Porinju Veliyath’s high-conviction stock picks hammered by Bears

A few days ago, I grimly reported that DHFL, Rakesh Jhunjhunwala’s fav stock, and Muthoot Capital, Dolly Khanna’s fav stock, had been mercilessly targeted by the Bears.

Yesterday, it was the turn of Porinju Veliyath to witness the wrath of the Bears.

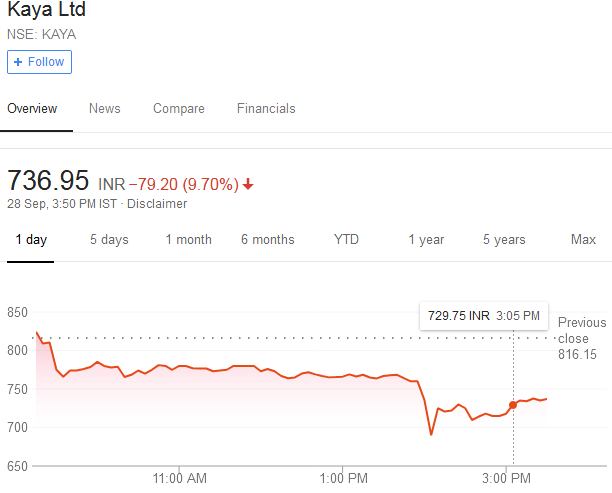

Kaya Ltd, his all-time favourite high-conviction stock pick, crumpled like a leaf under the ruthless and relentless Bear attack.

It lost a hefty 10%.

In just the last month, the stock has lost 23%.

Porinju and his Equity Intelligence PMS Fund hold a colossal quantity of 15% of Kaya’s equity.

Equity Intelligence holding in Kaya has now crossed the 15% mark. @porinju now holds almost a staggering 2 million shares. Bet big, bet hard on high conviction stocks. pic.twitter.com/QkciGQ2V50

— Kush Katakia (@kushkatakia) June 8, 2018

EQ's @porinju now owns a staggering 1751617 shares of Kaya Ltd. This works out to a massive 35% of the free float. This is what I would call "Putting money where your mouth is". https://t.co/EHarFRHfoJ

— Kush Katakia (@kushkatakia) April 18, 2018

LEEL, Porinju’s other high-conviction pick, has also been on a free-fall.

It has lost 73% on a YoY basis owing to the machinations of the dreaded Bears.

Leel Electricals in focus@porinju Equity Intelligence India stake in Leel Electricals has been increasing

Feb 2018 7.35%

Dec 2017 5.52%

Sep 2017 4.92%@CNBCTV18Live— Nigel D'Souza (@Nigel__DSouza) February 2, 2018

Va-Tech Wabag, also a fav stock of Porinju Veliyath, has been the subject of intense selling pressure after news emerged that L&T, the blue-chip behemoth, is girding its loins to storm the water treatment arena.

Investors In Porinju Veliyath's Fav Stock Nervous After L&T Storms Into Sector https://t.co/fWewl4knjg pic.twitter.com/At7Vb8h2Qb

— RJ Stocks (@RakJhun) September 1, 2018

Equity Intelligence' @porinju takes a massive bet on @vatechwabag , now owns 2.73 million shares (5.02%). pic.twitter.com/eue5rXsZcC

— Kush Katakia (@kushkatakia) March 16, 2018

This worthy has also lost 50% of its valuation on a YoY basis.

Whether the stock will ever recover its mojo in the light of the threat posed by L&T is anybody’s guess.

KNR Construction gave 1000% gain after Porinju recommended it

Thankfully, in the present days of gloom, we can still reminisce the golden days of the past when mega multibaggers were easy to be found.

Porinju recommended KNR Construction, then a little-known micro-cap, in April 2014, when it was languishing at a market capitalisation of Rs. 270 crore.

The logic was simple but impeccable.

“Clean BS, good business, good if you want to bet on Infra in the changing environment,” Porinju stated.

