Auditors go into panic mode after crackdown by SEBI & Piyush Goyal

At one time in the past, auditors used to merrily sign audit reports without a care in the world.

All that one had to do was add a few carefully worded qualifications. The accounts could be fearlessly signed off as being “true and fair” after this.

However, Piyush Goyal, the illustrious Minister in NAMO’s government, sent the clear message that the shenanigans of the CAs would not be tolerated anymore.

“If all chartered accountants come together and decide that they will only practice honesty, then the problem of corruption in the country will be resolved,” he said in a stern tone, implying that there is rampant corruption in the manner in which CAs do audits.

If all chartered accountants come together and decide that they will only practice honesty, then the problem of corruption in the country will be resolved: @PiyushGoyal

— Piyush Goyal Office (@PiyushGoyalOffc) February 6, 2018

He also accused CA’s of doing/ facilitating “टैक्स की चोरी” (Tax evasion).

टैक्स की चोरी यदि कोई करता है तो वह किसी गरीब को गरीब बनाये रखने में सहयोग देता है, ईमानदारी आसान रास्ता नही है, लेकिन यदि एक बार तय कर लें तो इस पर चलना संभव है: @PiyushGoyal

— Piyush Goyal Office (@PiyushGoyalOffc) February 6, 2018

NAMO also blasted the CA community for facilitating black money hoarders during demonetization by devising all sorts of illicit schemes.

Naturally, some CAs got their knickers in a twist at the plain-speaking by NAMO and Piyush Goyal.

However, public opinion is clearly supportive of the stance of the Hon’ble Ministers especially after the PNB NPA fiasco when the auditors were caught napping.

SEBI also moved swiftly and banned Price Waterhouse Coopers (PWC) from conducting audits.

#Satyam case fallout | Market regulator @SEBI_India bans @PwC entities from auditing listed entities for two years. More details on #Sebi ban on Price Waterhouse Network here: pic.twitter.com/14WeEzySmA

— ET NOW (@ETNOWlive) January 11, 2018

Congratulations, #SEBI for action on @PwC for “cooking” Satyam books/hiding the scam. In truer market system action would be harsher & faster. But this is a great beginning

— Shekhar Gupta (@ShekharGupta) January 11, 2018

However, the baffling aspect is that despite its dubious reputation and the ban by SEBI, PWC was chosen by the Government to investigate the PNB NPA scam.

Naturally, this aroused the ire of the intelligentsia.

isn't it ironical that #PwC whose role itself came under the scanner in the infamous 2009 Satyam episode and is now challenging a SEBI-imposed audit ban on it should be chosen by #PNB to probe the Nirav Modi affair? #NiravModi

— Prabhu Chawla (@PrabhuChawla) February 23, 2018

PNB appoints PwC to investigate fraud!

It is absurd as PwC is recently barred by SEBI from issuing audit certificates for any listed companies.

This audit firm was found complicit in falsifying Satyam Accounts that resulted in around Rs.10000/- crore scam!— Shaelesh (@Shaelesh) February 23, 2018

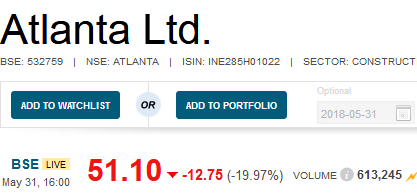

Atlanta, latest victim of Auditor’s reluctance to sign alleged doctored accounts

An unknown micro-cap (Rs. 400 crore) named Atlanta Ltd is the latest where the auditors have developed cold feet.

Asha Ramanathan, the distinguished partner of PWC, dashed off a terse letter in which she accused Atlanta of not disclosing “adequate and relevant information and explanations”. She announced that because of this, PWC was resigning from the post of auditors.

@PwC_IN resignation letter of May 29, giving up the account on tax related information not disclosed by Atlanta Ltd mgt to the statutory auditor.@BTVI @ShailDamania @Geetu_Moza @SEBI_India @theicai pic.twitter.com/PZrxyc8fki

— Siddharth Zarabi (@szarabi) May 30, 2018

The management adopted a belligerent stance and claimed that it was “quite astonishing” that the auditors resigned instead of “addressing on resolving off audit issues”.

