Few people have heard of Sanjay Agarwal or of his NBFC called AU Financiers operating in Jaipur, Rajasthan.

Yet, Sanjay Agarwal is a textbook example of an “intelligent fanatic” because of his single-pointed motivation, dedication, hard work and visionary approach.

In the embedded video, Sanjay Agarwal has explained the various trials and tribulations that he has gone through. He failed his CA exams multiple times and was able to scrape through his studies with great difficulty.

When he started AU Financiers, Sanjay Agarwal did the sensible thing of copying the business model of HDFC Bank. He cloned their methodology of evaluating business opportunities and risks and determining the credit worthiness of potential borrowers.

Copying the business model of HDFC Bank endeared AU Financiers to big-ticket investors like Warburg Pincus, International Finance Corp, ChrysCapital, Kedaara Capital etc.

Raamdeo Agrawal was amongst the first to recognize the potential of Sanjay Agarwal and of AU Financiers.

When Sanjay Agarwal walked into the office of Raamdeo Agrawal a few years ago, he (Sanjay Agarwal) was still a petty businessman with a gross income of about Rs 10 crore and net profit of Rs 2 crore and was desperate to raise money from investors to fund his expansion plans.

One look at Sanjay Agarwal and listening to his business plans told Raamdeo Agrawal that he had discovered an “intelligent fanatic” and that there was a gold mine of an opportunity in front of him.

When asked what he saw in AU Financiers, Raamdeo did not hesitate for a second. “The management .. the person … a chartered accountant, young, passionate and with integrity” Raamdeo said.

“We bought at Rs 50-60 crore valuation, we put Rs 20 crore, which gave us 30- 35 percent (stake). That was 6 years back. We sold it for Rs 5,000 crore .. 100x .. that’s the power of private sector banks” Raamdeo added with obvious pride at his ability to spot winners early on.

“It is a leap of faith. We are celebrating success” Raamdeo said with his customary humble and modest style.

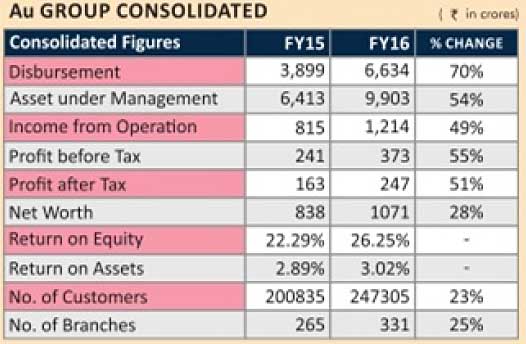

Now, the all-important aspect that we have to pay attention to is that AU Financiers has received approval from the RBI to set up a “small bank”. In furtherance of this, AU has reduced the foreign shareholding and will soon come out with an IPO to increase the holding of the Indian public.

This will give all of us the much needed opportunity to participate with an intelligent fanatic and hopefully make a 100-bagger of our own!

If he is so good, why his mutual fund is trailing in the ytd rankings. Incidentally where are the rs 5000 crores. Did he invest in his personal capacity

all these 100/1000 baggers are meant for the personal investments!

He must have invested in his personal capacity. The article states that the company will be coming out with IPO. Therefore it is still unlisted.

The article says he sold it for rs 5000 crores.

Investment was made through Motilal Oswal Private equity fund

Example of “Copying a good business model can also become a great business”

privatising the windfall gains and later give a pie to public to invest in IPO ramdeo estyle