Dalal Street rejoices after Trump leads over Biden

Investors and Punters on Dalal Street are closely following the developments in the USA relating to the Presidential elections.

This is because while Donald Trump is seen as the Messiah of the stock markets owing to his market-friendly policies, Joe Biden is seen as an enemy with his leftist policies.

In fact, Joe Biden has pledged to raise capital gains tax to a high amount, which will almost certainly torpedo the stock markets.

Joe Biden’s plan to increase the capital gains tax could lead to a large-scale sell-off of stocks, according to economic analyses. https://t.co/Wi8OOykWxR

— CNBC (@CNBC) September 21, 2020

Trump has also sent the chilling warning that a Biden victory will spell doom for the stock markets.

The Dow Jones Industrial just closed above 29,000! You are so lucky to have me as your President?With Joe Hiden’ it would crash?

— Donald J. Trump (@realDonaldTrump) September 2, 2020

Sleepy Joe Biden just agreed with the Radical Left Democrats to raise Taxes by Three Trillion Dollars. Everyone will pay – Will kill your Stocks, 401k’s, and the ECONOMY. BIG CRASH! #MAGA

— Donald J. Trump (@realDonaldTrump) August 8, 2020

Thankfully, the Presidential debate has given Donald Trump a decisive lead with 69% of the voters approving his policies as against only 19% being in favour of Biden.

— Donald J. Trump (@realDonaldTrump) October 1, 2020

“Lagta hai ke Trump Bhai elections jeetega. Biden Bhai Bakwaas kartaa hai aur voh haar jayega,” Madan Kaka, an intellectual, opined during our customary pre-market session of Chai and Gutka at Shyam’s Tea Stall.

“Aaj market solid chadega. Bindaas stock kharid lo,” Mukeshbhai added, girding his loins.

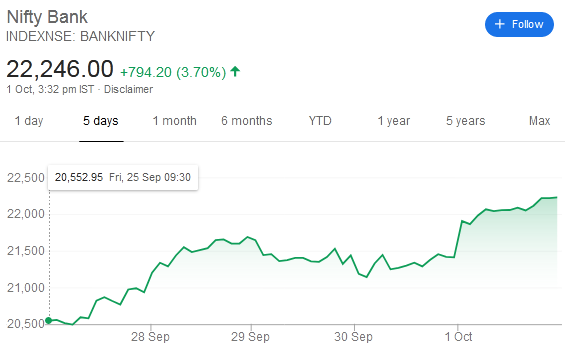

This prophecy came true because the Bank Nifty surged 800 points (3.7%), spreading cheer across the Country.

In fact, the Bank Nifty is up a mammoth 1700 points in just the last few days.

The Nifty also delighted with a hefty 170 points (1.5%) up move.

Stocks bought by PE Funds turn into multibaggers

One sure-fire method of homing in on potential multibagger stocks is to look for small-cap and mid-cap stocks which are in the radar of deep-pocketed Private Equity Funds.

This is because the Funds do cutting-edge research into the fundamentals of the Company and choose only the best.

Also, their buying power ensures that the stock surges like a rocket.

Gautam Trivedi of Nepean Capital confirmed that this is a viable investing game plan.

“Private equity funds buying a stake in companies is a big theme for this year, particularly in the midcap space,” he said.

“The theme that we are seeing in terms of new trends is PE funds. You have seen four this year alone – KKR buying JB Chemicals, Blackstone buying out Essel Propack, Carlyle announced 50 plus percent stake in SeQuent Scientific and earlier this year Advent took over DFM Foods. So you are seeing a lot of that coming up as well and that will increasingly happen to midcap companies where the promoters are either multi-family and second generation wants to go their separate ways,” he added.

He emphasized that several such stocks have given mega-bagger returns.

“Dixon Technologies is up 3.5 times in the last 12 months, Amber Enterprises has done very well. Hindustan Foods – that is not so much contract manufacturing or electronics but it is more for FMCG which is up 100 percent,” he said.

If you don’t invest in RIL, you are missing out on a big opportunity

Reliance Industries, the mother of all behemoths (Rs. 15 lakh crore market cap), is the go-to stock for all astute market participants.

