“Grandmother of Bull markets” is continuing

Ridham Desai and his team at Morgan Stanley are each famed for their brilliant and analytical thinking ability.

In the past, we have benefitted by listening to, and acting on, their advice.

Ridham was amongst the first who confidently predicted that the “grandmother of Bull markets” is around the corner and that we should buy stocks aggressively.

Needless to say, investors who followed his advice are beaming with joy with bulging bank balances.

New growth cycle starting with 20% earnings CAGR

Ridham has now opined that a “new growth cycle” is beginning and that “earnings could compound at 20% CAGR” which will obviously propel the stock markets to new highs.

His precise words are as follows:

“This could be the beginning of a new growth cycle. Earnings could compound at 20 per cent (annually) over the coming five years. Rising demand for equities from domestic households and potential M&A (merger and acquisition) activity would also push the markets in the coming months.”

‘Bull case’ vs. ‘Base case’ vs. ‘Bear case’

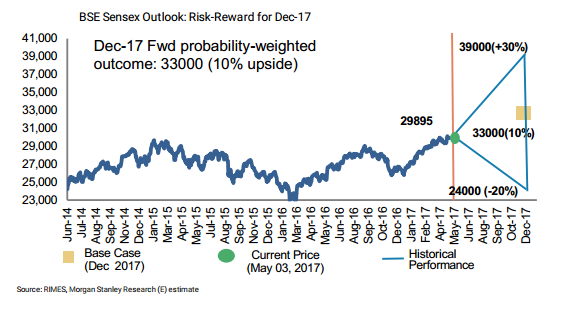

Ridham appears to have done complex algorithmic and mathematical calculations to support his theory with regard to the Sensex levels.

He opined that as per the ‘Bull case’ scenario, the Sensex will surge to 39,000 and that there is a 30 per cent probability of this happening.

The ‘Base case’ scenario projects that the Sensex will surge to 33,000. There is a 50 per cent probability of this eventuality.

The worst case scenario is that the Sensex will plunge to 24,000. This has been labeled as the ‘Bear Case’ scenario. The probability of this happening is pegged at 20 per cent which implies that it is a remote possibility.

(Image credit: moneycontrol.com)

Valuations are not stretched

Ridham offered the soothing assurance that despite the raging rally in the stock markets, the valuations are not expensive.

He explained that the rising RoEs of Indian stocks justifies their premium valuations.

“Versus EM, India looks rich but then ROE is gapping higher. The Sensex is still in a buy zone versus local bonds but mid-cap valuations look stretched. Valuations are useful to make a market call only at extremes, which is not the case at the moment,” Ridham said.

Morgan Stan: Sensex best case 39K by Dec. Equities may defy rationality ..good read pic.twitter.com/whEkmaIkIu

— Ajaya Sharma (@Ajaya_buddy) May 15, 2017

Sectors to buy now

Ridham has maintained his unflinching loyalty to the ‘consumer discretionary’ and ‘financials’ sectors.

His logic for doing so is flawless:

“In the consumer discretionary sector, strong consumer loan growth, positive real incomes and a broad recovery in jobs are driving our positive view. In the financial sector, banks are flush with liquidity, which will likely drive loan growth in the coming months. While margins are under pressure for banks, non-banks and property companies look fine on the margin front. Credit costs are also likely to decline, led by M&A activity and a recovery in economic growth“.

Model portfolio of stocks to buy now

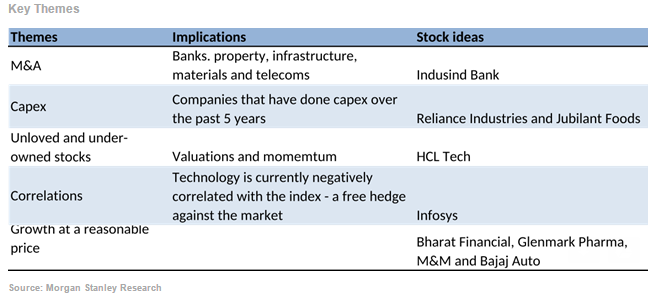

Ridham has systematically identified five themes which are likely to throw up winners. These are

(i) M&A,

(ii) Capex,

(iii) Under-owned stocks,

(iv) Correlations,

(v) Growth at reasonable price.

