Shankar Sharma raps novice investors on knuckles for panicking unnecessarily

It is no secret that novice investors have the tendency to get their knickers in a twist whenever there is a small correction in the stock markets.

We could see this a few days ago when the Nifty slumped like a ton of bricks and micro-cap stocks sank like a stone.

Novices were roaming around Dalal Street with a bewildered look on their faces, bemoaning their fate.

Naturally, this sorry state of affairs irked Shankar Sharma.

“If you can’t stand the heat of small caps, get out of the kitchen,” Shankar yelled in a stern tone even as he glared at the novices.

”If you can't stand the heat of small caps, get out of the kitchen": Shankar Sharma, 1966. Relevant even today

— Shankar Sharma (@1shankarsharma) September 22, 2017

When the novices calmed down a bit, he counseled them in a soothing tone that they will never be able to feast on the meat if they cannot tolerate the heat.

While on the subject of small caps: " Most people want the meat, but can't stand the heat": Shankar Sharma, 1967

— Shankar Sharma (@1shankarsharma) September 23, 2017

Shankar further counseled everyone to look towards the future (windshield) and not be obsessed with the past (rear view mirror).

Key to Contrarian Investing: "Most investors drive watching the Rear View Mirror. I drive watching the Windshield". Shankar Sharma, 1965

— Shankar Sharma (@1shankarsharma) September 8, 2017

Quest for multibaggers from micro-cap stocks

Inspired by Shankar Sharma’s advice, we have to shed our fears and resume the quest for multibagger stocks.

Fortunately, Madhuchanda Dey of moneycontrol research has done all the hard work and identified 24 high-quality micro-cap stocks which have the potential to shower multibagger gains upon investors.

Let’s take a quick look at these stocks.

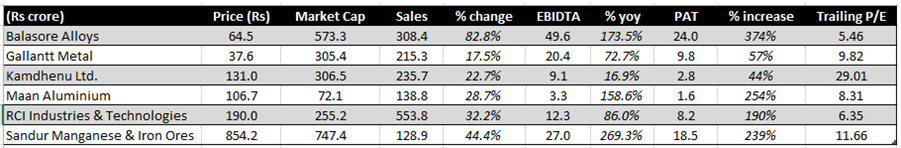

Six metal stocks

Presently, metal stocks are flying like rockets owing to some macro-economic reasons that are beyond our comprehension.

On a YoY basis, the S&P BSE Metal Index has given a whopping gain of 35.80%. The return over 24 months is an impressive 91.20%.

It is obvious that individual metal stocks have given even higher returns.

Madhuchanda Dey has shrewdly decided to capitalize on the euphoria towards metal stocks and recommended six micro-cap stocks which will prosper.

These are Balasore Alloys, Gallantt Metal, Kamdhenu, RCI Industries, Maan Aluminium and Sandur Manganese.

He has provided a succinct commentary which explains the merits of each stock.

(Image credit: Moneycontrol.com | Click for larger image)

Mudar Patherya recommended Sandur Manganese & Electrosteel Castings

It is worth recalling that Mudar Patherya recommended Sandur Manganese in December 2016 on the logic that it has zero debt, high EBITDA and huge operating leverage.

Electrosteel Castings was recommended on the logic that it will soon revive its “glorious days” and deliver multibagger gains.

What about GMDC, the favourite of Vijay Kedia and Mudar Patherya?

GMDC, the blue-chip PSU, is the ideal candidate to prosper from the demand for metal stocks.

Mudar Patherya has certified that GMDC’s fundamentals are so good and fail-safe that one can “bet his salary” on it.

Vijay Kedia also held a stake in GMDC in the past though his present holding is not known.

@freemanrodrigue GMDC looks cheap to me. But do your homework. I have vested interests in it.

— Vijay Kedia (@VijayKedia1) November 19, 2015

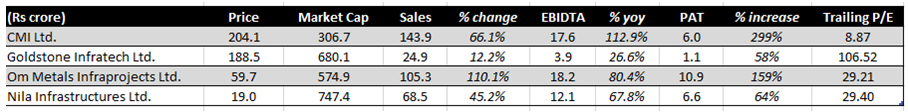

Four infra stocks

Porinju Veliyath has already assured us that 5x and 10x multibagger gains will be up for grabs from the infra sector and that we should tuck into these stocks without any further delay.

Over a dozen Infra cos at inflection point – stronger balance sheet, better visibility & exciting operating environment; potential 5x & 10x

— Porinju Veliyath (@porinju) July 26, 2017

Madhuchanda Dey has sensibly taken a cue from this and identified four micro-cap stocks that will benefit from the infra boom.

These are CMI Ltd, Goldstone Infratech, Om Metals Infraprojects and Nila Infrastructures.

(Image credit: Moneycontrol.com | Click for larger image)

Om Metals is Porinju Veliyath’s high-conviction pick

Porinju Veliyath has been aggressively loading up on Om Metals Infraprojects, one of his old favourites.

He was spotted at the counter a few days ago by Sonam Mehta, the charming and eagle-eyed analyst with CNBC Awaaz.

OM Metals Infrapro Ltd

EQUITY INTELLIGENCE INDIA PRIVATE LIMITED buys 13 lk shares @ Rs 62.70— SONAM MEHTA (@sonamcnbcawaaz) September 21, 2017

In fact, Porinju’s holding in Om Metals has exceeded 5% as was revealed by one of his devoted fans.