In fact, Atul Suri, the noted expert on technical analysis and protege of Rakesh Jhunjhunwala, has revealed that nearly 80% of his net worth is invested in only 3 stocks, of which Reliance is one (see I Am A Concentrated Investor. Only 3 Stocks Make 80% Of My Portfolio: Atul Suri).

Gautam Trivedi also gave Reliance a vote of confidence and opined that it is likely to shower more hefty gains upon its investors.

“My personal view is that RIL will cross Rs 3,000 in the next 18-24 months because the management has done an outstanding job and I don’t mean this from the India perspective, but from a global perspective. How on earth can one company go and raise so much capital [from foreign investors]. Literally, Mukesh Ambani has gone and raised a billion dollars a week for the past 25 weeks and it is simply incredible,” he said, admiration writ large in his tone.

He also cautioned that investors who stay defiant and don’t invest in RIL are likely to miss out on the big opportunity to rake in gains.

“RIL will continue to surprise and my view is if you are not in that stock, we do not own it because we are mid and small cap fund, but if you do not own it you are going to miss out on the big India opportunity.”

Tata Consumer has blossomed from a mid-cap to a large-cap. It is still a good buy

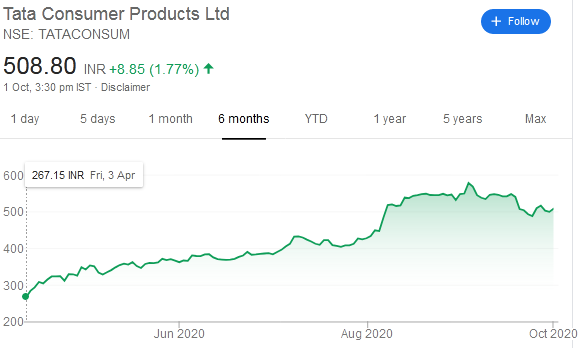

Gautam Trivedi had formally recommended Tata Consumer (earlier known as Tata Global Beverages) to us in April 2020 with the confident assurance that it is the “next food and beverages giant in the making“.

The recommendation has worked out well with Tata Consumer blossoming into a large-cap after its stock price surged from Rs. 267 (in April 2020) to the CMP of Rs. 510.

Trivedi credited whiz-kid manager Sunil D’Souza for the great achievement.

“Tata Consumer brought in Sunil D’Souza who has done wonders with Whirlpool; the stock of Whirlpool had gone up 3.5x in 5 year. Sunil D’Souza himself had a fantastic background having worked at Pepsi overseas and also the fact that they were merging consumer businesses of Tata Chemicals into Tata Consumer and this is basically going to be a flagship company for the Tata Group as far as consumer business is concerned and interestingly when we bought it was a midcap and it has now become a largecap,” he said.

He also pointed out that because Tata Consumer is a FMCG selling small-ticket essential items, it is relatively immune from the ravages of Covid-19.

Top stocks to buy now

Gautam Trivedi recommended that we buy high-quality and fail-safe stocks like Tata Consumer, Hindustan Foods, Aavas Financier, Aarti Industries, Navin Flourine, Vinati Organics etc and watch the gains compound slowly and steadily in our portfolios.

#TheBigVoice।#Part1। #NepeanCapital के को-फाउंडर और मैनेजिंग पार्टनर @trivedi_gautam का कहना है की फार्मा और केमिकल शेयरों पर भरोसा। पोर्टफोलियो में #TataConsumerPdts #HindustanFoods और #AavasFinanciers जैसे शेयर्स। देखिए ये खास चर्चा @shail_bhatnagar और @hemant_ghai के साथ। pic.twitter.com/xZTfS1hmz9

— CNBC-AWAAZ (@CNBC_Awaaz) September 30, 2020

Good to have @trivedi_gautam on @CNBC_Awaaz. His top long bets are #Tataconsumer #HindustanFoods #Aavasfinancier. Gautam likes #AartiInds #NavinFlourine and #Vinatiorganics. Good to have you with us, Sir. @hemant_ghai @YatinMota @SumitResearch

— Shail Bhatnagar (@shail_bhatnagar) September 30, 2020