Shyam Sekhar, the noted value investor, was the first to articulate the virtues of the dairy industry. He explained that the process of buying milk from the farmers and converting it into value added products like paneer, cheese, butter etc and later selling it to the consumer as a branded product creates enormous value. He added that the value added products are a small part of the product portfolio of the dairy companies at present but have the potential to become a large share of the product portfolio in the foreseeable future.

“The operating leverage of those businesses at that stage is not factored into the present valuations of the stocks” he said.

He also emphasized that a small change in the margins of the products as a result of value addition can have a huge impact because the base of these companies is large.

Shyam Sekhar also revealed that Hatsun Agro is his “high conviction” favourite stock from the dairy sector.

My #TOP2 high conviction stocks are ones i own for the past 5 years & will own for the next 5. LA opala glass & Hatsun agro. Richly valued.

— Shyam Sekhar (@shyamsek) December 20, 2015

Eminent wizards are already sitting pretty in dairy stocks

It is not a coincidence that all of our favourite stock wizards have already cornered large chunks of dairy stocks and are sitting pretty in them.

Heritage Foods – A ‘No-Brainer’ favourite of Dolly Khanna, Vijay Kedia and Kamal Kabra

Vijay Kedia personally handed over Heritage Foods to us on a platter as a “Diwali Gift”. He meticulously set out all the virtues of Heritage Foods and assured us that the stock was investment worthy owing to its high growth prospects, low debt and low valuations.

As if Vijay Kedia’s assurance is not enough, we could also take comfort from the fact that Dolly Khanna and Kamal Kabra have been holding Heritage Foods for years. Both have massive multibagger gains to their credit from Heritage Foods.

Vijay Kedia’s prediction comes true

When Vijay Kedia recommended Heritage Foods to us, he explained that the reason why the stock is available at a valuation lower then its peer Hatsun Agro is because Heritage Foods has a retail division which is losing money and is a drag on the valuations.

Vijay Kedia hinted that Heritage Foods may look to divest the retail division if it cannot turn it around.

If that happens, there will be a re-rating of Heritage Foods and it will surge to the same valuations as Hatsun Agro, Kedia opined.

That prediction has come true because Heritage Foods has now announced that it is in talks with Kishore Biyani of the Future Group to sell the retail division.

HERITAGE FOODS SOARS IN TRADE. Future Grp In Talks To Buy Co's Retail Biz @blitzkreigm gives all the details here – https://t.co/E5jg6x1q5S

— CNBC-TV18 News (@CNBCTV18News) September 19, 2016

Hefty gains from Heritage Foods

We have to express gratitude to Vijay Kedia because investors who followed his advice and bought Heritage Foods are richer by 90% in just ten months.

On a YoY basis, Heritage Foods is up 143%.

‘Blowout Phase’ prediction also comes true

We also have to compliment Himanshu Gupta who put his trading skills to good use and correctly predicted that Heritage Foods is in a “blowout phase”.

In fact, Vijay Kedia himself gracefully acknowledged that Himanshu Gupta’s prediction was correct.

@Tradersschoice u were right

— Vijay Kedia (@VijayKedia1) September 17, 2016

More hefty gains are on the anvil from Heritage Foods

Heritage Foods is still a small cap with a market capitalisation of Rs. 2,133 crore. It is managed by the family of N. Chandrababu Naidu, the dynamic Chief Minister of Andhra Pradesh.

Research Report by Ventura Securities

Ventura recommended a buy of Heritage Foods in May 2016 on the basis that it is a “compelling opportunity to invest in the fast growing domestic consumption story”. Ventura also opined that Heritage Foods’ valuations are “extremely attractive, considering the heady valuation of its peers and the other consumption stocks”.

Ventura’s target price of Rs. 925 for Heritage Foods has almost been reached.

Research Report by Religare

Religare recommended a buy of Heritage Foods in December 2015 on the basis that the stock has “tremendous potential”. Religare’s target price has also long been breached.

We have to await a formal update of the increase in target price by the two brokerages.

Impact of divesting of retail division, and extent of re-rating, not considered

It is important to note that the brokerages have so far not factored in the impact of divestment of the loss making retail division by Heritage Foods. If there is really a re-rating as expected by Vijay Kedia, there may be more gains that can be harvested from the stock.

Parag Milk Foods – favourite of Ashish Kacholia and NK Agarwal

Parag Milk Foods, a small-cap with a market capitalisation of Rs. 2700 crore, has found favour with Ashish Kacholia and Narendra Kumar Agarwal. While Ashish Kacholia holds 14,27,443 shares, Narendra Kumar Agarwal holds 9,62,040 shares.

CHARTBUSTER- No look-back for Parag Milk Foods.Stock up 62% since listing, +50% in 1Mth. Limited history good moves! pic.twitter.com/lxVPGh2LIi

— Geetu Moza (@Geetu_Moza) July 13, 2016

Investors presentation by Parag Milk Foods

Parag Milk Foods has issued an impressive presentation which provides salient facts relating to the production and consumption of milk and dairy products in India. Details are also given about the Company’s past track record and its plans for the future.

Research Report by Motilal Oswal

Motilal Oswal has issued an initiating coverage report on Parag Milk Foods in which it points out that the opportunity size in Dairy is huge and in-turn offers strong growth visibility for branded players. Parag, with its strengths on procurement, distribution, and management bandwidth said to be the best placed among peers.

