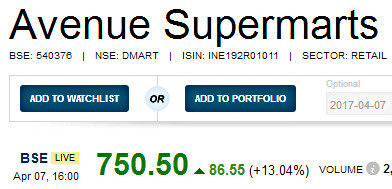

D-Mart’s spectacular surge of 13% today caused joy to many:

Dmart closes highest level since listing, guḍ chance of strong upside from here pic.twitter.com/FdQHw1JAXt

— Ashwani gujral (@GujralAshwani) April 6, 2017

Ashwani Gujral, the noted expert on technical analysis, was full of exuberance. It appears that he had predicted that the stock would surge and had advised his clients to load up on the stock. He opined that D-Mart has a good chance of more upside even from these exalted levels.

@GujralAshwani Sirjii, Thank you for your super duper call on D-mart… Hats off you…#respect????????

— Abhilash L.S (@abhilashkattay1) April 7, 2017

However, some lamented their decision to sell the stock prematurely.

Considered myself very smart when I sold my dmart ipo shared above 600 rs on listing day. And now at 720++, I feel like a fool

— KJ B Mathew (@kjbmathew) April 7, 2017

Some had an i-told-you-so look:

Continue to believe- #DMART cud be a 200k cr firm!

Had th same view even before listing wen firm ws valued at 18k crhttps://t.co/2jfLmyVmNe— Aakash K Hindocha (@aakashhindocha) April 7, 2017

D-Mart naysayers left red faced and scratching their heads..:)

— Kush Katakia (@kushkatakia) April 7, 2017

The stock is up a mind-boggling 180% from the issue price.

Radhakishan Damani made Rs. 6100 crore in just two days & becomes top 500 Billionaire in the World with net worth of $4 Billion

Radhakishan Damani attracts money the way honey attracts bees.

Amit Mudgill of ET did some elaborate number crunching to conclude that the wily Billionaire had raked in an enormous gain of Rs. 6,100 crore in just two days from D-Mart.

“Shares of Avenue Supermarts have rallied 2.5 times over its issue price of Rs 299 since their listing. The stock soared nearly 19 per cent in just two sessions till Friday to make Damani and his family richer by Rs 6,100 crore,” Amit Mudgill said with great excitement in his tone.

“The Bloomberg Billionaire index shows Damani as the 20th wealthiest Indian, with $4.10 billion wealth as of Friday. He is among the top 500 world billionaires,” he added with obvious pride at the incredible achievement of a fellow Indian.

Porinju Veliyath displays incredible foresight and sense of timing

At this stage, we have to compliment Porinju because though eminent experts had condemned D-Mart as being “beyond expensive” and as suffering from “irrational exuberance” and though Porinju had himself expressed the view that the IPO was overvalued, his sixth sense instinct goaded him to buy a chunk of 10,000 shares on the day of listing.

.@porinju: Bought 10,000 shares in D-Mart today.

— ET NOW (@ETNOWlive) March 21, 2017

Assuming Porinju bought D-Mart at the closing price of Rs. 641 on the day of listing, he has made a tidy profit at the CMP of Rs. 750 in just a few days.

CRISIL and JP Morgan give D-Mart a clean chit

What appears to have caused the great excitement at the D-Mart counter is the fact that CRISIL upgraded the rating to AA/stable while JP Morgan opined that the Company is a relatively “safe” play on India’s consumption growth story, given the non-cyclical nature of the food retail business.

JP Morgan made it clear that it is very bullish about D-Mart’s future prospects:

“Significant headroom to gain share with prudent store expansion (around 2.1 million sq ft over FY18-20); sustaining healthy average same-store-sales growhth momentum at around 18 percent over FY17-20 (against 25 percent over FY12-16); scope for margin improvement exists with scale benefits, though we build stable margins; and private label growth and contribution from online over the medium term would be growth drivers,” the eminent brokerage said.

Wal-Mart has 5000 stores in US, which has population of 33cr. DMart has 118 stores in a country population size of 120cr or 4x bigger thnUS

— Jitendra Kumar Gupta (@Jitendra1929) April 7, 2017

Snapdeal’s Kunal Bahl gets inspired by D-Mart

The unique aspect about Radhakishan Damani is that he not only inspires his fans but even his arch rivals look up to him for inspiration.

“While many other retailers were growing stores rapidly, D-Mart was ensuring that each store is profitable so that their growth is sustainable and well thought through. In their business, too, like ours, I’m sure there would have been differing voices in 2005-10 on whether rapid expansion of stores and top line is the right strategy or focusing on unit economics. Clearly, in spite of the external pressure they may have faced, they stuck to their principles and the results are phenomenal”, Kunal Bahl said with awe in his tone.

