Kenneth Andrade’s latest stock pick is a high-quality small-cap which has received clearance from...

Ramesh Damani

Brahmal Vasudevan’s Creador has stormed into a stock from a sector which has been...

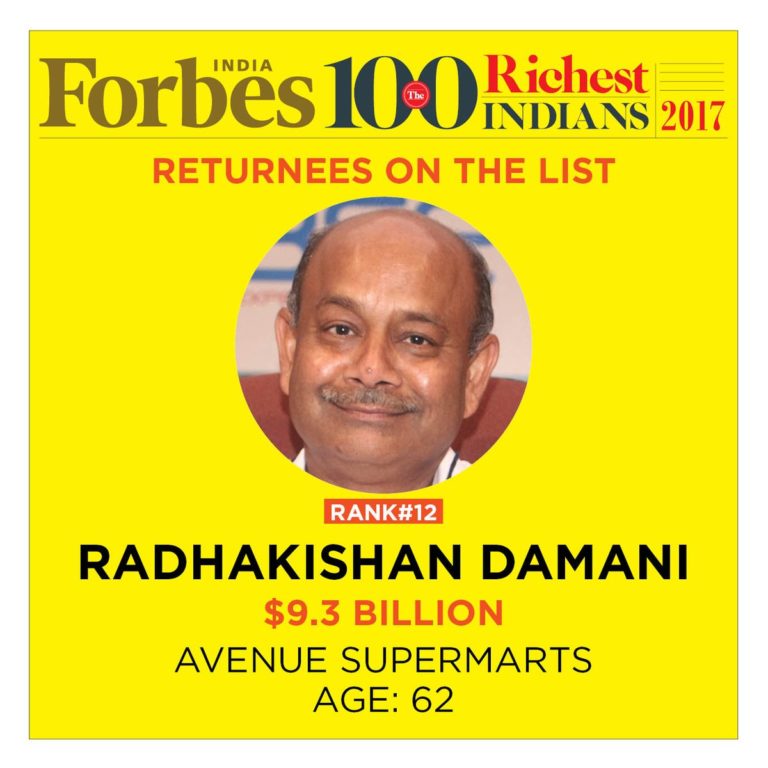

Radhakishan Damani, who faced the ignominy of being ousted from the Forbes Billionaires Club...

Sharekhan’s recommendations for Diwali 2016 have yielded a magnificent gain of 42%. They have...

Porinju Veliyath recommended a high-quality infra stock on the basis that the sector is...

The alleged disclosure by VG Siddhartha of Coffee Day Enterprises (CCD) of concealed income...

Mudar Patherya’s latest recommendation is a blue-chip MNC micro-cap stock. He asserts that the...

Novice investors have been buying so-called “Lakh crore ki kahani” stocks in an aggressive...

Yogita Khatri of ET has spoken to leading stock market experts and prepared a...

Manish Bhandari’s Vallum Capital has delivered a splendid performance in FY 2016-17 with 51%...