Vijay Kedia’s birthday celebrated with gusto by fans

Since the early hours of the morning, Vijay Kedia’s fans have been making a beeline to offer him birthday wishes. Some brought him virtual cakes and candles. Others thanked him for being an inspiration and a guiding force to them.

Almost all are appreciative of his humility and generosity.

No doubt, this is a sentiment to be cherished. Not all stock wizards are able to command the respect and affection that Vijay Kedia does.

Wish u a very happy birthday.. @VijayKedia1 Sir, saw u first on market makers with @nikunjdalmia. Ur thoughts have been guiding since then! pic.twitter.com/CoyVj9UdHu

— Finitelearner (@Finite0) November 4, 2017

@VijayKedia1 Happy Birthday Sir…Enjoy in tons and keep sharing your golden nuggets with your followers.. pic.twitter.com/z49V9xYqyW

— Sanjay Gupta (@Sanjubfsi) November 4, 2017

@VijayKedia1 Many happy returns of the day sir. You’re my idol. ? hope you have a multibagger year ahead ?⌚️

— bhargav kartik (@bhargav_kartik) November 4, 2017

Happy Bday sir…

Here's wishing u the best in this yr

Continue lighting up d screen with ur multibaggerss!!!— Nigel D'Souza (@Nigel__DSouza) November 4, 2017

@VijayKedia1 Happy birthday to our inspirational hero. Keep smiling sir.

— Bharath Reddy (@BharathReddy38) November 4, 2017

@VijayKedia1 many many happy returns of the day… Happy birthday sir… May your wealth and health multiply manifold in this year…

— MANAN AMIN (@MANANAMIN123) November 4, 2017

@VijayKedia1

Many many returns of the day sir.

You are my role model.

Wish you a great yr ahead.— Parth patel (@PDPatelkani1995) November 4, 2017

@VijayKedia1 I feel like writing the whole letter for thanking you to encourage the new investors like us but for now Happy Birthday Guruji.

— Vasu Lalan (@vasulalan) November 4, 2017

To the most diligent, prudent and yet very Candid Investor of our country @VijayKedia1 , we wish you a very Happy Birthday!?

— Jignesh R Mehta (@jigneshrmehta) November 4, 2017

@VijayKedia1 Warm wishes on your Birthday. Successful, yet you come across as an extremely humble person. I greatly admire you! Good day

— Mayank Jain (@MaayankJain) November 4, 2017

@VijayKedia1 HBD Sir your Great thinking skills helpful to all because you don't only keep it to yourself but spread it unconditionally

— Vishal Karia (@vishal3576) November 4, 2017

@VijayKedia1 Sir ji Happy Birthday nd party Hard??nenu market lo invest cheydaniki meru one of the reason..guruji?

— Stairway2Heaven?? (@gtsrikanth) November 4, 2017

Vijay Kedia gracefully acknowledged all the greetings.

Thank you all for your good wishes and kind words.

God bless you. ?— Vijay Kedia (@VijayKedia1) November 4, 2017

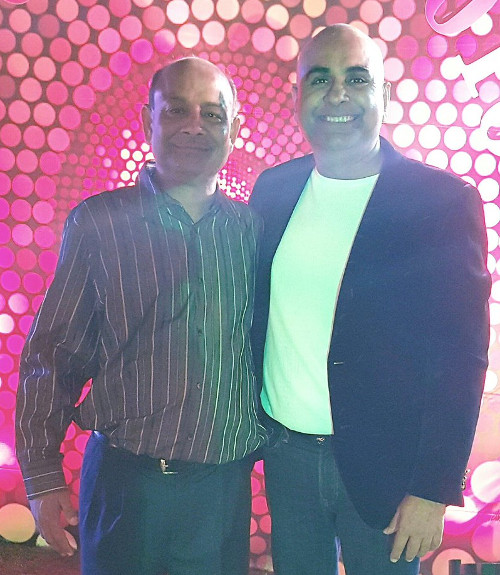

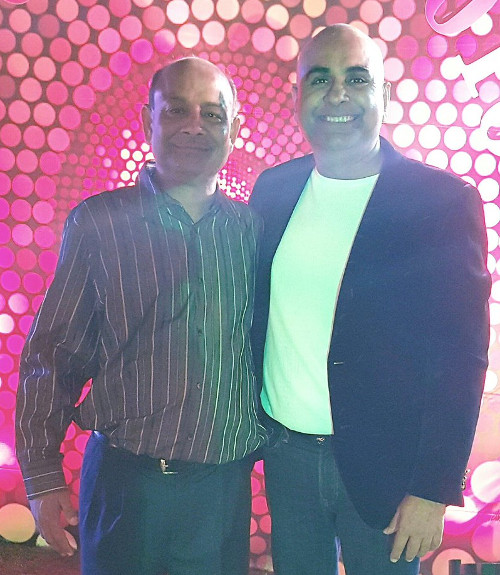

(Vijay Kedia with 9x Billionaire Radhakishan Damani)

Clarion call by Vijay Kedia: Small private banks should be bought aggressively because the worst is over for them

Amidst all the festivity, an important message sent by Vijay Kedia escaped the attention of his fans, namely that the time is ripe to aggressively buy small private banks because the worst is over for them.

