Dalal Street welcomes Joe Biden

There is a festive atmosphere in Dalal Street nowadays due to the Presidential elections in the USA.

Investors and Punters of all shapes and sizes have come from far and wide to partake in the festivities and buy stocks.

While we were earlier supporting Donald Trump, we have now shifted our allegiance to Joe Biden.

“Bidenbhai accha aadmi hai. Koi jhamela nahin karega stock markets ke maamle mein,” Madan Kaka declared, giving a clean chit to the new President.

“Bindaas stock kharido. Solid profit hoga,” Mukeshbahi added, mouthing his usual dialogue.

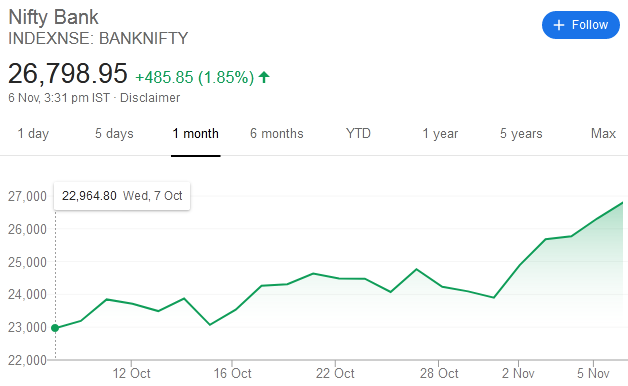

The BankNifty, which is the favourite instrument of all discerning traders, has been on a non-stop rally, piling on thousands of points in just the last few days.

The Nifty has also kept pace, albeit at a more sedate pace.

“Trumpbhai ho ya Bidenbhai. Apna solid profit hogaya,” Jigneshbhai quipped with a wide grin, eloquently echoing everybody’s sentiments.

It is notable that, according to experts in technical analysis, the Bank Nifty has, for the first time since November 2019, formed a “golden cross” in which the 50-DMA has crossed the 200-DMA.

This is a significant development which implies that the BankNifty will now be an unstoppable juggernaut and will effortlessly surge to unexplored heights.

NIFTY BANK BACK TO GLORY DAYS

50-DMA crosses above 200-DMA

Made golden cross first time since 20 Nov 2019LAST 2 DECADES

Total no. of golden crosses = 15

Total no. of winning trades = 9

Total no. of losing trades = 6

Average gain in each trade = +8.25% https://t.co/eousxcLMat— Jayesh Khilnani (@jayeshkhilnani) November 6, 2020

Shorters are trapped. More ferocious upside likely due to “shorts squeeze”

Apparently, large institutional traders on Wall Street and Dalal Street had built large short positions in anticipation that the uncertainty relating to the Presidential elections would cause the markets to tank.

However, this did not happen and instead the Indices have been surging upwards, leaving the shorters in the lurch.

According to Anil Singhvi and Nitin Murarka, who are experts on the Nifty, the shorters will have no option but to cover their shorts aggressively in the coming week, which will send the Indices surging further upwards.

“Market mein bahut short position hain aur puri short trap ho gayi hai. Bahut tej short covering aane ki mujhe umeed hai,” Nitin Murarka said.

This hypothesis was confirmed by Anil Singhvi.

“Nifty pe behad Bullish hain .. Yeh khubsoorti aur khasiyat hai bazzar ki ke correction ke baad turant daud lagane ki koshish karta hain,” he said.

It is worth recalling that on an earlier occasion, when the duo had predicted short covering, the Nifty had surged 1100 points while the BankNifty had surged 2400 points (see Nifty Makes History By Surging 1100 points In Just 9 Trading Sessions. Experts Explain What Led To The Super-Surge).

Obviously, this time we have to be well loaded with stocks and Calls to be able to benefit from the situation.

निफ्टी के निशानेबाज नितिन मुरारका की निफ्टी ऑप्शन से कमाई की दमदार स्ट्रैटेजी#Nifty #BankNifty @AnilSinghvi_ @nitinmurarkasmc pic.twitter.com/ubxdX8pId3

— Zee Business (@ZeeBusiness) November 6, 2020

India prospered during Donald Trump’s tenure. It will continue to prosper

Saurabh Mukherjea has obviously a better and deeper understanding about geo-political-economic issues than the local punters.