KNR Construction @ 97 – MktCap 270Cr. Clean BS, good business, good if you want to bet on Infra in the changing environment.

— Porinju Veliyath (@porinju) April 29, 2014

The timing was brilliant because in the blink of an eye, the stock surged like a supersonic rocket and posted massive gains of 450% even though its’ peers slumped.

KNR up 450% while most in Infra fell:

Huge EPC opportunities emerging, explore few Infra mid-caps with healthy B/S!https://t.co/2h7d3HW1Nv— Porinju Veliyath (@porinju) August 14, 2015

Thereafter, before anyone knew what was happening, the stock had given massive 10-bagger (1000%) gains.

“10x in 3 yrs! Many more KNRs in making. Trillion Dollar opportunity in Housing & Infra coming up, Grab it!,” Porinju exclaimed in an ecstatic tone, his eyes sparkling with excitement.

10x in 3 yrs! Many more KNRs in making

Trillion Dollar opportunity in Housing & Infra coming up, Grab it! https://t.co/2h7d3HW1Nv— Porinju Veliyath (@porinju) May 9, 2017

In the wake of the spectacular succeess of KNR Construction, Porinju opined that several other 5x and 10x multibagger stocks in the infra sector are lying in wait for us.

Over a dozen Infra cos at inflection point – stronger balance sheet, better visibility & exciting operating environment; potential 5x & 10x

— Porinju Veliyath (@porinju) July 26, 2017

At least 5 Infra companies with mktCap <10,000 Cr currently, heading for >30,000 Cr mktCap in 5 years in a favorable operating environment.

— Porinju Veliyath (@porinju) August 13, 2017

I see 25 listed 10x ( in next 5 Yrs) stocks in this picture! pic.twitter.com/T2y9Ng1nbQ

— Porinju Veliyath (@porinju) October 28, 2017

| KNR CONSTRUCTIONS LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 2,521 | |

| EPS – TTM | (Rs) | [*S] | 19.81 |

| P/E RATIO | (X) | [*S] | 9.05 |

| FACE VALUE | (Rs) | 2 | |

| LATEST DIVIDEND | (%) | 20.00 | |

| LATEST DIVIDEND DATE | 24 SEP 2018 | ||

| DIVIDEND YIELD | (%) | 0.22 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 82.34 |

| P/B RATIO | (Rs) | [*S] | 2.18 |

[*C] Consolidated [*S] Standalone

| KNR CONSTRUCTIONS LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | JUN 2018 | JUN 2017 | % CHG |

| NET SALES | 556.36 | 480.75 | 15.73 |

| OTHER INCOME | 17.76 | 12.26 | 44.86 |

| TOTAL INCOME | 574.12 | 493.01 | 16.45 |

| TOTAL EXPENSES | 446.5 | 396.22 | 12.69 |

| OPERATING PROFIT | 127.62 | 96.79 | 31.85 |

| NET PROFIT | 74 | 67.59 | 9.48 |

| EQUITY CAPITAL | 28.12 | 28.12 | – |

(Source: Business Standard)

KNR Construction has 135% gain potential: Dolat Capital

Dolat Capital has recommended a buy of KNR Construction on the premise that massive gains in excess of 100% can be raked in from it.

The logic is quite convincing:

“The annual report theme encompasses four decades of engineering excellence in the field of infrastructure such as roads, irrigation and water management works. KNR maintains its market position by continuously focusing on engineering excellence, improving and sharpening competencies, adapting latest construction technologies, deployment of sophisticated construction equipment and timely delivery. KNR reported revenue growth of 25.3% YoY in FY18. EBITDA margins expanded 509bps YoY to 20% led by operational efficiencies in addition to lower sub-contracting cost. Reported PAT grew 73% YoY to Rs. 2.7bn, however, after adjusting exceptional gains of Rs. 236mn in FY18 vs. loss of Rs. 109mn (FY17), Adj. PAT grew 47.8%.

