Auto ancillary stocks surge like rockets

First, we have to compliment Saurabh Mukherjea for his brilliant prediction that auto and auto ancillary stocks are on the verge of take-off and that we should load onto them ASAP.

“Auto and auto ancillaries would be my favourite play on economic recovery,” he had said in a prophetic tone.

This prediction has come true and top-quality auto ancillary stocks like Rane Brakes, Minda Corp, Lumax Auto, etc are surging and posting double-digit gains over the past few days.

Some have given mind-boggling gains in excess of 60% in just the last 30 days.

Some Auto Ancillaries This Month –

Igarashi Motors +63%

Rane Brakes +46%

Sterling Tools +28%

Pricol +21%Price anticipating recovery, or will it flatter to deceive?

— Mangalam Maloo (@blitzkreigm) December 27, 2019

RANE ENGINE ⬆ 20%

RANE HOLDING⬆ 15%

RANE BRAKE ⬆ 18%

RANE MADRAS ⬆ 20%

And many Auto and Auto ancillary stocks making high.

Sector rotation playing out— Zafar (@Maaachaaa69) December 26, 2019

Tyre stocks are also preparing to surge.

After Auto Ancillaries

Can tyres be too far behind? All At Day's HighMRF +4%

JK Tyre +4%

Balkrishna +3%

Apollo Tyre +2% https://t.co/H6U0JdgAKh— Mangalam Maloo (@blitzkreigm) December 27, 2019

It is notable that Saurabh has revealed that he has bought a two-wheeler stock with a top-quality franchise, high ROCs, high cash generation and good corporate governance.

He fondly described the stock as “too deliciously cheap to be ignored“.

We also need to grab this stock without any further delay.

Saurabh has also provided a detailed commentary on the other stocks in his portfolio and explained why they will continue to grow and prosper despite their alleged steep valuations.

Vijay Kedia recommends Sudarshan Chemical for 2020

Vijay Kedia follows the salutary practice of recommending to us only those stocks in which he has utmost confidence and conviction.

I pointed out earlier that Sudarshan Chemical is the crown jewel in his portfolio of multibaggers.

As of 30th September 2019, he held 19,85,215 shares worth nearly Rs. 80 crore.

Naturally, he has recommended the stock to us as well on the premise that it will sparkle in 2020 and make up for lost ground.

Sudarshan Chemical Ind, set up in 1951, produces pigments which are used in the paints, plastics, printing inks & cosmetics industries. This story shows you how to become a world class co by being intensely focused on a single line of business on @HSBC's #MakingItBig @abravi1 pic.twitter.com/9npdlgqYtt

— CNBC-TV18 News (@CNBCTV18News) September 22, 2018

Hot picks for the next decade with ET NOW’s Pankaj Poddar. Listen in! #Welcome20s #Welcome2020 pic.twitter.com/bJeQXhicIo

— ET NOW (@ETNOWlive) December 26, 2019

[Vijay Kedia with Gita Gopinath, the charming and distinguished Chief Economist of the International Monetary Fund (IMF)]

Basant Maheshwari recommends Bajaj Finance

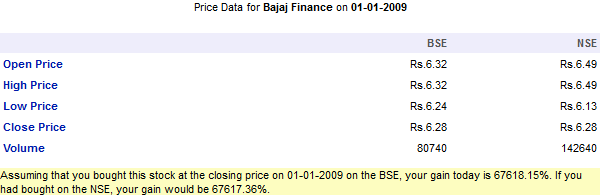

Basant Maheshwari is inseparable from Bajaj Finance.

He knows the stock like the back of his hand and constantly makes references to it in all his discussions.

This is understandable because the stock has showered incalculable gains over its lucky investors over the past few years.

In just the last 10 years, the stock has given an unbelievable gain of 67000% (670 bagger).

Due to this enviable performance, the stock has been conferred the prestigious title of “biggest and fastest wealth creator” in the latest Wealth Creation study of Motilal Oswal.

Bajaj Finance has the unique distinction of being in the top 10 Biggest as well as Fastest Wealth Creators. #WCS

— Motilal Oswal Financial Services Ltd (@MotilalOswalLtd) December 18, 2019

It is notable that Bajaj Finance is also Saurabh Mukherjea‘s favourite stock.

“If the broader credit industry continues to grow at a rate higher than 10% CAGR over the next decade, and within that if firms like HDFC Bank and Bajaj Finance double (to 12%) and treble (to 3%) their market share respectively, the current size of these lenders won’t be an impediment to growth,” he has advised.

