Festive atmosphere in Dalal Street as investors make Rs. 5 lakh crore in one day

Yesterday, there was much jubilation in Dalal Street.

The Sensex, Nifty and Bank Nifty surged like super-sonic rockets to touch levels rarely seen before.

The Sensex surged 1400 points while the Nifty kept pace with 425 points.

This is because the Exit Polls confirmed that NAMO would be re-elected for the second term.

Investors joyously pocketed a colossal fortune of Rs. 5 lakh crore in just one day.

#MarketAtClose | #SENSEX & #NIFTY end at record closing highs pic.twitter.com/fxJhezo2Oh

— CNBC-TV18 (@CNBCTV18Live) May 20, 2019

#ExitPoll2019 predicting BJP-led NDA win in #LokSabhaElections2019 help #Sensex & #Nifty end at record closing highs, with today’s gains being the biggest ever since 2009. Nifty Bank hits a fresh record high with today’s gain being the biggest ever in a day pic.twitter.com/kCZNt8mrpB

— CNBC-TV18 (@CNBCTV18Live) May 20, 2019

?Sensex & Nifty registered their biggest intra-day gains since 2009

?Sensex up by 1421.90 (3.75%)⏫

?Nifty up by 421.10 (3.69%)⏫

?Investors gain Rs 5 lakh crores in a single dayWaiting for librandus to claim after EVMs, Modi hacked Stock Market as well. ??? #ModiAgain

— Sir Jadeja fan (@SirJadeja) May 20, 2019

Feb 6: Sensex falls 561 points. JESUS. Rs 2.75 lac crores of investors' wealth erased. END OF THE BLOODY WORLD. India story OVER.

May 20: Sensex rises 1430 points. Rs 7.01 lac crores of investors' wealth ADDED. Aur sunao Mishra ji kya chal raha hai. Bas, Fog hi chal raha hai.

— Anand Ranganathan (@ARanganathan72) May 20, 2019

Billionaires Uday Kotak and Nirmal Jain were amongst the many who heaved a sigh of relief.

All Exit Polls indicate vote for stability with clear majority for NDA. Market will heave a sigh of relief. Let’s look forward to reforms continuing and economy getting stronger.

— Nirmal Jain (@JainNirmal) May 19, 2019

Time to focus on economy. Stable Government and sustainable policies are the foundation for long term economic growth. I dream about India in big league of economic powers. Time for execution.

— Uday Kotak (@udaykotak) May 20, 2019

Rakesh Jhunjhunwala, the Badshah of Dalal Street, also paid a much awaited visit to greet his followers and add cheer to the atmosphere.

NAMO‘s performance in the second term will be much better, the Badshah assured his legion of fans in a soothing tone.

#CNBCExclusive | Performance will be much better in the 2nd term of NDA, believes Rakesh Jhunjhunwala pic.twitter.com/HulBRG2JxC

— CNBC-TV18 (@CNBCTV18Live) May 21, 2019

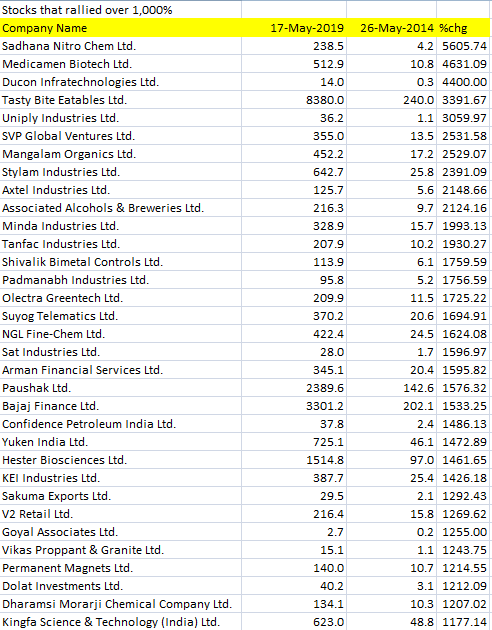

Stocks in NAMO’s v.1 regime gave 5500% gain

Few are aware that NAMO’s first regime has created incalculable wealth for investors.

As many as 800 stocks gave returns in excess of 100% over the past five years.

A few stocks gave eye-popping gains of as much as 5600% (56-bagger).

Sadhana Nitro Chem, a specialty chemical company, is at the top of the elite list. It delighted investors with 5,605% gain.

Tasty Bites Eatables and Stylam Industries kept pace with scorching gains of 3,392% and 2,391% respectively.

A number of stocks like Minda Industries, Olectra Greentech, Bajaj Finance, Kingfa Science & Technologies, Apollo Pipes and Indiabulls Ventures also soared more than 1,000 per cent during the same period.

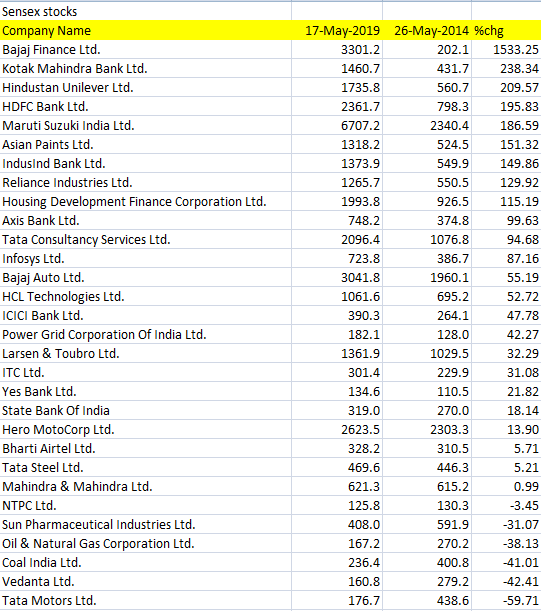

Even mega blue-chip stocks thrilled investors.