More multibagger gains expected?

It is obvious that we cannot afford to ignore Porinju’s pronouncements given the incredible luck that he has been enjoying on the Bourses.

“Possible for D-Mart to have a market cap of around Rs 1 lk cr in 3-4 years,” Porinju said with the air of a prophet implying that there are at least 200% gains waiting to be harvested from the stock!

.@porinju: Possible for D-Mart to have a market cap of around Rs 1 lk cr in 3-4 years.

— ET NOW (@ETNOWlive) March 21, 2017

So, in these circumstances, we will have to stay on red alert and look for ways and means to tuck into the stock whenever the opportunity presents itself!

Did Rakesh Jhunjhunwala bought shares of this company so far? I read that he was very curious about Dmart listing. Anyway i do not own Dmart shares as its m cap is too high and valuations highly stretched. I wonder how long this euphoria continues.

I don’t know,if this is case again like Eicher,Bajaj Finance etc ,where stock remained elevated level for years and could sustain due to underlying performance.I just waited for entry after almost every expert adviced against buying from market over 500 .Here I think Porinju was right ,generally a Master of Third Grade Quality Stocks proved right by buying right ( although many though he was wrong ).Now One will have to make stretegy ,how to enter.Again I think long scatered buying may prove right,SIP.

Many people are thinking who will be Wall Mart of India .Here I differ,he may be most profitable per store but will be small player,but Indian Wall mart will be Reliance Retail.Although RIL has surged but I think it has long way to go up.In my view RIL will reach 2000 only due to gains from its newly invested petro chemical capacity.Rel Jio has not been factored at all ,only projected loss due to Rel Jio has been considered as reduced by some extent.So In five years Rel Jio may add 800 Rs to stock ..And similarly as availability of money buring by online players is being reduced so organised retail may become profitable.And now I discuss Big Daddy of Indian Retail, that will be Rel Retail ,in next five years it may add 1000 Rs to RIL stock.I expect separate listing of both Rel Jio and Rel Retail in few years .And after demerge and separate listing in next five years , I expect residual RIL to trade at 2000 ,Rel Jio at 800 and Rel. Retail at 1000.So my target price of RIL is 3800.When RIL will beconme aggrassive ,all retail players will look like a idea ,vodaphone and airtel.RIL is just waiting for downfall of online retail ,which is now only one or two year away . Online retail have to stop discount for avoiding cash burn.And you know Indian consumer ,who had become cash less card savvy after Demonetisation ,but is again with cash after Demonetisation. If any body want to invest in Retail very cheap ,then RIL can be bought for expected free shares of Rel Retail and Rel Jio.These all are only my assumptions and I don’t advice any stock buying to any body ,as I am not an expert.

if current online retailers goes away, then other small players will enter in the market through other investors money. The circle will go on.

I have been a regular customer of D-Mart since last 8 yrs. like many others. The reason for the success of D-Mart is, its price points, product variety,simple store management, honest billing structure. Online retailers initially also worked on that model, but later on , under the greed and pressure of PE investors, started to deviate from this philosophy. Retail requires quick sales from shelf at cost effective management of inventory.

Reliance retail or online retailers or fashion cum commodity retailers have still not been able to figure out how to implement this in effective way. V-Mart is going the D-Mart way in fashion retail. Interesting story panning out, in my opinion.

DMart is valued at 47k crore MCap as of today. ETNow projects it to hit 1 lakh crores in the next 3 to 4 years. What nonsense. 47k crore to 1 lakh crores is just 2.1x in 3 to 4 years. Such a poor return.

Venky ,The Great ,for you 2.1X in three years is peanut.Pl suggest four or five stock ideas which can become 2X in in year or 5X in three years ,I know you are a 20 x 20 player ,so now play hit four or five sixers( Six time in three year} for members other wise they may go for poor returns like 2.1X in three years

I have recommended Emmbi industries so many times in this blogboard. I have even given detailed analysis on why Emmbi. I entered the stock at 30.5, recommended here (you can type my name and Emmbi, in the search box of this blogboard, you will get 5 entries from me on Emmbi) when it was 76, currently at 158 to 160. I see the stock hit 300 in the next two to three years giving me a 10x returns.

Entered Emmbi in July 2015.

Damani is already 61. Does he have enough time left to make it a Walmart? And how about the fact that Warren Buffet has dumped all his Walmart shares last quarter?

Age is your major consideration ,go for Kotak bank or RIL ,where Rel Jio and Rel Retail are being looked by( I think so) Young son and daughter of Mukesh Ambani .