Saurabh Mukherjea’s portfolio heavily outperforms Nifty & thrills investors

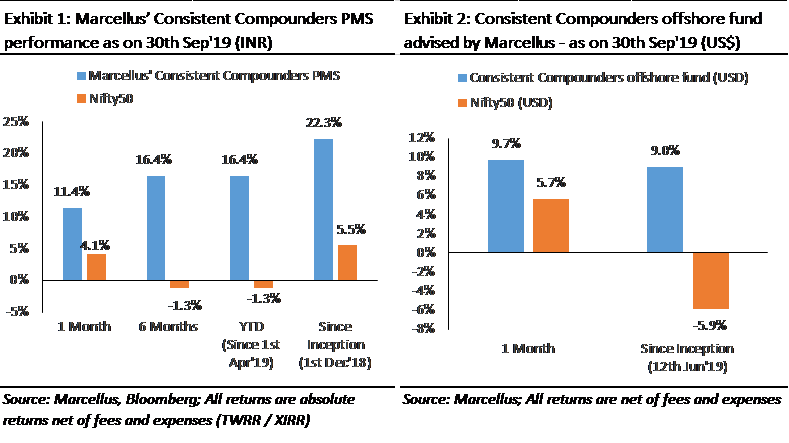

First, we have to compliment Saurabh because his PMS Fund named ‘Marcellus Consistent Compounders PMS‘ has heavily outperformed the Benchmark Nifty 50 Index.

According to top-secret information, the PMS has delivered a return of 22.3% since inception in December 2018.

The YTD return is 16.4%.

In contrast, the Nifty gave a beggarly return of only 5.5% and (-) 1.3% respectively in the same period.

Saurabh has pointed out that the PMS portfolio has about 25 stocks, each of which boasts of a high degree of consistency in ROCE and revenue growth rates.

We already know that some of these stocks are blue-chips like HDFC Bank, Asian Paints, Bajaj Finance, Pidilite, Kotak Bank, Relaxo, etc.

In fact, Saurabh has revealed that he is so enamoured by HDFC Bank that he is “buying it every single day for the past 9 months“.

No doubt, the choice of stocks is impeccable and the gains are well deserved.

#MarketMaster | Saurabh Mukherjea, Marcellus Investment Managers says believe the market is bracing itself for a poor Q2 earnings season; @KotakBankLtd, Bajaj Finance & @HomeLoansByHDFC are good picks for a portfolio#OnCNBCTV18 @latha_venkatesh @_anujsinghal @_soniashenoy pic.twitter.com/jgvcHGmIin

— CNBC-TV18 News (@CNBCTV18News) August 30, 2019

Which stocks will benefit most from the tax rate cut?

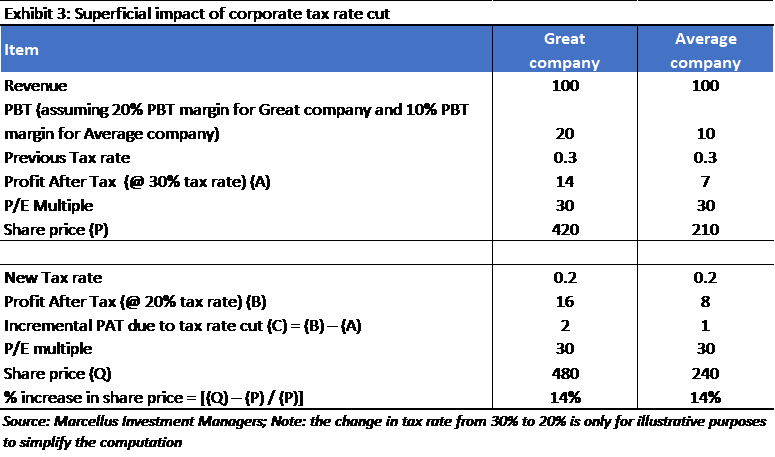

There is presently a heated debate in Dalal Street on which stocks will benefit the most from the corporate tax rate cut announced by NAMO and Nirmala Sitharaman.

According to some intellectuals, all that one has to do is to look for companies paying the highest rate of tax and then expect a 10-15% increase in their profits.

However, Saurabh has rubbished this approach as “superficial” and “knee jerk“.

Instead, he has relied on the authoritative advice offered by Warren Buffett, the World’s greatest investor, on how to shortlist the winning stocks after a corporate tax rate cut.