3rd listed co in a row where Auditors have resigned-Vakrangee, Manpasand & now Atlanta Ltd.

Underlines very little tolerance for even the slightest whiff of doubt. Take no risk-no chances approach! @BTVI @Geetu_Moza @stockgurupiyush @ShailDamania @SEBI_India @theicai @PwC_IN pic.twitter.com/00pnIBlf6W— Siddharth Zarabi (@szarabi) May 30, 2018

As usual, investors bore the brunt of the stand-off between the management and the auditors.

Atlanta is locked in the 20% lower circuit and has effectively blocked everyone’s escape route.

The MMB punters at the Atlanta counter make a pitiable sight.

“How many LC. …….????????” one punter sighed, resigned to his fate.

“Dhoka. …..Fraud. ……Loss to Investors. …..,” another wept, his voice choking.

3rd Auditor Resignation now, PWC Resigns as Atlanta's Auditor

PWC – Atlanta & Vakrangee

Deloitte – ManpasandImp Q to Auditors From Shareholders' Perspective:

Why not point out issues & give a qualified opinion?

Why Resign and leave shareholders wondering?— Mangalam Maloo (@blitzkreigm) May 30, 2018

At last auditors understood their responsibilities.

— bskar (@bsudhakar) May 30, 2018

Shankar Sharma expresses contempt for Big-4 auditors

Shankar Sharma was vicious in his criticism of the Big-4 auditors.

“I will never invest in a company that's audited by the so- called Big 4,” he fumed.

I am absolutely clear: I will never invest in a company that's audited by the so- called Big 4. There is 0% upside in valuation, and 100% Downside if these guys choose to quit. Makes no sense for any company to have them as Auditors. Absolutely unnecessary Risk @rab9604 pic.twitter.com/sLv8v3YgYF

— Shankar Sharma (@1shankarsharma) May 31, 2018

However, not all of Shankar’s followers were convinced by his stance.

Sir if you are invested in a company where the auditor has to quit, there is something wrong with your investment thesis and not with the 'so called Big 4 auditor'

— Abhishek Murarka ?? (@abhymurarka) May 31, 2018

You mean it’s safer to invest in a certain XYZ with jhanoori Lal and sons as auditors ?! Happily showing a 50% jump in profits year on year !

— sid (@sid58883181) May 31, 2018

Local small firms are no better. They are highly “accommodative” and never resign. At least big 4 resigns when things are out of control but local small firms never. This is from personal experience.

— Kamlesh (@maahirahaan) May 31, 2018

Dilip Buildcon: From “next L&T” to “next Manpasand/ Vakranjee”

Dilip Buildcon’s description as the “next L&T” was not made by over-enthusiastic punters but by Rohan Suryavanshi, one of the head honchos of the Company.

However, rumors of a dispute with the auditors suddenly surfaced and sent the stock tanking like a ton of bricks.

The management speedily clarified that all is well between them and the auditors.

Dilip Buildcon's Rohan Suryavanshi clarifies rumours regarding the company auditors resigning. pic.twitter.com/5koteeWQu8

— BloombergQuint (@BloombergQuint) May 30, 2018

'Rumours regarding resignation of auditors are baseless,' says Rohan Suryavanshi, Head-Strategy & Planning of Dilip Buildcon. Stock recovers from lows.

Watch the full conversation with @Nigel__DSouza @Reematendulkar @_anishaj pic.twitter.com/ISTj2lzZ0u— CNBC-TV18 News (@CNBCTV18News) May 30, 2018

However, questions began to be asked whether Dilip Buildcon is the “next Manpasand” and/or “Next Vakranjee”.

Amit Mantri- the same guy who wrote curious case of Manpasand asked few questions to the co like:

Why does co have 1660 crs of inventory (1.5x of annual raw material consumption)?

What are the intangible assets under development of 350 crs? Why does an EPC Co need this? Odd.— nickey (@OnlyNickey) May 30, 2018

Dilip Buildcon : Next Manpasand or Vakrangee ?

Post MP elections in any case it will become penny stock !! https://t.co/OlEbTanrQk— Pulika Nath (@nalandacapital) May 28, 2018

Naturally, some savvy investors did not want to wait to find out the answer. They bailed out in a hurry, sending the stock spiraling downwards.

