PMS Fund heavily outperforms Nifty & BSE 500

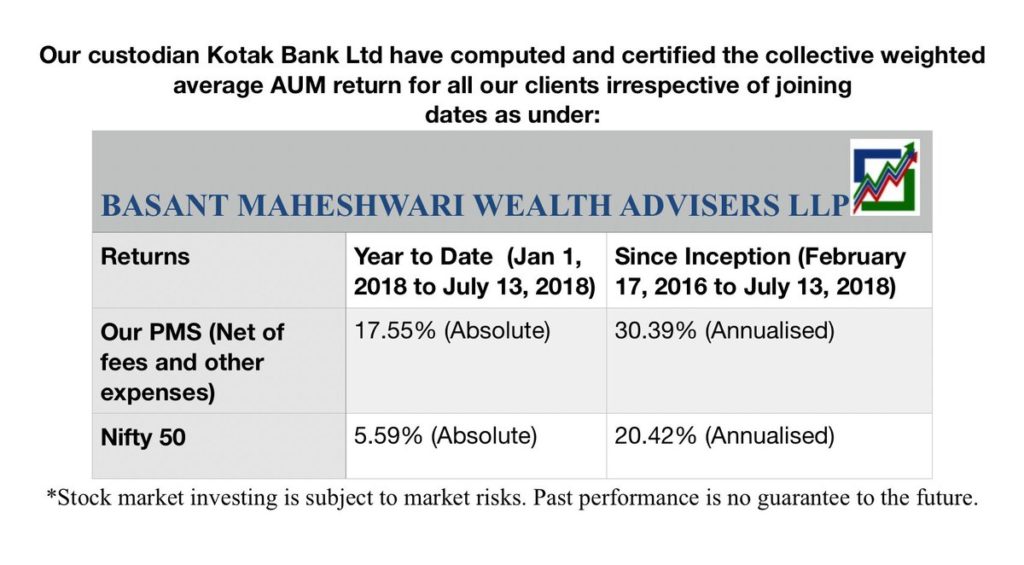

In the period from 1st Jan 2018 to 13th July 2018, Basant’s PMS was able to churn out a return of 17.55%.

In the same period, the Nifty could barely eke out a return of 5.59%.

The BSE 500 Index fared slightly better with a YoY return of 8.54% though it is also heavily overshadowed by Basant’s PMS.

The less said about the BSE Small-cap index the better it is. This worthy has lost 15.78% on a YTD basis. On a YoY basis, it is flat.

The BSE Mid-cap Index lost 13.42% on a YTD basis and is also flat on a YoY basis.

35% gain for the year?

If we extrapolate Basant’s YTD return for the entire year, it means that his clients may take home a return of close to 35%, which is simply outstanding given that all other fund managers are crying in despair at the colossal losses in their respective portfolios.

Performance since inception

In the 30 months since inception in February 2016, the PMS has delivered an annualized return of 30.39%.

This compares very favourably with the return of 20.42% delivered by the Nifty in the same period.

According to my rough-and-ready calculations, the BSE Small-Cap Index has delivered an annualized return of about 23% in the same period.

Sharing the Portfolio Management Service returns of Basant Maheshwari Wealth Advisers LLP to avoid the confusion of the various numbers floating around. Nifty comparison has been done for regulatory compliance. pic.twitter.com/qZJ5MYuDaG

— Basant Maheshwari (@BMTheEquityDesk) July 14, 2018

Which stocks contributed to the outperformance?

Basant has kept a tight lip over the names of the stocks in his portfolio.

For obvious reasons, he declined to reveal the names, citing SEBI restrictions.

Sebi expects us to disclose only on public recommendations. We own leaders from the high growth sectors with 75% of stocks and also the portfolio regularly hitting an ‘all time high’. Don’t want a pandora box of public opinion because we are sure of our style & stocks – both. https://t.co/AHCgNUogx3

— Basant Maheshwari (@BMTheEquityDesk) July 13, 2018

However, there is no bar on our speculating over the names.

D-Mart

Basant has earlier revealed that D-Mart, alias Avenue Supermart, is his “top holding across portfolios”.

Basant Maheshwari, @BMTheEquityDesk , says Avenue Supermart is our top holding across portfolios

— CNBC-TV18 (@CNBCTV18Live) April 30, 2018

Avenue Supermart has been a stunning performer with a YoY return of 72%.

The YTD return is 35%.

Basant has been periodically indicating his bullishness for the stock.

QUALITY helps you in bad times even as KACHRA sucks. The D-Mart stock is much like the D-Mart store. People who are in don't want to come out and the ones who are out can't get in. You can keep protesting but the stock is up 116% over listing price.

Disclaimer: We OWN it.

— Basant Maheshwari (@BMTheEquityDesk) February 23, 2018

The favourite pastime for critics and commentators who missed D-Mart is to – calculate the Company’s market cap. The luxury of calculating profits though lie only with the ones who bought it.

Disclosure: We OWN it. No recommendations. #TheThoughtfulInvestor

— Basant Maheshwari (@BMTheEquityDesk) April 11, 2018

Private Banks

Basant has been sensibly bullish about private banks on the basis that they are snatching market share from junkyard PSU Banks.