Warren Buffett explained (as far back as in 1986) that companies with very weak business franchises and operating in price-competitive industries will never benefit because they are compelled to pass on the benefits to the consumers.

On the other hand, businesses with strong franchises and monopolies are under no compulsion to humour their customers with a cut in prices.

Instead, they keep the prices unchanged and pocket all the benefits for themselves and their shareholders.

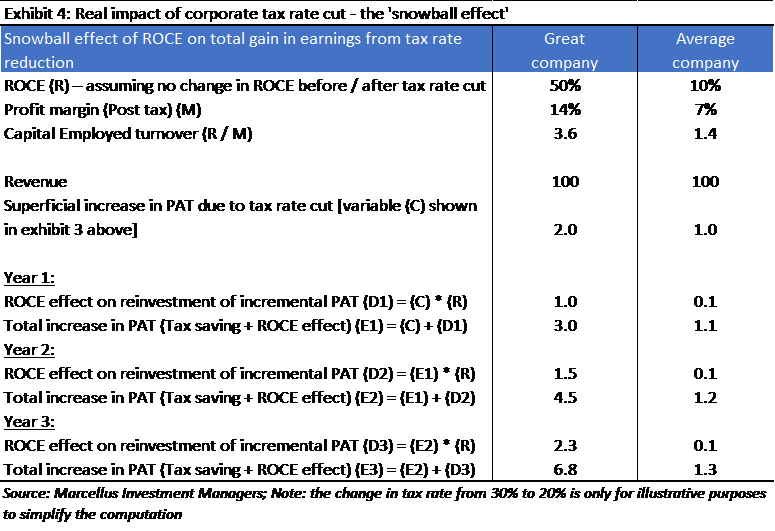

Saurabh has elaborated on Warren’s theory and explained that it is the “consistent compounders” which will benefit disproportionately from tax rate cuts.

He has explained that the real winners will be determined by the ability of a company to either:

(a) reinvest the incremental cash flows back into the business and generate a high return on capital on this incremental capital deployed; and/or

(b) increase operating expenditure via advert spends, price cuts, channel incentives, IT initiatives, HR spends, or R&D spends.

Hence, firms with high ROCE and high rate of reinvestment of cash flows will be able to create a ‘snowball’ effect on their future earnings, which is yet to be factored into their share prices.

He has also emphasized that the Marcellus’ Consistent Compounder stocks are “perfect fit” examples of such companies.

“Snowball effect” will catapult “great companies” more than “average companies”

Essentially, Saurabh’s theory is that a “great company“, earning 50% ROCE, will plough back the incremental profits generated from reduced tax rates, and thereby create a strong snowball effect as time progresses.

This ‘snowball effect’ accelerates the earnings growth rate of the Great company into the long term, he explains.

He has provided a detailed working to prove his point.

Will HUL, with 100% ROCE, prosper more than Asian Paints and Pidilite, with lower ROCE?

Naturally, the question will arise (at least in the minds of novices like me) whether a powerhouse like HUL, which boasts of a mind-boggling 100% ROCE, will prosper more compared to Asian Paints and Pidilite which have ROCE of 40%.

Saurabh’s answer is surprising and counter-intuitive.

He has pointed out that HUL will not prosper more because it does not reinvest the cash flows and so lacks the “snowball effect“.

In fact, while Asian Paints and Pidilite reinvest 51% and 68% respectively of their cash flows, HUL reinvestment is less than 20%.

HUL has not demonstrated its ability to redeploy a large part of its operating cash flows back onto the balance sheet and then sustain its high ROCE, Saurabh has observed.

Saurabh has also cautioned that HUL is engaged in a perpetual price war with its arch rivals like Patanjali, Nirma, Colgate, P&G etc and may be forced to sacrifice the incremental profits earned from the cut in corporate tax rates.

The vast majority of the Indian stock market will not benefit from the recent cut in corporate tax rates, Saurabh has observed, dashing the hopes of the punters who have grabbed these stocks aggressively.

Latest stock pick – Abbott India Ltd

Saurabh has announced that his latest stock pick is Abbott India Ltd, the fail-safe blue-chip MNC Pharma stock.

He has given flawless reasons for giving Abbott pride of place in the portfolio.

(i) Excellent track record:

Abbott India has delivered an excellent historical financial performance track record with industry-beating revenues, EBITDA and net earnings CAGR of 18%, 23% and 22% respectively over the last 10 years.

