Bulls recapture Dalal Street after fierce fire fight …

On the hot Monday afternoon, I was indulging in my favourite activity of dozing and day-dreaming of multibagger gains.

Suddenly, the radio crackled.

“Vehicle with Tangos spotted two clicks from Dwarka Restaurant”.

It was Jigneshbhai. He had spotted a truckload of Bears making their way towards Dalal Street.

I was up in a flash. After the humiliating defeat on the previous occasion when the Bears had taken control of Jeejeebhoy Towers, I was determined to avenge our losses.

I grabbed the SMAW (Shoulder Mounted Assault Weapon) and the M32 MGL (Mobile Grenade Launcher).

The SMAW is a rocket launcher which fires 83mm HEDP unguided rockets. The M32 MGL is an equally awesome weapon. Together, the two can obliterate enemy forces.

Meanwhile, Mukeshbhai was already in the vicinity of Dwarka Restaurant. He and the other patriots of the ‘Bulls Army of Dalal Street’ were conducting reconnaissance and combing operations in the alleys of Dalal Street to flush out the Bears who were well entrenched there.

“Aiyyo Rama, Mar Gaya Re,” Mukeshbhai suddenly screamed, his voice muffled due to the mouthful of Gutka and the static.

The scream chilled my blood. I knew that the Bears had waylaid Mukeshbhai and captured him.

“Aaj Ya Toh Is Paar Ya Us Paar,” I shouted in defiance and unleashed a fearsome volley of rockets and grenades upon the Bears.

The strategy worked.

The Bears were not expecting such aggressive resistance and retaliation from the Bulls.

They released Mukeshbhai from their clutches, turned tail and ran away from Dalal Street.

Soon thereafter, the Bulls regained full control and sent the Indices surging upwards like rockets.

The Midcap and small cap indices were up a handsome 1.40% and 1.29% respectively.

Several individual stocks breached their upper circuit limits.

It is time to buy micro-cap stocks now: Shyam Sekhar

The indication that the Bears have gone for good has come from an important pronouncement made by Shyam Sekhar.

“The way microcap is falling, the bottom seems to be coming apart. Time to ping at few ideas,” he said, sending the clear signal that the time is ripe to buy micro-cap stocks.

Looks like one cant be lazy for too long. The way microcap is falling, the bottom seems to be coming apart. Time to ping at few ideas.

— Shyam Sekhar (@shyamsek) March 31, 2018

Ashish Kacholia Buys (Back) Acrysil Ltd

MMB Punters are known to be sharp as a tack. Their eye for detail is legendary.

On 26th March 2018, Ashish Kacholia bought a chunk of 221,240 shares of Acrysil from Everest Finance & Investment Co at Rs. 468 per share.

While everyone assumed that the purchase was a fresh one, the punters pointed out that Ashish Kacholia had merely bought back the same number of shares that he had earlier sold to Everest Finance & Investment Co on 29th March 2017.

The only difference is that while Everest had bought the shares from Ashish Kacholia at Rs. 516 per share, it sold the shares to him at Rs. 486 per share.

Prima facie, Everest appears to have booked the loss on its holding before it turned into a long-term capital loss.

It is not known whether Everest and Ashish Kacholia are connected in some way.

Ashish Kacholia was first seen as a shareholder of Acrysil as of 31st March 2016 with the same holding of 221,240 shares.

(Chirag Parekh, CMD, with charming ladies Chef Shipra Khanna & Karishma Kotak)

Varun Daga of Girik Capital holds big chunk of Acrysil

Varun Daga is the co-founder of Girik Capital, a PMS Fund, which is credited with having identified several multibagger stocks.

His profile became known to us when he was grilled by Ramesh Damani as to his investment modus operandi.

Varun Daga revealed that he follows the famed ‘CAN SLIM’ approach to identify investment opportunities.

He also revealed that the ‘CAN SLIM’ method helped him home in on mega multibagger stocks like Ajanta Pharma.

As of 31st December 2017, Varun Daga holds 1,41,463 shares in Acrysil comprising 2.73% of its equity.

Another individual named Paraskumar Harakchand Daga holds 54,770 shares in Acrysil as of the same date.

However, it is not known whether he and Varun Daga are PACs.

From Varun Daga’s investment in Acrysil, we can safely conclude that it meets all the requirements of CAN SLIM and is a fail-safe stock.

Shyam Sekhar is also a major shareholder of Acrysil

Shyam Sekhar was first spotted in Acrysil with a holding of 24,923 shares as of 1st April 2015.

The holding swelled to 35,682 shares as of 1st April 2016.

As of 1st April 2017, the holding stands at 42,903 shares.

The present holding is not known.

Prima facie, the aggressive manner in which Shyam Sekhar has been increasing his holding in Acrysil suggests that the stock is a high-conviction one for him.

Nigel DSouza explains charms of Acrysil

To understand what it is about Acrysil that the ace investors have found irresistible, we have to turn to Nigel DSouza of Mid-cap Mania fame.

Nigel has explained that Acrysil is a monopoly supplier of high-end quartz sinks and kitchen appliances such as microwaves etc.

