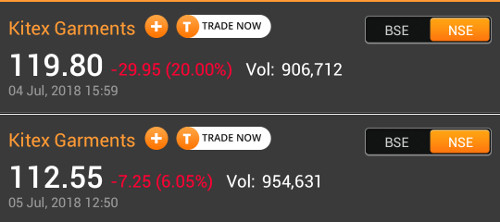

MMB Punters stay defiant despite Kitex Garments plunging 20%

“Sabu Jacob “intelligent fanatic” hai. Uska stock nahin dubega,” a middle-aged punter proclaimed in a defiant tone.

Several other punters at MMB nodded their heads vigorously in agreement.

“Though sentiment is in favour of shorters, Kitex may stun them towards fag end! Beware!!!” another punter observed.

“Basically there is no problem in kitek. The share value fluctuation is due to the operators game. By the coming election the share price is sure climb back to 700 levels,” yet another punter observed.

“Buy it now before it gets too late for you to enter the stock. Current Price 119, huge upside. No stop loss keep averaging on each fall,” another said.

The confidence in Kitex Garments is not confined to ill-informed novices and punters.

Even distinguished value investors endorse it.

Ocean Dial’s Gateway to India Fund (which is advised by Sanjoy Bhattacharyya, the doyen amongst value investors), has two such dubious stocks in its portfolio.

The first is Manpasand Beverages and the second is Kitex Garments.

With regard to Manpasand Beverages, blame for the collapse of the stock price was sought to be shifted on the auditors with the remark “Indian auditors may be adopting a stricter line than they have historically after one of the ‘big four’ audit companies fell foul of the regulator”.

With regard to Kitex Garments, the plunge in the stock price was rationalized as being due to “de-stocking as retailers react to competitive pressure from e-commerce players” and the “shut-down of Toys R Us”.

Prof Sanjay Bakshi, the authority amongst value investors, had written a detailed note on Kitex Garments titled “The Importance of Unconventionality” in which he heaped lavish praise on the stock.

Unfortunately, the note now appears to have been either deleted or moved.

As of 31st March 2018, the Prof’s ValueQuest India Moat Fund held 14,72,235 shares of Kitex Garments.

The present holding is not known.

Kitex Garments

VALUEQUEST INDIA MOAT FUND LIMITED Buys 2.65 lk shares at `443.1/sh@Sanjay__Bakshi— Varinder Bansal (@varinder_bansal) November 3, 2016

However, not all value investors were charmed by Kitex. Some like Ravi Dharamshi described it as a “mistake” and sensibly bolted before it could cause irreparable damage to his portfolio.

Have committed lots and lots of mistakes in my Investing career. Kitex hasn’t actually cost me anything. I have tried to keep my mistakes affordable. And never misled anyone into my mistakes. ??

— Ravi Dharamshi (@ravidharamshi77) May 21, 2018

Kitex Garments continues to plummet! A good example of how the past is just the past. It is what happens in the present that is an indicator of the future!

— Dr.C.K.Narayan (@CK_Narayan) May 21, 2018

Sabu Jacob is an “intelligent fanatic”?

Ian Cassel of Micro-cap Club is held in esteem by the intelligentsia because of his research on multibagger micro-cap stocks.

He has endeared himself to investors because of his theory that one can make a fortune of upto $50 million from micro-cap stocks even by investing petty sums of money.

There is no reason you can’t make $10 -$20 – $50 million or more starting with a very small amount of capital. https://t.co/UqAjwu0dYb

— Ian Cassel (@iancassel) March 11, 2017

He conferred the prestigious title of “intelligent fanatic” upon Sabu Jacob, the promoter of Kitex Garments.

Later today we will be posting our first intelligent fanatics of India case study on Sabu Jacob of Kitex Garments.

If you aren't a member, join here: https://t.co/1sxn4PYYTd pic.twitter.com/J0Le8ktBei

— Ian Cassel (@iancassel) March 8, 2018

This move met with vehement opposition from knowledgeable investors.

I'm a big fan of You and MCclub but I would strongly disagree with this choice Ian. I've Been an investor with Kitex in the past and followed it very closely. I'm sure you'll hear similar opinions in days to come.

— Niranjan Shetty (@ShettyNiranjan) March 8, 2018

Good luck with Kitex where sales/Profit/RoE is consistently decreasing……Management Quality is questionable….The first company you cover …

— Anil Bajpai (@anilbajpai) March 8, 2018

This tweet of yours @iancassel could possibly be preserved for posterity whichever the tide turns. @amitmantri will surely agree.

— varadharajan (@varadhar1) March 9, 2018

I agree he is a fanatic minus the adjective. U need a case study to understand his intelligence y he kept 250 crs cash in usd yielding 0% and served 120 crs Indian debt at 8-9%

— Darshit shah (@darshit_85) March 9, 2018

Ian – a basic Google search and forensic analysis will tell you that this a poor choice to highlight.

— Nalin Moniz (@nalinmoniz) March 8, 2018

Very very poor choice. Could never imagine that somebody like you would cover a company like this. It seems you are influenced by Prof Bakshi. Best of luck.

— StockResearch (@StockResearch12) March 9, 2018

Cooking books is one of the important quality of an intelligent fanatic ?

Or this is just an act of ego boosting ?— Harsh Saraswat (@harsh_jaipur) March 10, 2018

However, Ian Cassel stayed defiant. He claimed that Sabu deserves the prestigious title because of “how these leaders grew their business”.

We aren't picking stocks, we are analyzing how these leaders grew their businesses. It's unfortunate that some don't understand this.

