Mastery in recognizing changes in sectoral trends

Nobody can dispute the proposition that Dolly Khanna and Rajiv Khanna (her illustrious alter ego) are amongst the first to predict changes in sectoral trends.

This is proved by the fact that Dolly was amongst the first to buy specialty chemical stocks, sugar stocks and paper stocks, when they were in the doldrums and available at throwaway prices.

Needless to say, stocks in these sectors are now being described as “screaming buys” by leading experts even as Dolly is basking in multibagger gains.

Why are fertilizer stocks a good buy now?

This question is best answered by Kenneth Andrade, the whiz-kid fund manager of Old Bridge Capital Management PMS.

“Rural India is a huge pocket of opportunities,” Kenneth Andrade said in his typical soft spoken voice even as he proceeded to elaborate.

“Agriculture is 14% of GDP and almost 20% of the services income depends upon that cash flow from that economy …

… Fertiliser is the largest consumed product out there. You have got agrochemicals at one end and you got seeds at the other end ….

… in the agrochemical chain, there is a huge market opportunity from labour, seeds, fertilisers and agrochemicals …

Kenneth made it clear that he is buying agriculture related stocks for the Old Bridge portfolio.

“When we started the journey in Old Bridge, we put together a portfolio that actually addresses rural incomes. Rural income is a long term play on the India consumer cycle where 60% of your population actually is in that part of the world. One of the key assumptions out there is the current policy framework which probably started somewhere between 2007 and 2008, is going to be dramatically more socialist. That is something that you will see play out over the next couple of years.”

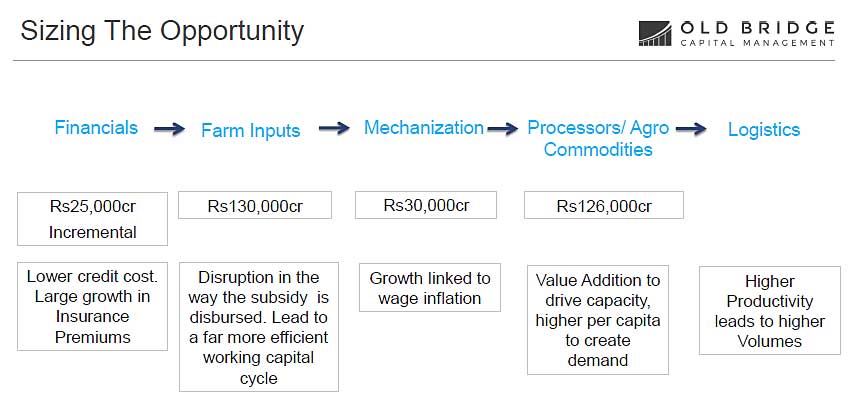

To make things even simpler, Kenneth Andrade provided a chart which illustrates the size of the opportunity in agriculture stocks:

The chart demonstrates that a massive incremental growth of Rs. 1,30,000 crore will come with respect to “farm inputs”, namely fertilizers, seeds, irrigation, tractors etc.

About Rs. 1,26,000 crore will come with respect to “value addition” of “processors/ agro commodities”.

Direct Benefit Transfer to be a game changer

Kenneth opined that the Direct Benefit transfer of subsidy will release fertilizer companies from shackles and give them freedom of pricing as per market demands.

“The fertilizer subsidy regime is going away and the Direct Benefit Transfer scheme will put $11.5 Billion straight in the hands of farmers. This should augur well for makers of complex fertilizers like Coromandel International”.

Dolly Khanna’s latest stock pick: GNFC

Dolly Khanna has explicitly endorsed Kenneth Andrade’s theory by buying 15,81,099 shares of Gujarat Narmada Valley Fertilizers & Chemicals Ltd a.k.a. GNFC as of 31st March 2017. The investment is worth Rs. 47.59 crore at the CMP of Rs. 301.

Fundamentals of GNFC

| GNFC – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 4,701 | |

| EPS – TTM | (Rs) | [*S] | 24.58 |

| P/E RATIO | (X) | [*S] | 12.30 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 20.00 | |

| LATEST DIVIDEND DATE | 25 AUG 2016 | ||

| DIVIDEND YIELD | (%) | 0.66 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 221.58 |

| P/B RATIO | (Rs) | [*S] | 1.36 |

[*C] Consolidated [*S] Standalone

| GNFC – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | DEC 2016 | DEC 2015 | % CHG |

| NET SALES | 1220.91 | 1179.28 | 3.53 |

| OTHER INCOME | 29.16 | 75.4 | -61.33 |

| TOTAL INCOME | 1250.07 | 1254.68 | -0.37 |

| TOTAL EXPENSES | 1017.76 | 1025.75 | -0.78 |

| OPERATING PROFIT | 232.31 | 228.93 | 1.48 |

| NET PROFIT | 66.77 | 54.54 | 22.42 |

| EQUITY CAPITAL | 155.42 | 155.42 | – |

(Source: Business Standard)

Why is GNFC a good buy now?

