Embassy Office Parks REIT: Latest stock pick of Radhakishan Damani

Normally, I am not inclined to dabble with IPOs and that too of unknown companies.

However, the news that Radhakishan Damani has taken a fancy to the IPO means that we cannot sit on our haunches.

We have to immediately come to grips with the stock and see if there is a chance for us also to pocket a few bucks.

The Billionaire has invested a sum of Rs. 160 crore in the REIT IPO which implies that it is a high-conviction bet for him.

Veteran Investor and Entrepreneur RK Damani invests Rs 160 crores in Embassy Office Parks REIT Anchor Book @BloombergQuint @_nirajshah pic.twitter.com/I7ZOWC4Ogs

— Yatin Mota (@YatinMota) March 16, 2019

#CNBCTV18Exclusive | Blackstone Embassy REIT offer from March 18-20 to raise Rs 4,750 cr; may price each unit at Rs 300 & assure 8.25% yield: Sources tell @PoddarNisha pic.twitter.com/Ntn6R3RB2s

— CNBC-TV18 (@CNBCTV18Live) March 12, 2019

(Radhakishan Damani in the distinguished company of Ramesh Damani, Mohnish Pabrai & Dakshana scholars)

What are REITs?

To understand the mystery behind REITs, we have to take the assistance of Sakshi Batra and Vandana Ramnani of moneycontrol.com.

The two ladies have explained the concept in a simple yet masterful manner.

Apparently, a REIT (i.e. Real Estate Investment Trust) is an investment vehicle that owns and operates real estate-related assets and allows individual investors to earn income produced through ownership of commercial real estate without actually having to buy any assets.

REITs offer investors the opportunity to invest in Grade A commercial real estate, which they would otherwise have been unable to.

The best part about REITs is that 80% of the AUM has to be invested in completed projects. Only 20% can be invested in under-construction projects.

This implies that there is a margin of safety because one can avoid the vagaries of under-construction projects.

NEW! #REIT = Real Estate Investment Trust. If you are a small investor and have 2 lakhs at your disposal, you might want to #invest in REITs

WATCH: All you need to know about India's first Real Estate Investment Trust with @vandanaramnani1 @sakshibatra18 https://t.co/RZlPYrU2if pic.twitter.com/4jnrte8V7c

— moneycontrol (@moneycontrolcom) March 14, 2019

Success of RERA has made REITs possible

According to some intellectuals, RERA, which is NAMO’s brainchild, has led to professionalising of the real estate sector and provided the impetus for REITs to become reality.

? Good to see the Real Estate sector professionalising. The big public policy impetus has been RERA. And now for India’s 1st REIT ( Real Estate Investment Trust.) Blackstone & Embassy Group propose to raise Rs 5000 crores thru India’s maiden REIT. Hopefully, others to follow.

— Vinayak Chatterjee (@Infra_VinayakCh) September 25, 2018

Positive news for the day. Owing to resounding success of RERA Passed by Modi Sarkar, industry is shaping up.

India’s 1st REIT ( Real Estate Investment Trust) Blackstone & Embassy Group proposes to raise Rs 5000 crores through India’s maiden REIT. ??

— Chowkidar Ashu (@muglikar_) September 28, 2018

REITs have outperformed S&P 500 and high-yield bonds & delivered 15% YTD return

According to data produced by Charlie Bilello, an expert, the Vanguard Real Estate ETF nicknamed ‘VNQ‘ has delivered a handsome return of 15% on a YTD basis.

The VNQ ETF has outperformed the S&P 500 and bonds by a hefty margin.

YTD Returns

Oil $USO: +26%

Nasdaq 100 $QQQ: +16%

Small Caps $IWM: +16%

MLPs $AMLP: +16%

REITs $VNQ: +15%

S&P 500 $SPY: +13%

EAFE $EFA: +11%

EM $EEM: +10%

Commodities $DBC: +10%

Preferreds $PFF: +8%

High Yield $HYG: +7%

Investment Grade $LQD: +4%

Bonds $AGG: +2%

Gold $GLD: +1%— Charlie Bilello (@charliebilello) March 15, 2019

The VNQ ETF also offers a dividend yield of 4.12% which means that it is a fail-proof investment.

REITs appear to be the favourites of Billionaires Johnathan Gray & Bill Ackman and one can see them in the youtube video pontificating on their merits and demerits.

