Dil Ke Armaan Aansuo Mein beh Gaye. Hum Wafa Kar Ke Bhi Tanha Reh Gaye

It is well known that Vijay Kedia has a penchant for composing poems and reciting them whenever the opportunity arises.

On this particular occasion, he surprised the distinguished audience by reciting the immortal couplet of Salma Agha.

“दिल के अरमां आँसुओं में बेह गए

हम वफ़ा करके भी तन्हा रेह गए”

When the startled audience asked him the reason for the despondency, Vijay Kedia revealed that he is feeling betrayed by the ill-liquid small-cap and mid-cap stocks in his portfolio.

“It is like a snake and ladder game. If you go to sell shares worth Rs. 50,000, the market capitalisation plunges by Rs. 50 crore,” he lamented.

“I have to rethink my strategy for the future. I have decided that going forward, I am not going to invest in small-cap and mid-cap stocks which are illiquid. I want peace of mind,” he added.

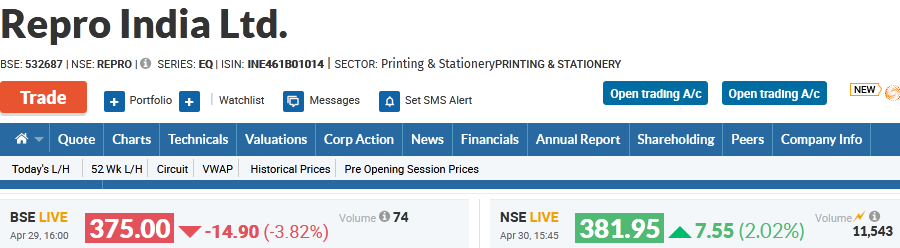

Though Vijay Kedia did not refer to any stock by name, it appears that he is referring to Repro India.

Repro India is one the crown jewels of his portfolio with a massive holding of 901,491 shares, worth nearly Rs. 30 crore.

He has also recommended the stock to us as being a “godsend” for the publishing industry (see Vijay Kedia Recommends First Mover Small-Cap Stock Which Is On A Disruptive And Exciting Phase Of Growth).

Unfortunately, the stock has not lived up its potential and has disappointed.

Worse, the stock is plagued with low volumes of only a few shares traded per day, which make it virtually impossible for large shareholders to buy or exit the stock.

Yesterday, for instance, only 74 shares were traded on the BSE and 11,543 on the NSE.

This is inspite of the fact that the markets are booming and the Sensex was up a massive 997 points.

We can also see the mockery of the stock being up 2% on the NSE while being down nearly 4% on the BSE.

In these circumstances, it is better for investors to steer clear of ill-liquid small-cap and mid-cap stocks and stick to their large-cap counterparts, Vijay Kedia sensibly advised.

Fail-safe blue-chips Zee Entertainment and Bajaj Auto

Vijay Kedia advised that we should play it safe and not venture beyond trusted large-cap stocks.

He recommended Zee Entertainment and Bajaj Auto.

ZEE Entertainment, under the dynamic leadership of the charismatic Anil Singhvi, is likely to scale new heights.

It is worth noting that Anil Singhvi is a highly qualified CA and CS, which implies that he has a sound understanding about business fundamentals as well.

Friends, wait is over n now time is come to put full stop on all the guesses . ….

I’m happy to announce my next inning. Now, I’m HEADING ZEE BUSINESS heading as it’s MANAGING EDITOR@ZeeBusiness @ZeeNews @ZeeNewsHindi @ZEECorporate

— Anil Singhvi Zee Business (@AnilSinghvi_) April 3, 2018

Bajaj Auto is also a stock where we cannot go wrong.

The company is a market leader in the two-wheeler segment, is debt-free and boasts of a dividend yield of 2.28%.

“If the government removes the lockdown soon then the recovery will first come in the two-wheeler segment. New launches and innovation to increase domestic market share. Strong balance sheet augurs well amid the near term demand slowdown,” Vijay Kedia opined.

Alert: this is not my recommendation as well… I just shared what I did for myself. And I can sell any share anytime. I may go wrong also as I have been many times in the past. https://t.co/F1eAwRkg1q

— Vijay Kedia (@VijayKedia1) April 29, 2020

Sandip Sabharwal recommends stocks which will benefit from consumption

Sandip Sabharwal also advised us not to venture into unknown stocks but to stick to top-quality names.

He opined that consumption will remain a dominant theme in India over the next 10 years and we should choose stocks which will benefit from it.

Britannia and Havells are the obvious choices given their dominance over the marketplace.

Britannia’s products are well accepted and it has strong balance sheet along with pricing power. As per capita income grows, branded food products with healthy connotations will grow rapidly.

Similarly, Havells is a powerhouse and can become a large-cap in the foreseeable future.

Its business has scaled up across segments and is creating brand power. It is a market leader in tech wiring segment in India and has become a strong consumer durables name over the last three years, Sandip Sabharwal pointed out.

Its ridiculous that people actually sell 10-20 year hold stocks on downgrades by Credit Suisse

1. They downgraded Asian Paints, stock fell 10% after that rallied 30%

2. They downgraded Britannia, stock fell 10%, after that rallied 25%

3. Now they have downgraded Jubilant Food….— sandip sabharwal (@sandipsabharwal) September 26, 2019

Experts saying 'Great time to buy quality stocks'

Nifty last lower circuit on 22-Jan-08Stock since 22-Jan-08

BajajFin +9920%

Eicher +5925%

AsianPaints +1640%

Britannia +1572%

HUL +930%

Titan +782%

IndusInd +730%

TCS +655%

HCLTech +622%

HDFCBnk +566%#nifty50— Nigel D'Souza (@Nigel__DSouza) March 13, 2020

Manish Sonthalia, Vikas Khemani and Pankaj Murarka also recommend top quality stocks

The other three distinguished experts who participated in the webinar also recommended fail-safe stocks.

Manish Sonthalia of Motilal Oswal advised us to consider ICICI Securities and HDFC Life.

He explained that healthcare and lifestyle are going to see major changes after coronavirus and that HDFC Life can grow its earnings at 15 per cent CAGR over next 10 years.

Similarly, the broking business has a high entry barrier owing to the compliance regulations. Volumes will increase in a big way over the next 10 years and broking is a non-linear scalable business model, he opined.

He also recommended ITC as a “deep value stock” with a superior high quality franchise. He described it as a free cash flow generating machine.

Vikas Khemani of Carnelian Capital Advisors revealed that he is bullish about ICICI Lombard, Aarti Industries and Eicher Motors.

He pointed out that ICICI Lombard has the ability to capture the opportunity and also has a strong management team. The industry is growing at 17% for last two decades and still under-penetrated. The company has the potential to double its profits in the next 3-4 years, he said.

Aarti Industries also needs no introduction. It is a tech leader in Benzene chemistry. Efficient use of bi-products resulting in cost leadership. The company has been consistently delivering over the past 10-15 years. It is well-diversified and has a significant moat.

Vikas Kemani described Eicher Motors as a “phenomenal franchise with a strong balance sheet and run by a great management team“.

He opined that the stock will create significant wealth once the environment changes.

Pankaj Murarka of Renaissance Investment Managers expressed confidence in Info Edge owing to its stranglehold over the internet in the form of Zomato, Naukri, 99acres, Jeevansathi etc.

All the businesses are still in a very nascent stage and have potential, he opined.

He also recommended Sun Pharma, the giant blue-chip. It can keep compounding 20 per cent earnings CAGR for next 5-7 years, he stated.