After inducing novices to clone, Mohnish Pabrai counsels them not to be “blind cloners”

Today, the pendulum has swung to the other extreme.

At one time, Mohnish had to coax novice investors to clone the stock picks of the wizards.

Now, he has to warn them of the risks of blind cloning.

Mohnish talked extensively about the concept of cloning in a talk that he delivered on 22nd August 2012 at the UC Davis’s MBA Value Investing class.

Mohnish gave some fine examples on how copying the moves of successful people is a good way to make progress in life.

Example 1: petrol pumps

Mohnish cited the example of two petrol pumps which were opposite each other. While the first one was flourishing, the other was languishing.

The secret of the first one’s success was that it gave its customers little freebie services at random. This created affection and loyalty amongst the customers and they would go out of the way to get their cars serviced by it.

The second petrol pump owner saw the technique of the first but still did not bother to copy it. He thought the technique would not work over long periods of time.

Yet, the first petrol pump prospered immensely over the years while the second owner suffered.

“If you run a business, you can tell your competitors all the secrets of how you make money etc but they will still not copy your methods,” Mohnish said, with wonderment in his voice at the naivety of people.

Example 2: Billionaire Sam Walton, the founder of Walmart

Some of the biggest businesses in the world are built on the concept of cloning, Mohnish said.

He cited the example of Sam Walton of Walmart who built a multi-billion dollar business by copying what other retailers like Sears did and increasing the scale.

Sam Walton was obsessed with what his competitors were doing and implemented their concepts and ideas if it appealed to them.

“There is nothing innovative that Sam Walton did whilst building an empire,” Mohnish said with admiration at the Billionaire’s ability to clone.

Example 3: Microsoft

Even Microsoft, the World’s biggest software producer of famous products like ‘Windows’, is a cloner, Mohnish said.

“Microsoft is not even a good cloner, it takes them four or five versions to get a product right,” he added with a chuckle.

“In spite of being a poor cloner, they have done well and made Billions,” he said to underline the enormous benefits of cloning.

Imitation is the Sincerest Form of Flattery – A study on cloning Warren Buffett’s picks

“Instead of tearing your hair out trying to find stocks to buy, just buy what the great investors are buying,” Mohnish said @18.00.

Mohnish referred to a study by Gerald Martin and John Puthenpurackal titled “Imitation is the Sincerest Form of Flattery” in which the duo has analyzed what the results would have been if an investor had bought the same stocks that Warren Buffett had bought and sold them after Buffett had sold them.

The researchers found that even the most inefficient investor who bought at higher prices, and sold at lower prices, than Buffett’s buying and selling prices would have outperformed the benchmarks by a wide margin.

This proves conclusively that cloning works and works well, Mohnish said with a big smile on his face.

I am a “shameless cloner”

“Most of the picks of Pabrai Funds have come from some other investor. I am what you would call a “shameless cloner”, Mohnish said @18.45, much the merriment of the audience comprising of young students.

(Mohnish Pabrai in the distinguished company of Rajiv (Dolly) Khanna & Porinju Veliyath)

Warning! Never buy a stock without doing your own research

Novices have taken Mohnish Pabrai’s advice to heart and are indulging in rampant cloning.

They are buying stocks left, right and center, without any application of mind, only because some illustrious investor has bought it.

This sorry state of affairs has alarmed Mohnish and he has now rushed out a warning.

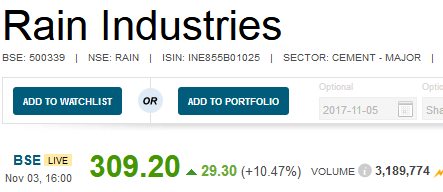

“Never buy a stock without doing your own thorough research. I’d never buy a stock even if Buffett recommended it to me without doing the work,” Mohnish said in a stern tone in response to a query whether Kolte-Patil, one of his portfolio picks, is likely to walk on the same path as the illustrious Rain Industries and shower massive riches on investors.

Never buy a stock without doing your own thorough research. I'd never buy a stock even if Buffett recommended it to me without doing the wrk https://t.co/Ed6vDTnkh8

— Mohnish Pabrai (@MohnishPabrai) November 5, 2017

Mohnish explained further that the concept of cloning is merely a “starting point to begin an intense drill down”. The ideas of other people have to be used as a “starting point for intense research”.

Sir what about ur earlier views like shameless cloner and betting on stocks which is mostly held by top investors as u said they know more than anyone else.

— Bimal B (@bairagya_b) November 5, 2017

It is a starting point to begin an intense drill down. I use other people's ideas as a starting point for intense research. https://t.co/b0H94r79st

— Mohnish Pabrai (@MohnishPabrai) November 5, 2017

Mohnish you clone shamelessly but only after validation thru your research I suppose ?

— Valupickerr (@valupickerr) November 5, 2017

Exactly! https://t.co/qLKiIfadKI

— Mohnish Pabrai (@MohnishPabrai) November 5, 2017

He advised investors to scout for stock ideas by watching TV.

Turn on @ETNOWlive @CNBCTV18Live or @BloombergQuint and you'll have an unlimited supply of recommended stocks to study.

— Mohnish Pabrai (@MohnishPabrai) November 5, 2017

But if Mohnish has already done “intense drill down research” do novices have to do it all over again?