— Ian Cassel (@iancassel) March 8, 2018

In hindsight, the decision to knight Sabu Jacob ought to have been reconsidered given the serious allegations (albeit unproved) levelled against him and Kitex Garments in the valuepickr forum and by knowledgeable experts as far back as in 2015 & 2016. (see Prof Sanjay Bakshi’s Fav Stock Falls From Grace Even As ValuePickr Forum’s Ominous Warning Rings True).

Kitex Garments – A house of cards whose crash should not come us a surprise https://t.co/Ly3hycHSRH

— Amit Mantri (@amitmantri) July 31, 2017

This is with the cash on book in forex snake oil story still having believers. God knows when that cult will collapse.

— varadharajan (@varadhar1) August 1, 2017

Kitex mgt attributes postponement of orders due to US elections! Any link between kids garments and US elections?

— Jagdesh (@cjrsaaketa) November 3, 2016

They seemed to be convincing equity investors more, not their customers 🙂

— Jagdesh (@cjrsaaketa) November 3, 2016

#kitex garments – Pathetic set of numbers. Wonder why is Sanjay bakshi still holding on to it. He has to jump out of the ship soon.

— Lalit (@lalitinvestor) May 2, 2017

We will have to see whether Ian Cassel now strips Sabu Jacob of the title of “Intelligent Fanatic” or still stays defiant that his judgement is right.

Change in auditors implies that all is not well with the accounts?

M/s Varma & Varma, the distinguished auditors of Kitex Garments, received a generous fee of about Rs. 20 lakh in FY 2017-18 for auditing the accounts of the Company.

In the previous FY 2016-17 the fee was only about Rs. 8 lakh.

So, prima facie, there was no provocation for M/s Varma & Varma to unceremoniously put in their papers and make way for another firm of CAs named MSKA & Associates.

While M/s Varma & Varma maintained a stony silence on the reasons for their resignation, Sabu Jacob claimed that the Company had decided to go for a “much better firm” of CAs in view of some international expansion plans.

Latha Venkatesh and Sonia Shenoy, both of whom are seasoned business journalists, did not appear convinced by Sabu Joseph’s explanation if one goes by their body language.

Kitex Garments has appointed a new auditor after the previous auditor showed an unwillingness for reappointment. Watch Sabu Jacob, Chairman & Managing Director Of Kitex Garments in a #CNBCTV18Exclusive conversation with @CNBCTV18Live’s @latha_venkatesh @_soniashenoy pic.twitter.com/yA1eyaQuOg

— CNBC-TV18 News (@CNBCTV18News) July 5, 2018

Auditors are “running scared” and dumping dubious clients

In the recent past, we have seen auditors in three companies, namely Vakranjee, Manpasand and Atlanta, relinquishing their positions in a hurry.

3rd listed co in a row where Auditors have resigned-Vakrangee, Manpasand & now Atlanta Ltd.

Underlines very little tolerance for even the slightest whiff of doubt. Take no risk-no chances approach! @BTVI @Geetu_Moza @stockgurupiyush @ShailDamania @SEBI_India @theicai @PwC_IN pic.twitter.com/00pnIBlf6W— Siddharth Zarabi (@szarabi) May 30, 2018

Dilip Buildcon is also reeling under the suspicion that it is the “next Vakranjee” and that the auditors are putting in their papers.

Dilip Buildcon's Rohan Suryavanshi clarifies rumours regarding the company auditors resigning. pic.twitter.com/5koteeWQu8

— BloombergQuint (@BloombergQuint) May 30, 2018

8K Miles Software also plunged like a stone over auditor worries.

#OnCNBCTV18 | Not facing any auditor issues; Will be reporting Q1 results on time says 8K Miles pic.twitter.com/rH9JLtxWPu

— CNBC-TV18 (@CNBCTV18Live) July 3, 2018

Has this ever happened? Rarely

It is uncommon for auditors in India to resign halfway through an audit.

On Apr. 27, Price Waterhouse & Co resigned as auditor of Vakrangee Ltd.

On May 26, Deloitte Haskins & Sells resigned as auditor of Manpasand Beverages Ltd.The change

— #RenukaJain, FCA ?? (@RenukaJain6) June 30, 2018

The seminal question as to why auditors are suddenly developing cold feet and are exiting in a hurry has been answered by Aashika Suresh and Saket Sundria of Bloomberg.

The duo has pointed out that auditors in as many as 30 listed companies have abruptly resigned in the first five months of the year.

It is claimed that these departures are because the regulators are cracking down on governance lapses and outright corporate fraud, as part of Prime Minister Narendra Modi’s efforts to recast the image of Asia’s No. 3 economy as a corruption-free place to do business.

#Satyam case fallout | Market regulator @SEBI_India bans @PwC entities from auditing listed entities for two years. More details on #Sebi ban on Price Waterhouse Network here: pic.twitter.com/14WeEzySmA

— ET NOW (@ETNOWlive) January 11, 2018

It is also stated that because of an amendment in the law, the entire firm can be held guilty of misconduct because of the misdeeds of a single partner.

This makes it impossible for auditors to tolerate the shenanigans of their clients and to look the other way while the books are being cooked.

Conclusion

Obviously, it is beyond our intellectual competence to comment on whether Sabu Jacob is really an “intelligent fanatic” or whether Kitex Garments is a “House of Cards”. The limited takeaway is that it is better to hit the exit button at the first sign of trouble. There is no point in being defiant and holding onto such stocks specially when there are several other fish waiting for us in the pond!

Good article pointing out fraud managers. Very disappointing management from the owner.

I can only recommend TCI Express and Suven and Suprajit. Good management and great prospects.

At least I was sure, what will happen to Kitex Stock, I had discussed that many times in this forum.

Teaching Note on Unconventionality – Alpha Ideas

PDFalphaideas.in › uploads › 2014/12 › Teac…