Radhakishan Damani storms into “Top 10” Club of Billionaires

First, we have to compliment Radhakishan Damani because he has now officially entered the “Top 10” club in Forbes’ list of Billionaires.

His net worth has surged to a colossal $14.3 billion (Rs. 107,250 crore).

This announcement was made by Forbes amidst great pomp and show and was welcomed with much jubilation in Dalal Street.

D-Mart's Radhakishan Damani breaks into the 'top 10' club with $14.3 billion#ForbesIndiaRichList2019

Full list: https://t.co/HhQsMVycaA#DMart pic.twitter.com/fVV7hVqFxs— Forbes India (@forbes_india) October 14, 2019

It is worth noting that Radhakishan’s journey into the Billionaires’ Club was not without its own trials and tribulations.

In 2016, during the deadly Bear market, he was unceremoniously stripped of his stature as a Billionaire by Forbes (see Bear Market Claims First Victim As Radhakishan Damani Loses Coveted Status Of Forbes Billionaire).

However, a tenacious fight against the Bears, and ultimate victory, meant that Radhakishan was given back his much deserved title in 2017.

(Billionaires Ball in Dalal Street: Radhakishan Damani, Rakesh Jhunjhunwala & Rashesh Shah with Ramesh Damani, Madhusudan Kela and Dharmesh Shah)

Delta Corp: Latest stock pick of Radhakishan Damani

Radhakishan Damani’s latest stock pick is Delta Corp, the mid-cap stock with a market capitalization of Rs. 5077 crore.

As of 30th September 2019, he is the proud owner of 41,34,896 shares of Delta Corp.

The investment is worth Rs. 77.32 crore at the CMP of Rs. 187.

Delta Corp in focus

As per Sep Shareholding

RADHAKISHAN S DAMANI Holds 1.53% stake in CoAlert: His name wasn't in June Shareholding, so may be it's fresh addition, or he held less than 1% earlier.

— Mangalam Maloo (@blitzkreigm) October 18, 2019

One of the jewels of Rakesh Jhunjhunwala’s portfolio

It is a matter of record, and does require repetition, that Delta Corp is one of the jewels in the portfolio of Rakesh Jhunjhunwala, the Badshah of Dalal Street.

As of 30th September 2019, Rakesh Jhunjhunwala holds 1,15,00,000 shares while his better half, Rekha, holds 85,00,000 shares.

Collectively, the holding is 200,00,000 shares and is worth Rs. 374 crore at the CMP of Rs. 187.

The Badshah has come on record that he is “very excited” about the prospects of Delta Corp.

Delta Corp: Survivor of NAMO’s demonetization strike

When NAMO introduced demonetization in November 2016, Delta Corp was given up for dead.

This was on the premise that gamblers, who use their ill-gotten cash in casinos, would no longer patronize Delta.

Vijay Kedia led this school of thought.

“I have yet to see somebody who swipes to gamble in the casino,” he said in a succinct manner, meaning that it was GAME OVER for Delta.

I have yet to see somebody who swipes to gamble in the casino. https://t.co/zaJ4dpt8II

— Vijay Kedia (@VijayKedia1) November 17, 2016

Delta Corp lower circuit. Biz model goes out of the window with cash

— Darshan Mehta (@darshanvmehta1) November 9, 2016

#Delta Corp:From Casino to "Cash No" in a single night. The worst affected company of this black money move.

— Arun Mukherjee (@Arunstockguru) November 9, 2016

However, it is obvious that everyone had underestimated the stickiness of Delta’s business model.

The stock is far from dead though it is still limping from the wounds inflicted by demonetization and GST.

The stock is more or less flat since that fateful day, which is quite an out-performance compared to its peers in the mid-cap space which have lost large sums of their market capitalization.

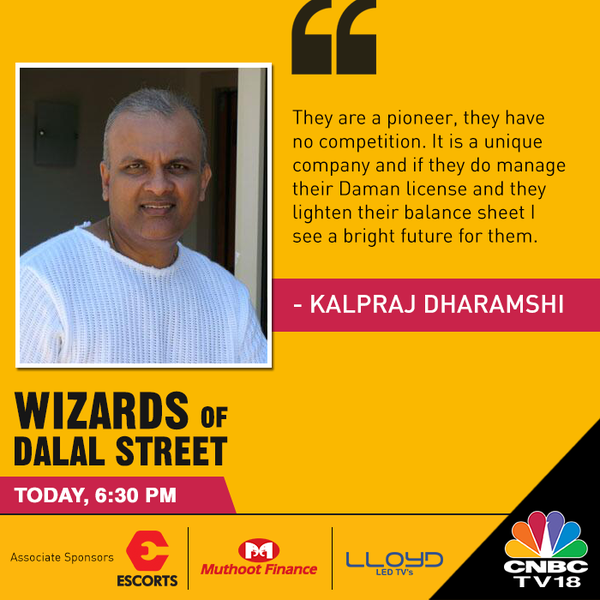

Delta Corp is a pioneer with no competition: Kalpraj Dharamshi

Kalpraj Dharamshi, the veteran value investor, came out with all guns blazing in support of Delta Corp in an interview with Ramesh Damani in September 2015.

“They are a pioneer. They have no competition. It is a unique company and if they do manage their Daman license and they lighten up their balance sheet, I see a bright future for them,” the veteran stock picker said.

No doubt, Kalpraj’s theory still holds good as is shown by Radhakishan Damani’s conviction in the stock.

3 Point Analysis of Delta Corp

Sakshi Batra, the charming journalist with moneycontrol.com, has conducted a “3-point analysis” of Delta Corp in which she identified the salient features and and explained why investors should pick the stock.

Sakshi has explained, in a succinct manner, that the company’s focus on online gaming will be the next big driver, given the growing internet penetration and availability of online payment options.

She has also pointed out that Delta Corp has multiple growth drivers that make it a good pick for investors with an eye on the long term.

Delta Corp is attractively valued and has 49% upside potential: Motilal Oswal

Motilal Oswal has conducted a detailed study of Delta Corp and recommended a buy.

The logic is quite convincing:

“Post a sharp correction, the stock is now attractively valued at 17x FY21E EPS. While the GST-related hangover remains, the operational performance is intact and will likely continue improving hereon.

We largely maintain our estimates and expect sales/EBITDA/adj. PAT CAGR of 11%/12%/19% over FY19-21.

We value the stock at 25x FY21E EPS to arrive at a target price of INR254. Maintain Buy“.

The target price represents a handsome 49% gain from the CMP.

Lol! What happened to TV18 that was a joint venture too!

TV18 didnt get u??

What connection TV18 has with Delta Corp.

Those are also Jewels in their portfolio!

TV18 is a great company available dirt cheap now. Their subscription numbers last quarter have come in very high (despite the new channel structures worked out by TRAI).

Once the economy turns around, and advertising revenue starts to shoot up, this stock will fly.

Disclaimer: I hold both Delta and TV18.

I really enjoy reading these articles and do my own research post reading this article and decide whether to invest or not.

Thank You.

Sab golmaal hai bhai sab golmaal hai. Hazaaro investers banao pahle niche mai gharido, phir innocent investors ko “Buy ” Advice karke dhok do; bus maza hi maza.

Junjunuwala ho ya Tuntonuwala. Note

gina-ney ki bhi jarurat nahi

I am worried about the corporate governance issues and difficult to trust the owners & management who are into gambling field. TV18 CG issues are well known and stock has reached no where in the last decade.