Dalal Street spooked after Indices plunge

Yesterday’s savage crash in the Indices spooked everyone.

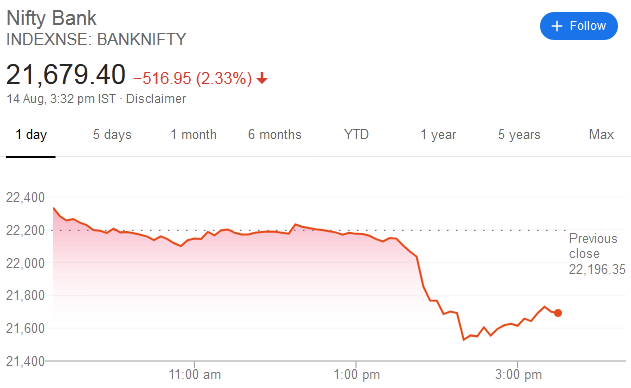

The Nifty suddenly plunged 122 points (1.08%) while the Bank Nifty nosedived 517 points (2.33%).

“Mereko lagta hai ke solid crash aanewala hai,” Mukeshbhai muttered, struggling to control his emotions and keep his eyes dry.

“Sab stocks bech ke bhaag jaate hain,” Jigneshbhai added.

Sanjiv Bhasin, the veteran investor, confirmed that the fears of the two stalwarts is correct.

“At 11,300 there is greed written across the screen,” he opined.

“There is a 500-point correction waiting to happen and that will differentiate the men from the boys,” he warned in an ominous tone which sent a chill down the spine of marketmen.

“We have short positions on Nifty and Bank Nifty,” he added, implying that the time is ripe to load up on Puts.

Sanjiv Bhasin’s advice cannot be taken lightly because he has so far been reading the markets correctly.

In February 2020, when the Nifty had plunged to an all-time low of about 8300, he had advised us to aggressively “buy the fear“.

Overriding global fear seeing stocks get cheap… watch out for 2nd half of March—- could see sharpest rally globally & locally-Buy the Fear for sweetest April rebound ?

— sanjiv (@sanjiv_bhasin) February 27, 2020

No doubt, the advice was brilliant because the NIFTY thereafter surged like a supersonic rocket and showered mammoth gains on the few brave-hearts who had “bought the fear“.

He also recommended that we buy blue-chip stocks like Ashok Leyland, BEL, Bharat Forge etc at the depths, which have showered hefty gains.

u always rock sir and u r among very few whom we can trust.god bless. https://t.co/qJBNVQut6F

— SURI RAWAT (@surisince1984) August 13, 2020

Some astute investors were also able to profit from the shorts.

@sanjiv_bhasin thank you so much sir,

aapne bola nifty niche jane wala hai be carefull then i got a buying on nifty put 11300 at 60 then 214 exit (20lot )

RS 2.10 LAKH THANK YOU A AGIN ?✌️— MR.shubham kusundal (@ShubhamKusundal) August 14, 2020

Stocks with 10% dividend yield are a “screaming buy”

Sanjiv Bhasin made it clear that the correction is not something to be afraid of but has to be welcomed because it again gives us a chance to scoop up stocks.

“The process of correction is inevitable and it will be very healthy for the market …. and that is what we will again utilise to buy,” he said with a comforting smile.

As to the stocks which are a good buy now, he advised that we stick to the blue-chip PSU stocks which are still quoting at beggarly valuations and offering a hefty dividend yield.

“I have been whole hog saying that PFC, REC at 10% dividend yield were a scream. We still think the stocks can give you a 50% upside. A lot of the re-rating is on some of the PSUs. PFC and REC have come out with stellar numbers. Both the companies gave a profit of Rs 12,000 crore. They trade at a PE of 2 on a dividend yield of 10. BEL has been a star. Hindustan Aeronautics is now starting to rev up after putting up a disastrous show,” he stated.

He also advised that we buy stocks which have been laggards so far because they are likely to catch-up with the rest of the market.

Some of these stocks are NBCC, IDFC First, Federal Bank etc, where there is earnings visibility and also valuation comfort.

“Be with the firmer names where you can see visibility going forward into the next one-two years,” the veteran rightly advised.