There are some aspects about a stock that an academic study of the numbers does not reveal.

In the case of GNFC, the big news is that the Government is likely to impose an Anti-Dumping Duty on TDI (toluene diisocyanate) and other products which will make GNFC the monopoly supplier in India.

This was first revealed by Ayesha Faridi, the charming editor of ETNow.

GNFC

REPORTS

TDI import duty likely on China,Japan,Korea

DGAD seeks anti-dumping duty on TDI imports

Co has TDI capacity of 67,000 MTPA— Ayesha Faridi (@AyeshaFaridi1) April 10, 2017

Varinder Bansal, the ace investigative journalist with CNBC TV18, corroborated this.

Some reports that anti Dumping on TDI Chemical of GNFC introduced on imports from Korea, China, Japan.

— Varinder Bansal (@varinder_bansal) April 25, 2017

The implication on GNFC of such an ADD (Anti-Dumping Duty) has been clearly explained by Malini Bhupta of moneycontrol.com.

GNFC is the only manufacturer of TDI in India with a market share of 50%

According to Malini Bhupta, GNFC is the country’s only producer of TDI and has a marketshare of 50 percent in the domestic market. After the imposition of anti-dumping duty the company expects to increase its market share as cheap imports would be restricted.

She pointed out that GNFC has invested Rs 2500 crore in a new plant, which has a capacity of 160 tonnes per day.

Rajiv Kumar Gupta, GNFC’s MD Director was quoted as follows:

“TDI is a very guarded technology and we are the only producer in India with a total capacity of 65,000 tonnes across two plants. There has been a lot of dumping by players from Korea and Japan, which is why we applied for anti-dumping duty to be imposed. The DGAD carried out due verification and has suggested a provisional anti-dumping duty to be imposed.”

He added that the entire process is expected to be completed in a few weeks.

It is also stated that a levy of USD 310/tonne has been proposed for imports from Korea BASF and USD 260/tonne for imports from all Chinese manufacturers and USD 140/tonne for all Japanese manufacturers.

Is GNFC going the NOCIL way?

It is worth recalling that Dolly Khanna aggressively bought NOCIL on the eve of the announcement of levy of Anti-Dumping Duty on its products. This game plan worked out well because the stock has surged like a rocket after that.

Whether, GNFC will demonstrate similar price behavior after the ADD is levied requires to be seen.

Accolades to GNFC from Sunil Singhania

Sunil Singhania, the whiz-kid fund manager with the multi-billion dollar Reliance Mutual Fund, complimented GNFC’s MD over news that the Company has achieved the “Highest ever yearly production & marketing of TDI” and described himself as a “happy shareholder”.

@drrajivguptaias Happy shareholder ?Thanks for the hard work of Team GNFC

— Sunil Singhania (@SunilBSinghania) April 2, 2017

Prima facie, this accolade is a big deal because large institutional investors have to be kept in good humor. They are capable of launching aggressive buying action if they view a stock as doing well.

Reliance Mid & Small Cap Fund already holds 2.02% of GNFC stock. However, there is no saying when they (or other mutual funds) may develop the sudden urge to buy more.

Nice bounce back by GNFC team in hitting 100% TDI capacity, after the Nov accident. Esp useful in the face of very firm TDI prices globally. https://t.co/WOTM3kUpp5

— Naresh Katariya (@KhivrajNaresh) April 4, 2017

Gnfc…my old fav stk will b in highlight again…Gnfc is d sole TDI manufacturer in india https://t.co/iDHcg7Vu8s

— n pal (@npal20) April 9, 2017

GNFC to set up Rs. 526 crore plant with Ecophos, Belgium

According to Mint, GNFC is partnering Belgian firm Ecophos SA to set up a di-calcium phosphate (DCP) plant at Dahej in Gujarat at an estimated cost of Rs526 crore.

It is stated that this project will be a “downstream integration” of TDI-II Dahej plant.

Good monsoon augers well for fertilizer stocks?

It is common sense that good monsoon always results in a boost for agriculture related stocks and especially fertilizer stocks.

The India Meteorological Department’s (IMD) as well as the South Asian Climate Outlook Forum (SASCOF) have opined that normal rainfall is expected over the Southern parts of Asia, while above normal will occur over the broad areas of eastern and south western parts of the region.