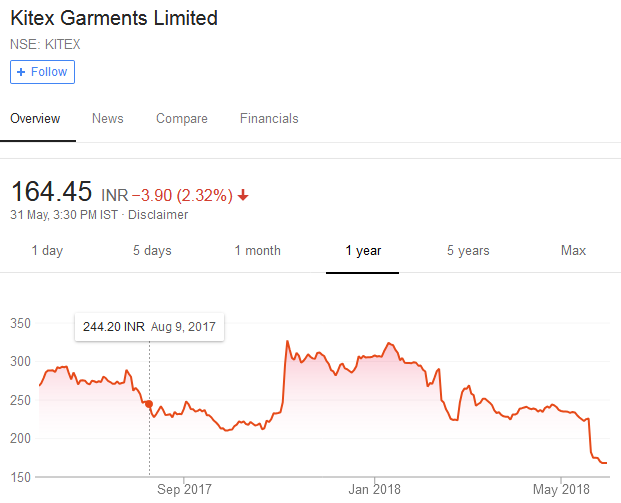

Kitex Garments, no more “Next Page Industries”

Today, it sounds atrocious that anyone would have the temerity to describe Kitex Garments as the “next Page Industries”.

Yet, even distinguished stock pickers like Ravi Dharamshi were taken in by Kitex’s charisma and opined that the stock was comparable to Page Industries and would give “fantastic returns”.

Ravi Dharamshi fairly admitted later that Kitex Garments was a “mistake” and that he had exited it before it could cause large damage to his portfolio.

Have committed lots and lots of mistakes in my Investing career. Kitex hasn’t actually cost me anything. I have tried to keep my mistakes affordable. And never misled anyone into my mistakes. ??

— Ravi Dharamshi (@ravidharamshi77) May 21, 2018

However, Prof Sanjay Bakshi, the authority on value investing, has maintained stony silence over Kitex Garments.

The Prof is the original discoverer of Kitex Garments. He had written an elaborate “teaching note” titled “The Importance of Unconventionality” in which all the virtues of Kitex were enumerated in glossy detail.

(Unfortunately, the note is now deleted from dropbox).

When the stock sank amidst rumors in the valuepickr forum that things are amiss in Kitex Garments, the Prof launched a defiant and no-holds-barred buying action to average the original buying price.

Kitex Garments

VALUEQUEST INDIA MOAT FUND LIMITED Buys 2.65 lk shares at `443.1/sh@Sanjay__Bakshi— Varinder Bansal (@varinder_bansal) November 3, 2016

As of 31st March 2018, the Prof’s ValueQuest India Moat Fund holds a treasure trove of 14,72,235 shares of Kitex Garments.

Guess the prof hasn't given up on his 'intelligent fanatic' yet.

— RG (@Rohit_FP) November 3, 2016

is it a case of throwing good money after bad?

— Super Stock Ideas (@superstockideas) November 3, 2016

Some knowledgeable experts have boldly described Kitex Garments as the “Next Vakranjee” and a “house of cards” which means that the sensible strategy would be to exit the stock with whatever can be salvaged from it.

Kitex – The Next Vakrangee?

— Amit Mantri (@amitmantri) May 18, 2018

Kitex Garments – A house of cards whose crash should not come us a surprise https://t.co/Ly3hycHSRH

— Amit Mantri (@amitmantri) July 31, 2017

Kitex Garments – Fooling some of the people all of the timehttps://t.co/RBVkAfwDFS

— Amit Mantri (@amitmantri) May 2, 2017

How gullible investors fell for #Kitex to be the next #Page .. https://t.co/j1p3v00GcC

— Amit (@SindhiTweetani) May 26, 2018

#BQStocks | Shares of Kitex Garments decline as much at 18%.https://t.co/tnKr1ljOzL pic.twitter.com/EsRiLf15uM

— BloombergQuint (@BloombergQuint) May 21, 2018

What ails LEEL, Porinju Veliyath’s crown jewel stock?

Porinju Veliyath has adopted the strategy of taking concentrated positions in his high-conviction stock picks.