It is also pointed out that while the rest of the listed Dairy players are either regional in nature or have dominant B2B positioning, Parag offers a pan-national branded dairy play with B2C focus.

Prabhat Dairy

Edelweiss has recommended a buy of Prabhat Dairy on the basis that it will clock revenue/PAT CAGR of 17%/72% over FY16-18, with adjusted pre-tax RoCE of 15.1% (17.1% including incentives) in FY18. Edelweiss has opined that Prabhat Dairy can be valued at 18x FY18E EPS for a target price of INR144 in the light of its robust earnings visibility and strong growth in the organised dairy space.

Vivek Nirmal, JMD, Prabhat Dairy, explained that the USP of the Company is that it is the best amongst peers in terms of EBITDA margin because it makes around 9-10% of EBITDA consistently. He explained that the dairy sector is very different than other FMCGs because milk which is the major raw material has to be procured 365 days, twice a day. This makes the whole sector very challenging and companies need to have an integrated business model he said. He added that unless companies have a control over your milk procurement in terms of quality and quantity, they will not be able to get the advantage of pricing. He emphasized that Prabhat Dairy is established in the consumer good space, in terms of value added products like paneer, dahi, ghee, shrikhand, lassi, chach and cheese especially. Last year Prabhat Dairy set up the third largest cheese plant in the country and is already suppliers to lot of large chains as well as the food service segment.

View of Vikas Khemani of Edelweiss

Vikas Khemani of Edelweiss pointed out that consumption is going up as a big theme and that there is a shift from the unorganised to the organised. He also pointed out that the dairy industry is a $60 billion industry and that less than 20% is organized. This will change dramatically over the next 10 years as Indians consume more cheese, ghee, paneer and other value added products.

Vikas Khemani also opined that Parag Milk Foods and Prabhat Dairy are best placed to take advantage of the growth in the dairy market.

Kwality Ltd

Kwality was first recommended by Vineeta Mahnot of Hem Securities in June 2014 when it was languishing at a throwaway price of Rs. 40. At the CMP of Rs. 123, massive gains of 240% are on the table.

Latest research report on Kwality by Nirmal Bang

Nirmal Bang has issued an initiating coverage report on Kwality Ltd where it has recommended a buy on the basis that the Company is “on a strong profitability growth path”. It is claimed that business model transformation, expansion in EBIDTA margin, decline in working capital cycle and de-leveraging are the key value drivers which will lead to a re-rating in the stock.

| Stock | M Cap (Rs Cr) | CMP (Rs) | YoY Gains (%) | 3 Month Gains (%) |

| Hatsun Agro | 5110 | 335 | 18 | 2 |

| Heritage Foods | 2133 | 919 | 143 | 74 |

| Parag Milk Foods | 2727 | 324 | – | 28 |

| Prabhat Dairy | 962 | 98 | – | (15) |

| Kwality Dairy | 2896 | 123 | 73 | 14 |

Research Report on the dairy industry by Ambit Capital

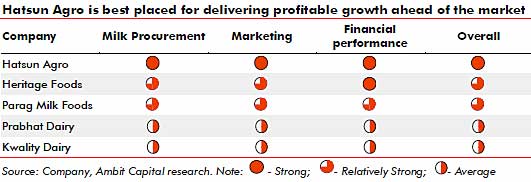

Ritesh Vaidya and his team at Ambit Capital have conducted a meticulous analysis of the dairy sector and of the stocks in it.

The report points out that fresh dairy products like liquid milk, curd, paneer, butter milk promise higher growth/ profitability as compared to other companies in the consumer sector. The report uses a competitive advantage framework to evaluate companies on their ability to expand direct milk procurement, product portfolio orientation towards fresh dairy products and distribution reach.

At the end of a meticulous assessment, Ritesh Vaidya and his team have reached the conclusion that Hatsun Agro with 2.5mn litres of daily milk procurement directly from farmers, portfolio focus on fresh dairy products and distribution reach across South India is best-placed amongst Indian dairy companies on our framework.

Conclusion

It is now an undisputed proposition that dairy stocks are going to sparkle and turn into multibaggers in the foreseeable future as predicted by all the eminent wizards. If we do not have dairy products in our portfolio, we have to take immediate remedial steps and choose one or more of the dairy stocks listed above. Then, we can also have a big smile on our face like the cat which got the cream!

I like the way you have tried to represent your thought. But also I would like to tell you that these stocks are quoting at extremely high valuations. Most of them are beyond 50 PE, which doesn’t make sense for a value investor to invest in these stocks, on the other hand, the milk market in India is highly unorganized, and the demand for the proper packaged, branded milk is increasing heavily. So, in the coming 10 years can become the real game changer for these co.’s. Looking at all the things, one can bet a little bit portion of their portfolio in this stocks.

Very true Mr. AP. I just know about the PE of Hatsun agro, and at these astronomical rates can’t think of investing. The opportunity might be there, but one is better off investing in stocks with cheaper ratios.

How these companies will tackle Amul?

Is there any reason of Hatsun being down from 500+ for last few months?

Hatsun PE at 85 right now. Is something very right about this stock or are people just crazy ? Are these PE justified for a dairy business ? Please can some informed investor help ?