A wit, who prefers to remains anonymous, asked that if Mohnish has already done “intense drill down research” and given the all-clear signal to a stock, would it not be pointless and counter-productive for a novice to do the research all over again.

Of course, the comment was made in jest. Mohnish’s core point is that novices have to develop self-conviction in the stock.

Cloning Mohnish and Dolly Khanna in Rain Industries would have given us up to 985% gain

It goes without saying that we have to follow Mohnish Pabrai’s advice against “blind cloning” in the same obedient manner in which we have cloned his stock picks.

It is unbelievable that since I first reported Mohnish’s purchase of Rain Industries in April 2015, the stock has given an eye-popping 985% gain.

Even if we had bought the stock after it was reported that Dolly Khanna bought the stock in July 2017, gains of 168% are on the table.

In fact, even after the announcement of the increase in stake by Dolly Khanna, the stock is up nearly 75%.

Rain Industries has “enduring tailwinds” and target price of Rs. 615 in “Bull case”: Motilal Oswal

Now, the best news is that it is still not too late for us to join Mohnish and Dolly because Motilal Oswal has issued an initiating coverage report in which it has recommended a buy.

The logic is quite compelling:

“Rain Industries (RAIN) is the second largest carbon product supplier to the aluminum industry. Its carbon segment contributes 80% to consolidated EBITDA. Its chemicals segment converts coal tar distillates into resins, modifiers, aromatic chemicals, superplasticizers, etc. It also operates a 3.5mt cement plant in southern India and sells cement under the Priya brand.

Enduring tailwinds

Re-rated, yet attractive

– RAIN is riding tailwinds, triggered by supply disruption in China, which are driving margins and volume growth. We expect these tailwinds to last for 2-3 years, enabling EBITDA/PAT CAGR of 24%/50% over CY16-19.

– RAIN has been generating strong FCF and rewarding shareholders with dividends and buybacks. We believe it will continue to do so.

– The stock has been re-rated on change in business dynamics. Yet, our price target of INR362 indicates 33% upside. We initiate coverage with Buy.

Dual benefit of demand growth and supply shock driving CPC prices Calcine pet coke (CPC) production is hurt in China after the government’s firm action in 2017 to contain pollution. As a result, China has turned a net importer of CPC. Simultaneously, aluminum production is set to grow outside China – many smelters in North America and Europe are restarting. The dual benefit of demand growth and supply shock is driving up global CPC prices.

CT pitch market has stabilized on capacity cuts in key markets CT pitch (CTP) has been oversupplied for many years in RAIN’s key markets due to declining aluminum production. Consequently, there have been many shutdowns. Koppers, the largest producer of CTP in the world and a key competitor, has closed seven plants in the last 2-3 years. This has resulted in supply correction and improved utilization. The industry is now running at 80- 90% utilization and margins have stabilized. As aluminum production starts to recover on expected restart of smelters, demand and margins will expand.

Investing in high IRR organic growth projects RAIN has decided to set up a 370ktpa CPC kiln at a capex of USD65m near Vizag to meet strong growth in demand from Indian smelters. It is also investing USD17m in debottlenecking of petrochemical feedstock distillation by 200kt in Europe. Both projects are scheduled for completion by March 2019 and short payback period of 2-3 years should drive remunerative volume growth.

Value the stock at INR362/share – 33% upside; initiate with Buy After trading at low single digit PE for very long period, RAIN has finally got re-rated on visibility of margin expansion and growth driven by multiple enduring tailwinds and multiple competitive advantages. Although stock has run up sharply, the valuations are still reasonable. We value the stock at INR362/share – 33% upside, based on SOTP (Exhibit 19). We initiate coverage with a Buy.”

Motilal Oswal has also predicted a ‘Bull case’ target price of Rs. 615 and a ‘Bear case’ target price of Rs. 214.

If the ‘Bull case’ does come into being, we are talking of 100% gain from the CMP of Rs. 309.

Mohnish himself predicted 4x gain from Rain Industries

Motilal Oswal’s Bull case target price of Rs. 615 may not be far fetched because Mohnish Pabrai himself predicted that the stock has the potential to give magnificent 4x gain.

His precise words were as follows:

“I put 20 million of Pabrai Funds into the Company (Rain Industries). It is now worth north of 50 million. I think we will probably get 100 million or even 200 million out of it,” Mohnish said (@ 53).

Mohnsih was addressing the students of UCI Paul Merage School of Business in the University of California.

Conclusion

While Mohnish’s warning against ‘blind cloning’ is timely and has to be diligently followed by novices, we shouldn’t go into a shell and close our eyes to all stock ideas. Instead, we have to have a judicious balance between cloning and application of mind and ensure that we buy only those stocks in which we are able to develop conviction!

One get courage to put big bets and conviction to hold only when he studies the stock himself. One can not make money with borrowed knowledge.

very important and well said, no matter how much a person clones, he will not be in a position to stay invested unless conviction is built to stay longer and understand reasons for rerating.

porinju owned EQUITY INTELLIGENCE INDIA PRIVATE LIMITED [P M S] bought 2.0 Lac shares of PDS Multinational Fashions Ltd at average price Rs 260.76 On 08 Nov,2017