@porinju @ 5.27% stake in Om Metals Infra is a super conviction bet sir… Wow… Cheers and hope the Om journey begins now!!! pic.twitter.com/7wck84PW6A

— Jitesh Jain (@JiteshJ29312309) September 21, 2017

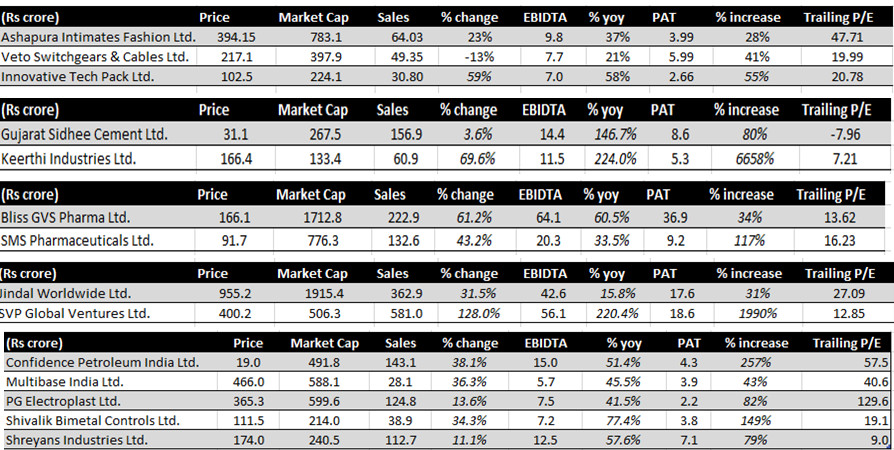

FMCG, Pharma Etc stocks

The other stocks recommended by Madhuchanda Dey are a balanced mix of stocks from the FMCG, Pharma, textiles, cement and other consumer facing sectors.

These stocks are Ashapura Intimates Fashion, Veto Switch Gears and Cables, Innovative Tech Pack, Gujarat Sidhee, Keerthi Industries, Bliss GVS, SMS Pharmaceuticals, Jindal Worldwide, SVP Global Ventures, Confidence Petroleum, PG Electroplast, Shivalik Bimetal Controls and Shreyans Industries.

(Image credit: Moneycontrol.com | Click for larger image)

Ashapura Intimates Fashion, the “next Page Industries”?

Of these stocks, Ashapura Intimates Fashion is familiar to us because it is the former favourite of luminaries like Lashit Sanghavi and Nikhil Vora.

The stock was also recommended by Ajay Relan as his stock pick for 2016.

In fact, Ashapura Intimates is described as “the next Page Industries” in informed circles though this may be an exaggeration.

Veto Switch Gears, fav of Billionaire Anil Ambani and Brahmal Vasudevan

Veto Switch Gears needs no introduction to us given that Billionaire Anil Ambani’s Reliance Wealth and Brahmal Vasudevan (of Creador) have a stranglehold in it.

There are no prizes for guessing that the stock is on the way to becoming a megabagger in the foreseeable future.

Innovative Tech Pack, FMCG Proxy

Innovative Tech Pack is the ideal proxy for the FMCG sector given that it manufactures packaging material for the MNC FMCG Companies.

Ayush Mittal, the illustrious co-founder of the valuepickr forum, held a big chunk of the stock as of 31st March 2017 though his present holding is not known.

The stock is presently under the weather because the Company has proposed at the AGM to raise debt and dilute the equity. This proposal has spooked investors and they are dumping the stock like there is no tomorrow.

TCPL Packaging, potential 3-bagger

Whilst on FMCG proxy stocks, we also have to pay respects to TCPL Packaging because it has won the confidence of Dolly Khanna, Anil Kumar Goel and Vijay Kedia.

According to Viraj Mehta of Equirus PMS, a noted stock market expert, TCPL Packaging has the potential to become a magnificent 3x multibagger if things fall in place.

Shreyans Industries, Dolly Khanna’s fav stock

Shreyans Industries, a manufacturer of paper products, is not familiar to us. However, its’ credentials as a potential multibagger are established by the fact that Dolly Khanna holds 1,51,285 shares in it as of 30th June 2017.

Basket approach required

Prima facie, Madhuchanda Dey has done an admirable job in making a perfectly balanced portfolio. He has chosen the best stocks from different sectors and provided much needed diversification and safety.

It goes without saying that an investment in micro-caps is a high-risk and high-reward game. While the gains can be multifold, the mortality rate of such stocks is also high.

Accordingly, one has to necessarily adopt a ‘basket’ or ‘portfolio’ approach whilst investing in such stocks. Hopefully, the gains will be more than the losses and we will all come out smelling of roses!

SUBRAMANIAN P has held 1.43% in shreyans Industries for the past 3 Quarters

Could you please let me know your source?

Dear Sir,

Could you please let us know who is P. Subramanian and what are all his portfolio. He has held stake in many companies and those companies are doing really good.

Regards

Ranga

http://www.subramoney.com/

Sanwaria Consumer ltd next multibagger.

Small cap company operating with 2-3% margin and 1000 crore in Debt. Have you gone crazy!!!

bro sanwaria is the next multibagger keep tracking and see it blast upwards

excellent detailed analysis! i will start making trips to the market and will raid these counters. watch out for my name in the shareholder list of all these stocks at the end of quarter.

Should we look out for the name to be ‘ajju’ or Rakesh Jhunjhunwala or Donald Trump or what?

all say buy all the time in so many scrips…nobody says sell in any scrip !! Just see how brutal the fall is, when it comes from the blue !!

Om Metals, Shreyans Ind and Maan Aluminium appear to have lot of promise.

Agree on Shreyans Inds. Picked up a small quantity. Though fundamentals are good we have to be aware that paper industry is currently facing headwinds.

man has already double

I bought Balasore Alloys yesterday at 55. Fundamentals are good and the stock is undervalued.

Can someone give the “24 promising micro caps” listed by wealth insight magazine in their Oct’17 issue.