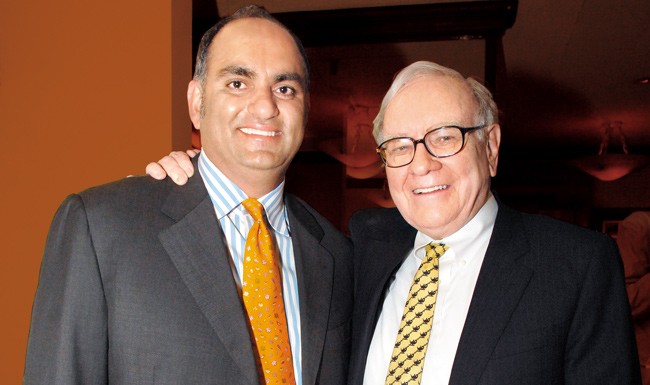

Rap by Samir Arora puts Mohnish Pabrai on the right path

Today, Mohnish Pabrai is very much a part of the investment landscape in India. We can see him on almost a daily basis at Dalal Street, hobnobbing with the local punters and exchanging notes on the best multibagger stocks to buy.

However, few are aware that there was a time when Mohnish Pabrai was estranged from Indian stocks and had vowed to never step foot on Dalal Street.

When he was quizzed about the reasons for his estrangement, Mohnish stated:

“I don’t invest in India because there are too many regulatory hurdles”.

Later, he offered the feeble excuse that “I had stayed away from India as most of the companies tend to be family owned and lots of them have governance issues and hence we didn’t prefer to invest in family controlled businesses”.

Naturally, the excuses offered by Mohnish Pabrai infuriated Samir Arora, a whiz-kid investor in his own right and fund manager of the Billion dollar Helios Capital.

Mohnish’s excuses are “random” and “pathetic”, Samir Arora said, annoyance writ large on his face.

Had stayd away fm India as most cos tend to b fmly owned & lots of them hv governance issues

Pabrai's pathetic excuse 4 not investing in IND— Samir Arora (@Iamsamirarora) July 3, 2015

@rrajiv33 Correct reason he should say is that "he made a mistake"- why random excuses.

— Samir Arora (@Iamsamirarora) July 3, 2015

@RahatTalreja no- giving wrong reasons to run down is. Why is bottom up investor giving such random excuses

— Samir Arora (@Iamsamirarora) July 3, 2015

At this stage, we have to compliment Mohnish because he immediately saw merit in Samir Arora’s criticism and decided to make up for lost time.

He caught the next flight and landed up at Dalal Street, his pockets bulging with cash, determined to buy multibagger stocks.

After initial hiccups, multibagger gains gush into portfolio

Understandably, Mohnish took time to get accustomed to the sights and sounds of Dalal Street.

His debut stock picks like J&K Bank, South Indian Bank etc, ended in a bit of a fiasco.

However, once Mohnish found his feet, there was no looking back.

Today, his portfolio boasts of magnificent multibagger stocks like Rain Industries, Balaji Amines, Kolte-Patil Developers, Sunteck Realty etc.

| Latest portfolio of Indian stocks held by Pabrai Funds | ||

| Stock | Nos of shares (lakh) | Net Worth (Rs Crore) |

| Rain Industries | 162.55 | 182 |

| Rain Industries | 127.58 | 143 |

| Sunteck Realty | 10.74 | 48 |

| Balaji Amines | 6.07 | 23 |

| Kolte-Patil Developers | 10.86 | 20 |

| Net worth as of 31st March 2017 | 416 | |

We love Indian stocks

Now, the amusing part is that Mohnish Pabrai has done a complete somersault and declared that he “loves Indian stocks”.

“I love what we own in India. We’ll make a lot of hay from our Indian holdings in the years ahead,” Mohnish said in his latest newsletter to the distinguished investors of Pabrai Funds.

Highest exposure to Indian stocks

“We also have the highest exposure we’ve ever had to companies based in India (over $100 million or over 18 percent of the pie),” Mohnish gushed.

In contrast, he gave a vote of no-confidence to US stocks.

“I don’t find the U.S. markets overvalued, but they aren’t obviously undervalued either. The pickings in the U.S. have been very slim.”

Mohnish also revealed that the AUM or net worth of Pabrai Funds presently stands at a whopping Rs. 3500 crore ($535 million).

Forget China, Brazil and Russia. India is where it’s at: J.C. Parets

Mohnish’s confidence about Indian stocks is shared by other enlightened investors as well.

J.C. Parets of All Star Charts, an authority on emerging markets, is very vociferous in his appreciation of India as an investment destination for foreign investors.

“Forget China, forget Brazil and Russia. India seems to be where it’s at,” Parets said with a big smile on his face.

Parets explained that reason for India’s outperformance is because it is relatively insulated from the problems facing the global economy.

