Bulls wrest control of Dalal Street from Bears

Today, at 0915 hours IST, an ace team of commandos, set up by the Bulls Army of Dalal Street (BADS), stormed Dalal Street.

The team was under the command of Colonel Mukeshbhai. Lieutenant Jigneshbhai was second in command. I and several other local punters were on sepoy duty.

We were armed to the teeth with a formidable arsenal of weapons comprising of AK-74 assault rifles, SMAWs, MGLs (Multiple Grenade Launchers) and ATGMs (Anti-Tank Guided Missiles).

After a fierce battle, we managed to gain control of the Sanctum Santorum at 1100 hours IST.

This sent the indices surging like a rocket.

At 1400 hours, we lost some ground. The Bears staged a vicious counter attack and reoccupied some territory.

However, by the EOD, we had triumphed. The Sensex surged 347 points while the Nifty surged 100 points.

At the time of going to press, Col. Mukeshbhai had not yet given the all-clear signal. Combing operations are still underway to flush out the entrenched Bears.

Market surges in last hour on huge short covering. @Nigel__DSouza with more https://t.co/VWT06kfG36

— CNBC-TV18 (@CNBCTV18Live) September 25, 2018

Fav stocks of Rakesh Jhunjhunwala & Dolly Khanna targeted

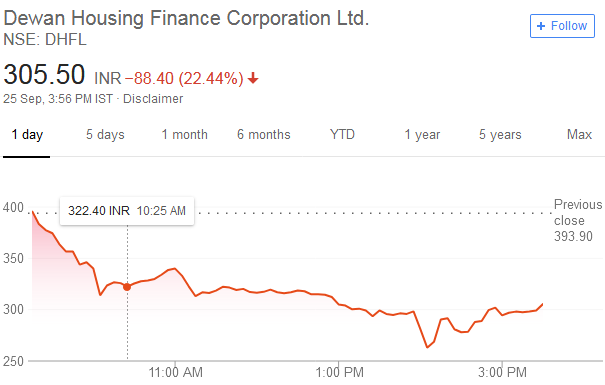

DHFL, the apple of Rakesh Jhunjhunwala’s eye and a crown jewel of his portfolio, was again targeted by the unscrupulous Bears.

The stock plunged a mammoth 22%.

However, thanks to Herculean efforts, the stock did not breach the panic level of Rs. 246 touched on Friday.

DHFL panic low on Friday was 246.25

— Darshan Mehta (@darshanvmehta1) September 25, 2018

Muthoot Capital, which was recently given pride of place in Dolly Khanna’s portfolio, also came under heavy selling pressure from the miscreants.

The stock has been clobbered owing to the Kerala floods and fears that NPAs will surge.

Other popular HFC stocks such as Can Fin Homes also took a pummeling.

CAN FIN HOMES -12% today

Keep an eye on CANARA BANK!!!

CANARA BANK holds 29.99% stake in CAN FIN HOMES— Nigel D'Souza (@Nigel__DSouza) September 25, 2018

Best NBFC stocks to buy now

A few days ago we saw that distinguished personalities like Basant Maheshwari and Madhu Kela assured us that NBFC stocks are safe as a house and that we should take advantage of the carnage to aggressively buy them (see Technical Sell-Off Has Created Brilliant Opportunity To Buy NBFC Stocks).

However, the two stalwarts did not name any stocks and instead left us hanging in mid air.

Basant Maheshwari #OnCNBCTV18 says don't think Govt can let NBFC sector fail. Think earnings will support market going forward, should go & buy high quality names right now, think it’s a good time to invest in quality names pic.twitter.com/fanh6Hp7Mh

— CNBC-TV18 (@CNBCTV18Live) September 24, 2018

#CNBCTV18Exclusive | Madhu Kela says temporary tightness in the money mkt would not have a long-term impact & @Lakshmi1876, CIO Debt, @KotakMF says current panic offers good opportunity to MFs to buy bargains in the market@_prashantnair @SumairaAbidi pic.twitter.com/0HtG6pDxtw

— CNBC-TV18 News (@CNBCTV18News) September 21, 2018

Thankfully, Kotak Institutional Equities has come to our rescue.

This elite research agency (which caters only to deep-pocketed institutional investors and not to riffraff) commissioned an ace team of analysts to cherry-pick the best of the NBFC stocks to buy now.

As expected, the analysts have done a splendid job with their recommendations.

No liquidity risk to the NBFC stocks

Kotak has first issued the soothing assurance that there is no liquidity risk and consequently no risk of bankruptcy of the NBFCs.

“We don’t find liquidity risk to any of the NBFCs under-coverage due to factors discussed above. However, the risk-averse stance of debt markets will likely lead to higher funding costs in the near-term,” it is said in an authoritative tone.

It is also pointed out that “NIM compression” is being built into the forecasts to tackle the risks arising due to vagaries in the bond market.

It is emphasized that the strong fundamentals and business trends of NBFCs under coverage has created value in the stocks.

Investors have been advised to look beyond near-term volatility and grab well-run NBFCs with proven business models.

Top 7 NBFC stocks

(i) Shriram Transport Finance: Upgrade to Buy from ADD| LTP: Rs 1161| Target: Rs 1550| Return 33%

Shriram Transport Finance trades at 1.6X book FY2020E.

We expect the company to deliver 17-18 percent medium-term RoE. We expect CV sales to moderate hereon, though we note that loan growth will remain strong at 17-18 percent during FY2019-21E on the back of a strong business in used CVs.

Increase in axel load norms will partially offset the pressure of higher fuel prices and augur well for asset quality performance even as NIMs in CV business remains under pressure. As on March 2018, the company has a negative ALM gap in 1HFY19, which is fully covered in 2HFY19.

