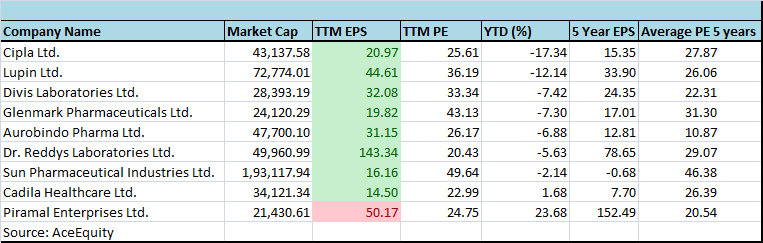

We saw a few days ago how the concerted crackdown by the USFDA on top-quality Pharma companies like Dr. Reddy, Sun Pharma, IPCA, Aurobindo Pharma, Lupin, Cadila Pharma, Natco etc has completely de-rated the Pharma sector. On a YoY basis, the Index has lost 9%. Blue-chip large-cap stocks like Cipla, Dr. Reddy, Lupin, Divi’s Labs etc have lost up to 21% of their value on a YoY basis.

Rakesh Jhunjhunwala, the Badshah of Dalal Street, has offered the clear-cut advice that the time is opportune to buy Pharma stocks.

Raamdeo Agrawal has echoed the wisdom of the Badshah and offered the same advice. As expected, the rationale of the duo is very convincing:

(i) Indian Pharma supplies 40 per cent of American generics and 7 per cent value. There is scope for increasing the volume and value share;

(ii) Indian costs of manufacture are very low as compared to American and European manufacturers and so there is no option but to outsource to India;

(iii) Indian companies have understood the market and are getting big-sized so as to compete with their American and European counterparts;

(iv) USFDA is a temporary problem. It is only a matter of time before Indian Pharma companies gear up to the required standards of the USFDA;

(v) The business opportunity is beyond doubt because the world needs generics. Indian generics have no global alternatives for the long term.

(Image Credit: ET)

Both stalwarts have opined that the crash in the prices of Pharma stocks is a “wonderful opportunity” for us to tuck into top-quality companies and hold them for a lifetime.

If you are wondering which Pharma stocks to buy, one suggestion is to stick to the small and mid-cap Pharma stocks which are certified as potential 100-Baggers in Motilal Oswal’s 19th Wealth Creation Study. These four stocks are Granules India, Shilpa Medicare, Aarti Drugs and Suven Lifescience.

Of these, Granules India is most familiar to us because almost everyone has recommended a buy of it and it has also delivered on the promises.

According to the latest research report by Motilal Oswal, Granules is at a “Game Changer” and “Strategic Inflection Point”.

Shilpa Medicare is also familiar to us because Daljeet Kohli has given it the green signal. Daljeet recommended a “strong buy” of the stock in March 2014. The stock has given a return of nearly 260% since then. Daljeet has again recommended a buy on the basis that the stock is “ripe for re‐rating on regulatory clearance at API facility”.

Aarti Drugs came into the spotlight when we realized that the stock was an ex-favourite of Radhakishan Damani, the legendary stock wizard. Motilal Oswal and other experts have recommended a buy of Aarti Drugs on the basis that it is a “High Quality Proxy Play”.

Suven Lifesciences is of the same high pedigree as the other three stocks. Over the past two years, the stock has notched up hefty gains of 140%. However, it is presently experiencing headwinds and has lost 30% on a YoY basis.

So, the advice of the wizards that we should buy stocks of Pharma companies now is a very sensible one. These companies are debt-free, enjoy high levels of free cash flows, have high RoEs etc and will compound our wealth in a slow and steady manner. Before we know it, these stocks will become multi-baggers and we will also be able to bask in great riches!

#STOCK #MARKET #TIPS ::

Rakesh Jhunjhunwala is favoring the pharma sector and there is actually no reason to move against the sector. In last quarter, pharma sector has witnessed tough time during US FDA inspections and nearly more than 400 observations has been done. Due to this pharma stocks were de-rated as well with good correction. Now the stocks are in restructuring phase and with the decent valuation stocks are giving better buy at current levels. Natco Pharma could be a multibagger at current levels with better potential. Sun Pharma is a never give up stock. During China crash, Sun Pharma surged nearly 6% in same month. These are the potential stock and we really should not miss those.

Stock Market Tips