Today, the Bears ran amok and caused the Nifty to close below the psychological...

Crash

Ashwani Gujral and other astute traders are grinning from ear to ear as the...

The wizards at Motilal Oswal have homed in on 10 high-quality fail-safe mid-cap stocks...

The vicious crash in the stock markets has spooked novice investors. However, the Gurus...

Investors have assumed that the savage crash in the market was due to the...

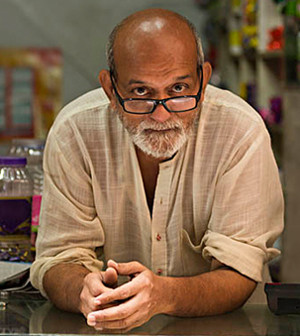

SP Tulsian’s latest recomm endation is a high-quality MNC which is debt-free, fail-safe and...

The nervousness amongst investors about the outcome of the Gujarat elections has not gone...

The wizards at Stewart & Mackertich have recommended four high-quality blue-chip mid-cap stocks which...

Shyam Sekhar’s technique of homing in on contrarian stock picks has yielded rich dividends...

A group of elite ace investors has been covertly pocketing big stakes in a...