It is the dream of every investor to find a micro-cap which is transitioning into a mega-cap.

Prima Plastics appears to be treading that salutary path.

In an earlier piece, I have explained the entire nuts and bolts of Prima Plastics. I emphasized in particular that Prima Plastics has several ambitious plans in place which will catapult it into the big league. I quoted from the reports of leading experts to support my proposition.

I also suggested later that Prima Plastics is exhibiting many of the characteristics exhibited by multibaggers according to the “100 Bagger formula” formulated by Raamdeo Agrawal.

According to Raamdeo Agrawal’s formula, a stock must have high RoEs, dominance with customers, free cash flows, longevity of the opportunity to make high profits and the ability to withstand the competition.

Prima Plastics lays out the red Carpet for savvy investors

The management of Prima Plastics has done the sensible thing of inviting savvy and big ticket investors to invest in the Company.

The Company laid out the red carpet for big-ticket investors like HDFC Mutual Fund, Kotak Mutual Fund, Veda Investments (Jyoti Jaipuria), ValueQuest (Kalpraj Dharamshi), Param Capital (Mukal Agrawal), ChrysCapital, Alchemy Capital (Hiren Ved) etc and explained to them in detail as to why Prima Plastics is investment worthy.

This strategy has paid off big time because today one of the big-ticket investors decided to take a closer look at Prima Plastics and scooped up a truckload of the stock.

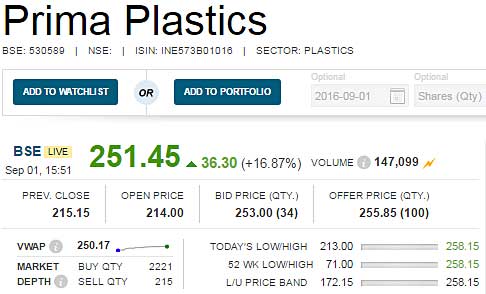

This sent the stock price soaring 20%. The stock ultimately settled at Rs. 251, up nearly 17%.

The strategy of wooing big-ticket investors is a very sound one because it shows that the management is serious about getting its act in order and of putting the foot on the gas pedal.

It also augers well for small investors like you and me because the big investors do their due diligence and ensure that everything is ship-shape before entrusting their money into the stock.

Shyam Sekhar’s portfolio sparkles

Shyam Sekhar is one of the biggest beneficiaries of the visionary approach of Prima Plastics’ management. As of 30th June 2016, he lords over 215,794 shares. The investment is worth Rs. 5.41 crore at the CMP of Rs. 251.

In fact, Shyam Sekhar appears to have anticipated the move because he has been aggressively ramping up his holding in Prima Plastics. In March 2016, for instance, he held 178,507 shares.

In the ETNow interview, Shyam Sekhar revealed that his favourite stocks include other small-caps like La Opala, Hatsun Agro and KRBL.

My #TOP2 high conviction stocks are ones i own for the past 5 years & will own for the next 5. LA opala glass & Hatsun agro. Richly valued.

— Shyam Sekhar (@shyamsek) December 20, 2015

Shyam Sekhar also has a chunk of Jayant Agro which has also turned out to be a magnificent multibagger.

Bullish about the agriculture theme

It is worth noting that Shyam Sekhar shares Kenneth Andrade’s bullishness for the agricultural theme.

Kenneth Andrade has provided a detailed presentation in which he has explained how the agricultural theme will surge and lead to several multibaggers in the years to come.

The difference between the two stalwarts is that while Kenneth Andrade is bullish on the “input” side of the agricultural theme (e.g. Coromandel International), Shyam Sekhar is bullish on the “output” side where there is scope for value addition and branding (e.g. Hatsun Agro, KRBL, Jayant Agro, Heritage Foods etc).

Core portfolio vs. Satellite portfolio

Shyam Sekhar has also revealed that his modus operandi is to have a core portfolio of about ten high-conviction stocks and a satellite portfolio of low conviction stocks which are being tested.

@Manish1S In a portfolio, about 10 stocks will be 80%. The rest will be ideas in the making.