If this comes true, one can expect the entire stock market to surge. Fertilizer and other agriculture stocks will sparkle.

Research report on GNFC by Angel Broking

Vaibhav Agrawal of Angel Broking has recommended a buy of GNFC. The logic is crisp and to the point:

“Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC) is engaged in operating businesses in the industrial chemicals, fertilizers and information technology (IT) products space. GNFC is engaged in manufacturing and selling fertilisers such as urea and ammonium nitro-phosphate under the Narmada brand. The outlook for fertilizer business is positive following good monsoon. On the chemical sector, the current low per capita consumption in the domestic market and strong growth outlook for end usage are the key growth drivers for this industry. GNFC is planning to set up a lime purification project for which a joint venture company with Santosh Agrochem LLP was set up to purify by-product lime, to make it more marketable. This will resolve the environmental issues and at the same time add value to the product. GNFC is partnering Belgian firm Ecophos SA to set up a di-calcium phosphate plant at Dahej in Gujarat at an estimated cost of Rs. 526crore. The company has initiated actions for setting up 2,00,000 mtpa di-calcium phosphate (DCP) project. With the implementation of this project, entire hydrochloric acid (HCI) generated as byproduct from the toulene di-isocyanate (TDI) plant at Dahej will be utilised for production of DCP, resulting into improvement in the profitability of TDI business. The company is exploring opportunities in countries where there is availability of raw materials like natural gas, rock phosphate and other petroleum products at economic prices. Hence Buy.”

Fulfilling Hon PM's vision Neem Project's current season kickstarted with big meeting of field workers of GNFC & GLPC. Target 35000 MT????

— Dr Rajiv Kumar Gupta (@drrajivguptaias) April 26, 2017

Big money in cashless townships?

According to reports, GNFC has been appointed by Niti Aayog as the nodal agency to facilitate digital transition of residential townships across the country.

GNFC already has an information technology division called (n)Code Solutions which is an expert in this field.

It is stated that GNFC has already facilitated 81 less-cash townships in 12 States.

The 81 townships include those of Central public sector companies, like ONGC, Indian Oil, NTPC, SAIL, BHEL, NMDC, CRPF, BSF and Police Lines, and private sector townships, like Reliance, Essar, Adani, Birla Aditya, Welspun. As of now, the initiative covers the townships Delhi, Gujarat, Uttar Pradesh, Madhya Pradesh, Maharashtra, Bihar, and Chhattisgarh.

The townships cover a population of around 2 lakh and are collectively doing about 2.5 lakh transactions everyday — almost 9 crore transactions in a year.

Prima facie, GNFC may be charging a fee for this facility and that may translate into big bucks for the P&L A/c.

@drrajivguptaias GNFC is not just no.1 producer of TDI, Formic Acid, Acetic Acid, Ethyl Acetate etc. But institute which gave birth 2 CASHLESS revolution!

— Yogesh Patel (@YogeshPate1) April 14, 2017

According to a study conducted by PWC, another benefit of the cashless regime is that the farmers are able to enjoy cost savings due to fewer trips to the fertilizer shops and higher discounts. This improves their purchasing ability.

An estimated 87% of fertilizer retailers reported a rise in total revenues, revenue per transaction and total transactions, according to the study by PWC.

Conclusion

It is obvious that Dolly Khanna has done a lot of thinking in deciding the best fertilizer stock to buy. Her choice of GNFC appears to be impeccable given the monopoly status in TDI, neem based urea, cashless revolution, good monsoon and other factors. One can confidently say that GNFC will be yet another feather in Dolly Khanna’s cap!

All big investers are enjoying sector rotation party .They buy all average old compnies trading at historical average PE and soon after their buing stock got rerating. Usualy all old commodity type compnies trade in single digit during normal times or at the most 10 PE .Stock is already up 3X in last one year .Can it go up from present about 15 PE to 20 PE ,why not ?All bull run ends when such stocks go to 20PE or more .No harm in enjoying such parties with your Postional trade even for months with strict trailing stop loss .But dont forget to jump when music stops ,as same story repeats in every boom for many compnies including this.But dont consider such stocks as your core portfolio and no harm in swimming with tide but not naked( Without stop loss)

Who can contest the sane advice of Mr Kharb ,born of long experience.Any investor who gets swayed by media report(including this) should do this at his own peril.I am at loss to understand – why there is no mention of big investors buying price:after all most of the companies are good investment at right suitable price,or price range.

Fertilizer is undoubtedly a Buy Right, Sit Tight kind of sector.

Personally I think GNFC might go price correction soon, would prefer wait and watch