PPFAS outperforms benchmark

First, we have to check how the PPFAS Mutual Fund has performed in the last one year, given the extreme turbulence in the markets.

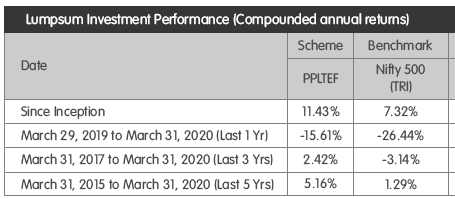

Thankfully, it has outperformed by losing only 15.61% as against 26.44% lost by the Nifty 500 Index.

Over the past five years, the Fund has delivered a CAGR gain of 5.16% as against 1.29% delivered by the Index.

Since inception, the Fund has earned 11.43% CAGR while the Index has trailed with a 7.32% return.

The AUM now stands at an impressive 2448 crore.

Portfolio of Indian and foreign stocks

One aspect about the PPFAS Mutual Fund that is unique is that an investor gets a cocktail of the best Indian and the best foreign stocks.

As one can see, upto 31% of the AUM is invested in five top-notch foreign stocks being Alphabet (Google), Anazon, Facebook, Suzuki and Nestle.

All five are fail-safe powerhouses.

Amongst Indian stocks, one can see the familiar names such as HDFC Bank, Bajaj Holdings, Mphasis, Hero Motocorp etc.

There is proper attention paid to the sectoral allocation as well.

The maximum allocation of 18.72% has been awarded to the Banking sector, while 10.08% has been allocated to the Finance sector.

The Software sector has taken up 10.42%, followed by a proper allocation to the Consumer Services, Auto, Pharma etc.

Three new stocks added to the portfolio

Three new stocks have been ushered into the portfolio.

These are ITC Ltd, Oracle Financial Services Software (OFSS) and MCX.

ITC Ltd is very familiar to us.

It is a fail-safe diversified conglomerate with interests in the FMCG, Hotels and Tobacco.

According to knowledgeable experts, the stock is the cheapest in the FMCG sector, when compared with peers like HUL, ColPal, Dabur, Marico etc.

The stock also boasts of a mind-boggling dividend yield of 10%, which implies that there is complete downside protection.

ICICI-Direct has recommended a buy of ITC for a gain of 45%.

The logic is quite persuasive:

“In the recent market fall, ITC witnessed a significant correction of ~30%. At the current price, the stock is trading at 11x & 10x its FY20E & FY21E earnings. Though the current economic conditions would have an adverse impact on ITC’s earnings for a quarter or two, we believe the company would be able to sustain the earnings growth in the long run backed by improvement in cigarettes as well as FMCG segments. Moreover, with the recent change in dividend policy, the stock is trading at attractive dividend yield (on account of dividend policy & special dividend). We value the stock at sum of the part valuation method (valuing cigarettes business at 14x FY22 earnings, FMCG at 5x price to sales) and arrive at a target price of Rs 230 per share with a BUY recommendation.”

I ended up buying so many shares of ITC that it's dividend alone (going by the latest proposal) can fund our annual family expenses.

— D.Muthukrishnan (@dmuthuk) April 5, 2020

P/E (earnings trailing 12 months) of some companies that are into must consumption businesses

~ Britannia 47

~ Colgate 42

~ Nestle 77

~ HUL 71

~ ITC 14

~ IRCTC 36

~ Tasty Bites 56

~ DFM Foods 25

~ Hawkins 27

~ 3M India 70Consumption is forever, will attract premium valuations

— LearnLifeWealthTravel (@AnyBodyCanFly) April 1, 2020

#ITC remains the #cheapest and most favoured stock by the analysts in the sector. https://t.co/sqVcEtoyXO pic.twitter.com/L8ZrjMIw34

— MY VΛLUE PICKS (@myvaluepicks) October 3, 2019

MCX

One unique aspect about MCX is that only “fit and proper” persons are eligible to buy shares in it.

Riff-raff and persons of dubious reputation and integrity are disqualified from becoming shareholders.

This is because MCX is a commodities exchange and needs to protect its own well-being from being soiled by unsavory persons.

Stock and Commodities Exchanges are supposed to be money-spinners enjoying ‘operating leverage’.

They have fixed costs and every trade adds to the bottomline.

MCX is no exception to this and that is why it has attracted investors like Rakesh Jhunjhunwala to its ranks.

Motilal Oswal has recommended a buy of MCX on the logic that it is “Key beneficiary of global market volatility“.

Investors are aggressively buying/ selling commodities like Gold/ silver/ crude/ copper etc and this is adding to MCX’s profitability.

MCX achieves a record market share of 94% in FY20

MCX's bullion turnover increased by 92.59% and energy turnover by 55.58%. The total turnover in futures trading rose by 27.40% to Rs.83.97 lakh crore in the last fiscal. #MOMarketUpdates— Motilal Oswal Financial Services Ltd (@MotilalOswalLtd) April 8, 2020

Oracle Financial Services (OFSS)

Oracle, a MNC stock, was founded by visionary Billionaire Larry Ellison and produces “enterprise software” which is widely used in all applications.

The parent company owns nearly 74% of the equity of the listed company, which means that there is limited floating stock for the Indian public.

No doubt, the stock will prove to be a steady compounder in the years to come.