Increasing competition from banks and the organized sector over the medium term poses a key risk. Besides, its large size and limited segments of operations is a concern.

However, these risks are reflected in current valuations, in our view.

(ii) LIC Housing Finance: Upgrade to buy| LTP: Rs 438|Target: Rs580| Return 32%

LIC Housing Finance has the highest dependence on the bond market at 87% of total borrowings. However, comfort in its strong parentage ensures steady funding availability for the company. In fact, PSU banks prefer lending to LIC over other private NBFCs during the period of crises.

However, marginal spreads are currently thin and the company will need to raise home loan rates over the next few weeks. We build NIM compression into our estimates (EPS down 3-5%) but don’t rule out further near-term downside risk.

The company saw a 54% deficit in the first bucket in March 2018, lower than 100%+ deficit in the first bucket during the previous few years. According to the management, high prepayments in home loans help in managing liquidity and hence it keeps the deficit in the first bucket.

However, current valuations (1.3X FY2020E book) factor in the aforesaid risk if one looks at the medium-term. A large retail book (79% home loans and 16% LAP) provides comfort.

(iii) Magma Fincorp: Buy| LTP: Rs 126| Target: Rs 165| Target: Rs 31%

We continue to believe that recent operational changes under the new management will boost the profitability of Magma over the next two years, even as loan growth may remain muted in the near-term.

We expect the company to deliver medium-term RoE of about 15 percent. Our revision in the target to Rs165 from Rs200 reflects a higher cost of equity.

Being a smaller NBFC, the company is a bit more vulnerable to vagaries in debt market but a lower bond market exposure (23% of total) provides comfort.

(iv) L&T Finance Holdings: Retain ADD| LTP: Rs 140| Target: Rs165| Return 17%

Tailwinds in rural business, cleaner book post-write-offs in the wholesale book will drive 18-19% RoE over the medium-term. At the target of Rs160, the lending business will trade at 2.2X book FY2020E.

Reduction in TP from Rs190 reflects a lower multiple for the lending business on the back of an increase in the cost of equity. Its exposure to NCDs is high at 45 percent; however, its parentage provides comfort to debt investors.

(v) Shriram City Union Finance (SCUF): Retain ADD| LTP: Rs 1820| Target: Rs 2120| Return 16%

We believe that SCUF has a strong franchise of lending at the lower-end of the market. Improving growth in business loans will drive 21 percent loan book CAGR and 27 percent EPS CAGR during FY2019-21E. We expect near-term RoA to remain strong at 3 percent and RoE moderate at 16-17 percent.

(vi) HDFC: Retain ADD| LTP: Rs 1835| Target: Rs 2,020| Return 10%

HDFC is a large borrower in the bond market with 54 percent borrowings from NCDs and CP, however, overall investor comfort on HDFC will ensure liquidity for the company.

Besides, the company has a dynamic deposit mobilization program which can be scaled up if the debt market fund dries up (as seen in FY2008).

The company had a surplus 15 percent in the one-year bucket in March 2018. Nevertheless, we cut our estimates by 2 percent to reflect lower NIM. HDFC’s core business will trade at 2.8X FY2020E book. Our investment thesis on subsidiaries remains unchanged.

(vii) Mahindra Finance: Upgrade to ADD| LTP: Rs 411| Target: Rs 450| Return 10%

The rural cycle remains strong. Strong rural cash flows will boost the near-term growth of Mahindra Finance even as NIM may remain under pressure due to competition from banks and NBFCs like L&T Finance.

Its exposure to NCD is 44 percent and CP is high at 16 percent. From a liquidity point of view, the Mahindra Group provides comfort; the company is running positive ALM in the first two buckets.

We expect the company to deliver 16-17 percent medium-term RoE and 21 percent EPS CAGR during FY2020E-21E. At our RGM-based TP, the stock will trade at 2.1X FY2020E book; we add Rs65 as the value of the subsidiaries. Our earnings are keenly sensitive to government spending in rural areas.

How come sundaram finance missing

One can also consider Chola Finance. It is a conservative and reputed group of the Murugappa family.

DHFL trading at just at price to book value of 1.07. Till now nothing negative in public domain, just keep watch on news flow. If hardening if interest rate is there, it is for all NBFC. In NBFC business housing is comparative safe business as compare to consumer finance. Till date DHFL has not defaulted in many decades. A stock to keep on watch for possible recovery if there is no concrete negative is found.

I am invested in stock since long ,still sitting on profit.

I agree. Unless some concrete negative is confirmed in DHFL, it is a great buy at the current price of around 300-350. As of now, there is no negative news about the company. DHFL is far better than other companies who are into retail and consumer financing because in case of DHFL, the mortgage is against housing property which is a rock solid mortgage.

Markets witnessed Jindal Steel, Rel telecom, Manpasand, PCJ, Vakrangee, Pharma FDIs, Jet airways and so on for various issues. My heart bleeds for DHFL investors knowing it fell damn hard for no reason. DHFL has HF, MF, Micro Fin and Education loan businesses which had great growth in loan book and profitability.

Markets are so irrational and brutal that IT companies which have neither achieved growth nor profit increase in last 5 years hitting 52 wk highs just because of 10% dollar appreciation.

Strange that the RJ fan site is not giving a Buy sign on RJ’s favourite, DHFL! It was my favourite till it crossed 600. Now, again its become a good buy. But I am amazed why hardly anyone recommending it! Maybe all are busy buying it, and then they will come out after it regains lost ground!! Or there is something murky happening in the background! Who knows? The Games People Play!

I can understand the pain shareholders of companies like DHFL or India Bull Housing and other finance companies are going through however the NCD holders fo such companies are also selling the NCDs in secondary market at high discount? Any views for NCD or FD holders?