(ii) Consistent high ROCE:

Abbott India has consistently generated high ROCEs, averaging 39% (pre-tax) and ROICs (averaging 94% pre-tax) over the last 10 years.

(iii) Strong focus by MNC parent:

The firm benefits from a strong focus on India by its MNC parent firm Abbott Laboratories, which is reflected in terms of new product introductions, rigorous oversight on product/ manufacturing quality and support in the implementation of global best practices across all key functions.

(iv) Top brands:

All top ten revenue contributing brands of Abbott India rank either as #1 or #2 in their respective application areas – for instance Thyronorm (treating Thyroid), Duphaston (infertility/miscarriages), Vertin (Vertigo), etc.

(v) Will grow faster than other Pharma companies:

Abbott India has an opportunity to grow faster than Indian pharma industry on the back of:

(a) presence in under-penetrated therapy areas like thyroid, gynaecology, vaccines, etc;

(b) market share gains in core products as well as introduction of new products for treating adjacencies within the broader therapy areas.

(vi) Strong resilience to price control measures:

Abbott India is exceptionally strong in product efficacy, sales and marketing.

The company’s earnings have historically demonstrated strong resilience to price control measures – for instance, reduction in Thyronorm prices in FY14 led to an increase its market shares/volumes and the ensuing operating leverage helped mitigate the adverse impact on margins.

(vii) Margin expansion:

There exists an opportunity for margin expansion on the back of rising share of own brand contribution (currently Abbott India generates ~30-35% revenues from distribution of Novo-Nordisk Insulins where the distribution margin is low).

(viii) Strong track record of capital allocation:

Miles White, the Chairman and CEO of Abbott Laboratories has had a strong track record of capital allocation which is particularly important for a high cash generative firm like Abbott India which currently holds Rs 17 billion of surplus cash on its balance sheet.

| ABBOTT INDIA LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 23,014 | |

| EPS – TTM | (Rs) | [*S] | 228.17 |

| P/E RATIO | (X) | [*S] | 47.46 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 150.00 | |

| LATEST DIVIDEND DATE | 13 AUG 2019 | ||

| DIVIDEND YIELD | (%) | 0.60 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 945.22 |

| P/B RATIO | (Rs) | [*S] | 11.46 |

[*C] Consolidated [*S] Standalone

| ABBOTT INDIA LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | JUN 2019 | JUN 2018 | % CHG |

| NET SALES | 998.89 | 844.92 | 18.22 |

| OTHER INCOME | 29.6 | 21.76 | 36.03 |

| TOTAL INCOME | 1028.49 | 866.68 | 18.67 |

| TOTAL EXPENSES | 824.71 | 733.57 | 12.42 |

| OPERATING PROFIT | 203.78 | 133.11 | 53.09 |

| NET PROFIT | 116.94 | 82.4 | 41.92 |

| EQUITY CAPITAL | 21.25 | 21.25 | – |

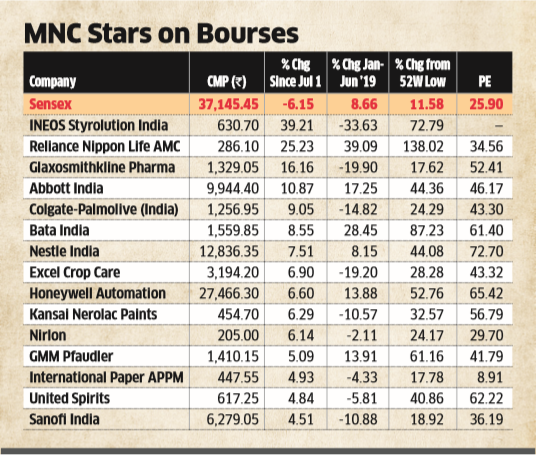

MNC stocks are stars on Bourses

It is no secret that MNC stocks are hot favourites amongst investors in Dalal Street.

“Big MNC names attract investors in tough market conditions owing to their long history of creating wealth, coupled with strong balance sheet, trusted brand advantage and high level of corporate governance,” Sanjeev Hota of Sharekhan said, eloquently capturing the sentiments of investors.

“Investors get more comfort investing in large MNC companies as they are also cash rich and pay high dividends,” he added.

