Savage crash in the stock market is not attributable to demonetization

Most novice investors have assumed that NAMO’s surgical strike on black money has crippled the Indian economy and that the crash in the stock market is the result of this.

However, this is not correct.

Samir Arora, the whiz-kid fund manager with Helios Capital, made the important revelation that the global markets have also tanked in a commensurate manner and that there is no co-relation between demonetization and the correction in the markets.

Do u think that Ind mkt down bec of demonetization?

Last one mnth:

Ind: -6.38%

Em Mkts: -6.47%

Asia Ex J: -5.45%

Brazil: -11.3%

China:-6.1%— Samir Arora (@Iamsamirarora) November 15, 2016

This opinion was corroborated by Manish Chokhani of Enam. He also produced important data to establish that all the global markets are in a corrective mode, with some having corrected a whopping 14% since Donald Trump’s election as President of the USA.

We are not alone on the way down. However I expect we will lead the way up ?? pic.twitter.com/zOXU3VwkHf

— ManishChokhani (@chokhani_manish) November 21, 2016

In fact, it is notable from the data produced by the two stalwarts that the Indian stock markets have actually outperformed their peers in the other emerging markets.

Demonetisation is a blessing or a curse for the economy?

The other aspect troubling novice investors is whether demonetization is a blessing or a curse for the Indian economy in the long run. It is difficult to come to any definitive conclusion given the conflict of opinion.

Bharat Dabholkar, the well-known ad guru, has formulated a simple formula to decide the issue.

He points out that while the supporters of demonetization are eminent personalities like Narayana Murthy, Deepak Parekh, Bill Gates etc, it’s opponents are junkyard politicians of dubious credibility like Arvind Kejriwal, Mayawati, Mamta Bannerji etc.

This itself implies that demonetization is good for the Country and the economy and should be welcomed with open arms, Dabholkar says with a chuckle.

Brilliant analysis Mr @bharatdabholkar pic.twitter.com/k5Yb4QGHCy

— The Bad Doctor (@DOCTORATLARGE) November 17, 2016

Today, I am taking pledge that either I’ll die or live but will remove PM Modi from Indian politics: Mamata Banerjee pic.twitter.com/UIvZz5FOOG

— ANI (@ANI_news) November 28, 2016

@ANI_news U #MamtaBannerjee better die. Evil woman stop your hateful disastrous propaganda. Nation won't forgive you.

— Asha Bisht (@AashaBisht) November 28, 2016

Ace investors have called demonetization a “game changer”

We can also come to the same conclusion as Bharat Dabholkar as to the merits of demonetization because all the eminent stock wizards have unanimously declared it to be a “game changer” for the economy. The experts have confidently advised that the time is ripe for us to aggressively buy stocks and assured that we will pocket huge gains in the foreseeable future.

“Huge positive” and “Best case scenario”: Kenneth Andrade

Kenneth Andrade, the founder of Old Bridge Capital, is renowned for his clarity of thinking and visionary approach.

I have earlier carefully examined his investment strategy and also discussed his favourite sectors and stocks.

In his latest interview, Kenneth Andrade was a symbol of ice-cool confidence as he systematically explained the salient terms of demonetization and how it would impact the Indian economy.

Temporary phenomenon

“It’s a temporary phenomenon and doesn’t change the long term pattern of how the economy will evolve” Kenneth assured in a soothing tone. He explained that the impact of demonetization over the GDP would be felt over a period of 12 or 18 months. “Things would stabilize after that” he added.

Deflationary environment would result in plunge in interest rates

Kenneth also explained that demonetization would lead to a deflationary environment and this would prompt the RBI and the Government to lower the interest rates with a view to stimulate the economy.

It is well known that lower interest rates always result in a revival of the economy and this leads to a commensurate surge in stock prices.

Why demonetization is the “best case scenario”

Kenneth Andrade gave a glimpse of his brilliant tactical thinking ability as he set forth the benefits that would ensue as a result of demonetization:

(i) As the economy shifts from a cash economy to a credit economy, companies with robust balance sheets and no leverage will continue to get higher market share in the segment that they operate in;

(ii) Such companies are able to provide credit to their customers as they are organized, aligned with the credit system and are de-leveraged;

(iii) Business which have high market share and a zero debt balance sheet can grow their market share disproportionately because the weaker section of the industry is going to collapse;

(iv) Such businesses will consolidate significantly faster than earlier.

