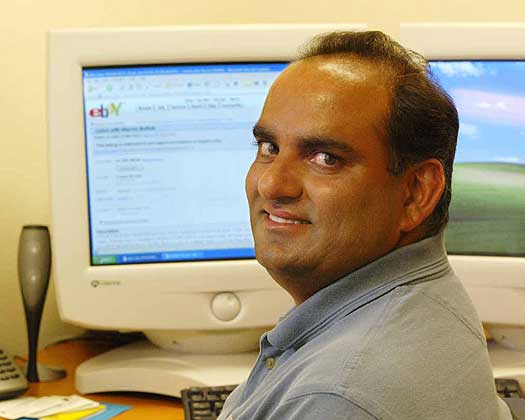

Mohnish Pabrai latest portfolio

First, as per hallowed tradition, we have to peep into the latest portfolio of Mohnish Pabrai to check whether the gains are rolling in thick and fast.

| Company | No of Shares (in Lakhs) | Rs Crore | YoY Gain (%) |

| Rain Industries@ | 290.13 | 303 | 200 |

| Sunteck Realty | 10.74 | 48 | 92 |

| Balaji Amines | 6.07 | 20 | 28 |

| Kolte-Patil Developers | 10.86 | 19 | 33 |

| Total | 390 | 353 | |

| Simple average return | 88 | ||

(@ 162.55 lakh shares (worth Rs. 170 cr) are held by Pabrai Investment Fund 3 Ltd. 127.58 lakh shares (worth Rs. 133 cr) are held by The Pabrai Investment Fund II LP)

As one can see, Mohnish is raking in big bucks hand over fist.

It is also notable that Mohnish runs a tight ship with only four high-conviction stocks in the portfolio.

Rain Industries is the crown jewel of the portfolio with a massive allocation of Rs. 303 crore, which comprises 78% of the total AUM.

The stock has richly rewarded Mohnish with a mind boggling YoY return of 200%.

Sunteck Realty has also put in a spirited performance with a hefty gain of 92%.

The other stocks, being Balaji Amines and Kolte-Patil Developers, have also earned their keep by contributing in a meaningful manner to the welfare of the portfolio.

The simple average return from the portfolio of four stocks is 88%, which is incredible by any standards.

Only Dolly Khanna has been able to match this awesome record with a simple average return of 91% from her portfolio.

Of course, Mohnish will be the first to admit that even he is no match for Dolly’s awesome stock picking skills.

Best stocks to buy from Mohnish Pabrai’s portfolio

Now, we have to turn to the pleasurable activity of deciding which of the stocks we should piggy-back on.

For this, we have to rely upon the research reports of leading experts, which have conducted a meticulous analysis of Mohnish’s stocks.

Buy Rain Industries for a target price of Rs. 139: IDBI Capital

Nobody can dispute that the wizards at IDBI Capital have an in-depth understanding of the workings of Rain Industries.

In December 2016, when the stock was languishing at the throwaway price of Rs. 54, IDBI Capital recommended a buy for the target price of Rs. 82 (51% upside).

The target price was laughable because Rain Industries took it out within no time and surged to an all-time high of Rs. 123 on 4th May 2017.

It is high time we take IDBI Capital’s recommendations seriously.

In the latest report, they have recommended a buy with the target price of Rs. 139.

As always, the logic is flawless:

“Rain’s consolidation and restructuring efforts (over CY13-15) and improvement in demand for its Carbon Product segment has resulted in strong operating and financial performance in the last four quarters. We believe rising demand for CPC and CTP are likely to drive strong improvement in profitability and improve the credit profile of Rain. We expect further margin improvement in during 2QCY17 and 3QCY17 (seasonally strong quarters). We raise our target price from Rs103 to Rs139 and maintain our BUY rating.”

Buy Sunteck Realty for target price of Rs. 570: ICICI-Direct

Daljeet Kohli was the first discoverer of the potential of Sunteck Realty.

He recommended a buy in September 2016 when the stock was at Rs. 228 and promised a target price of Rs. 358.

At the CMP of Rs. 444, Daljeet’s target price is a forgotten memory.

ICICI-Direct has now picked up the gauntlet and issued an initiating coverage report in which it has assured a target price of Rs. 570.

The logic cannot be faulted:

“Sun(teck) set to rise!!!