In my biased opinion, the worst in small private bank is over.

— Vijay Kedia (@VijayKedia1) November 3, 2017

Vijay Kedia’s view shared by Nischal Maheshwari of Edelweiss Securities & Tushar Pradhan of HSBC Global AM

Vijay Kedia did not articulate the reasons for his view and so it is not known what change has happened which has made private banks so alluring.

However, Nischal Maheshwari of Edelweiss Securities provided a masterful explanation as to why NBFCs and private banks are an irresistible buy now.

“NBFC space and financial inclusion is going to be the big theme which has been running for years and it will continue for at least next three to five years,” he said with supreme confidence.

Forget PSU Banks

Nischal Maheshwari was somewhat contemptuous of PSU Bank stocks. He called their rally a “one-time pop up” and said that he still has a “cautious outlook” about them.

“There is going to be a couple of quarters of pain going ahead because they have to now start taking the write offs,” he added in a grim tone.

“We still favour the private sector banks and the NBFCs over PSU banks,” he said firmly.

Best NBFC stocks to buy: DHFL & CAPF

Nischal Maheshwari came out with all guns blazing in favour of Dewan Housing Finance and Capital First.

He pointed out that both stocks have a 30-35% kind of growth, improvement in ROEs and insatiable demand.

He emphasized that both stocks are “very reasonably priced” in relation to the other bank and NBFC stocks.

“Dewan Housing is around two times price to book with around 16% kind of ROE and Capital First is around 2.3 times with around 14% ROE going towards 16 by FY19. Both of them are reasonably priced, one can look at acquiring these two stocks,” he advised.

Great PSU Bank recapitalization will not wrest market share from NBFCs and private banks

Tushar Pradhan of HSBC Global AM offered soothing advice on an issue that has been troubling all investors, namely, that the PSU Banks will storm into the marketplace and grab market share from the NBFCs and Private Banks.

“The growth in the NBFC sector has not come at the cost of the banking sector. The market has expanded,” he said, implying that the market is large enough for all players.

“Just because the public sector banks have returned to some sort of health does not mean that someone who is being borrowing from the NBFCs now will go to a public sector bank,” he added.

Tushar Pradhan also made the important point that there is a culture difference in the way that PSU Banks and private banks operate.

A SME seeking a small ticket loan will find it inconvenient to go to a PSU Bank and wade through their bureaucratic procedures to be able to avail a loan.

A private bank or NBFC will be able to meet the needs of the SME swiftly as compared to a PSU Bank, he explained.

“There is considerable reason to believe that the expansion of credit in the economy will continue, more and more people will now be accessing the credit markets for various reasons,” he said, implying that the market size will be ever increasing and that the dominant players will prosper.

Vijay Kedia’s high-conviction private bank stock pick: Karnataka Bank

Karnataka Bank is Vijay Kedia’s high-conviction stock. As of 30th September 2017, he holds a treasure trove of 56,60,703 shares.

The investment is worth Rs. 95 crore at the CMP of Rs. 168.

The stock has done well with a 45% YoY return and a 61% return over 24 months.

He has recommended Karnataka Bank to us as part of his Diwali Dhamaka recommendations where he shared the stage with Porinju Veliyath (Porinju also recommended three stocks).

“Going forward, Karnataka Bank should show improvement in performance. I also expect improved asset quality and earnings for this bank in the coming years,” Vijay Kedia said, implying that we can buy the stock without any hesitation.

He has also written an elaborate article in Outlook Business in which he has described Karnataka Bank as his “best pick for 2017”.

Karnataka Bank has unveiled a vision 2020 plan under which it intends to double its loan book to Rs 80,000 crore by March 2020 from Rs 38,484 crore as of June end, 2017.

It goes without saying that if these ambitions are achieved, Vijay Kedia’s promise that Karnataka Bank will be a multibagger will be effortlessly fulfilled.

Karnataka Bank has shown ‘solid performance’ and has target price of Rs. 200: Centrum

The wizards at Centrum have conducted an in-depth study of Karnataka Bank and recommended a buy on the basis that it has shown “solid performance”.