This is not just because of demonetisation, but also because of GST, Kenneth added.

Kenneth also laboured the point that the government’s balance sheet would improve significantly as the falling interest rates would mean lower expenditure. At the same time, there would be a capital receipt from the RBI in the form of a write off of the demonetized cash which becomes worthless.

“This is my best case scenario for buying a company …. It is a huge positive” Kenneth added with a big smile on his lips.

Buy financials but avoid PSU Banks like the plague

It is implicit in Kenneth Andrade’s advice that lower interest rates would benefit bank and NBFC stocks.

However, he cautioned that investors should not be tempted to invest in PSU bank stocks owing to their rock-bottom valuations.

“They are not efficient allocators of capital …. there is nothing structural with these companies …. over periods of time they continue to suffer from a loss of market share” he said in a chilling voice.

“Over a long period, PSU Banks have just destroyed capital. So I would rather look at a well-run financial services company than play a valuation bet in some of these names”, he added.

Avoid consumption stocks

Kenneth warned that the impact of demonetization of freezing liquidity would adversely affect consumers and the consumption economy and that we should stay away from these stocks.

This chilling forecast was corroborated by Harsh Mariwala, the visionary founder of Marico. He stated that the sales in November are affected by a whopping 20-25%.

Currency purge impacts Marico’s November sales by 20-25% @sharleendsouza

Read| https://t.co/Z6DUF3luLl pic.twitter.com/ReIERJpWZD

— BloombergQuint (@BloombergQuint) November 26, 2016

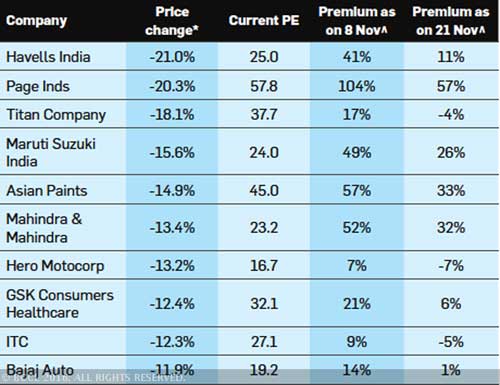

It is also notable that several consumption oriented stocks such as Havells, Page Industries, Titan Industries etc have been clobbered out of shape as a result of demonetization.

(Image credit: ET)

However, several eminent experts opined that the sharp erosion in the stock valuations has made these stocks attractive for long-term investors given their strong dominance over the market place.

Top Ten stocks that are immune to the evil effects of demonetization

Kshitij Anand of ET has conducted a meticulous assessment of several stocks and identified ten stocks which he claims are “immune” from the side-effects of demonetization.

These ten stocks are HDFC Bank, SBI, Aurobindo Pharma, Apollo Hospital, KNR Constructions, Tata Consultancy Services, Infosys, Dr Reddy’s Lab, Lupin and Wipro.

Conclusion

Kenneth Andrade’s analysis of the impact of demonetization on the economy and the stock market is convincing and is commensurate with the opinion of the other stock wizards. We also need to shed our inhibitions and aggressively buy stocks to take advantage of the fallen valuations!

Any Body who says Demonetistion is good inspite of it being badly managed is theoretical economist or has no choice to critcise . As it was done just for politcal gains in UP after BJP sensed defeat there,so it was done without any prepartion .It will have direct bad impact on Economy for six months and its ripple affect will drag Econmy for atleast one more year.More over adverse impact of Trump on IT sector due to lower hiring will create deadly combination with Demonetisation Made Recession.As positive political impact of this will die down soon as public memory is short,Modi Govt is expected to contnue with such knee jerk actions every six month till 2019.With daily firing on boarders ,unfortunately it can get out of hand any time due to miscalculation from either side . Govt is already in Election Mode ,so Economy will be first casualty in series of upcoming political dramas.No doubt stock specfic movement may contnue with some bounce back in between but roaring bull market is doubtful as it can never run during uncertainty.My biggest worry is UP election,as any set back there inspite of Demonetisation will paralysis this Govt .

So you can’t wait to see if the move is good or not? By the time you need to start criticizing before things have even begun?

You can see it already – It failed!

All black money guys exited white! Only few fools like bhakts are supporting it!

Btb.. Chinese Market had 6% gain from 1-month.