Sunteck Realty (SRL) is a Mumbai based real estate player with development potential of ~23 mn sq ft (msf) spread across 24 projects and four rented assets. Out of this, SRL enjoys strong cash flow visibility from its completed and ongoing projects (4.24 msf). We expect SRL to generate Rs 3311 crore from these projects over the next few years. The completed projects in BKC along with ongoing projects in Goregaon coupled with comfortable leverage (debt-equity at 0.53x) lend us comfort on the valuation and growth prospects. We initiate coverage on SRL with a target price of Rs 570 (0.9x FY19E NAV).”

Axis Direct has also woken up to the potential of Sunteck Realty and recommended a buy with a target price of Rs. 503:

“Strong Q4; positive cash flow outlook

Despite demonetization, Sunteck Realty (SRL) reported strong performance during rest of the year with pre-sales up 17% YoY and collections up 12% YoY. The company generated strong operating cash flow which helped in reducing debt by ~Rs 3 bn at ~Rs 8.5 bn (net D/E of 0.47x) in FY17. Management targets to lower debt to ~Rs 5 bn.

We expect operational performance to improve in FY18 on (1) improved traction at BKC projects (all three projects are now complete), which can drive collections and (2) launch of Avenue 3– smaller ticket size than Avenue 2 and thus should receive strong response. We increase our pre-sales assumptions to factor in fading impact of demonetization. We also roll forward our valuation to arrive at our revised TP of Rs 503 (vs. Rs 329 earlier).”

Buy Balaji Amines for target price of Rs. 485: Nirmal Bang

Balaji Amines has the unique distinction of being the favourite of several notable investors such as Porinju Veliyath, Ashish Chugh and Shyam Sekhar.

While Ashish Chugh has pocketed massive gains of 739% from the stock, Porinju Veliyath has gains of 339% to his credit. Shyam Sekhar is believed to have similar hefty gains to his credit from the stock.

According to Nirmal Bang, Balaji Amines is a must-buy for our portfolio. The rationale is as follows:

“For FY17-19E we expect the sales of Balaji Amines to grow by 16% and PAT by 24% (as interest cost is likely to come down and with no major capex lined up depreciation is likely to be stable at current levels). BAL is leading amine player and enjoys handsome market share in its basket of products. It is consistent dividend paying company. We maintain our positive outlook given the improvement in ROCE and ROE with positive free cash flow. We recommend BUY on the stock for price target of Rs 485 (12x FY19E).”

Buy Kolte-Patil Developers for target price of Rs. 195: HDFC Sec

HDFC Sec has summarized all the salient points of Kolte-Patil Developers in a succinct manner and recommended a buy:

“Strong recovery

Kolte Patil Developers Ltd. (KPDL) delivered strong 4QFY17 revenue growth of 62.5% YoY. Outperformance was led by Life Republic, Mirabillis and Corolla projects. The impact of demonetization seems to be largely behind with KPDL pre-sales rebounding 72% QoQ to 0.55mn sqft (last 12 quarters average run-rate).

KPDL achieved 2mn sqft of pre-sales during FY17 and in base case expects similar run-rate during FY18E. Uncertainties around new launch approval (~4.5mn sqft) timeline under RERA remain key unknown. Hence, KPDL has not given any formal pre-sales guidance for FY18E.

KPDL with 70% of launch portfolio (~7.5mn sqft) under LIG/MIG segment will be key beneficiary of Government affordable housing stimulus. This shall result in strong pre-sales recovery from FY19E. We upgrade KPDL to BUY from NEU, increase NAV based TP to Rs 195/sh (vs Rs 177/sh earlier).”

Conclusion

Piggy-backing on the broad shoulders of the eminent stock wizards and cloning their stock picks has proved to be a very profitable exercise for novice investors. No doubt, we have to take advantage of the situation and make hay while the sun shines!

Dear Sir,

I am having following stocks.

(1) Krbl ltd. (2) Shriram transport (3) Chemfab Alkalies

(4) Camphor and Allied Products (5) H I L. (6) Ambuja Cement. (7) Vidhi Specialities foods Ltd (8) Gujarat Intrux Ltd. (9) E C E Industries Ltd.

(10) Fiberwab india Ltd.

Kindly let me know if any of these stock could be double in a year or so.

Thanks,

Rajesh Patel

If he knew will he not buying. Do your research and validate your rational..

Does portfolio percentage allocation, diversification etc applicable only to novice investors ? sigh!!

These are just his Indian holdings.

In may you reported Piramal enterprises as Mohnish pabris recommended stock. Whereas it does not reflect in his holdings. Has he sold off after recommending it?

Rain Industries, a great cyclical play, languishing at 30-35 till last year was a no brainer. I bought.

He is holding Rain for more then 2 years, previous years this stock did not moved much