Acrysil is1 of the 4 players globally producing Quartz Sinks, only co to make Quartz Sinks in Asia @Nigel__Dsouza #MidcapMania pic.twitter.com/GmEiyddkqc

— CNBC-TV18 News (@CNBCTV18News) February 26, 2018

Acrysil is1 of the 4 players globally producing Quartz Sinks, only co to make Quartz Sinks in Asia @Nigel__Dsouza #MidcapMania pic.twitter.com/GmEiyddkqc

— CNBC-TV18 News (@CNBCTV18News) February 26, 2018

ACRYSIL #midcapmania

Key Focus on Quartz Sinks

1 of 4 players globally who produce Quartz Sinks

Revenue

FY18e 200cr

Medium Term Tgt 500cr

Long term Tgt 1000cr #CARYSIL#STERNHAGEN https://t.co/VyzUcQvojg— Nigel D'Souza (@Nigel__DSouza) February 26, 2018

Prima facie, the stock appears to be a beneficiary of the great real estate and housing boom.

It is also a beneficiary of the boom in QSRs (Quick Service Restaurants) given the large variety of kitchen appliances such as Dosa makers, tandoors, microwaves etc that it manufactures.

| ACRYSIL LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 278 | |

| EPS – TTM | (Rs) | [*S] | 11.50 |

| P/E RATIO | (X) | [*S] | 46.62 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 50.00 | |

| LATEST DIVIDEND DATE | 12 SEP 2017 | ||

| DIVIDEND YIELD | (%) | 0.96 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 172.37 |

| P/B RATIO | (Rs) | [*S] | 3.11 |

[*C] Consolidated [*S] Standalone

| ACRYSIL LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | DEC 2017 | DEC 2016 | % CHG |

| NET SALES | 48.24 | 41.07 | 17.46 |

| OTHER INCOME | 0.3 | 0.49 | -38.78 |

| TOTAL INCOME | 48.55 | 41.57 | 16.79 |

| TOTAL EXPENSES | 42.38 | 35.56 | 19.18 |

| OPERATING PROFIT | 6.16 | 6 | 2.67 |

| NET PROFIT | 1.88 | 0.86 | 118.6 |

| EQUITY CAPITAL | 5.19 | 5.19 | – |

(Source: Business Standard)

Latest Investors presentation

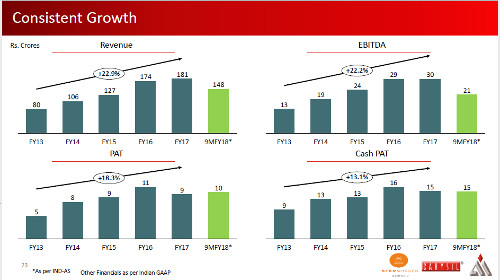

The latest investors’ presentation lays bare the ambitious growth plans of the Company.

The salient aspects of the presentation are as follows:

Pillars of Integrated Business

Brand

▪ Aggressive brand promotion on TV and in print, along with exposure through sponsorship of events like Times Food and

MasterChef Australia

▪ Introduced a new top-of-the-line brand titled ‘Tek Carysil’,

featuring kitchen sinks, faucets and appliance that represent

a revolution in design, style and quality

▪ Vision is to build global brands

Manufacturing Facilities & Technology

▪ Quartz Sinks: 400,000 pa , Stainless Steel : 75,000 pa and

Appliances: 10,000 pa

▪ Enjoy in-house capability extends to manufacturing and assembling chimneys, hobs, hob-tops and food waste

disposers

▪ Technology: Only company in India and Asia and among 4 companies globally to have the technology to manufacture

Quartz Sinks

Distribution Network Gallery

▪ The acquisition of 98.75% stake in a distribution company: Homestyle Product Limited, in UK which outsources sinks and sells to the top customers

▪ Vital access to key customers based in markets in Europe and UK

▪ Current Domestic Market: ~+1300 Dealers, ~65 Galleries & 80 distributors

Product Basket

▪ Offers a wide range of cutting edge technology products to customers based on their needs

▪ Continue to hold the market’s attention with new product categories, new launch events, new technologies, and new models

Multiple Growth Drivers

Strong Distribution Network

Strengthen the Distribution network by tie up with Homestyle and plan to add new 100 galleries and 34 more distributors

Branding & Technology

Focused on capturing the Brand Mindspace of niche Consumers

Huge Product Range

Entry into the kitchen appliances market with innovation, R&D and design capabilities – Aim to become a major player

Expansion

Currently catering to 43 countries strive to spread the wings to 70 countries in next three years by exploring the uncatered geographies

Only Quartz Sink Company

Only company in India and amongst the 4 global players manufacturing Quartz Sinks

Conclusion

The decision of Ashish Kacholia, Varun Daga and Shyam Sekhar to invest in Acrysil cannot be faulted. The stock is likely to walk in the illustrious footsteps of CERA, Kajaria, Hawkins, etc and shower multibagger gains upon its lucky investors if all goes as per plan!

Yes looks like worst is over. Now super bull market will start from today

Gujjus scores again! Kacholia is younger brother of Kedia bhai in terms of smart investing. Both being Gujjus who are known for their for their business acumen and having a pulse of the stock market. Safe to follow them. Like i have shared before, as a proud Gujju, Gujjus are by far the most smartest and shrewdest when it comes to the stock market and makes sense to track these masters at work and benefit enormously from the wisdom they so generously share to the public as part of their giving back to society for all the blessings they have received from Lord Mahavir.

No matter how smart gujjus are..The hotshots in businesses and stock market is still marwaris.. You cannot rule out marwaris from the equation..Damani, Jhunjhunwala,etc. are all marwaris..

hehe, damani is gujju!!

Parochial thinking does not work in stock market.

Check pot directors names of ojas consulting which holds 4.23% of Acrysil

These guys are good with gold mining stocks.