He also gave a clean chit to Joe Biden and assured that India would prosper to the same extent as it has prospered under Donald Trump.

“The sheer extent of the post lockdown economic recovering India will help us override whatever be the outcome there. One thing though if a Democratic sweep across Senate is seen, it is a very good chance that the Democrats bring back Big State they bring back lots of states interventions,” he opined.

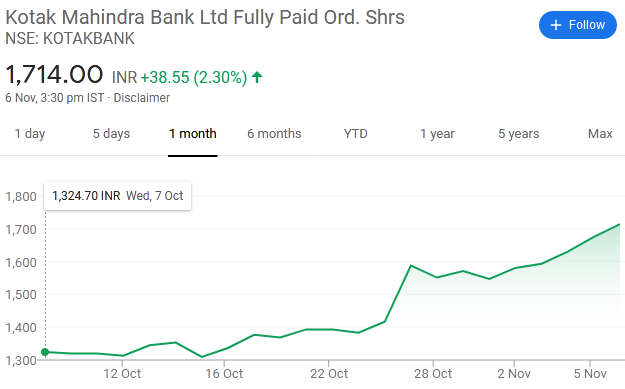

All stocks recommended by Saurabh Mukherjea are surging

Saurabh has been rewarding us generously by offering periodic stock tips.

He also rightly counselled us (during the depths of the crash) to ignore the Gloom and Doom prophets and just buy stocks.

It is notable that all the stocks recommended by him such as Kotak Mahindra Bank, Bajaj Finance, HDFC Bank, Pidilite, Asian Paints, Divis Labs etc are surging and contributing to our prosperity.

Saurabh Mukherjea says don's get caught up in the near term forecasts, focus on long term. Bajaj Finance, HDFC Bank, Kotak Bank look incredibly 'juicy', attractive at this level

Premium financials in NBFC space, auto look very attractive— avanne dubash (@avannedubash) May 11, 2020

Saurabh has also, in an unprecedented act, revealed the names of all the stocks in his Little Champs portfolio of mid-cap and small-cap stocks (see Check Out The Multibagger Small-Cap Stocks In Saurabh Mukherjea’s Portfolio Of Little Champs).

Investors who desire to build a robust portfolio of small and mid-cap stocks should simply clone these stock picks because they have been subjected to rigorous screening before being given the green signal.

AU Small Finance Bank Ltd: Latest stock pick for the ‘Kings of Capital’ Portfolio

Saurabh revealed that AU Small Finance Bank is the latest addition to his illustrious portfolio of high-quality Banks and NBFCs.

AU Small Finance Bank is very familiar to us because it was personally recommended by Raamdeo Agrawal when it was still a NBFC.

Raamdeo disclosed that he had helped Sanjay Agarwal, the visionary promoter of AU Small Finance Bank, with capital when the latter was a small and struggling businessman.

The Bank rose to the big league because it did the sensible thing of cloning HDFC Bank‘s business model and methodology of evaluating business opportunities and risks and determining the credit worthiness of potential borrowers.

This saved it from crippling NPAs and ensured a steady and consistent growth rate.

Raamdeo was richly rewarded with 100x multibagger gains for his enterprising approach in assisting AU in its infancy.

“We bought at Rs 50-60 crore valuation, we put Rs 20 crore, which gave us 30- 35 percent (stake). That was 6 years back. We sold it for Rs 5,000 crore .. 100x .. that’s the power of private sector banks … It is a leap of faith. We are celebrating success,” he said with justified pride in his tone.

Sanjay Agarwal also narrated an inspiring story of rags to riches. He failed his CA Exam multiple times before being successful. He also explained how he single-handed built such a magnificent empire.

No doubt, Saurabh’s stock pick appears to be quite sound. We will have to see whether it is able to match the performance of its bigger peers like Bajaj Finance, HDFC Banks etc.