Justify the statement – all black money guys exited white? What makes you think so?

They use binami holders to convert money to white. Plus, the real back money 99% exists in gold, land & foreign money – ofcourse they are funders for BJP and are safe.

So this move is only 10% effective & 990% defective as it hit lot of business there by affecting stock market too. Let us see the next quarter GDP.

From where did you get these statistics? Can you give me a valid source link or a valid calculation for the same?

well said. Infact the moderators of this forum are pretty strange. It almost appears that they are bhakts in their true form. Any person criticizing the so called PM is being put down. espite they being more knowledgeable than the owners of this forum!!!!

@JP

An investor with sights set on just the coming quarter GDP huh?

Have proof to back up your statements about 99% black money in real estate, gold etc and which is held by funders of BJP….

There is an ancient Tribal proverb – it says that before we can see properly we must first shed our tears to see the way. So its ok for some to cry hoarse about the demonitisation view.

hope you not badly hit by the move

@sean,

why criticize the admin when you wish to stand against a tsunami of approval to the demontisation move? Like I have said repeatedly, everyone in this abused democracy of ours is entitled to his/her opinion and voice it. You keep voicing yours and let others voice theirs.

The fight has just begun. Waiting eagerly for the next moves announced by the GoI

Kharb, Its easy to say that these actions will paralyzed economy and this government, after-all its a fashion statement to speak anything against Modi these days. You should join astrology as how precisely you predicted that BJP has sensed defeat there. Astronomers are earning huge money by giving such predictions. I would request IMF to hire you as Chief Consultant who has predicted Recession due to demonetization. Boss, Demonetization was just a trailer and please stop crying for that now. Real picture is still left as everything is happening in sequence. It started with opening bank accounts for all in which Harvard pass Economist Manmohan Singh failed miserably. He has not managed to get accounts for all. Then Linkage with Aadhar card came, then voluntary declaration of black money, then demonetization. I believe this is only a link in a bigger process. Some peoples are bound to oppose Modi.

Priya I would think that was a rather disproportionate response to Kharb and you might be erring on the side of blind support.

Kharb, i appreciate your neutral views and despite my vote earmarked for NaMo, i am a bit worried given that he is mortal and prone to sways by playing to the galleries (read: elections). I am also somehow of the view, that a large part of the DEMONET drive has been driven by security concerns in J&K, NE, and Maoist hotspots.

If NaMo can kick start public spending massively, we have a good chance of a bull run, so the next Budget to me is the most critical one in the last ten years.

Any guess on who will be the CEA to Rahul Gandhi (when and if he becomes the PM)?

I doubt Demonetisation has any thing to do with Black money except Political Stunt,otherwise Govt know that their Scheme has fallen flat on its face with Crooks and Black money holders using various methods of old notes conversion and Modi Govt also standing there to help them with 50% Brand new Fair and Lovely Scheme,if any portion of black money is still left out with out conversion.Who stops Modi Govt to take direct action againat concerned Black money holders and entire nation behind it for direct action .It is only common people and Economy who will be ultimate loser in this high cost political stunt.

Well said Priya. I think a lot of people have missed the bigger picture. It’s not just a one off action. There are many more on the way, as it seems now. And this is the best time to do it. Everyone knows what happens in UP elections. Some of my friends from UP are cheered up that at least there would be some amount of fairness there in this election. When foreign media is praising Modi for his actions, our own citizens and pseudo-intellectuals are pulling the Govt’s leg. Demonetization was long due. And you can’t argue with Kharb. I’ve tried and failed. He is a staunch NDA/Modi hater and opposes every good action no matter what.

Prasanna ji, let us note the leaders dissenting – Mamta, Mayawati and the double jokers Laloo and Khujliwal. I’m not counting RaGA as I dont know where Congress fits in now. They are all joined by a single cause of corruption and votes. E.g., Mamta is in power due to the 20% votes on illegal bangla migrants who cant convert their money legally now. Full marks to NaMo for pulling the trigger largely due to the large Lok Sabha mandate.

However, i think you are expecting a lot from NaMo in the remaining 2 odd years and foreign media for me is no benchmark of review.