The logic is as follows:

“Solid performance; reiterate BUY

We retain Buy on Karnataka Bank (KBL) with TP unchanged at Rs200 (valued at 1.3x FY19E ABV). Q2’18 results were strong on all fronts – loan growth accelerates, margins improve, fee income strengths further and asset quality – ie slippages moderate. Commentaries on each of the above key parameters remain encouraging and thus even as we factor in elevated provisioning; we believe RoE’s are set to inch towards 12% levels by end-FY19E. Capital position remains strong; valuations at 1x FY19E ABV remain undemanding.

– Q2FY18 result – Solid performance: Q2’18 NII at Rs4.4bn grew 10.8% YoY and was led by 12.3% YoY growth in loans and further expansion in NIM (calc) to 2.75% (+9bps QoQ 3bps YoY). Non-interest income too came in higher (fees grew 36% YoY; treasury were up 21% YoY) and with stable costs saw operating profit grow 57% YoY. Slippages stood at Rs3.74bn (3.6% of loans annualised) vs. Rs4.98bn QoQ and after providing for the same including tax related provisioning, net profit came in at Rs934mn (down 25% YoY). While sequential decline in slippages is positive, provision coverage ratio at 27.3% (flat QoQ) is still on the lower side to peers and needs some attention. Deposits grew by 6.5% YoY led by 15.6% YoY growth in CASA deposits; CASA ratio has inched to 28.6% (vs. 26.3% YoY).

– Margins on upmove; slippages set to moderate: NIM at 2.75% (calc) for the quarter is on an upward trajectory and is following continued efforts at a) containing overall cost of deposits (6.23% in Q2’18 vs. 6.3% in Q1’18) b) scaling overall loan-to-deposit ratio higher (Q2’18 LDR at 72.7% vs. 68.4% QoQ / 69% YoY) and c) garnering CASA deposits including recent reduction in SA rates (effective August, 2017). Levers are in place and will see overall NIM (calc) inch towards 2.9% by FY19E. Q2’18 slippages at Rs3.74bn included one large account of Rs2.3bn (housing-infra sector) that was downgraded to NPA. This account was earlier recognised as SDR and the bank carries adequate provisioning thereon. Standard restructured loans stood at Rs6.9bn and coupled with GNPA, SDR and S4A make for 6.5% of loans (vs. 8.6% in FY17). Commentaries on incremental slippages remain encouraging and we have factored the same into our estimates.

– Provisioning to impact near-term profitability; underlying trend intact: The trends on the operating front remain encouraging – loan growth momentum accelerating, NIM, loan-to-deposit ratio on an up-move, increasing contribution from core-fee income, improving CASA and stable operating costs. We thus have revised our NII / PPOP estimates upwards and are now factoring in 15.5% / 23.9% CAGR respectively over FY17- 19E. Slippages are set to moderate / decline in H2’18; provisioning however is set to remain higher given a) NPA ageing b) provisioning towards IBC cases and c) any markdown (if required) on the security receipt (SR) portfolio. The quarter saw SR related provisioning of Rs250mn; the bank has Rs4.5bn of O/s. SR. Given the above factors including the need to increase overall PCR we are factoring in 130bps of credit cost over FY17-19E. We expect the bank to report 24% CAGR in PAT over the similar time-frame

– Valuation, view and key risks: KBL Q2’18 results were in-line with our estimates on several fronts. We, however have tweaked our estimates on provisioning front. Though at a nascent stage of transformation, the bank has made strong in-roads in its journey of RoE improvement. The transformational exercise as envisaged will further augment overall RoE’s. Valuations at 1x FY19E ABV remain attractive. Retain Buy with TP at Rs200 (valued at 1.3x FY19E ABV). Higher than expected slippages and lower than expected credit growth remain near-term risks.”

Will Karnataka Bank be the next Heritage Foods

In the past, we have prospered immensely by listening to Vijay Kedia and acting obediently as per his instructions.

Heritage Foods is one example that comes readily to mind.

He recommended the stock in November 2015 as a “Diwali Gift” on the premise that the producer of dairy products like branded milk, cheese, butter etc would prosper immensely in the foreseeable future.

This has come true.

Novices who bought Heritage Foods on Vijay Kedia’s recommendation have a hefty gain of 220% in their portfolios and more appear to be on the way.

It should not come as a surprise to anyone if Karnataka Bank also delivers similar hefty gains!

Please throw some light on amtek auto in next arrival it’s a worth story , your artical help all of us , I bought Emami infra and Sarla performance accordingly , thanks.