He has formulated the theory that assuming a 15% industry credit growth and that the market share of the private banks increases from 50% to 70%, it means that private banks will show a growth rate of 27% CAGR.

Reading between the lines from this @udaykotak interview. A 30:70 ratio between private and public moving to a 50:50 ratio in 5 years assuming a 15% industry credit growth means a 27% CAGR for private financiers. Smaller companies in niche segments can grow faster ! https://t.co/CgZQNlSM6x

— Basant Maheshwari (@BMTheEquityDesk) March 21, 2018

He has also described HDFC Bank and Kotak Bank as “no-brainer investments”.

#OnCNBCTV18| Basant Maheshwari, @BMTheEquityDesk says stocks like @HDFC_Bank & @KotakBankLtd are no-brainer investments@_anujsinghal @SurabhiUpadhyay pic.twitter.com/5UmiA7xZGc

— CNBC-TV18 News (@CNBCTV18News) April 30, 2018

From this, we can safely assume that Basant has either HDFC Bank and/or Kotak Bank in his portfolio and/or their smaller counterparts being RBL Bank, AU Small Finance Bank, Bandhan Bank etc.

It is worth recalling at this stage that Raamdeo Agrawal has recommended at the Sohn India 2018 conference that we buy RBL Bank on the logic that it can blossom into a magnificent 10-bagger if all goes as per plan.

Buy High RoE stocks with predictable growth prospects

Prima facie, Basant’s investment strategy is quite simple to understand.

He has advised that we buy companies with high RoE and with a long predictable growth runway ahead of them.

These stocks are usually easy to spot because they are already leaders in the stock market and are quoting at “All time highs”.

“We own leaders from the high growth sectors with 75% of stocks and also the portfolio regularly hitting an ‘all time high’,” Basant said in the tweet quoted above.

“My objective is to search for high growth companies with predictability, surety and certainty,” he added.

There are several high RoE companies. A high RoE is generally an outcome of brands – pricing power – profit margins and if you can outsource your process the RoE jumps up even more. Read about Du-Pont analysis and it’s decomposition in ‘The Thoughtful Investor’’.

— Basant Maheshwari (@BMTheEquityDesk) July 8, 2018

With high margin and low capex the profit margin and asset turnover goes up. But companies are like kangaroos they like to sit on cash. However, as the foreign parents have no avenue to take money off they force distribution of dividends which removes the cash off balance sheet.

— Basant Maheshwari (@BMTheEquityDesk) July 8, 2018

As the companies become cash light the RoE stays at elevated levels. Generally, RoE gets depressed with companies having cash on balance sheet because cash earns only FD rates (pre-tax). If cash is paid off as dividends it also implies that capex requirement or growth is low.

— Basant Maheshwari (@BMTheEquityDesk) July 8, 2018

Markets like RoE with growth. High RoE is like intelligence .& growth the big vision. If you have intelligence but no vision you’ll just be self sufficient. If you have vision but no intelligence you’ll finish off soon. Most are like that and do well only till the going is good.

— Basant Maheshwari (@BMTheEquityDesk) July 8, 2018

But if you have big vision (Growth) with intelligence (RoE) you become a Page or an Eicher! These are rare companies that change lives and set the future. They need special glasses ? to analyse.Not everyone understands them because everybody cannot be rich at the same time. ??

— Basant Maheshwari (@BMTheEquityDesk) July 8, 2018

But high RoE with low growth will lead to stagnation

Basant also made it clear that mere high RoE is not enough if it is not accompanied with high growth.

He cited the example of HUL, which has an exceptional RoE of 77x but a poor growth rate of 4%, as a stock which is not investment worthy.

As there is no “predictability, surety and certainty” of HUL’s (high) growth, it is unlikely to stay in the fancy of the market for long, Basant opined.

No recommendation. I wouldn’t invest because my objective is to search for high growth companies with predictability, surety and certainty and the moment you have these three attributes in a stock markets start to discount ahead. More the predictability longer the discounting. https://t.co/M4HsgXQaqJ

— Basant Maheshwari (@BMTheEquityDesk) July 8, 2018

Of course, it is a fact that HUL has been a stellar performer in the recent past with a 24-month gain of 88% and a 12-month gain of 54%.

India is a land of contradictions.The ever boring HUL’s of the world multiplied you wealth nearly 6 times in the last 8 years. Where as, the much popular real estate-infra ones’ destroyed wealth to tune of 80%. And still HUL is called ‘a defensive’ and others ‘aggressive’. pic.twitter.com/3z2Uz0M61V

— Suraj Nair (@SurajNairMoat) July 12, 2018

Avoid ‘kachra’ & ‘chakri’ stocks like the plague

Basant also reiterated his earlier stern warning that we should stay afar from alleged ‘kachra’ and ‘chakri’ stocks.

We don’t participate in kachra, chakri & crap not because we don’t like making money but because we don’t want to lose it ‘all’ back. Our style is different. Like fire, markets demand respect. We need fire?to cook food but if used carelessly it also burns the whole house down ! pic.twitter.com/fSSPLSgSyT

— Basant Maheshwari (@BMTheEquityDesk) July 1, 2018

Don’t obsess over the price while buying quality companies

Basant advised that we should not pass over high quality stocks on the basis that the asking price is too high.