Where I do agree with you is that NaMo has a roadmap of 5 years aimed at the re-election with triggers built-in every now and then, GST, Demonet, etc. Somehow i cant think of any remaining big triggers excpet the Public spending boost and I hope I am proved wrong by some measures on GOLD and BENAMI

Can’t agree with you more on this. None of us are thinking of Modi as a Messiah or savior of Indians, I’m sure we will have better leaders in future. No matter what the Govt. does to curb corruption it will certainly find its way out of that. But there shouldn’t be any doubt on the intention of demonetization. Foreign media praising Modi can’t be a benchmark but is definitely a compliment. Let’s give Modi at least 2 terms to make things better when we have given so much time to the Congress. I don’t see any alternative as of now. Do we have a PM candidate from any other national party who has got the stature and experience of Modi? There is hardly anyone who is as incorruptible and determined as the one we have currently.

The only situation nobody can beat Kharb at is the one involving Modi bashing. Kharb is always the first off the block. Doesnt matter where he eventually finishes in the race.

No offense meant Kharbji … just stating a factual occurence

The whole situation reminds me of BSE vs NSE debate in the late 80’s / early 90’s where in the handful with vested interests (the coiterie of brokers) didnt want to reform which the NSE sought to bring out. For years now we all know how NSE brought about a paradigm shift in our financial markets

Demonitisation as part of the larger battle against black money will also, in the larger and longer term scheme of things, bring about a paradigm shift in our economy, our mindset, the way we do business etc etc (and all for the better)

Don’t be too Ignorant. Time being all the activities of Modi government failed – black money hunt, digital india, corruption hunt, fuel price cut, demonitization. Only those corrupted corporates & black money holders are winning – BJP took 10000 crores admoney from these masters.

+ these fakers have faked GDP too. Expect something like that for the market to boom!

Unfortunately for some self professed “know it all”, they live in a country of ignorants. Utterly routed these voices are but in this abused democracy of ours, even the dismal minority voice has a place too.

My point is even if it has been done with an eye on UP election whats wrong in being able to kill two birds with one stone. Isnt everbody in Indian politics leeches to power? Dont they all go to any lengths to win or cling on to power?

tough luck to the opposition which as things appear are sore and behave like cry babies for (i) their loss of money (ii) checkmate in the game of UP elections

and it sure is fun watching the black money guys (including those who exit to white – as if this sudden surge in their white will not be questioned) sweat and live in fear of the next move

We need to wait and watch to see the actual impact of demonetization. Don’t be disappointed by the reaction, kharb. If folks don’t get to see you praising Modi at every stage, they will be quick to pounce on you and discredit your argument and you in the process. And maybe also brand you anti-national.

I am waiting and watching as the scenario unfolds. There is no easy conclusion at this stage.

I can tell from experience that if I praise Mr Modi on my FB page, there are tons of likes. Post one negative article and the same friends turn vitriolic.

I think the strength of this country has been (at least till now) on healthy debate without folks getting personal. We should keep it that way!

China Index shows +6% growth for 1-month. So the post is wrong!

https://www.google.com/webhp?sourceid=chrome-instant&ion=1&espv=2&ie=UTF-8#q=shanghai%20composite

Hello Friends!

I want to ask you that, if PM Modi Suddenly took the decision of “Demonetization” for Surgical strike for Black Money in India. But here i want ask you that why new denomination of Rs 2000/-? (already Fake INR of Rs 2000/- is circulating watch—-> https://www.youtube.com/watch?v=mq5xMuhJQ9w)

I read an article of Marc Faber that he mentioned lots of Debt in Banking Sector can affect to the Indian Economy!

Is this step really affect the Black Money? or just refresh the black money with new currency? also is this step stop corruption in India?

What happened the black money of black people of India in Foreign countries?

Whether Demonetization failed, Whether Modi or his half baked Niti aayog thought about it – is the past- What the opposition does has not much consequence unless public supports them.

What matters in this forum is if you make money or not! If the answer is yes- then the act of currency change is good -if not -it is bad.The like of Porinju, Kenneth and Rakesh J etc are just money makers whose world revolves around money.They do not have any understanding beyond that.

But- look at it this way- it was a savage blow to the poor-for anybody earning a daily wage -it was a terrific body blow.

Whatever will be the monetary outcome is will be clear in another 1 month.

But -is it the end of most shopkeepers , wage earners, marginalized communities-that will be the big question? Looks like -it will be-with the coming of the online onslaught .

Saturn, Priya, Kharb, JP………………. It is a good debate.

just have a look at what KSE index has given in last one year.