HDFC Bank, Reliance Industries, Maruti Suzuki, Tata Consultancy Services, Infosys and Maruti Suzuki lived up to investors’ expectations by giving hefty gains ranging from 196% to 88%.

These gains are hefty given that the investment is in a blue-chip and is safe as a house.

The Indices also posted reasonable gains.

The BSE Midcap gave a return of 69% while the Smallcap index gave a return of 56%.

Which are the best stocks to buy for NAMO v.2

Eminent and top-notch experts like Vivek Ranjan Misra of Karvy and Atish Matlawala of SSJ Finance have cherry picked ten of the best and fail-safe stocks that are ripe for a buy now.

These ten stocks are the following:

(1) State Bank of India:

The Bank is often regarded as the bellwether of India’s economy. The asset quality continues to improve with Gross NPA at 7.53 percent in the March quarter compared to 10.9 percent recorded in the year-ago period.

The Net Interest Income (NII) has also improved. We expect a return on equity (ROE) of the bank to improve in FY20 on the back of improving asset quality and recovery in the credit growth.

(2) ICICI Bank:

The credit quality has improved and we believe that the bank is on its way to recovery. The underlying loan growth is healthy and the bank is also diversifying its loan book to make it less risky. The ROE of the bank should improve significantly in FY20.

(3) Tata Steel:

The demand for metals should improve on the back of a cyclical recovery in the economy, which we believe will happen after Q2FY20, the valuations are also attractive.

(4) Larsen & Toubro:

L&T will be the key beneficiary of a pickup in capex spending and we also expect the company’s margins and ROE to improve going forward.

(5) Mahindra & Mahindra:

The valuations are attractive and will benefit from a recovery in consumer demand as well as focus on agriculture in the coming years.

(6) HDFC Bank:

The private sector lender has continued to display strong earnings growth momentum, supported by strong advances growth, stable NIMs, steady cost structure and low credit costs.

Operating expenses are under control due to digital initiatives undertaken by the bank. Stable asset quality, superior corporate governance, and solid performance make HDFC Bank attractive at current levels.

We believe HDFC Bank will be able to deliver profit growth at the rate of 20-22 percent CAGR for at-least five more years. We have a buy rating on the stock with a price target of Rs 2,500.

(7) HDFC:

Stable asset quality, superior corporate governance, and solid performance make HDFC attractive. HDFC has been able to grow its loan book by 18-20 percent in the March quarter, which we believe should continue for coming years as well.

Value unlocking by listing of subsidiaries and equity infusion will help HDFC to raise funds and maintain its net interest margins (NIMs).

We expect HDFC to deliver 15 percent AUM CAGR over FY19-21, driven by 17 percent CAGR in the retail business. Growth over the last two years was driven by volumes rather than value, which is positive.

We expect this trend to continue, especially given the strong macro tailwinds in the lower ticket size segment.

We believe HDFC will continue to outperform Nifty, hence, we recommend buying.

(8) Tata Consultancy Services:

We believe TCS will outperform industry growth rate and will continue to gain market share.

The management is quite confident of posting double-digit growth in the foreseeable future.

However, the margin may remain under pressure in the near-term. There are some macro concerns in the US, which will put some pressure on the stock in the near future.

However, we are positive on the company in mid to long-term. We advise investors to buy the stock with a target price of Rs 2,600.

(9) Reliance Industries:

Reliance Industries is steadily transforming itself from petrochemical to retail, telecom and digital services.

We believe the petchem, retail and digital services will continue to perform well in the coming quarters.

In telecom biz, management targets to achieve a subscriber base of 400 mn by FY20.

Trials for JioGiga Fibre services for Homes and Enterprise is being rolled out across 1,600 cities where it is optimising its service offerings across fixed broadband, entertainment and IoT based smart home solutions.

It also plans to grow big in online shopping and E-money, where it has already started to build an app that can provide seamless and quick transition across grocery to fashion to electronics.

We see huge potential in Reliance going ahead and recommend to buy with a target price of Rs 1,600.

(10) Bajaj Finance:

Bajaj Finance is the largest consumer durables and lifestyle financier in India and has been continuously gaining market share in these businesses. Continuous market share gain and strong distribution have created entry barriers for competitors.

One of the key strengths that Bajaj Finance has built over time is a quick turnaround time which is unmatched by most other retail financiers.

Thus, other than purchases on credit cards of banks, there are very few other competitors that Bajaj Finance sees in the consumer durables business, which provides it with pricing power.

It is also diversifying successfully into personal loans, overdraft facility that can be seen as a natural extension of consumer finance. We recommend a buy with a price target of Rs 3,500.

Namo 2.0? Roflmao. Dont build castles in air based on exit polls. Modi is not coming back. He is going back to ignominy of gujarat along with his first lady amit shah.

Save your tears for tomorrow.

Dear ALL,

These are THE SAME BUNCH OF OPERATORS … Who managed to Close SENSEX & NIFTY in UPPER CIRCUIT when Congress Govt. was elected in Lok Sabha just few years back !!! (2009-10 may be).. … Take all such NaMo non-senses with a liberal dose of SALT & LAXATIVES… it will at least help you clean your belly !!!

Operators are VERY happy because corrupt NaMo Govt. provides them with ample scope of “sustained manipulation of Indexes”… just look at the prices of mid-cap & small cap stocks… ???!!!

PLEASE Beware… Dollar RALLY is coming over next two years !!! bringing potential DEMISE of EM Economies…

Posted in absolute good faith for all small & honest investors community !!!

AB

What is the great thing about recommending these stocks? These are such good companies that they will grow and make money irrespective of whoever is the PM. You tell what to do about LEEL and Rain.

Exactly