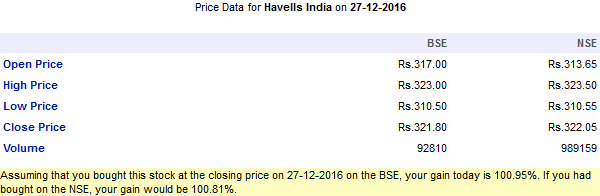

Sandip Sabharwal recommends Havells India

Sandip Sabharwal follows the simple but effective technique of aggressively buying stocks whenever they are in the doldrums.

We saw a live example of this with our own eyes in August 2019 when the stock market had crumpled and there was a sense of extreme panic amongst investors.

While everyone else was cowering in fear and hiding in the bunkers, Sandip Sabharwal aggressively bought many stocks and revealed that he would even withdraw funds from FDs to invest more.

I bought many stocks today.Huge panic creating lot of value

Not sure if will go up next month but will make big money over 2-3 years for sure

If markets fall another 5% will move FD's into the marketI am sure @narendramodi will eventually act & not destroy the massive mandate

— sandip sabharwal (@sandipsabharwal) August 23, 2019

No doubt, the conviction has paid off big time now that the stock market is coasting at all-time highs.

Havells India, which is Sandip Sabharwal’s recommendation for 2020, is a textbook example of a fail-safe powerhouse which is presently in the doldrums.

Over the past three years, the stock has given a gain of 100% though it has languished over the past 12 months.

7 other stocks recommended for 2020

The other seven experts roped in by ET Now, namely, Rakesh Arora, Milind Karmakar, Pankaj Murarka, Vinay Khattar, Kunj Banasal, Amnish Agarwal and CK Narayan have recommended Granules India, Trent, Syngene International, Titan Industries, ICICI Lombard, HDFC Bank and HDFC Life respectively.

1/n

1. Vijay Kedia : Sudarshan Chemical

2. Basant Maheshwari : Bajaj Finance

3. Rakesh Arora : Granuales India

4. Sandip Sabharwal : Havells India

5. Milind Karmakar : Trent

6. Pankaj Murarka : Syngene International

7. Vinay Khattar : Titan Industries— Pankaj Singh (@Shispank) December 26, 2019

2/2

8. Kunj Banasal : ICICI Lombard

9. Amnish Agarwal : HDFC Bank

10. CK Narayan : HDFC Life— Pankaj Singh (@Shispank) December 26, 2019

No doubt, each of the recommended stock is a fail-safe powerhouse which will handsomely enrich investors over the next 10 years!

BigBull–RJ Sir always rocks. Stocks recommended are seemed to be picked up perfectly. Sudarshan chemical is worth to have in portfolio.

Gas, AMC, private banks, Insurance and speciality chemical sector will dominate in coming years.

Don’t trust recos who have skin in the game.

My 2020 Stock picks are :

Present levels Dec 30, 2019

1.HDFC Bank – Rs.1282 FACE.VALUE-1

2.SRF – Rs.3415 F.V-10

3.Avanti Feeds – Rs.569 F.V-1

4.Deepak Nitrite – Rs.374 F.V-2

5.Muthoot Finance – Rs.765 F.V-10

6.Avenue Supermart – Rs.1884 F.V-10

7.Lincoln Pharma – Rs.198 F.V-10

8.Tata Global Beverages – Rs.321 F.V-1

9.IRCTC – Rs.926 F.V-10

10.Relaxo Footwears – Rs.612 F.V-1

awesome picks…could you elaborate face value concept a bit…is it just an additional parameter to check stock?

Face value is the issue price of the share during the first time issue of the company to the public. Its always 10 in India. Its not a criteria for selecting a stock. I just mentioned it for reference. Companies can reduce Face Value of their shares, and the stock price changes accordingly. For example HDFC Bank is actually Rs.12820 for 1 share at Face value-10 , but it quotes for Rs.1282 on Nifty and BSE at F.V-1. This year if for example, SRF reaches Rs.4000 F.V-10 and then if the company in case wishes to reduce Face value to 5, then the share holder will get 2 SRF shares and SRF price will become Rs.2000 F.V-5, which is actually a good Profit from present level of Rs.3415 F.V-10 for 1 share . I just quoted it to check actual profits from present levels this year or later and calculate accordingly in case there is any change in Face Value to lower levels. The companies I select are based on Earnings and future growth potential and not on Face value basis.

Can you please further eloberate the rationale on Lincoln pharma..

Hi Prabhu,

Any new recommendation now or still these stocks are good in Feb ?

Thanks

Good work!