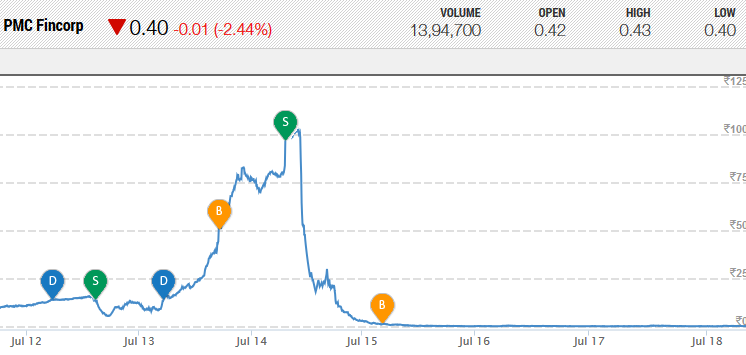

170x multibagger gain from penny stock PMC Fincorp

Generally speaking, journalists and editors have a highly academic approach towards the stock market.

They wax eloquent about complex issues relating to the stock market without ever having bought or sold a single stock.

This occasionally gets them into trouble.

We saw a few days ago how a journalist made some atrocious statements about mutual funds and PMS fund managers.

He was severely reprimanded by Nilesh Shah, the fearless MD of Kotak Mutual Fund, and warned not to “lie or twist facts to suit your negativity”.

"Most MF down between 20-40 % in a flat market"

This isn't true even for PMS where stocks are down more than MF. We have fallen for sure in a falling market but not as much as you are accusing. Please don't lie or twist facts to suit your negativity…4…..

— Nilesh Shah (@NileshShah68) October 12, 2018

However, Raghav Bahl, the distinguished editor of BloombergQuint, is an exception to this rule.

He has not only a thorough grasp about the theoretical aspects of the stock market but is also able to rake in massive multibagger gains and that too from penny stocks.

His technique is the envy of investing legends like Warren Buffett, Radhakishan Damani and Rakesh Jhunjhunwala.

In September 2012, Raghav Bahl and his charming wife, Ritu Kapur, homed in on an unknown penny stock known as ‘Priti Mercantile Company’ alias ‘PMC Fincorp’ which was promoted by an unknown entrepreneur named Raj Kumar Modi.

The duo pounced on the stock and grabbed a massive chunk of 4.93% of the equity capital at the throwaway price of Rs. 5.50 each.

The total sum invested in the penny stock was Rs. 3.03 crore.

As if on cue, ‘Priti Mercantile Company’ alias ‘PMC Fincorp’ took off like a supersonic rocket on steroids.

By October 2014, the stock was the pride of Dalal Street and had surged to an ATH of Rs. 848 (before adjustment for split and bonus).

At this stage, we have to compliment Raghav Bahl for his sagacity.

He dumped his entire holding in PMC Fincorp at the peak and took home massive multibagger gains of Rs. 115 Crore.

Naturally, the gains were claimed to be long-term capital gains and to be fully exempt from income-tax under section 10(38) of the Income-tax Act.

Raghav Bahl’s timing was impeccable because soon after he dumped the stock, it plunged into a steep dive and never recovered.

Presently, the stock is languishing at Rs. 0.47.

Too greedy? Tax sleuths pounce on Raghav Bahl & allege capital gains to be “bogus”

Raking in such massive capital gains, and that too from a dubious penny stock, and claiming the entire sum to be totally tax-free, is like waving a red flag before an angry Bull.

The stormtroopers of the income-tax department raided Raghav Bahl’s office and residence and pinned him down.

They are alleging that the so-called gain is “bogus” and that it is his own unaccounted funds which are being laundered back.

This was revealed by one Dhruv Singh who appears to be an IRS officer working for the department.

Bahl invested Rs 3 CR in a penny stock PMC Fincorp , a @BSEIndia listed shell company. Next year, he and wife offloaded their shares for Rs 118 CR . Nothing but conversion of black money. Great job by Income-tax#IRS#nationfirst#Incometaxdpt @FinMinIndia @IRSAssociation pic.twitter.com/9mWkHjGV4e

— Dhruv Singh (@Dhruv_IRS) October 12, 2018

Another twitter user named ‘IRS Officer India’ endorsed this.