“Mehenga roye ek bar Sasta (kachra) roye bar bar” he said, implying that it is better to buy a high-quality stock at nose-bleed valuations rather than a junkyard stock at dirt-cheap valuations.

I know what you’re saying.But without recommendations be mindful that ‘Mehenga roye ek bar Sasta (kachra) roye bar bar’.But it’s not easy & takes a lot of effort for individual investors to read/understand the ‘fine print’ on what a kachra portfolio has/ has not done. Be careful. https://t.co/RgM5nesoCQ

— Basant Maheshwari (@BMTheEquityDesk) July 5, 2018

In fact, the 7500% gain delivered by Page Industries despite its “expensive” tag proves Basant’s point.

In contrast, the junkyard PSU Banks, which were always “cheap”, are notorious for the colossal wealth destruction caused to investors.

Which are the high RoE stocks with high predictable growth rates?

According to my rudimentary research, there are a few stocks which fulfil the requirement of high RoE and high growth.

(i) Rane (Madras)

Rane (Madras) has the following salient features according to screener.in.

• Market Cap: Rs. 785.77 Cr.

• Current Price: Rs. 676.95

• 52 weeks High / Low 1050.00 / 457.00

• Book Value: 229.53

• Stock P/E: 18.79

• Dividend Yield: 1.77 %

• ROCE: 18.72 %

• ROE: 19.03 %

• Sales Growth (3Yrs): 16.68 %

Pros:

Company has been maintaining a healthy dividend payout of 32.61%

Cons:

Stock is trading at 2.95 times its book value

Prima facie, the high RoE/ RoCE coupled with 3 year sales CAGR of 16% and the reasonable P/E of 18.79x makes it a candidate eligible for consideration.

(ii) Caplin Point Laboratories Ltd

Caplin Point Laboratories Ltd also appears to be having all the necessary attributes according to the data in screener.in.

• Market Cap: 3,016 Cr.

• Current Price: 399.05

• 52 weeks High / Low 784.80/ 336.05

• Book Value: 48.30

• Stock P/E: 20.85

• Dividend Yield: 0.38 %

• ROCE: 69.54 %

• ROE: 55.93 %

• Sales Growth (3Yrs): 32.39 %

Pros:

Company has reduced debt.

Company is virtually debt free.

Company is expected to give good quarter

Company has good consistent profit growth of 64.49% over 5 years

Company has a good return on equity (ROE) track record: 3 Years ROE 51.81%

Cons:

Stock is trading at 8.26 times its book value

(iii) Lumax Industries Ltd

Lumax Industries Ltd also appears to be a powerhouse stock.

• Market Cap: 1,886 Cr.

• Current Price: 2,017

• 52 weeks High / Low 2580.00 / 1175.25

• Book Value: 313.23

• Stock P/E: 29.73

• Dividend Yield: 1.14 %

• ROCE: 24.66 %

• ROE: 23.40 %

• Sales Growth (3Yrs): 13.98 %

Pros:

• Company has good consistent profit growth of 35.92% over 5 years

• Company has been maintaining a healthy dividend payout of 31.54%

Cons:

• The company has delivered a poor growth of 9.59% over past five years.

(iv) Aurobindo Pharma Ltd

Aurobindo Pharma may come back into fancy if the tide turns in favour of the Pharma sector:

• Market Cap: 35,280 Cr.

• Current Price: 602.15

• 52 weeks High / Low 809.45/ 527.00

• Book Value: 201.32

• Stock P/E: 14.56

• Dividend Yield: 0.42 %

• ROCE: 27.60 %

• ROE: 27.69 %

• Sales Growth (3Yrs): 22.55 %

Pros:

Company has reduced debt.

Company has good consistent profit growth of 65.36% over 5 years

Company has a good return on equity (ROE) track record: 3 Years ROE 31.21%

Cons:

Promoter’s stake has decreased

Company might be capitalizing the interest cost

(v) P I Industries Ltd

• Market Cap: 10,892 Cr.

• Current Price: 789.85

• 52 weeks High / Low 1034.00 / 675.00

• Book Value: 143.24

• Stock P/E: 29.72

• Dividend Yield: 0.51 %

• ROCE: 34.40 %

• ROE: 33.08 %

• Sales Growth (3Yrs): 12.59 %

Pros:

Company has reduced debt.

Company is virtually debt free.

Company has good consistent profit growth of 41.85% over 5 years

Company has a good return on equity (ROE) track record: 3 Years ROE 31.94%

Cons:

Promoter’s stake has decreased

Conclusion

Inspired by Basant Maheshwari’s stellar performance, we will have to take a vow to never invest in ‘kachra’ and ‘chakri’ stocks again. At the same time, we will have launch a manhunt for stocks with high RoE and high predictable growth prospects and tuck into them ASAP!

I am in complete agreement with Basant , forget Kachra patti stocks, just buy Top grade stocks and sit tight , Indian large cap are like mid cap of developed world , just enjoy Indian growth through leaders .