“It is largely self-propelled, so its growth or deceleration is determined less by external forces than its own momentum,” he said.

NAMO given credit for success by experts

Richard Rossow, an expert on USA-India policies, credited NAMO for attracting droves of foreign investors.

“Prime Minister Narendra Modi has personally inspired a high degree of business confidence with his focus on executing important national goals like electrification and financial inclusion, while also initiating new reforms in areas like coal, railways and defense, that are helping open new opportunities to India’s private sector. In addition, his party, the BJP, has been winning recent state elections — underscoring the point that voters are inclined to support these pro-growth policies,” Rossow said.

Jim Rogers repents abandoning Indian stocks

We have already seen that Jim Rogers, also a visionary investor, candidly admitted repentance over his hasty decision to sell Indian stocks.

“I am amazed, shocked and stunned on GST … If Modi continues doing stuff like GST, then not just me, everybody has to pay a lot more attention to India,” Jim Rogers said, paying rich tribute to NAMO.

Conclusion

It is clear from the sayings and doings of visionaries like Mohnish Pabrai, Jim Rogers, J.C. Parets, Richard Rossow etc that we have no reason to fear that Indian stocks are overvalued. Instead, we have to take advantage of the situation to aggressively load up on top-quality stocks whenever there are moments of correction!

India is a great story for atleast next 10 years There are atleast 200 companies where you can invest and can expect around 15% CAGR and if you are good picker and can chose best 100 best Companies out of this 200,You can get 20% CAGR,If you better stock picker and can find out best 50 stocks out of that 200,you can get 25% CAGR If you are master stock picker to filter best 25 Companies you may ends up 30% CAGR in next 10 Years

For 15% Safe CAGR I have invested in Yes bank,HDFC bank,Kotak bank,ICICI bank,Axis bank,DCB bank, Federal Bank, RBL bank,IDFC bank, DHFL,LIC Housing,GIC housing,Rel Capital,L&T Fin holding,ICICI prudential Insurance,RIL,L&T,ITC,Asian Paints,HUL,Vardhman textiles,Lupin,Sun pharma, Maruti, TataMotors,Dmart.

Great slection of stocks from an accomplished stock picker.Who does not that these are all excellent companies ? I m sure you will beat the market hands down with your investments.

I am confident that your CAGR will be aroud 30%.

Do not you feel that your portfolio is overweight on finance companies and banks and need more sectoral diversification ?? Off course the scrips you chose are amongst the top 50 only !! Kudos for that !!

Yes I have half of my portfolio in financial as dont take chances ,so has invested more in pvt financial stocks,where growth is there and RBI is good regulator .I only invest where I am sure of growth for next few years.I dont follow big investers who can pick any third grade stock at average multiple and just after their buying stock is re rated .People forget to question why these compnies which have done nothing in last 10 ,20,30 years will change just after buying some one .I was amazed to see that stock of a company ( which I visited 35 years back as student) which did nothing for last three decades was trading at 52 week low,just start trading at 52 week high in four days after buying by a prominent investment manager.What three generation of permoters could not do,this invester did in four days with his followers .I avoid such diversification .I had also invested half of my portfolio in mutual funds like dsp microcap, mirae emerging blue chip,Franklin smaller compnies fund,rel small cap fund ,hdfc mid cap fund ,rel growth etc .If you know some good company in growth sector with good management and market share,pl let me know to increase my diversification .Thanks in advance

Thanks Mr. Kharb for detailed response. My pleasure to go thorough it.

Compared to your tenure in market and your wisdom about companies I am no one to suggest you any investment …

I just tried to draw your attention to old adage in stock market “Do not put all your eggs in one basket”.. Off course you are well diversified within the sector as you own no. of NBFCs and banks !!! Hats off to your openness and courage to discuss your holdings in public domain !!

Your stocks are mostly towards Banking and Financial space.

Is there any reason for the same

I forget to mention UltraTech cement ,which is also part of my portfolio.

I feel golden period of HUL is behind it. Difficult to overcome competition from Patanjali.

I do agree that Golden period of many blue chips including HUL is behind us,but if any body is taking Patanjali as serious player is not more than joke.Patanjli and products of other Babas as well are just fullfiling brand needs of many people who were Earlier using unorganised sector FMCG unbranded produts,now they can get Quality and Price of unbranded products with just a Baba label . So unbranded players are facing competion from Various Baba’s Products .You must be aware various Quality issues in Baba Products Army Canteen has just banned one Patanjali product just last week.

I don”t think Patanjali is anymore baba company as they are evolving into a professionally managed company. They are making a lot of money,hence they can easily hire quality professionals.I am sure the process is already on.We should not forget that they are intelligent and disrupteor thinker.They will make mistakes but they will improve.

