In August 2015, when the stock markets had cracked viciously over fears of a meltdown in China, the experts had rushed in to advise that investors should take advantage of the situation and buy stocks aggressively (see Forget China & Get Ready To Make Mega Bucks From Mega Rally: Ace Technical Expert).

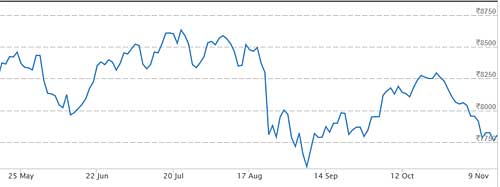

This worked as per plan because after touching a bottom of 7558 on 7th September 2015, the Nifty zoomed to a high of 8259 on 23rd October.

This means that in just 7 weeks, the Nifty spurted a magnificent 9.27%. Individual stocks obviously gave a much higher return.

The story is repeating now. From the high of 8259 on 23rd October, the Nifty is now (16th November) at 7806.

This means that in just 3 weeks, the Nifty has plunged 5.48%.

Anuj Singhal, markets editor of CNBCTV18, has systematically analyzed the situation. He claims that the markets are in “oversold zone” and are a “ripe for a 100-200 point bounce”. He predicts that the Nifty could surge to 8000 in the next few days/ weeks.

The same opinion was expressed by Andrew Holland of Ambit Capital. He opined that “India markets hugely oversold now”.

India markets hugely oversold now

— Andrew Holland (@Hollaand) November 16, 2015

It may be recalled that Andrew Holland has already predicted that the Nifty would surge to 10,000 levels by the end of the year. His prediction caused a controversy because his colleague, Saurabh Mukherjea, predicted that the Sensex would plunge to a level of 22,000 by the same time.

Rajat Sharma of Sana Securities is also of the same view as Andrew Holland. “Market is in a super oversold scenario …. expect a 10% upside in under 6 months” he tweeted.

Market is in a super oversold scenario….expect a 10% upside in under 6 months.

— Rajat Sharma (@SanaSecurities) November 16, 2015

It may be recalled that Rajat Sharma had earlier confidently predicted that Tata Motors is a “screaming buy”. On that day (1st October), Tata Motors was at Rs. 297. Today, it is at Rs. 400, notching up magnificent gains of 35% in just 6 weeks.

Ajay Bagga, fund manager, is also gung ho that the markets will see a sharp bounce. “Technically market looking oversold; Markets not frothy at all” he was quoted as saying by Bloomberg.

Now, the important question is about the stocks to buy.

The prediction by Vijay Kedia a few days ago that NAMO’s shameful defeat in the Bihar elections will prod him to ensure that the GST Bill is passed by Parliament appears to be coming true.

Today, there was great excitement in the air over the statement of Finance Minister Arun Jaitley that Government would “make all efforts to persuade the opposition for the passage of Constitution amendment bill for implementation of GST in the winter session”.

This was reciprocated by the Congress stating that there is “room for compromise” with the Government. The top brass was quoted as saying:

“there was room for a compromise on the GST Bill and there was a possibility of thrashing out the genuine concerns the principal opposition had to the crucial tax reform legislation.

Unlike the land Bill where we had decided that there would be no compromise, there is room for a compromise on the GST Bill. We have concerns which can be talked out.”

So, we have to be ready for the eventuality that Vijay Kedia’s prediction will come true by loading up on top-quality GST-sensitive stocks like TCI, Gati, Century Ply etc, etc. We will then have a chance to bask in great riches if the GST Bill does get passed!

it is saurabh mukherjea and not upadhyaya at Ambit Capital

Thanks. Corrected.

Nope. It is not true. Nifty will take support only at 6109.86.