higher EBIT from High Margin Pdts

Stationery Biz EBIT at 0.86 Cr vs 0.12 Cr

Gifts EBIT at 1.03 Cr vs .9 Cr@CNBCTV18Live @ArchiesCO— Mangalam Maloo (@blitzkreigm) November 30, 2017

| ARCHIES LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 97 | |

| EPS – TTM | (Rs) | [*S] | – |

| P/E RATIO | (X) | [*S] | – |

| FACE VALUE | (Rs) | 2 | |

| LATEST DIVIDEND | (%) | 15.00 | |

| LATEST DIVIDEND DATE | 18 SEP 2015 | ||

| DIVIDEND YIELD | (%) | 0.00 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 34.80 |

| P/B RATIO | (Rs) | [*S] | 0.83 |

[*C] Consolidated [*S] Standalone

| ARCHIES LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | MAR 2018 | MAR 2017 | % CHG |

| NET SALES | 42.74 | 48.6 | -12.06 |

| OTHER INCOME | 0.75 | 0.7 | 7.14 |

| TOTAL INCOME | 43.49 | 49.3 | -11.78 |

| TOTAL EXPENSES | 40.88 | 50.5 | -19.05 |

| OPERATING PROFIT | 2.61 | -1.2 | 317.5 |

| NET PROFIT | 0.31 | -1.61 | 119.25 |

| EQUITY CAPITAL | 6.76 | 6.76 | – |

(Source: Business Standard)

Conclusion

At this stage, novices are so badly bruised by the savage correction in the markets that we have no appetite to buy any stocks, leave alone a ‘chor’ stock. However, we have to keep our eyes and ears open because the tide may change suddenly and the appetite for these stocks may be revived!

With regards to the long term performance of his PMS, are the figures he is claiming audited? If yes, by whom? And are these performance figures after or before fees? I would be interested to see his after fees performance figures. Also, what is his portfolio turnover? A very high turnover equates so high trading costs = lower returns to clients. Would be quite interested to see what the “clean” and “genuine” long term performance figures look like. I suspect he may have done a bit better than the index but nowhere close to what he claims in these figures. Happy to be proven wrong though!

Archies ltd.

Pe = neg

Roce = neg

Roe = neg

Div. = 00

What is positive ?????????

There parameters work only if the company is stable and making steady progress, and not for startups and turnaround companies that are slowly making progress and moving from Loss to Profit gradually. For these kinds of companies you need to dig deeper. This kind of approach is specialized, and requires long experience, and still the success rate is marginally over 50%. Porinju, in my opinion, is nerdy enough to have put in place proper risk management strategies.

Attitude.

I don’t agree that one can not make money by investing in Blue chips, just check performance of Any PMS or mutual fund win comparison to a portfolio of just four blue chips stocks portfolio with equal weight of 25% of blue chips HDFC Bank, Kotak Bank, HUL and Maruti, it might have beaten 90% of all these Gurus and members at this forum in last one, three and five years and let this uncertainty run for few more months and almost all will be beaten by this portfolio. No recommendation but investors just cross check it.

If I had added one more blue chip Bajaj finance, this five blue chips stocks portfolio might have done wonder in last five years.

Correct Asian paints pidilite berger pains maruti tcs nestle galxo consumer Honeywell automation were blichips in 2005 and bluechips today as well…and made tons of money for investors

Forget about a portfolio of blue chip stocks which can do wonder, Just one blue chip, Kotak Bank inspite of being over priced can out smart most of these Gurus in next 5 years. No recommendation but for discussion.

The confused contrarian EPS in me says the current result season rally is probably the last chance to exit mid caps in this cycle.

The derating will then force us to hold for very long periods of time.

Size and stature of investor will make the wait doubly excruciating

At least have your opinion instead of copying someone else tweet

It’s ok if he copies someone thought.Everyone is quoting Munger and buffet to become a professor .Look at what has.happenned to stocks like Sintex. I think he has copied the right tweet.

“Even a SSC can pick blue chip stocks”. That’s exactly the point why speculation in penny stocks is ill advised.Many of us are less than SSC’s in investing and bank balance though we may be PHDs in our regular professions.Blue chips will never fail you in the long term but penny stocks almost certainly will in the long game.Not denying the phenomenal return but for every such return there will be one with equal loss

Remarks of Kharb are very incisive and informative as always. Now, I feel, a basket of Yes Bank, RBL Bank, Maruti, D Mart, and Bajaj Finance can deliver fabulous results. Buying high quality at reasonable prices and holding them for long is the key.

Yes, good blue chips can give 20%CAGR without loosing sleep if chosen wisely.

Investors should avoid any dead cat bounce in D grade Speculative stocks, you will be trapped and you will be giving chance only to Manipulators an exit route to dump these third class stocks to you. Rally in third class stocks is Over.

I agree with you Kharb. I have burnt my finger buying some of these stocks like Singer , Sarla, Sintex, KTK Bank, Aries Agro based on these marquee names. I am sure more retail will be trapped with new stories and new share holding patterns.We need to stick to quality and swayed by bulk deasl or shareholding patterns in d grade stocks.

Pratik bad luck mate . I think you watched Mr Kedia’s Diwali pick and bought KTK bank He has already sold it. Hope u dont now go and buy Everest Masala and Repro books now. Sarla performance promoter looks like a trader like ashwini who sells his stock when it goes up and when its expected to give bad results. Singer the promoters have been offloading trucks of their holding beware!

Porinju’s strategy of investing in turn around situations is aimed at finding diamond in the rough. Which is a tough task. Huge downside but huge upside also and strong volatility. This strategy is being followed by many international Gurus. But just because this strategy does not suit layman investor like me, I can’t condemn it.

Most of D grade stocks are trading for many years, many of these turn around in every stock market boom with cooked numbers and rigged share prices with help of manipulators.After end of every bull run these turn around just from Bad to ugly to worse to delist and small investors are left with these duds.

If any body needs to churn his portfolio more than 20% per year or average holding is less than 5 years , he needs to learn selecting good stocks for investing.

Bedrock of Porinju’s philosophy is if a stock unanimously accepted as a good stock, goodness gets priced in, leaving not much for the investor. Hence he tries to see what is not apparent.Turn around situations presents such opportunities. This strategy needs long experience,deep conviction,unwavering patience and arrogance to go against the crowd.Expected results could be great risk,which should be managed,or huge multibagger returns.Even 3 to 4 stocks go dud in the portfolio of 10 stocks,upside in rest of the stocks will more than make up.

I no fan of Porinju.My investment style is different In I follow no investment guru, I go by own investment thesis. However, I like thinking process of Mohnish Pabrai.

Another point to keep in mind are the taxes to be paid. PMSes report figures net of fees but those don’t include taxes that the investor has to separately bear.

Porinju does well to ensure that most of the times it is LTCG (zero until Jaitley thought he was pulling off a masterstroke with a 10% LTCG) and rarely STCG.