Thanks @newslaundry for covering the real truth

— IRS Officer India (@irsofficerindia) October 13, 2018

Did promoter of PMC Fincorp confess that Raghav Bahl converted black money into white?

According to a website named mynation, Raj Kumar Modi, the promoter of PMC Fincorp confessed to the income-tax sleuths that he had laundered black money and converted it into tax-free capital gains.

His precise statement is as follows:

“So far as I remember, Ritu Kapoor and Raghav Bahl got Rs 100 crore converted,” he is alleged to have stated.

“These persons approached me through their CAs. These persons were promised LTCG exempt returns of about 10-15 times by me. The amount for the purchase of shares of the company PMC Fincorp were paid to me through cheques issued in the name of the company holding the shares,” he added.

Raj Kumar Modi also candidly admitted that the sharp rise in the share price of PMC Fincorp was rigged.

“… the financials of the company have no correlation with the movement in share prices … the prices of the share have been rigged for the purpose of bogus long-term capital gain,” he stated.

According to Sree Iyer, an author at PGurus, with “37 patents” to his credit, Raghav Bahl and the promoters of PMC Fincorp may have indulged in the nefarious practice of “pump and dump”.

Yet another website named newslaundry.com claimed that PMC Fincorp is/was a serial offender and that it was hauled up by SEBI in the past for various illegalities.

Raghav Bahl alleges inquiry by Tax Dept is “attack on freedom of press”

Predictably, Raghav Bahl reacted in a belligerent manner to the allegations of the income-tax department that his massive capital gains from the penny stock is “bogus” and that he will have to pay income-tax thereon.

He claimed that his publication was held to the “most intrusive ransom by India’s tax officers”.

He also pleaded that his long-term capital gains is genuine and tax-free.

My statement post the I-T raids at @TheQuint offices and my residence on October 11, 2018. pic.twitter.com/SSmutdzZgd

— Raghav Bahl (@Raghav_Bahl) October 12, 2018

He also released a video on the topic in which he got all his reporters to pose with glum faces. He blasted the tax department and described the raid as “bogus“.

Some intellectuals supported Raghav Bahl’s stance.

Raghav ji not to worry, since last 4 years AAP leaders r raided many times but IT found nothing. BJP is just trying to suppres the opposition. Honest reporters never afraid

— comrade Shoeb Sayed (@Shoeb24in) October 13, 2018

Anyone who is critical of this Gvt can expect raid of any kind. That is the curse of this country. Not much difference between India and Male.

— Truth prevails (@Kumar_go) October 13, 2018

However, some were not impressed.

The media in the garb of freedom of media should not think these statements impress us. We have seen NDTV’s tax defaulcation case on which there were such uproar till the Delhi high court upheld the IT claims. Some of the media houses are big time economic criminals !!

— Ravi Rajagopal (@RR1965) October 13, 2018

Why all corrupt jurnos want a sheild from scrutiny. Why don't you use the same words that you use for others when raided by IT. Why self certification

Let the law should take it's own course.— Young India (@Ajoykush1) October 13, 2018

Victim card

Pay taxes timely— MAHENDRA RATHORE (@singhbattleford) October 13, 2018

Tribes of Politicians & journalists consider themselves above law. Whenever any one of them brought under scanner, immediately a herd of their own species strat howling on agencies and abusing the leader of nation.

— Prem Jain (@PREMCJAIN) October 12, 2018

Will Shantadevi’s case bust Raghav Bahl’s claim that capital gains are genuine?

At this stage, we have to keep red alert because a similar attempt by Shantadevi Bimalchand Jain to claim tax exemption for capital gains from penny stocks was busted by the Tax Tribunal and the Bombay High Court.

Shantadevi, a housewife, had raked in massive 100-bagger capital gains from a penny stock named ‘Khoobsurat’ and claimed it to be tax-free.