In LEEL (alias Lloyd Electric), Porinju’s EQ India Fund holds a mammoth quantity of 3,303,473 shares as of 31st March 2018.

This holding comprises of 8.19% of LEEL’s equity.

Leel Electricals in focus@porinju Equity Intelligence India stake in Leel Electricals has been increasing

Feb 2018 7.35%

Dec 2017 5.52%

Sep 2017 4.92%@CNBCTV18Live— Nigel D'Souza (@Nigel__DSouza) February 2, 2018

Unfortunately, today the stock tanked and tripped the lower circuit of 20%.

The stock has lost 30% on a YoY basis.

According to the MMB punters, the Q4FY18 results are “disastrous”.

When I last checked, the punters were in a foul mood due to the unending excuses offered by the management.

Porinju has stated that if investors were earlier rationally bullish about a stock at a higher price, they should be even more bullish about it at lower prices.

If you were rationally bullish on a stock at 120 in January, it's a screaming buy today at 95!

— Porinju Veliyath (@porinju) May 23, 2018

We will have to wait and watch whether Porinju acts on his own advice and buys more of LEEL or prefers to wait on the sidelines for the dust to settle.

Some punters are also suggesting that Porinju should storm into the Board of Directors of LEEL and demand a seat.

Prima facie, this is a good idea because if Porinju becomes an “activist investor” like Billionaires Carl Icahn and Bill Ackman, it will send the fortunes of LEEL surging upwards!

Leel eletrical 20%lc…sarda plywood..falling knife…kitex..kati patang…only when the tide goes out you know who is swimming naked!!!..invest always in the best quality not some junk advised by some pms babas

Even at rs10 it isnt a screaming buy…sell and run

Skeletons are tumbling out from so called multi baggers suggested by Gurus. The fall has just begun. Many more will follow vakrangee

Strange that Prof has deleted his Kitex thesis from Dropbox. It should have been a good learning experience. In the end, turns out all this gyan works only if stock moves up, else its useless cr@p.

Look who is speaking about corruption. Piyush goyal who is himself involved in a 650 crores scam. Sau choohe kha ke, billi haj ko chali…roflmao

The biggest and most corrupt are sitting in the central Cabinet. Any idea about the Highways and Ports minister from Maharashtra who once had his driver, mali and sundry as fellow directors of his company to siphon off funds? With all investigative departments in the govt’s hand (esp IT, CBI, MoCI, ED), there has been no check on any of these powerful ministers affairs during or after the demonetisation saga – how much money was laundered by them at that time? There were big rumours that the RS2000 bundles were reached privately to many capitalists (by who else than the govt officials?) and also rumours that the old notes were used to buy real assets prior to the announcement. More than 60000 crores is allotted for highway development, but hardly any devt is being seen in highways, barring PPP models where toll companies spend all the money and recover from the commuters.

And bigger surprise is, the CAG, which was so active prior to 2014, has gone to sleep completely. Not a single report has been tabled in Parliament to my knowledge. Is everything hunky dory?

The alleged fraudulent companies that are coming out in the open now are from Gujarat (Manpasand) or Maharashtra (Atlanta, Vakrangee) – these two states (with blessings of BJP bigwigs) seems to have taken over from Hyderabad (Satyam et al).

Market behaviour is selecting bride. Jain Irrigation with excellent fundamentals is languishing with PE of 14 (2019), whereas people go behind Vakrangee and PCJ.

Old D street saying pump and dump! Don’t forget that. However it is a mystery that the activities have been carried out under the nose of the regulator and today thousands of crores have been lost of investors, not gullible this time since these are accounting frauds and beyond the balance sheet statements!

Then who shall protect the investors?

Some big fund managers are against the big 4, but not supporting those who expose the accounting scandals! How ethical! Perhaps that is how they are so big!!

This is not end but just Start of Blood Bath in poor Quality Stocks, many of these may be just showing false profit and sales no and it can not go on as they will be unable to deposit income taxes for long .It always happens when ever market goes up and investors are always warned but they will just blindly buy .

Sir, any clue why Majestic research is also spiralling down?

if all politicians decide to curb corruption than there would be nothing like india

I am no longer hopeful on Leel