Sharekhan has expressed the view that the correction is temporary and the long-term uptrend in the market stays intact, though there could be a consolidation phase in the immediate term.

Sharekhan has realigned its Top Picks portfolio to increase exposure to the pharmaceutical sector by introducing Cadila Healthcare in place of Bharat Electronics.

Another change includes Zee Entertainment Enterprises, which is replacing Reliance Industries. Though Reliance Industries has corrected significantly and is attractive at the current levels, Sharekhan sees a number of issues limiting the possible upside in the near term. On the other hand, Sharekhan is enthused by the successful launch of a new general entertainment channel by the Zee group and thus see the recent correction in the Zee Entertainment Enterprises stock as a buying opportunity

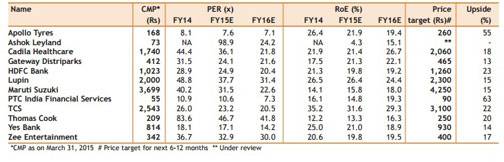

Sharekhan’s Basket of Top 12 stocks

(Image Credit: ET)

Apollo Tyres Ltd: Target price Rs 260:

Apollo Tyres is a leading player in the domestic passenger car and truck tyre segments. The tyre industry’s volume has been subdued, given the weak macro environment. Sharekhan expects the demand to improve in FY2016 with a pickup in the economy and higher utilisation of commercial vehicles (CV).

The European operations too have reported a strong performance with a strong volume growth and high profitability. The company will be investing EUR200 million for setting up a greenfield facility in Eastern Europe which will start production in Q4FY2017 and cater to the long-term growth in Europe.

Additionally, it will invest Rs 2,000 crore in its Indian operations for capacity expansion. The brokerage firm likes the stock for its consistent performance and long-term growth prospects (expansion in Europe and Chennai).

Ashok Leyland Ltd: Target price under review:

Ashok Leyland Ltd (ALL) is the second largest CV manufacturer in India with a market share of 25% in the heavy truck segment and an even higher share of about 40% in the bus segment. Given the scale of economic slowdown, the segment had halved over FY2012-14. With the pick-up in the economy, a sharp recovery is expected in the segment.

ALL’s operating profit margin (OPM) has recovered from the lows on the back of a reduction in discounts and price hikes taken by the company. Its margins are expected to expand further, given the operating leverage.

ALL has raised Rs660 crore via a qualified institutional placement and sold non-core assets to pare its debts. With no significant capital expenditure (capex) planned, Sharekhan expects the balance sheet to get de-leveraged and return ratios to improve.

Cadila Healthcare Ltd: Target price Rs 2060:

Cadila Healthcare is set to enter a high-growth trajectory, thanks to its aggressive product filings in the USA and Latin America, a recovery in its joint venture business and the launch of niche products in the Indian market, including the generic version of Gilead Sciences’ Hepatitis C drug, Sofosbuvir, in India under the brand name SoviHep

Sharekhan expects Cadila to record an overall revenue CAGR of 20% over FY2014-17 from the base business and the OPM of the company will see a sustained expansion over the next two to three years, mainly on the back of stronger traction in the branded business in India and Latin America, a better generic pricing scenario in the USA and optimisation of capabilities in the joint venture business.

Sharekhan expects the OPM to expand from 16.6% in FY2014 to 23% in FY2017. In view of better traction in the generic business in the US market, the potential from the launch of Hepatitis-C drug in India and the product ramp-up in the other key markets including business from joint ventures.

Gateway Distriparks Ltd: Target price Rs 465:

An improvement in exim trade along with a rise in port traffic at the major ports signals an improving business environment for the logistic companies. Gateway Distriparks being a major player in the container freight station (CFS) and rail logistic segments is expected to witness an improvement in the volumes of its CFS and rail divisions going ahead.

Sharekhan continues to have faith in the company’s long-term growth story based on the expansion of each of its three business segments, ie CFS, rail transportation and cold storage infrastructure segments.

Given the improvement in the profitability led by lower non-performing asset (NPA) provisions, a healthy growth in the core income and improved operating metrics, Sharekhan recommends a Buy with a price target of Rs465.

HDFC Bank Ltd: Target price Rs 1260:

HDFC Bank has a strong presence in the retail segment (50% of the book) and therefore has been able to maintain a strong growth in loans even in tough times. Going ahead, with a recovery in the economy and improving sentiment in consumer sectors, the loan growth will improve further which will drive the profitability.

HDFC Bank maintains impeccable asset quality and its NPA ratios are among the lowest in the system. HDFC Bank is adequately capitalised and further capital raising of Rs10,000 crore will boost its capital ratios and help to tap the growth opportunities going ahead.