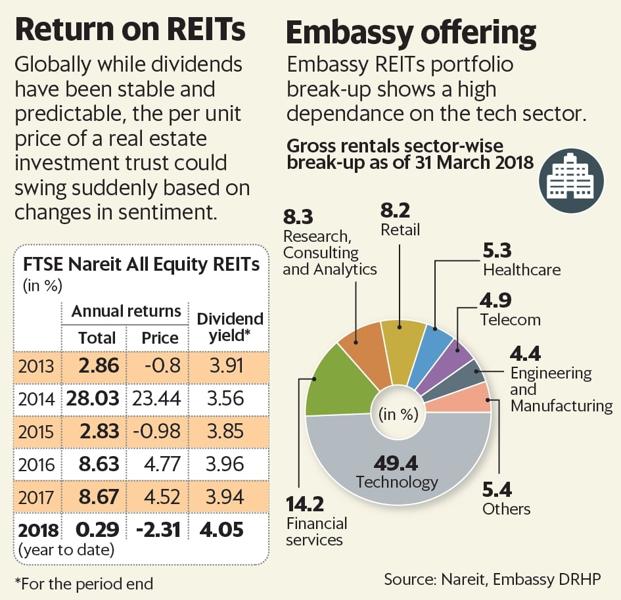

However, Vatsala Kamat of LiveMint has pointed out that in mature markets like the USA, REITs deliver an annual return of around 7% to 10% which hinges on the rental yields from commercial spaces and price appreciation of the units, depending on the trends in realty.

This is corroborated by Shobhit Agarwal of Anarock Property Consultants, an authority on real estate.

“With REITs, the return on investment will be more structured, realistic and less risky“, he stated and opined that 7-8% annual return is a realistic expectation for those investors who are looking to diversify their portfolio beyond gold and equity markets.

Adverse taxation of REITs

Vandana Ramnani has painted a somewhat grim picture of the taxation prospects of REITs.

She has explained that there are a plethora of taxes which make REITs unattractive.

When a REIT sells its assets, the capital gains are taxable. In contrast, in the UK where REITs have been operating for over a decade, there is no taxation on income and gains from their property rental business. Instead, shareholders are taxed on REIT-related property income when it is distributed, and some investors may even be exempt from tax altogether.

The end result is that investors in REITs will have to be satisfied with a meagre return on only 7-8% annually, after adjusting fund management fees, she opines.

Is Phoenix Mills, Mohnish Pabrai’s latest stock pick, better than Embassy REIT?

Assuming one is bullish about commercial properties and their rentals, an alternative to investing in REITs is to invest in realty stocks like Phoenix Mills.

According to experts, Phoenix Mills is the ideal amalgam of retail and realty owing to its Malls in Metro cities like Mumbai which are bringing in rental income from retail stores.

Motilal Oswal has described the stock as “the unique way to play India’s retail growth story“.

Nirmal Bang has also recommended the stock on the logic that there is 1) Anticipated continued strong growth in rental revenues of operational malls. 2) Steady growth in office space rentals and 3) Strong growth in hotels because of cyclical upturn of the sector.

Mohnish Pabrai’s ‘The Pabrai Investment Fund IV’ holds 15,75,561 shares of The Phoenix Mills Ltd as of 31st December 2018.

The investment is worth about Rs. 100 crore at the CMP of Rs. 665.

Conclusion

It appears doubtful that REITs will be able to deliver multibagger gains. At best investors will have to stay content with a paltry annual return of 7-8%. However, because Radhakishan Damani has trusted the stock, we will have to keep it in our watch-list and monitor it carefully!

Do you think 7 to 9% return in the form of dividend is a great income.

The whole operation of a REIT fund is at best opaque.

One can get a similar return of 7 to 9% even from a liquid fund. What is so great here.

I totally agree. The taxation is not favorable either because most of the income will be rental income and taxed at the marginal rate (here liquid funds are better if held for three years).

Only dividend income (if any), will be tax free.

There are many REITs in the pipeline. So might be best to wait for a while and enter once this asset stabilizes in India and has some track record.

I am sure RD might have got sweet deal earning much more than 7-8% return. As a most successful & experienced investor, he would not fall for 7-8% . The problem for his followers and normal guys is, we get filtered info concealing the actual info. Never ever copy big shots and smart investors.

But this allotment to RD is out of a public issue – though his allotment is from institutional/ anchor investors’ reserve quota, but his price cannot be vastly different than the public issue price.

In fact, normally anchor investor/ institutional investors’ price is slightly more than the public issue price.

So the question of sweet deal remains unanswered.

Wish things are so transparent like IPO allotment and getting on par with the retail investor. Few reasons that I could think of :

His network with public issue owners, potential listing gains and Direct or Indirect linkage of this REIT IPO with space requirements of DMart. When a normal person sees liquid fund is better than this IPO, am sure RD might know better than all of us.