ICICI Bank grabs chunk of Karnataka Bank

Darshan Mehta of ET Now and Varinder Bansal of CNBC TV18 are both known for their vigilance when it comes to monitoring developments in stocks held by eminent wizards like Vijay Kedia.

Today, the duo simultaneously flashed the red alert that ICICI Bank, the blue-chip banking giant with a market capitalisation of Rs. 164,783 crore, had bought 30.72 lakh shares of Karnataka Bank.

EXCHANGE FILING

ICICI Bank buys 30.72 lk shares in Karnataka Bank in March Quarte— Darshan Mehta (@darshanetnow) April 11, 2017

EXCHANGE FILING

ICICI Bank buys 30.72 lk shares in Karnataka Bank in March Quarterhttps://t.co/VbeIOmuMzm— Varinder Bansal (@varinder_bansal) April 11, 2017

This is a very significant development because large cap banks of the stature of ICICI Bank normally don’t invest in the stocks of rival small-cap banks unless there is a significant strategic reason to do so.

Is ICICI-Bank looking to take over Karnataka Bank?

Varinder Bansal downplayed the action of ICICI Bank of buying stock in Karnataka Bank as maybe “just a treasury operation and nothing more”.

This could be just a treasury operation by ICICI BANK…and may be nothing more https://t.co/fq01sdQZAl

— Varinder Bansal (@varinder_bansal) April 11, 2017

However, a little big of digging shows that ICICI-Bank has earlier made an attempt to take over Karnataka Bank.

According to a report in the IE, ICICI Bank had submitted a formal proposal to the Reserve Bank of India (RBI) to acquire Karnataka Bank.

However, for reasons unknown, the proposal did not work out and ICICI Bank had to return home disappointed.

ICICI Bank has a history of taking over private banks in an attempt to grow at an aggressive pace.

The two past incidents that come immediately to mind are the takeovers of Bank of Madura and Bank of Rajasthan by ICICI Bank.

So, prima facie, the possibility of ICICI Bank making another attempt to buy Karantaka Bank cannot be ruled out.

ICICI Bank buys 1.09% equity in midcap private Karnataka Bank in Jan-Mar 2017 quarter;consolidation buzz to get stronger? @BloombergQuint pic.twitter.com/rOz4BgCpQz

— Shraddha Babla (@shraddha_babla) April 11, 2017

Vijay Kedia buys more of Karnataka Bank

I pointed out earlier that Vijay Kedia has been aggressively buying Karnataka Bank on every occasion that he gets:

| As of | Nos of shares held |

| 30th June 2016 | 19,02,108 |

| 30th September 2016 | 25,02,108 |

| 31st December 2016 | 31,36,703 |

| 31st March 2017 | 56,60,703 |

Vijay Kedia’s holding of 56,60,703 shares in Karnataka Bank translates into an investment of Rs. 91 crore at the CMP of Rs. 160.

Whether Vijay Kedia is now satiated with his holding or he plans more incursions into the Karnataka Bank counter requires to be seen.

Why is Karnataka Bank a “sitting duck multibagger”?

In my earlier piece, I have drawn attention to the opinion of eminent experts like Sanjay Dutt of Quantum Securities, Centrum, HDFC Sec, Religare and AUM Capital on how the Bank is ideally placed to take advantage of the immense growth in credit in the Country.

In fact Vijay Kedia himself laboriously explained to us that Karnataka Bank is quoting at such rock bottom valuations in comparison to its growth potential that it has no where to go but up. He has also written a detailed article on the subject in which he has explained the matter threadbare.

Abha Bakaya grills Vijay Kedia about Karnataka Bank

Vijay Kedia’s latest interview with Abha Bakaya, the charming former editor of Bloomberg, reveals several unknown facets of his investment strategy.

The best part is that Abha Bakaya was not content with asking Kedia theoretical questions. Instead, she pinned him down and pointedly asked him why he invested in Karnataka Bank when there are so many other private banks and NBFCs floating around.

Kedia’s answer is refreshing and shows why he is a multi-millionaire while we are still struggling to make ends meet.