HDFC Bank is likely to maintain healthy return on equity (RoE) of 19-20% and return on asset (RoA) of 1.8% on a sustainable basis.

Lupin Ltd: Target price Rs 2300:

A vast geographical presence, focus on niche segments like oral contraceptives, ophthalmic products, para-IV filings and branded business in the USA are the key elements of growth for Lupin.

Lupin has remarkably improved its brand equity in the domestic and international generic markets to occupy a significant position in the branded formulation business. Its inorganic growth strategy has seen a stupendous success in the past. Lupin is now debt-free and that enhances the scope for inorganic initiatives.

Lupin has recently got the Foreign Investment Promotion Board’s clearance to raise the investment limit for foreign institutional investors to 49% from 32% currently.

Maruti Suzuki India Ltd: Target price Rs 4250:

Maruti Suzuki India Ltd (MSIL) is the market leader in the domestic passenger vehicle (PV) industry. In M9FY2015, as against an industry growth of a modest 3.7% MSIL has grown its volumes by 13% and in the process expanded its market share by 373BPS to 45%.

Sharekhan expects customer sentiment to improve on the back of a strong government at the centre. Additionally, the PV segment is expected to benefit from the pent-up demand over the past two years; this will benefit MSIL the most due to its high market share in the entry level segment. The recent depreciation of the Japanese Yen is expected to boost profitability.

PTC India Financial Services Ltd: Target price Rs 90:

PTC India Financial Services (PFS) stands to benefit from the government’s strong thrust on the renewable energy sector (mainly solar and wind) which should result in a robust growth in the loan book (at a 40% CAGR over FY2014-17). About 70% of the incremental disbursement will be from the renewable segments (loan sanction pipeline of Rs7,000 crore or 1.2x of the existing loan book) which has lesser.

Sharekhan expects PFS to register a strong growth in earnings (40% CAGR over FY2014-17 excluding the one-off gains of FY2014) without factoring in the gains on its equity investments. The asset quality is likely to remain robust and the company is likely to deliver high RoAs (3.5%) which leaves scope for more upside.

Tata Consultancy Services Ltd: Target price Rs 3100:

TCS pioneered the IT services outsourcing business from India and is the largest IT service firm in the country. It is a leader in most service offerings and has further consolidated its position as a full-service provider by delivering a robust financial and operational performance consistently over the years.

Though cross-currency headwinds and softness in some verticals will affect the earnings in the near term, we believe the overall improvement in the USA will drive the growth in the coming years. Also, the company’s increasing capabilities in the digital space, which is a high-growth area, consolidates its position among the top tier global IT companies.

Thomas Cook Ltd: Target price Rs 250:

Thomas Cook India Ltd (TCIL) is an integrated leisure travel company with offerings across the value chain including travel services, holiday packages and foreign exchange services.

The improvement in the foreign tourist arrivals in India and improving sentiments of the domestic travelers would help TCIL’s travel and financial services businesses to post a better performance in the coming years.

An improving financial performance of Sterling and value unlocking potential in Quess Corp are re-rating triggers.

Yes Bank Ltd: Target price Rs 930:

Given a decline in inflation and the possibility of further reduction in the policy rates by the Reserve Bank of India, the cost of funds will reduce and benefit Yes Bank.

In addition, the bank’s investment book stands to benefit from a fall in bond yields due to surplus statutory liquidity ratio securities and substantial corporate bond book (Rs10,000 crore). The bank will also be included in the Nifty index which will be positive for the stock.

Sharekhan expects Yes Bank’s earnings to grow at healthy rates (about 22% CAGR over FY2014-17) driven by an expansion in the NIM and an uptick in the non-interest income. The asset quality remains robust and the quality is likely to sustain going ahead.

The return ratios are expected to improve further (RoA of 1.7% and RoE of 20%) resulting in better valuations. They have rolled over our valuations to FY2017 estimates resulting in a fresh price target of Rs930 (2.4x FY2017E book value).

Zee Entertainment Ltd: Target price Rs 400:

Among the key stakeholders of the domestic TV industry, Sharekhan expects the broadcasters to be the prime beneficiary of the mandatory digitisation process initiated by the government. The broadcasters would benefit from higher subscription revenues at the least incremental capex as the subscriber declaration improves in the cable industry.

ZEEL is well placed to benefit from the digitisation theme and the overall recovery in the macro economy. Also, the success of the newly-launched channel, “&TV”, would augur well and improve the company’s position in the general entertainment channel space.

Any body who thinks RIL is going to post Indias biggest QoQ growth in 2015 some quarter after Jio, Retail and PetroChem all firing