FIIs and Mutual Funds storm into LT Foods alias Daawat

The first sign that a small-cap stock is transitioning into a mid-cap comes when the FIIs and mutual funds begin to show interest in it.

Generally, the large investors nibble on the stock and test the waters to see whether the stock has the wherewithal to deliver the goodies.

However, in the case of LT Foods, the FIIs and mutual funds are in no mood to wait.

They have launched aggressive action and mopped up a huge consignment of the stock aggregating 5.31 crore shares.

The list of allottees reads like who’s-who of India’s best FIIs and mutual funds. It includes SBI Mutual Fund, DSP Blackrock Mutual Fund, Reliance Mutual Fund, Societe Generale, Schroder Gaja, Morgan Stanley, Citigroup etc.

LT foods – Allotment of equity shares to QIBs – List of allottees CC: @prashmundu @MoneyMystery @MrRChaudhary

BSE Link:https://t.co/aS1w7cJ443 pic.twitter.com/D8F4TfeZAY

— Rohan Gala (@RohanG90) December 26, 2017

LT Foods is the next KRBL?

One of Porinju Veliyath’s favourite stories is of how he recommended a buy of KRBL when it was still a “penny stock” and how it transitioned into a mega bagger before his very eyes.

“KRBL is a global leader in Basmati and was available at the valuations of a penny stock,” Porinju exclaimed, his eyes round with astonishment that such mind-boggling opportunities to make money exist in India’s stock market.

“There are hundreds of such companies still available at penny stock valuations,” Porinju said in an inspiring and motivational tone.

Citing KRBL as an example Porinju Veliyath (@porinju) talks about how one should look out for leaders in businesses.https://t.co/G5VftzNYz1 pic.twitter.com/x2uRJxFKvu

— BloombergQuint (@BloombergQuint) December 17, 2017

When KRBL surged like a rocket, Porinju defected to the camp of LT Foods alias Daawat and raked in a fortune from it as well.

Daawat at historic high today; had shifted from 'IndiaGate'; found it more delicious 🙂 https://t.co/kc1xetkowt

— Porinju Veliyath (@porinju) July 20, 2016

Daawat 100% more delicious in 6 mths? https://t.co/zz3dTekMrn

— Porinju Veliyath (@porinju) February 8, 2017

This clearly suggests that LT Foods is walking in the illustrious footsteps of KRBL and is also likely to shower multibagger gains upon its lucky investors.

This proposition is reaffirmed from the fact that Dolly Khanna holds a massive chunk of 29,07,256 shares as of 30th September 2017.

Roadmap to double revenue to $1 Billion by 2022

FIIs and Mutual Funds like companies which have a proven track record and a clear-cut roadmap for the future.

LT Foods has an illustrious past and a promising future.

Ashwani Kumar Arora, the CEO, assured that the Company would effortlessly double its turnover by 2022. His precise words are as follows:

“LT Foods expects revenue to double to $1 billion by 2022. We have a clear roadmap. We are leveraging our brands to build an export-driven global food company. Improvements in procurement, processing, sales and distribution should lift operating profit as a percentage of revenue to 15 percent in the coming years from 12 percent”.

He explained that the branded rice business presently rakes in about Rs 2,700 crore and that by 2022, the target is to increase it to Rs 4,500 crore. The new business categories, like organic staples, two-minute rice food (for US market), rice-based snacks and other value added products will also contribute in a big way to the fortunes of the Company.

Value added products will spur revenue and profits

LT Foods has done the sensible thing of tying up with a Japanese behemoth named Kameda Seika to produce savouries/ snacks which will be sold under the brand name ‘Kari Kari’.

The Japanese company knows the pulse of the savouries market and of the tastes of teenyboppers given that it is already a market leader in the competitive markets of Japan, Thailand, Vietnam, China and US.

The market for snacks and savouries is simply gigantic. According to Euromonitor, the savory snack food market in India is projected to grow at a compounded annual growth rate of 12% between 2016 and 2021 to reach Rs 445 billion.

LT Foods expects that the ‘Kari Kari’ Brand will itself reach Rs. 100 crore of revenue by 2022

More bucks will gush in from other value added products like organic staples, two-minute rice food (for US market) and rice-based snacks.

Research reports on LT Foods

LT Foods is strongly recommended by Angel Broking and Karvy.

Karvy has emphasized that LT Foods has “huge opportunities to scale up business” given the fast growing organic business in USA and Europe and the JV with Kameda for the Kari Kari snacks.

Angel has described LT Foods as an “emerging global Foods Company” with a focus on basmati and other speciality rice, organic foods and convenience rice based products. It has also pointed out that the Company has established on ground presence in the US, Europe and Middle East in order to unlock the full potential of these territories.

Conclusion

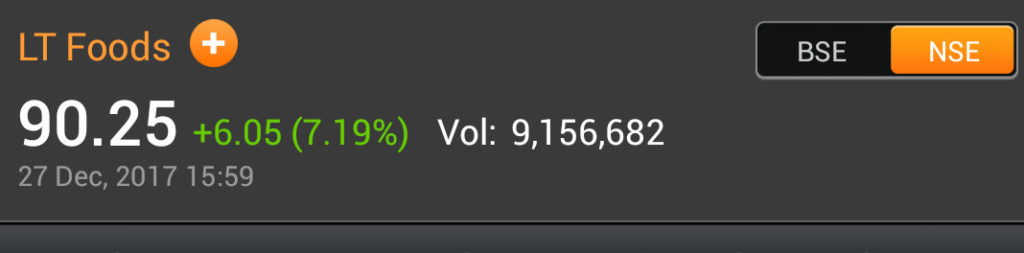

We have already cut a sorry face for having stayed aloof from LT Foods despite the clear-cut buy recommendation from Dolly Khanna and Porinju Veliyath. Now that the FIIs and Mutual Funds have also given the green signal that it is safe to invest in the stock, we have to barge in and make up for lost time!

Chamanlal satia also is good

Yeah LT Foods and Chaman Look good