“In this kind of a downturn cycle, investors find comfort in MNCs as they will not expect any kind of negative surprises from them. They are not only governed well but are also answerable to overseas regulators,” Pankaj Pandey of ICICI Securities opined.

Nestle, Abbott, Bata, INEOS Styrolution India, Reliance Nippon AMC, GlaxoSmithKline Pharma, Honeywell Automation, Sanofi India, and Colgate-Palmolive are few of the MNC stocks which have put up a spectacular show even during the present Bear market.

Abbott may prefer to delist rather than dilute 75% holding: MMB Punters

According to the punters at MMB, Abbott is unlikely to yield to Nirmala Sitharaman’s dictate that promoters should reduce their holding to 65% in place of the present 75%.

Earlier, MNC companies like Atlas Copco, Solvay Pharma and Cadbury delisted from the Bourses because the concept of sharing their wealth with Indian shareholders did not appeal to them.

However, this sparked off a massive rally in the stocks because the Indian shareholders grabbed the stocks and held onto them tight, knowing that the MNCs would pay a King’s ransom to get rid of them.

Even recently, INEOS Styrolution, a specialty chemicals company, announced delisting its shares from the Indian bourses.

The stock has surged like a rocket and gained 40 per cent since July 1.

“If INEOS succeeds in delisting its Indian arm, more MNCs will follow the route instead of diluting their stake in case of a SEBI go-ahead for the finance ministry proposal,” Amar Ambani of Yes Securities pointed out.

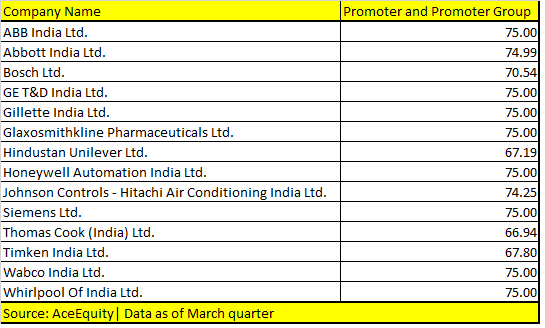

List of MNC delisting candidates as per moneycontrol.com:

Multibase India is a MNC with 75% holding but stock is down heavily. Huge corporate governance issue. Can’t trust MNC stocks also 🙁

Even RICOH was a MNC with a big fraud case 🙁

Wonderful

(1) When you have ROCE differential of 5 times between an average company and a good company, then, every thing else will fall in its designed place because all other figures are formula based and depend upon ROCE figures. And further, this gap will keep on increasing as the years pass on, also because of the ROCE differential of 5 times.

Nevertheless the theory is profound and good and there is no issue with the theory. It is simple that those who can use the ‘money saved’ in a better way by investing back in their super growth oriented businesses will always have better metrics on all parameters.

(2) The case of buying into Abbott at 47 PE and 11 PB looks expensive but as they say that for good compounders with tremendously high ROCE will reward in the long run is true.

I don’t think Abbott India is his recent pick,he ha been mentioning it since long,stock has done good in recent past.

So, then, what is the purpose of running this story line now. Any mischievous motive?

As per newsletter it is latest purchase of stock by Marcellus

“In September, we added one stock to the portfolios of our clients (no stock was exited though) – Abbott India Ltd. Abbott India has delivered an excellent historical financial performance track record with industry-beating revenues, EBITDA and net earnings CAGR of 18%, 23% and 22% respectively over the last 10 years. Abbott India has consistently generated high ROCEs, averaging 39% (pre-tax) and ROICs (averaging 94% pre-tax) over the last 10 years. The firm benefits from a strong focus on India by its MNC parent firm Abbott Laboratories, which is reflected in terms of new product introductions, rigorous oversight on product/manufacturing quality and support in the implementation of global best practices across all key functions. All top ten revenue contributing brands of Abbott India rank either as #1 or #2 in their respective application areas – for instance Thyronorm (treating Thyroid), Duphaston (infertility/miscarriages), Vertin (Vertigo), etc.”

But Pharma sector is not good now. See Aurobindo Pharma down 11% tday after FDA warning letter.

So better to avoid Pharma stocks now.

Conept of investing consistent compounding stocks is good. I have good quantity of HDFC Bank, Pidilite, Asian Paint in portfolio. I have held over many years. Good returns are there from such stocks 🙂

Don’t take headline of the post seriously. Just read and move on but don’t burn the fingers…