For some reason, Porinju Veliyath has developed the reputation of being a picker of low-quality and junkyard stocks with dubious corporate governance standards. This perception has made him the target of purists who believe that such stocks are risky and no better than a gamble. Also, when Porinju rakes in big bucks from such stocks and tom-toms the fact, the purists suspect that there is more to it than meets the eye.

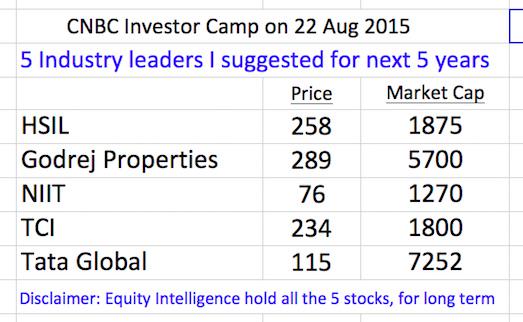

Fortunately, in recommending stocks at the CNBC Investors’ Camp, Porinju has been sensible and has steered clear of controversy. He has recommended stocks which are text-book examples of top quality management, corporate governance, and high growth potential.

Let’s do a quick review of Porinju’s latest stock recommendations:

Hindustan Sanitaryware (HSIL): We are very familiar with HSIL because it also happens to Daljeet Kohli’s favourite stock. Daljeet has carefully dissected the stock and explained each of its fundamentals to us. Emkay and Vikas Sethi are also bullish about HSIL. The stock is presently in the doldrums because of the slow down in the real estate sector. However, given its “strong brand, variety of product portfolio, and very strong distribution network across the country” it is only a question of time before the stock takes off in an upward trajectory.

NIIT: Porinju has already made a packet from NIIT as we saw earlier. Porinju called the stock a “very, very safe stock at inflection point”. The stock also has the backing of Vijay Kedia. Vijay Kedia recently tweeted about NIIT: “For 3 years perspective it looks to be a good investment. It holds 24% of NIIT Tech.”

Godrej Properties, Tata Global Beveragres and Transport Corporation of India:

All three are well-known blue chip and no-brainer stocks.

Godrej Properties belongs to the reputed Adi Godrej group and is engaged in top-quality realty projects. When the real estate market recovers, Godrej Properties will be among the first to get off the block.

Tata Global Beverages belongs to the venerable Tata group. It has been one of Porinju’s old favourites though it has also been very sluggish. Porinju is hopeful that the change in management strategy will send TGBL rocketing into space.

Transport Corporation of India (TCI) also needs no introduction to us given its pedigree of ace investors. Ramesh Damani and Radhakishan Damani hold large stakes in it. TCI has a stranglehold over land and coastal shipping and is a direct proxy for the growth in the great Indian economy and the e-com sector.

It is clear that Porinju has put in a lot of thought in selecting his top five stock picks. He appears to have consciously avoided his other “high risk – high reward” stocks like Izmo, Palred, Sahyadhri Industries, Ansal Buildwell, Jubilant Industries etc as they may not be suitable for an average-Raju sort of investor.

Hopefully, now even the purists will like Porinju’s stock selection and they will go easy on him in the future!

after seeing so many articles on porinju on this website, I am sick of him…Now a days not seeing any articles on other stalwarts like Professor shivanand mankekar etc.,

all their portfolios have got such a bad hammering that there is nothing to write about them

I am hearing about Tata Globel for last two years.I remain invested in it for three years.It did not move.Many so called experts including HDFC securties have failed in their prediction about this.I think now it is turn of Parnju to go wrong.TCI is in market for last three decades,did nothing great, may be It was waiting for Pronju recommendation to fire ?Godrej properties in realty sector going for long stagnation.HSIL ,Daljit kohli has gone to non striking end with out big score in waiting for glass division to fire.May be glass division of HSIL was waiting for Parnju recommendation for giving super profits..These stocks will underform market ,inspite of Pronju bullishness.Usually big wealth creater compnies do good from start and start doing better with time and become segment leaders in less then 25 years.Parnju is recommending stocks which did nothing great in start of their business life cycle,nothing in their prime and expecting to do them great in their last leg of business life cycle. Actually in start of any bull run,every body is proved right by recommending any share as usualy market is under priced due to bear market.Only after maturing of bull market ,we come to know who was swimming naked,when tide turn to low from high,we can differentiate boys from men..Remain invested in good qualty business ,with qualty managements in compnies in dominating position and with some pricing power. No bravery in backing . proven under performers.

so any stocks on your radar??

Hilarious..I hope Porinju gets to read this ..but he has spotted many winners ..you can not deny this

Great comment. Qudod…

You are right, I am amazed to see how NIIT after remaing in 35 around level for so many years, suddenly doubled sometime I think its operator driven or may be there might be followers who are following him blindly and just buying whatever he is recommending.

Porinju’s stock I see only hits upper and lower circuit.

The quality stocks are also falling but not in lower circuit and giving you enf time to get out so atleast you won’t loose 10 or 20% in single day.

please suggest some beaten down stocks

u can look at Mayur Uniquoters, century ply, repco home finance, ratnamani metals. invest in SIP mode, as there is too much uncertainty nw and no one can corerctly predict the extent of damage that China can cause. But yes, India is much better placed than other EM’s but we are part of global market so will be affected in case of global turbulance

What about Arcotech ltd, why it is falling, any one suggests, what to do??