He has thereafter pinpointed the stocks that fall within each theme.

While the M&A theme is dominated by IndusInd Bank, the Capex theme is shared by Reliance Industries and Jubilant Foods.

HCL Technologies has been condemned to the category of ‘unloved and under-owned stocks’ while Infosys, the blue-chip tech behemoth, has been categorized as ‘Corelations’ implying that it is a ‘free hedge’ against the market as it is inversely co-related with the Index.

Four stocks have been given the coveted designation of ‘growth at a reasonable price’ implying that they are likely to turn into multibaggers.

These four stocks are Bharat Financials, Glenmark Pharma, M&M, and Bajaj Auto.

(Image Credit: moneycontrol.com)

Properly diversified model portfolio

It is obvious that in preparing the Model Portfolio, Ridham Desai and his ace team at Morgan Stanley have paid attention to the basic norms of diversification.

The Model portfolio has two stocks from the financial sector. While IndusInd is a large-cap, Bharat Financial is a mid-cap.

There are also representatives of the Oil & gas, FMCG, Technology, Pharma and Auto stocks in the portfolio, making it perfectly balanced.

IndusInd Bank has 41.4% upside: Ventura

Ventura has issued an initiating coverage report on IndusInd Bank in which it has predicted that the Bank will maintain its “stratospheric growth” over FY17-20.

Ventura has forecast a target price of Rs. 2008 and recommended a buy. The logic is quite convincing.

HCL Technologies has 20% upside: Angel Broking

HCL Technologies, which has suffered the ignominy of being put in the “unloved” basket has supporters other than Ridham Desai.

Angel has recommended a buy on the basis that the Tech behemoth has a “strong order book” and “attractive valuations”.

Conclusion

Even if the Bull case scenario of Sensex 39,000 does not materialize, the ‘Base case’ scenario of Sensex 33,000 is realistic and likely to materialize given the reforms that are underway. This itself is a hefty 10% upside on the Sensex which implies that individual stocks will see an upside ranging from 20% to 40%.

The bottom line is that when the stock markets correct, we should not be paralyzed with fear. Instead, we have to grab the opportunity to buy top-quality stocks!

I WANT TO INVEST MONEY. PLS TELL ME WAY.

IndusInd Bank and RIL are good picks.Best of technology stocks is behind us ,no doubt after such under performance there will be some bounce back in short term ,but to stagnante again in long term.For any secular growth story ,one needs to look into demestic sectors like pvt banking, housing finance, nbfc ,insurance, auto,infra and defence, consumer Staples,white goods and tourism.

Technology story is irreversible.Even Trump effect can’t reverse it.. Currently sentiments are low and all negatives are factored in.. Niche digital companies , product companies and very large companies would be good bets for longer term. These winners you can’t get at current bargain prices.. Saksoft, Nucleus soft could be good bets..

Question is not that technology stocks will give returns or not ,question is if technology index will out perform Nifty like in past or not,.My view is that IT index may under performance over long term unless some thing new comes up like Google ,apple or Facebook comes in IT index.It has nothing to do with Trump,but is more due to size and business model of present big IT companies .I can not say this about any other smaller individual company ,which can always happen in any sector.

stock exchanges exists as there is a difference of opinion between buyer and seller. Me being from the IT industry, am more bullish on IT than you on a long term basis.. Rest of the world just does not have the scale India has and also ability to adapt quickly to change..

Happy to learn your back ground of IT.No doubt you must be knowing more than general public like me .Keep on giving your views as expert on IT for the benefit for members of this forum.

I would believe that Glenmark Pharma is a value pick at its CMP. I hold.

Careful investing would be the mantra for the remainder of the year…..Pharma and IT are great investments for now if you have a 1 to 3 year hold.

Conservative investments would be in Hudco, Coal India, REC and PFC.

Doing it slowly makes sense which means SIP mode is critical for now.

How can HCL be an unloved stock? It has been a recommendation from many in past.