Vijay Kedia’s Latest Portfolio

First, we have to pay our customary respects to Vijay Kedia’s latest portfolio of multibagger stocks:

Company |

No of Shares (in Lakhs) | Value Rs Crore | YoY Gain (%) |

| Sudarshan Chemical Industries | 25.55 | 94 | 99 |

| Karnataka Bank | 56.61 | 93 | 49 |

| Cera Sanitaryware | 2.00 | 60 | 34 |

| Repro India | 7.54 | 34 | 10 |

| Lykis | 57.13 | 34 | (2) |

| Apar Industries | 4.25 | 32 | 48 |

| Vaibhav Global | 3.45 | 18 | 89 |

| Astec Lifesciences | 2.00 | 11 | 88 |

| Atul Auto | 2.53 | 10 | (16) |

| Apcotex Industries | 2.32 | 10 | 22 |

| ABC Bearings | 5.49 | 10 | 34 |

| Aries Agro | 5.98 | 9 | 28 |

| TCPL Packaging | 1.20 | 6 | (22) |

| Cheviot Company | 0.58 | 7 | 87 |

| Panasonic Energy India Company | 0.93 | 2 | (21) |

| Total | 433 | 527 | |

| Simple average return | 35 | ||

As one can see, Sudarshan Chemical has retained its position as the crown prince of the portfolio though Karnataka Bank is snapping at its’ heels.

Karnataka Bank is somewhat under the weather because of the loan waiver announced in the State of Karnataka and fears that this may adversely affect the “repayment culture” of the borrowers.

However, this is likely to be a temporary event. Karnataka Bank has otherwise been certified as a “sitting duck multibagger” by leading experts.

The average YoY return of the portfolio is adversely affected by the fact that as many as four stocks refused to participate in the Bull Run and delivered either flat or negative returns.

No doubt, these stocks will either have to shape up or ship out of the portfolio.

Repro has also been a disappointment with a sub-par return of only 10%.

The stock is a high conviction bet for Vijay Kedia with a massive allocation of Rs. 34 crore. Unfortunately, its golden days look elusive.

Even the punters at MMB have lost interest in Repro, which is an ominous sign.

Nevertheless, the simple average return of 35% generated by the portfolio is quite commendable and deserves to be applauded.

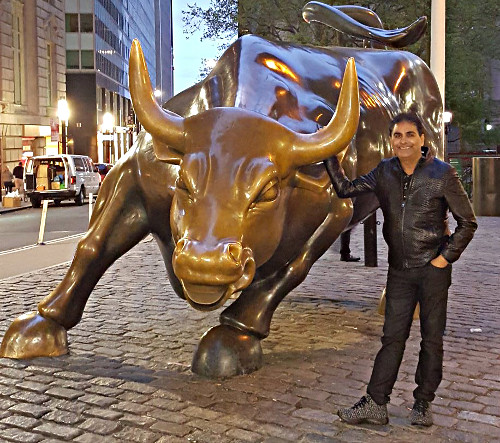

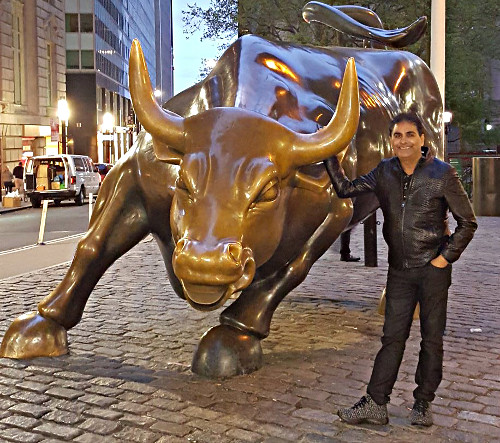

(Bulls paradise – Vijay Kedia poses with the famed ‘Charging Bull’ of NYSE)

Careful in short-term, very bullish about the long-term

Vijay Kedia sent the chilling warning to his army of followers that we have to “be careful” in the current market scenario.

@VijayKedia1 Sir, what is your advice in current market scenario?

— Vikrant Kashyap (@vikrant0382) June 23, 2017

Be careful. https://t.co/6Xd2ZjZI0D

— Vijay Kedia (@VijayKedia1) June 23, 2017

However, he was dismissive about short-term concerns in his interaction with Ayesha Faridi and Nikunj Dalmia.

“The market has always been risky. We have seen it fall from 9,000 to 7,000 and that has happened twice. So, market was risky that time and market is risky now. We have seen all the ups and downs all our life. All these things do not bother me,” Kedia said with his customary wide smile.

He added that the so-called “overheated or overvalued” state of the market is a part and parcel of investing and should not bother seasoned investors.

Even stock plunges of 30-40% are not a cause for anxiety if the fundamentals of the Company are ship-shape, he said.