Is Karnataka Bank the next RBL Bank?

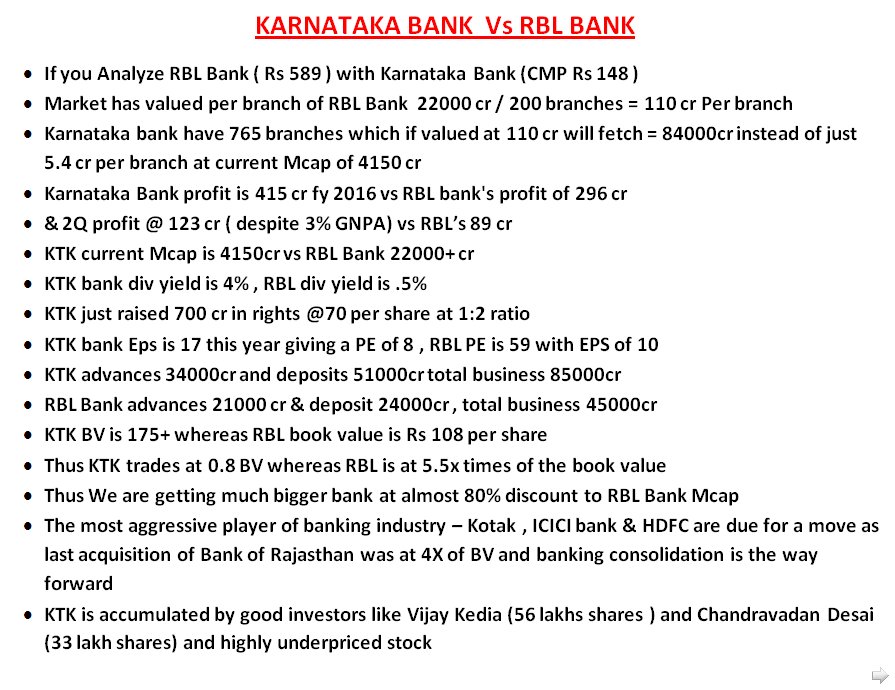

Some knowledgeable investors have drawn a comparison between Karnataka Bank and RBL Bank and pointed out that while the business profile of the two is more or less the same the latter is being valued at a whopping Rs. 110 crore per branch while the former is being valued at a throwaway price of Rs. 5.4 crore per branch.

There are several other relevant distinctions pointed out which imply that Karnataka Bank is deeply undervalued in comparison to its peers in the private banking space.

Excellent Comparison between Karnataka Bank And RBL Bank

Reality Vs Hype

Value Investing Vs Chasing momentum pic.twitter.com/4Lxtzn8tu3— Rishi Bagree (@rishibagree) April 11, 2017

Conclusion

The foray by ICICI Bank into the territory of Karnataka Bank appears to be a significant event which requires to be watched closely. If the former again approaches the RBI with a takeover request, there could be serious implications on the price of the stock. Even otherwise, the theory that the latter is deeply undervalued and is a safe investment warrants serious consideration from us!

In my view in small pvt banks ,RBL,DCB,Federal Bank and IDFC bank are better bets ,although money will be made in all including Karntaka bank.But real picture will emerge after next few quarter results,so keep watch and shift to best of lot ,forgeting where Kedia is invested .Now onwards quarterly resuotsv will drive next move and decide thr winners.

ICICI bank is also good buy as now they will be having some profit by booking profit in Karntaka bank and will help in reducing its NPA.

Hehe I just sold ICICI bank and bought Karnataka Bank

I believe in – one can add/buy but never to sell any bank. After, this quarter result is perfect example of ICICI share price which touched its 52 week highs.

The comparative figures between RBL & KTK have to be seen in the light that how many years of operations did it take for these banks to achieve the figures? Many quarters of centuries for KTK and less than a decade for RBL. Chalk and cheese cannot be compared.

I bought 50 shares of KTK bank way back in 1997 @ 50 odd bucks and sold 150 shares (after rights/bonus) at 150 odd bucks a few years later. After 20 tears the pride is same. Of course after couple of rights/bonus issues. If I remember correctly AXIS bank wa savailable at rs 35 or so(10 F.V) in 1995. Now where is it?