In my view Federal bank, DCB bank and RBL banks looks good in small pvt banking space and are consistent perforners . Aditya Birla Capital , L&t fin and DHFL are good bets in NBFC and housing finance space.

One can also look at insurance stocks also in portfolio in financial space, hdfc life, icici life and icici Lombard looks good long term stories.

In the private banking space, Karnataka Bank, RBL, Federak Bank and DCB Bank (though all of them have already surged fast in the last couple of days) and in NBFC space, ABCL, L&T Finance (though now at high price) and of course, insurance stocks like, HDFC Life, ICICI Life and ICICI Lombard look good for long term investment.

How about two small Pvt. banks from south, South Indian Bank and Catholic Syrian bank ?

is catholic bank listed.

Karnataka bank is looking to improve.Its billboards now has vibrant colour.Definately looks like a good bet.

The list provided by Kharb is perfect. Perhaps, Capital First, Reliance Capital and Yes Bank can be added to this list.

Yes Doctor.

Even Kharb has been a big proponent of Reliance Capital.

But it is not included in his comments in the sections above. How one can understand whether Kharb is invested in R Capital or not.

Let’s make posts/comments based on real facts.

Let Kharb make a comment on this.

To all those who recommend Aditya Birla Capital, remember Premji invested valuing the company @ 32K cr on June 2017. Current valuation stands @ 40K to 42K cr. With not even single result out after demerger, 30% rise to June valuation should not be taken lightly. To whomever concerned. Not safe stock during corrections.

Pick up those that are not valued correctly instead of already over valued

Yes you are right if Aditya Birla Capital goes down, it can be added, but if don’t goes down one may have to pay more than Prem Ji.

Karnataka Bank stock had a good run inspite of the poor results in last several quarters. Funny comparison was done between KB and RBL to justify the KB stock price and valuation. It had not shown any growth and does not deserve the current price or valuation. I understand Kedia is a celebrity investor and hence stock price shot up inspite of shaky fundamentals. Mohnish Pobrai burnt his hands in J&K Bank. Pure private banking space and semi govt banking space are different and I would not buy KB. Federal Bank, RBL and DCB are much better bets. Even among these 3, RBL stands out with scorching growth story.

Mr. Krish, Kedia has invested millions in this stoke, not peanuts like you and me,don’t underestimate his wisdom,don’t be silly in assessing a successful person

Didn’t realise in this age and time WISDOM IS DIRECTLY PROPORTIONAL TO ONE’S WEALTH.

Wisdom is always directly proportional to ones wealth and power. There never have been an exception to this rule.

Mr. Krish, Kedia has invested millions in this stoke, not peanuts like you and me,don’t underestimate his wisdom,don’t be silly in assessing a successful person

Even Sanjay Bakshi had failures in KITEX and Poddar. He is still a great investor. Not every stock they invest would become multi baggers. Should not blindly follow any celebrity investors. They have failures too. No one is taking away impressive credentials of Kedia. But that does not make his investment in KB run away success.

Kedia entered when it was 70 around , yesterday it closed at 156,still the valuation is attractive.the comparison was superb. !00 % perfect

Do your own analysis. Its topline and bottomline was almost flat in last 2 years and still the stock price doubled, due to only hype of VK investing.

Too much of analysis lead to paralysis. I only inquire about the efficiency and honesty of the promoters.

One need not do detailed quantitative analysis. But Business growth, Profit rise, EPS and assessing competitors are important besides promoters integrity. I didn’t see growth in Business and Profits of KB numbers in last 2 years. I am unable to see what is so great about KB promoters.

All kedia stocks have become gold mine.If u want to make bucks, just invest or keep off without finding fault with his choice

It is gold mine for VK but not for followers. No one ever got to know when he invested in KB @ 70. General public get to know only after so much run up and they get into suckered game. There is no juice and steam left but still small buyers gets excited. I am happy to keep off.

just before kedia entered I. e before 2 years KTK was in operator hand and was giving 10% gains sometimes in single day and also price was widely swinging from hi to low over period of time 150 -70 like an inverted cup. But now after entry of kedia no such swings and KTK very nicely moving up Eve. though pace is slow. after crossing 195 we can see one sided big up move like cerasanitary, Aparind and atul auto, Repcohome.

With disappointing Q2, I would be surprised if it goes beyond 200. KTK should be back to 140 with X-Mas correction that typically happens in Dec. Cera, Atul & Repco stories were different. They posted good numbers for several quarters after Kedia got into them. I am anticipating that Kedia would reduce his stake in KTK in coming quarters and we may not be able to track him if his stake reduces below 1%. It would be interesting to watch. Ofcourse story might be reversed if KTK comes out with excellent Q3 results which I doubt.