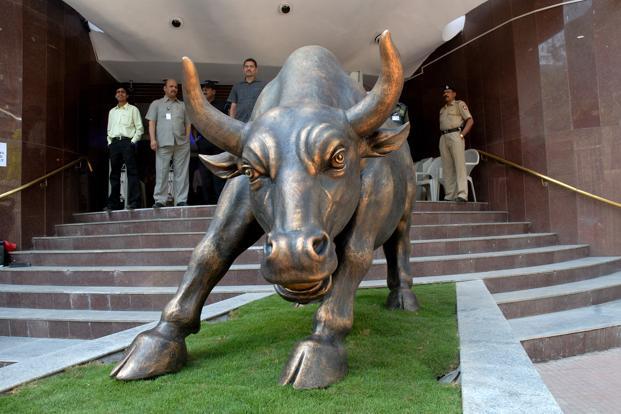

‘Corona Virus’ spooks Dalal Street

Today, a junior level Babu of the Ministry of Health walked into Dalal Street unannounced.

“Ab India mein bhi Corona Virus ho gaya hai. Sab log careful raho,” the pot-bellied Babu announced absent mindedly, while chewing his Paan.

The news spooked everyone.

We rushed to the sanctum sanctorum to dump our stocks.

However, it was too late.

The markets had already nosedived, leaving everyone stranded and with heavy losses.

Update on #COVID19:

Two positive cases of #nCoV19 detected. More details in the Press Release.#coronoavirusoutbreak #CoronaVirusUpdate pic.twitter.com/kf83odGo8f

— Ministry of Health (@MoHFW_INDIA) March 2, 2020

Some Babus advised that we should do “Yoga” and spray “Cow Dung” and “Cow Urine” all over to stay immune from the evil effects of the deadly virus.

We all know cow dung is very helpful. Likewise, when cow urine is sprayed, it purifies an area. I believe something similar could be done with cow urine, cow dung to cure #coronavirus: Assam BJP MLA Suman Haripriya

— Press Trust of India (@PTI_News) March 2, 2020

If you adopt Yoga in your life, you will not get CoronaVirus: CM Yogi said today

— Aman Sharma (@AmanKayamHai_ET) March 1, 2020

World markets collapse as Corona hits.

Global demand will fall.

India already suffering a weak economy will find it v difficult to recover.

Jobs growth all set to suffer. Immediate attention needed.But hey, Hindu Muslim Hindu Muslim.

— Chetan Bhagat (@chetan_bhagat) February 28, 2020

The technicals were always bearish though the Nifty was propped up artificially

Gautam Shah claimed that the technical indicators have been flashing a red alert over the past six months that a major crash in imminent.

However, everyone ignored the warning because the Nifty was in great shape and surging from one high to the next.

“The foundation of what is happening right now was laid six months back. Many of the technical charts that we follow have been negative for a while now. The technical indicators have not been in sync with the price action but because the Nifty had such a great run on account of a handful of stocks, we never questioned the technical indicators till Nifty hit 12,300-12,400 levels,” he disclosed.

He also warned that the heavy volumes with which the stocks are crashing suggests that this is not a “plain vanilla” correction but is the harbinger of a mega crash.

For the last two years, many money managers were huddled together around certain large stocks thereby protecting the funds/schemes. In turn it protected the Nifty. Now “if” one man breaks the huddle, imagine the outcome.

— Gautam Shah, CMT, CFTe, MSTA (Distinction) (@gshah26) February 28, 2020

HDFC Bank was the ‘Pied Piper’ but now Bank Nifty may plunge 2000 points

We already know that the Bank Nifty, which comprises of the choicest of private and PSU bank stocks, has been a massive outperformer and wealth creator.

In fact, since 2000, the Bank Nifty has delivered a gain of 2581% and heavily outperformed the Nifty.

Since inception from 2000, the #BankNifty has returned nearly 4.07 times more than #Nifty.

While #BankNIFTY has gained 2581.47%, #NIFTY has gained 638.68% over its lifetime from the time it was introduced.#investing #trading pic.twitter.com/1kZxhrdhln

— Milan Vaishnav, CMT, MSTA (@Milan_Vaishnav) November 5, 2019

However, Banking stocks are likely to run into heavy turbulence now and may have to reverse course.

“A possible 2,000 point fall on the Bank Nifty is likely and some of the top names in the space, apart from ICICI Bank which has broken out of a 10-year consolidation, look weak,” Gautam Shah said, in a tone which sent a chill down the spine.

Stocks to stay away from

Gautam Shah provided clear-cut advice on the stocks that we should avoid.

It is obvious that PSU Bank stocks (other than SBI) as well as heavy-weight capital goods stocks (such as L&T) should be avoided like the plague.

These junkyards did not create wealth even during the best of the Bull markets and are now likely to squander away even the little that is left.

“Many of the top capital good stocks are setting up for a much bigger breakdown that could lead to 10 per cent to 15 per cent downside for the index and for most of the stocks,” he opined.

“PSU banking is in terrible shape; most stocks are making 52-week lows and there are no signs of bottoming out,” he added.

At Goldilocks Research we come out with a unique report called the “Sun Downers” every month where we highlight the underperformers and stocks to avoid. Good time to share a sample copy of the same. Sometimes this simple advice is enough to keep one on the right side of things. pic.twitter.com/7sXj6r9gB5

— Gautam Shah, CMT, CFTe, MSTA (Distinction) (@gshah26) February 25, 2020

It is obvious that airline stocks like Indigo and cinema stocks like PVR are also a strict no-no for us.

Coronavirus impact: Watch aviation, miltiplex, Tata global (starbucks)

— Darshan Mehta (@darshanvmehta1) March 2, 2020

Safe Haven stocks

Pharma stocks are obviously safe haven stocks.

We have already seen how Abbott India, Ajanta Pharma, Divis Labs, Dr Reddy, JB Chem etc are notching up massive gains.

“I believe that the pharma bull market is only starting off. Some of the top stocks in the pharma space have the potential to gain 25% to 30% over the next 6 to 12 months,” Gautam Shah advised.

Friends, as I study more sectors I realise that the pharma index which has been in a bear mkt for 3 years could have bottomed out. The index lost 50% (insane) in this period. Foundation laid for a large recovery over the next many weeks/months.

— Gautam Shah, CMT, CFTe, MSTA (Distinction) (@gshah26) November 7, 2019

Specialty chemical stocks are also likely to excel because of the production curbs in China.

Vinati Organics, Deepak Nitrite, Sudarshan Chemicals etc have notched up impressive gains in the recent past.

Vinati Organics +7%@vinatisaraf to CNBC TV18

None of the important raw materials are imported from China

One of the largest competitors for ATBS is in China

Seeing more enquiries for ATBS due to coronavirus

15-20% revenue growth expected for the Company— Sonal Bhutra (@sonalbhutra) March 2, 2020

400 to 520 now https://t.co/jFbrPIB3zk

— Darshan Mehta (@darshanvmehta1) March 2, 2020

Gautam Shah also opined that the outperformers of 2019 might take a backseat and the underperformers may give supernormal returns.

“Therefore this is a good time to shuffle portfolios because money is chasing into some of the high beta stocks and in the broader markets, the opportunities are immense,” he stated.

“There are so many stocks that could easily move up 50-100% over the next 6 to 12 months,” he added.

Info-Tech stocks like Infosys and TCS, together with insurance stocks like HDFC Life, ICICI Pru etc, are also fail-safe stocks to whom we can entrust our hard-earned money in these times of distress!