5 HAM Wins Lead to Rs. 59.6 bn Orderbook (3.0x TTM Revenue)

KNR received 4 NHAI HAM in Q4FY18 and 1 KSHIP HAM in Q1FY19. However, these are not included in the orderbook as financial closures are yet to complete. In the current scenario where, weak balance sheet-companies are facing difficulties for financial closure, KNR has proved its excellence by receiving term loan sanctions for 3 HAM projects and are in the process of completing financial closure.

Stabilization in BOT Toll Collection

KNR’s toll BOT project Walayar-Vadakkancherry in Kerala has received final 100% CoD on 31-Oct-15 and toll collection during FY18 stood at Rs. 517 mn. Currently, toll collection per day is Rs. 2.3 mn. Another toll BOT project Muzaffarpur-Barauni in Bihar has received final 100% CoD on 24-Aug-17 and toll collection started from 1-Oct-17. Toll collection during FY18 stood at Rs. 453 mn. Currently toll collection per day is Rs. 2.0 mn.

Growth Plans and Focus

Under the KNR growth plan, thrust will be given to highway HAM projects, EPC in highways, irrigation including waterways, flyovers and segmental structural section in metros and bridges. In complex bridges, flyovers and railway connectivity projects, KNR will explore technological-cum-financial JV partners. Focus will be on capacity building in manpower, machinery, materials and finance with the objective of timely delivery with perfection.

View

We expect KNR to witness healthy revenue growth over FY18-20E, supported by healthy margins and return ratios coupled with well managed balance sheet, comfortable working capital and low D:E ratio. Hence, we maintain Buy with a SOTP of Rs. 418.”

#1QWithCNBCTV18 | KNR Constructions reports Q1FY19 results pic.twitter.com/bmpJjPS5aJ

— CNBC-TV18 (@CNBCTV18Live) August 10, 2018

KNR’s outperformance continues: HDFC Sec

HDFC Securities has projected a target price of Rs. 392, which means that gains in excess of 100% are waiting to be reaped by us.

The reasons are also quite convincing:

“KNRC continues to outperform its growth guidance and delivered strong 1QFY19 revenue at Rs 5.6bn which was 18.4% above estimates. EBITDA at Rs 1.1bn was 35.7% above our estimates, with EBITDA margins expanding to 19.7% (+215bps YoY, +42bps QoQ). We estimate sustainable margins to be around 16-17% and have revised our estimates to reflect the same. APAT beat stood at 57.5%.

Order book is Rs 59.5bn with Rs 2bn addition in Arunachal Pradesh project scope. KNRC is focusing on completing financial closure of its 5 HAM projects (EPC value – Rs 39.8bn) that were won in 4QFY18. KNR has announced FC for 3 and 4th HAM FC is expected in Aug-18.

KNR continues to maintain a lean WC capital cycle with NWC days at 30, especially demonstrating strong control on receivables (28days) as compared to 50-75 days for other listed peers. We continue to maintain BUY with and increased SOTP of Rs 392/sh.”

#OnCNBCTV18| K Jalandhar Reddy, ED, KNR Constructions says targetting to bag further orders worth Rs 2,000 cr in FY19@_anishaj @_soniashenoy pic.twitter.com/8iUQJHoiGg

— CNBC-TV18 News (@CNBCTV18News) April 18, 2018

Similar bullish targets have been projected by Motilal Oswal & Reliance Securities.

Conclusion

It is obvious that we cannot turn a blind eye to infra stocks in the light of Porinju Veliyath’s assertion that 5x and 10x multibagger gains can be raked from them. We will have to keep KNR Construction in our watch-list and pounce on it whenever the situation is appropriate!

Wat about sp tulsian recommendation on pnb. Only in august he was flashing with big buy on pnb 90percent upside and 10 percent risk.since then stock has fallen 100 percent.who allows him on tv channels.is sebi not watching

Just wait for couple of years story on KNR. It is infra and Hyderabad based Company and let us see how it spans out.