— Shyam Sekhar (@shyamsek) August 28, 2014

In a blog post, Shyam Sekhar has advised investors to have two parts to their portfolio. The major part should comprise of the core stocks which are intended to be held for a lifetime. The tail portion can comprise of the numerous experimental stocks that one wants to dabble in from time to time.

There strategy has two advantages. The first is that by providing a specific allocation to the tail part of the portfolio, the investor can satisfy his urge to periodically buy and sell stocks without adversely affecting the core portfolio.

The second advantage is that the investor has the chance to closely study the stocks in the tail portfolio and decide whether or not it is worthy of being elevated to the core portfolio. If conviction develops in a stock, one can allocate more funds to the stock.

Dolly Khanna’s portfolio emulates this strategy

Prima facie, Dolly Khanna appears to be practicing this strategy. It may be recalled that Rajiv Khanna, Dolly’s alter ego, had revealed in a CNBC-TV18 interview that he has as many as 40 stocks in the portfolio.

My guess is that a bulk of the stocks in the portfolio may be stocks which are undergoing probation and testing to determine whether they are worthy of being elevated to the core portfolio.

Beneficial strategy for novice investors

The strategy of demarcating the portfolio into a core part and a satellite part is especially beneficial to novice investors like you and me. We can allocate a portion of our funds to the satellite part of the portfolio and go wild with buying and selling stocks without feeling guilty that we are doing something stupid!

dear arjun i have been reading your blog for 1 year and i really like all of your posts your research work is awesome. sir would like to learn few tips from you on research side, if you could spare your valuable time

thanks

regards

mohan

Everybody should check about the micro cap stock Patels Airtemp.

It is a great company. It is a 100 crore market cap company producing 118 crore annual sales with 7 crore net profit and 57 crore reserves. With great replacement demand coming from chemical and manufacturing companies it is going to be a sure multi bagger.

Check its profits. It is steadily increasing quarter on quarter.

Hi Arjun,

thanks for this great info . Wonder how you track those hundreds of companies and give prompt update .

Yesterday “J S L ENTERPRISES” bought a chunk of 58k stocks of prima .

Can you please guide how to find out legal brain behind this investor .

I tried googling but it did not helped much . If anybody know about it please provide inputs .

Thanks & Regards,

Prashant

Hi,

You can easily invest in such stocks. Check out Prudent Equity. The advisory recommended Prima Plastics @ 58 in July, 2015 and Patels Airtemp @ 85 in Aug, 2014. Talk to the advisor and subscribe if you are satisfied.

Buddy,

to let you know few of my investments .

Prima @50 – before PE recomonded it .

Cupid @ 28 – cmp 300+

NBCC @ 120+ – exited at 1000+

Sanghvi movers @50 – cmp 250+

HSIL @ 100+ cmp 350+

V2 retail @ 30 – cmp 90+

I have exited few more stocks after multibagger returns such as Ramco systems, PTC Fin etc .

Now please let me know if your PE Can beat my performance 🙂 .

More over I have seen a dirty spat between PE and some of the subscribers , so a big NO NO for such advisories .

Thanks & Regards,

Prashant

It does not matter to me whether You want to go for PE or not. Nor I am interested in your investments performance. I thought you wanted a good advisor so I posted my reply. Even PE has several multi bagger returns to its credit.

Am really not sure why everytime any discussion happens some one will always start beating drums of PE .

Looks like lot of clones here to do the job .

PLease read my message to Arjun carefully , I never asked for any advisory suggestions .

Thanks,

Prashant

Informative video about Dolly Khanna.

video about rajiv khanna and his style of investing ..thanks for inputs

Dolly Khanna has increased her stake in Stylam Industries, I came to know about Stylam from Arjun article in which he informed that Porinju bought Stylam almost 2 years back. While going through Stylam AR today, I found that Dolly has bought almost 5K shares and her total holding in the company is around 0.5%. This info is not available on BSE website as her holding is less than 1%. Stylam seems to be next multibagger stock which Dolly Khanna seems to be accumulating slowly.

HI ARJUN

your views on india nivesh latest intiatial coverage on sunteck reallity ??