Without being particular to any Baba and no intention of taking fight with their Chelas,I dont doubt various modern Baba’s Capacity to fool public at the lower end of pyramid of population .But I feel after a certain no, it is difficult to add numbers to this category.We no more having ( if any body claim so,I dont have objection for sake of avoiding controversy)selfless people serving Babas or learned highly respected Gurus like in old times Goutam Budha,Mahavir Swami ,Guru nanak ,Swami Dayanand etc ,to sustain numbers above a certain level.

MULTINATIONAL COS ONCE CALLED SALT TO BE INJURIOUS TO HEALTH & NOW THEY ADD SALT TO THEIR TOOTPASTE. ONCE THEY ADVOCATED BABY FOOD INSTEAD OF MOTHER’S MILK. WOULD YOU PREFER YOUR KID TO DRINK COKE OR NIMBU PANI.THINK BEFORE TALK ABOUT BABAS. ASK YOUR MOTHER WHAT SHE WILL PREFER. DONT BE JUST AFTER PROFITS

I am no baba”s chela. I have presented my dipassionate analysis.You should not paint all babas with the same brush.However I am impressed by disruptive , innovative and bold thinking of Baba Ramdev and his team.He has proved himself–this is unanimous opinion.

Best portfolio Karnataka bank,yes bank,DHFL,Sriram Citi union finance, Balaji amines,care rating,Maruti,eisher motors,phoinex lamps, sun TV,srf, vatech wabag, UPL, pi industry, alkem lab,dishman pharma,

No moderation for now

I have nothing against any Baba or any of their products. I would be most happy person on earth if any Baba Can export their FMCG and Food products to USA , The Biggest Consumer of FMCG in World after thumbs up from USFDA .This will not only earn lot of Foreign Currency to compensate for slow down in IT .But I know it will never happen, Quality is small word to discuss in India ,with Loose regulatry environment in India loaded heavily in favour of third grade food and FMCG products under name of Ayurveda or Unbranded products .In India Bottom of pyramid people are exposed to huge health risk by almost invisible ineffective FMCG and Food prodcts regulator. I hope in Indian Regulators also become stringent like USFDA for the health of Indian public.In India I doubt that even MNC FMCG products may be of substandard quallty as compare to US and Europe , due to said reason.

In my personal view one should avoid all FMCG and fast pood products ,fairness cream as they are no substitute to fresh home cooked foods or fresh fruits .Obesity and poor health is also one of side affect of excessive use of FMCG products world over..Without naming any Baba,in past I appreciated many Babas for Critcising use of FMCG products, colas ,creams ,soaps,chocolate. But I was shocked when same Babas introduced their own products in critcised FMCG categories .What a SOMERSAULT,in Olympics one can get 10 out of 10 with such acts of Acrobatics.

But you should also appriciate that improvisation ,guided by innovating thinking has led them replace harmful contents with better and more useful contents mentioned in scriptures.

But you should also appriciate that improvisation ,guided by innovating thinking has led them replace harmful contents with better and more useful contents mentioned in scriptures.Name wise products appear similar but porducts contents wise are not.

I fully agrre

I fully agree

Dear Shakti Khanduri I do have lot of respect to you ( I never mean Chela word for U) and even all said Baba’s .I dont hesitate to admit Modern Baba’s are greatest Marketing Brain India has produced ,and all students of Marketing and Management can learn marketing tools from them .Right from establishment of their Empire,large fan following ,FMCG products and how to remain right side of politics , are proof of their marketing talent .Salute to their this Talent .

Sir, winning a constructive& healthy arguement(discussion) is your art, I salute to you for your knowledge and rational plus analytical thought process.

I do not know much about Rambaba except that he is a yoga guru. I have no personal fascination or animosity for him. But I am fascinated by Patanjali products for the quality and natural ingrediants.

The products have penetrated the middle pyramid (middle class) but still a distance away from the bottom pyramid (rural folk and low income group).once the bottom pyramid also starts embracing the products, then one can see the real competetion playing havoc for MACYs.

When i buy any product i look for price, ingredients and mfg date. Whereas for patanjali I only look at mfg date only to ensure more shelf life.

I have seen the shift happening in many of our neighbouring families, friends and relatives homes . I guess people will not mind paying premium for patanjali products. This statement may be contradicting the perception that people are buying patanjali products for its relatively cheaper price.

Patanjali revolution has just begun. It will transform and soon will become a Bahubali dwarfing Daburs, HLL etc.,

Let’s wait and watch. The day is not faraway.

However, one thing amusing me is that the baba who professes swadesi, travels in videsi car (Porsche)….

Agree with you. I find Patanjali products are value for money, plus many products are superior to competition. The middle class has taken to Patanjali in a big way and it’s growing at a fantastic CAGR.

The only thing I don’t like about Patanjali is that it’s not listed.

What about Mohnish’s stake in J&K, SOuth Indian Bank? Has he sold or still in portfolio with small amount?