The moot point is the efficiency of new generation pvt banks vs old generation and PSU banks. But all said and done we cannot ignore the wisdom of Vijay Kedia. But my guess is, it is not pure business prospects of KTK bank which is the theory behind such huge investment. There must be something else which is beyond our imagination. What could it be?

Both banks are old – RBL existed as a laid back bank called Ratnakar Bank, a coastal south Maharashtra based bank, until about 4-5 years ago, an American banker Mr Ahuja took over its management completely. Karnataka Bank is still managed by traditional management, from a small city. When aggressive bankers take over stake, the fortunes change. I dont think ICICI, Axis or HDFC taking over Karnataka Bank is much good news; rather, if Kotak, Yesbank, IndusIndBank or even RBL Bank were to take it over or merge, then its a big positive for all!

By the way how good is City Union Bank. I would like to buy. Is it good for long term?

ICICI bank has clarified ,the Karntaka Bank stocks shown as stake are securty of equity brokers and dont belong to bank .Story was just planted to hype Karnatka bank,after clarification stock will again go down to its original levels.

Net npa of Karnataka Bank – 2.65

Net npa of rbl bank – .69

45k crores of business in 200 branches of rbl bank and 85k crores of business in 765 branches of Karnataka Bank so business per branch s so higher in rbl bank

Q3 fy17 Net interest margin is 3.38 % in rbl bank and 2.4% in karnataka bank

so why one should go for KTK Bank?

De Nora India – MNC Company

De Nora India as part of De Nora is a leader in the fields of:

Cathode & Anode for Chlor-Alkali Industry

Electrochlorinators

Cathodic Protection Systems

De Nora is recognized worldwide as a leading supplier of technologies for the production of chlorine, caustic soda and derivatives for the chlor-alkali industry as well as the largest worldwide manufacturer and recoater of noble metal-coated electrodes, electrolyzers, coating solutions for the electrochemical industry in general.

Energy saving and environmental protection are De Nora’s distinguishing technologies.

De Nora India is a 54 percent subsidiary of De Nora Group of Italy and they are making anode and cathode for electrolytic process. Anode and cathode is a positive and negative energy and electrolytic process is mainly used by the chloralkali industry for heating. In fact you heat the salt and it gets converted into the caustic soda, that is the chloralkali industry. So, that is a very critical process. So, they manufacture as well as coat and in fact, these anodes and cathodes are used for the membrane cell technology. And, earlier all these companies, they were on the mercury cell technology and they have now migrated to membrane cell technology.

“They are making the anode and cathode for the membrane cell technology. And if you see, membrane cell technology is used for the chloralkali industries and in fact, it has a replacement because all the mercury cell technology have migrated to membrane cell. And these anode and cathode needs coating after every 6-7 years. And if you see the migration, that has happened maybe 5-7 years back. Apart from that, they are electrolytic processes used in waste and waste water treatment, pulp and paper manufacturing, surface finishing and all these are opening a new avenues.

In fact, if you see, waste water management, that is a very big area, now because of Swachh Bharat or maybe because of the pollution norms being adhered to by all the world over. So, they have the command on all these industries.

The Government of India and the State Governments are very focussed towards cleaning of Ganga and huge capital has been allocated to Namami Gange Programme and this company is a direct benificiery of this programme.

This company is world leader in the raw material which is required to make Transformers..

Modi government is committed for electricity for all by 2022, so Transformers is the basic requirment.

It is also a delisting candidate and it can be done at huge premium. Last year there were talks that the delisting can even be in four digits.

It is the company which goes very well with Govermment policies like

Swatch Bharat

Ganga Rejuvenation

Electricity for all

It is a must have in a portfolio and can be in four digits before general election of 2019.

In comparison of Karnataka bank and RBL, one important parameter has been missed. The dreaded NPAs. Have a look at those numbers and therein lies the answer why RBL is valued much higher than Karnataka bank.