For some reason, Porinju wanted to keep his purchase of Nirvikara Paper Mills (now known as Balkrishna Paper Mills) a top-secret. That is perhaps why he chose to purchase his first lot in the name of an obscure company called “Honey Bricks Property”. However, Porinju was not successful in keeping his purchase under wraps because the sleuths of ET and CNBC, who are renowned for their alertness and sharpness, immediately let the cat out of the bag by letting the whole World know that Honey Bricks was Porinju’s investment arm.

More than 100% gains in about a month

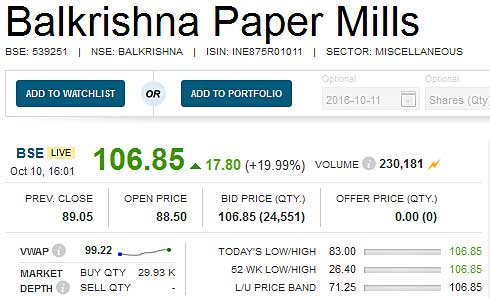

The absolutely astonishing aspect is that in the 40 days that have elapsed since Porinju bought Nirvikara Paper, the stock is up by more than 100%.

In fact, Porinju bought his first tranche of 69,366 shares at Rs. 49.59 on 29th August 2016. At the CMP of Rs. 106, gains of 113% are on the table. The second tranche of 1,50,000 shares was at a higher price of Rs. 56.99 each.

The stock surged a magnificent 20% yesterday.

All paper stocks are surging on hopes of a turnaround in fortunes

The more astonishing aspect is that the surge is not confined to Balkrishna Paper Mills. Instead, all paper stocks are surging like rockets.

The Business Standard pointed out that almost all paper companies stocks such as Kuantum Papers, Seshasayee Paperand Boards, Malu Paper Mills, Emami Paper Mills, Pudumjee Paper Products, Ruchira Papers, International Paper APPM, Star Paper Mills, Nath Pulp & Paper Mills etc were either locked in upper circuit or registered hefty double digit gains.

| COMPANY | LATEST | 52 WK HIGH | PREV HIGH | PREVDATE |

|

BALKRISHNA PAPER |

85.40 | 90.70 | 88.80 | 16-Sep-16 |

|

EMAMI PAPER |

100.35 | 100.35 | 87.00 | 06-Oct-16 |

|

INTERNAT. PAPER |

331.70 | 349.00 | 344.00 | 27-Jul-16 |

|

JK PAPER |

76.65 | 78.60 | 74.10 | 06-Oct-16 |

|

KUANTUM PAPERS |

393.00 | 393.00 | 354.85 | 07-Sep-16 |

|

KUSHAL TRADELINK |

209.90 | 210.60 | 210.15 | 06-Oct-16 |

|

MALU PAPER |

29.90 | 29.90 | 29.50 | 31-Aug-16 |

|

N R AGARWAL INDS |

201.50 | 208.90 | 192.00 | 06-Oct-16 |

|

RAMA PAPERMILLS |

21.00 | 22.05 | 21.89 | 26-Sep-16 |

|

RUCHIRA PAPERS |

105.80 | 108.70 | 99.00 | 06-Oct-16 |

|

SAFFRON INDUS. |

9.12 | 9.12 | 9.12 | 06-Oct-16 |

|

SESHASAYEE PAPER |

614.90 | 614.90 | 543.45 | 03-Oct-16 |

|

SH. KARTHIK PAP. |

7.00 | 7.00 | 6.72 | 06-Oct-16 |

|

SHREYANS INDS. |

80.00 | 80.50 | 75.10 | 26-Jul-16 |

|

STAR PAPERMILLS |

115.50 | 115.50 | 113.65 | 26-Aug-16 |

|

T N NEWSPRINT |

364.05 | 367.55 | 359.00 | 06-Oct-16 |

|

WEST COAST PAPER |

125.20 | 128.45 | 125.00 | 06-Oct-16 |

Business Standard explained that paper mills have reported a sharp increase in their profitability in the April-June 2016 quarter (Q1FY17), indicating a turnaround in their fortunes after three years of low margins.

Investors are expecting that the companies will report strong earnings growth in the July-September 2016 quarter (Q2FY17) as well.

It is also believed that the rising demand of writing and printing paper, coupled with a fall in raw material prices will boost the profit margins of the paper mills.

Paper stocks are a “screaming buy” now

S. P. Tulsian, the veteran stock picker, conducted an expert analysis of the phenomenon that has gripped the market. He opined that some stocks such as Seshasayee Paper, International APPM and TNPL are “excellent companies” and may still constitute “screaming buys”.

Tulsian did, however, caution that in the case of companies such as Malu Papers, the valuations may have gone out of hand and investors should exercise caution. He advised investors to approach paper stocks with a “cool mind” and not get carried away.

Investors can still expect to make “Crazy Returns” from trading in paper stocks: Parag Thakkar

Parag Thakkar of HDFC Securities explained that the optimism for paper stocks is founded on the basis that several global paper companies have shutdown their operations. So, not only is there is no risk of oversupply, but there is robust demand for paper. He also explained that there is too much liquidity chasing too few stocks.

Thakkar expressed optimism that more gains can be harvested from paper stocks in the short-term from a trading perspective.

“It can give you a 50% rise in one week. That is a crazy return for a retail investor” he said.

Shut down by BILT has resulted in shortage of supply?

Some knowledgeable investors opined that the shut-down of two paper plants by Ballarpur (BILT) may have caused a shortage of supply and resulted in an increase in prices.

PAPER -Steep Price hikes seen in Paper Industry-Paper prices up 10%in last 1 month on shutting down of 2 plants by BILT. pic.twitter.com/iM5xF7heWK

— Rakesh Laroia (@r_laroia) October 6, 2016

Will Porinju cash in on the big bucks or hold on for more gains?

Now, the million dollar question is whether Porinju will encash the massive gains that have effortlessly come his way or he will hold on for more gains.

Common sense dictates that when a stock surges in such a vertical trajectory, it is bound to give up a lot of those gains sooner than later and one should cash in before that. Whether Porinju follows the common sense path or whether he will carve his own path requires to be carefully watched!

I dont think the big guys wants to keep their purchase a secret. Thats how they make money. Retail blindly follows them. Bitter truth.

https://twitter.com/dhavalp/status/785871509092990976

This company Balkrishna Paper is making cash loss. How does one explain the current spike in prices?

Bull market gives chance to every sector to spurt!