Vaibhav Global, Latest Multibagger stock pick

Vijay Kedia revealed that he got interested in Vaibhav Global, the e-commerce diamond company, when its stock price plunged from Rs 1,000 to Rs 250.

In hindsight, this was a sensible thing because when a stock plunges in such a savage manner, it usually recovers some of its losses.

So, if one can buy the stock at its nadir, there is a chance to effortlessly pocket a few bucks when the stock rebounds.

Reverse logic for buying Vaibhav Global

Vijay Kedia explained in a light-hearted manner that he bought Vaibhav Global on “reverse logic”.

“Usually what happens, foreigners buy Indian companies listed on American Stock Exchange. I bought a company which is doing business in America and listed on Bombay Stock Exchange. So you can understand that what do I think about this company,” Kedia said with a guffaw even as Ayesha Faridi and Nikung Dalmia burst out laughing.

On a more serious note, Vijay Kedia explained that Vaibhav Global is “learning from its mistakes” and is “on the right path”.

“Slowly and steadily, it will keep on progressing,” he assured.

Very bullish about the market as “Revolution” is happening

Vijay Kedia does not need an excuse to be bullish about stocks. He is inherently so.

“I do not know what is going to happen in next five-six months, but if you ask me for next five-six years, I am very bullish. The market should remain bullish for next five years, six years, or maybe 10 years. Revolution is happening in the market” he said, his eyes sparkling.

“As we all know, domestic money is coming like anything and India is going to become or may have become or is on the verge of becoming the world’s biggest bull market. So obviously, there are good times ahead,” he added cheerfully.

You are clearly missing some of the stocks like lic housing finance. He has bought some and sold it like BEL and speciality restaurant.

Fedral Bank is better choice than Karnatka Bank.Fedral bank has come out with QIP at peak of market ,so not only it has got much required funds for growth but its book value will also improve and price to book will also go below 2.Stock is also darling of mutual funds and fiis.Other two good small cap bank bets are DCB bank and RBL bank.Those who had patience for next two years and want to buy a low ticket bank stock can look into IDFC bank.Even large cap banks like HDFC bank,Kotak bank,ICICI bank ,Indus sind bank and Axis bank are good long term bet for long term.Other good financial bets can be Icici Prudential insurance, l& t finance,Rel capital,DHFL,lic housing and Gic housing.In other sectors one can look into stocks like RIL,L&T,ITC,Asian paints,HUL,Ultra tech cement , Maruti and D mart.I hold all these stocks in my long term portfolio and portfolio is firing with all cylinders on.For small cap I am invested throug DSP micro cap,franklin small cap fund,hdfc mid cap fund,mirae emerging blue chip ,Rel small cap funds.

I always read ur comments. Awsome.

Correct your facts first. Repro is on verge to become maybe a 8-10 bagger in my opinion. Company is finally on the right track & everything Vijay said about Repro earlier will become true in this year.

Watch this interview: https://www.youtube.com/watch?v=GWB5kvMxyb4

He is one of the very few guys i admire in indian market. very humble and down to earth unlike some of the others who just praise themselves all the time.

If you look at his portfolio, barring one or two like cera, atul auto etc, others hardly inspire any confidence. I always wonder how these guys invest in these kind of companies where the past business performance is not great, no earning visibility, complex to under type of business. I have seen the same pattern in the portfolio of almost all big investors. comments welcome.

I find the portfolio of Kharb extremely good. He has the most undervalued gem —Reliance Capital in his portfolio. I hope, this stock has multiple triggers like demergers and listings. Perhaps this may double in two years. Ditto for IDFC Bank. This is a new generation Hi Tech Bank which has the potential to enter next orbit. Only stock that is missing is Yes Bank. Comments please.

I also hold yes bank and it is having biggest weight in my portfolio .

Your reply reinforces my conviction in Yes Bank, even more. Thanks Kharb.

The effort you and your friends put in to prove their point. Remarkable.

so another multi-bagger in the making – Vibhav Global?

I like Kedia’s ‘earthly wisdom’, although I have never cloned him (except a recent, albeit very late entry in Repro..I evaluated Sudharshan when he recommended but did not get conviction but was proved wrong for the umpteenth time). Kedia’s stories fall into a pattern – first when u look at what is in front of your eyes – quarterly performance etc will not make you follow his buys….then the story will emerge over months and quarters and by then it will be late…….and Kedia knows when to exit too and this is invaluable for an investor. example…his timely exit of Atul auto

Look at Repro India now haha! The story was/is the books on demand business. Anyone who knew that would understand that Repro India was a sure shot buy. No one bothered to look beyond what is presented. Another example is GAEL. Everyone thinks is commodity oil business but in reality it is a maize processing business with handsome margins and capex on going for maize exclusively. Agro oil is a legacy business. They are a similar story to that of KRBL.