However, when grilled by the tax sleuths as to how or why Khoobsurat surged like a rocket, she drew a blank.

Shamim Yahya, a seasoned tax judge in Nagpur, blasted Shantadevi.

“It is a clear case where the assessee had indulged in bogus and dubious share transaction meant to account for the bogus and undisclosed income in the garb of long term capital gain,” he held.

“There is no justification whatsoever that the shares of an unknown company of Rs. 5/- can be sold within two years time at Rs. 485/- without there being any reason on record. This unexplained spurt in the value of unknown company shares is beyond preponderance of probability,” he added.

“These transactions of the assessee can by no stretch of imagination be considered as investment transactions. They are only make believe transaction. Hence I do not find any infirmity in the revenue taxing the receipt in this regard,” he continued in the same breath.

“The fantastic sale price realisation is not at all humanly probably, as there is no economic or financial basis, that a share of little known company would jump from Rs. 5/- to 485/-,” he said while dismissing the appeal.

Shantadevi rushed to the Bombay High Court to save her 100-bagger capital gains from the clutches of the tax department.

However, two lady judges named Justices Vasanti A Naik and Swapna Joshi were not impressed by her pleadings.

“The assessee had not tendered cogent evidence to explain as to how the shares in an unknown company worth Rs. 5 had jumped to Rs. 485 in no time …. the fantastic sale price was not at all possible as there was no economic or financial basis as to how a share worth Rs.5 of a little known company would jump from Rs.5 to Rs. 485,” they held.

Raghav Bahl’s case is on a worse footing if one goes by the alleged confession of the promoter of the penny stock that everything was rigged.

In that case, the Tax Courts may tear him apart and throw him to the Wolves.

The only silver lining is the case of Prakash Chand Bhutoria where gains of 3100% from a penny stock were held to be not taxable.

A Judge named Sudhakar Reddy let Prakash Chand Bhutoria off the hook on the basis that while such sensational gains from penny stocks are “suspicious” they cannot be treated as bogus.

We will have to see which way the dice rolls for Raghav Bahl and whether he gets to keep his massive capital gains or has to part with some of it!

It is a simple and shut case.

If Raghav Bahl stops criticising BJP government, the case will be settled in his favor, otherwise against him.

Look at CBI director Verma or RBI Governor Urjit Patel – both hounded for not falling in line with the government of the day.

Excellent.Please request Bahl to find a company for us, the shares of which becomes Rs.500 from Rs.3/-.Please make sure that the company should be a financial company with annual turnover of Rs.10 lakhs only .Why bring Modi or BJP in between. Please vote for congress so that old times come back.

Much better than the times of today..

Old times means, do what Bahl did and you will not be questioned.This is what happened in congress time.In this government be prepared to pay taxes honestly.Be prepared to be questioned on source of income.No wonder, this year 80 lakh new income tax payees have been added.Pappu does not want to pay taxes.

fully agree. If you want to be a wrong-doer and be safe, then stay with the ruling party, BJP only. (it was the same when Congress ruled too – no one in the ruling party got affected, until the uproar went far too high, using the good offices of CAG). Now, there is no one to complain, as all the autonomous agencies (including CAG, CBI, EC et al) have been dumb-folded, with hands tied behind.

Any crime gets cleaned up in the holy water called BJP.

In India, those who fail in law exam become journalist because then they can act as a lawyer and judge both. When they get caught either for sexual harassment or for corruption they blame the govt. We have the worst press in the whole world.

Raghav Bahl should get ideas from Amit Shah and his son how to increase the value of a company by 16000% in one year. And also he should start licking the feet of the govt like Arnab does. Then he can do anything. Maybe he will also get a share in the next warship building contract.

good suggestion

don’t spread lies.You are talking like congress pappu.This forum should not be used for such topics.Go to another channel.This forum should be used for investment ideas.By the way, the company of shah’s son actually made losses.Have you seen the P& L account?

Very simple tax-chori. This is done by many people. As long as this is one off and the stock is part of portfolio of stocks, this is complete bogus. Who would invest this kind of sum in a bogus company without knowing the end result?

Kudos man