Novice investors fearful; Expert investors bullish

A savage stock market crash, such as the one seen on the occasion of NAMO’s surgical strike of demonetisation, always separates the men from the boys.

One could see that while novice investors like you and me were cowering in fright at the merciless destruction of our wealth, the experts were fearlessly roaming the streets, their pockets bulging with cash, looking for bargains to buy.

As always, Porinju Veliyath was at the forefront, sending out a barrage of inspirational tweets and coaxing his army of followers to come out of their storm shelters and be brave.

Two Weeks Pain, Two Decades Gain!

Guys, are you ready? #BullishOnIndia— Porinju Veliyath (@porinju) November 10, 2016

Yet to invest in equities? Opportune time to build a Portfolio. Focus on beaten-down stocks, Good Biz affected temporarily by DeMonetization

— Porinju Veliyath (@porinju) November 17, 2016

Rare opportunity to value invest in Indian equities, with long term earnings visibility and identifiable near-term set-back!

— Porinju Veliyath (@porinju) November 18, 2016

"OMG, I missed it" – will be the expression of many people after 2-3 months, looking back at today's prices of many small & mid-caps!

— Porinju Veliyath (@porinju) November 22, 2016

Planning invest in Indian equities, better start before the 'Budget Rally' market talk. If you are fully invested, just go on holidays!

— Porinju Veliyath (@porinju) November 28, 2016

This time, Porinju was not alone. He was accompanied by other knowledgeable investors who rightly recognized that the crash in the stock market would be short-lived and presented a rare opportunity to buy stocks at a discount.

India will witness Biggest BULL market in coming days

Those who have sold shares will never able to buy them at lower rate

Buy domestics— Rishi Bagree (@rishibagree) November 24, 2016

1 year from now investors will look back at today's stock prices and realize that demonetization presented a great opportunity.

— Rajat Sharma (@SanaSecurities) November 18, 2016

In 2020 when you are looking at 15 Nov 2016, it will look like a very small dip in the markets!

— Vijay Pahwa (@Wealth_Park) November 16, 2016

I am putting some money in midcap funds today, will buy more if market falls more. (Since I cannot have direct stock exposure)

— Anuj Singhal (@_anujsinghal) November 16, 2016

Young investors should rejoice. They will get more shares for their savings at the end of the month. Many are worried instead 🙂 🙂 🙂

— Vijay Pahwa (@Wealth_Park) November 15, 2016

Stocks fallen the most and where valuations are looking reasonable. Good cos ONLY for fundamental investors. pic.twitter.com/Fbw5CBYs1W

— Varinder Bansal (@varinder_bansal) November 23, 2016

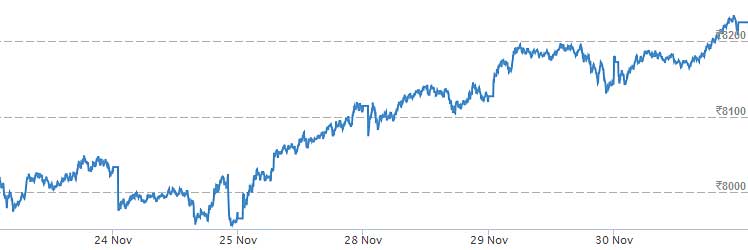

Mega Gains gush in as worries recede

The inspirational messages by the knowledgeable investors had the desired effect. As the novice investors warily looked up from their bunkers, the markets picked up speed and posted hefty gains.

Understandably, the expert investors couldn’t resist patting themselves on the back.

Nifty Up by 200 points and Sensex by 700 points since this tweet

All negative news has been discounted

Shorters will be trapped badly https://t.co/StcAOQQDSI— Rishi Bagree (@rishibagree) November 29, 2016

Anyone got that feeling already? https://t.co/asDFW3Jc3c

— Porinju Veliyath (@porinju) November 29, 2016

2 weeks and everything is up over 20%!! https://t.co/V2GaUTiw11

— Rajat Sharma (@SanaSecurities) November 29, 2016

NBFCs we bought on 15th Nov are on a roll! https://t.co/KVL4BsXTdr

— Vijay Pahwa (@Wealth_Park) November 29, 2016

Revisiting

Ramkrishna Forging up 12%

Satin Credit up 8%

Jet Airways up 5%

Manppuram up 7%

Shriram Transport, Granules up 3% https://t.co/RuXNTco1p2— Varinder Bansal (@varinder_bansal) November 23, 2016

Top Ten stocks to buy

At this stage, we have to compliment Porinju because while the other expert investors were content with giving abstract advice, Porinju was moved by the plight of novice investors who reached out to him for help.

@porinju Can we have an idea on what stocks to go for? We are the calves in the bull market

— GOPAL IYER (@BEALOTUS) November 18, 2016

Porinju recommended the following nine stocks.

Nifty7929

Godrej Ind 373, Jet 348, HSIL 288, IRB 189, Fed Bank 67, Godrej Prop 290, Wockhardt 693, Century 682, MCX 1219 – some solid biz..— Porinju Veliyath (@porinju) November 22, 2016

Practice what you preach

Porinju acted on his own advice. He rushed to Dalal Street on 23rd November to buy 200,000 shares of Sunil Hitech Engineers Ltd in the names of Shilpa and Sunny Veliyath. Later, he also bought a chunk of 90,000 shares in the name of Equity Intelligence, his PMS. The total investment in Sunil Hitech is about Rs. 4.93 crore.

Let’s take a quick look at the ten stocks recommended by Porinju

| Stock | CMP (Rs) | YoY Gains (%) |

| Godrej Ind | 391 | 0.35 |

| Jet Airways | 398 | (22) |

| HSIL | 294 | (3) |

| IRB | 187 | (28) |

| Federal Bank | 71 | 20 |

| Godrej Prop | 301 | (9) |

| Wockhardt | 700 | (56) |

| Century | 808 | 38 |

| MCX | 1216 | 40 |

| Sunil Hitech | 202 | (35) |

As one can see, Porinju has chosen his stocks in a sensible manner. There are four aspects worth noting from the selection of stocks.

The first is that all the stocks are well known names, with proven business models and reputed managements. So, there are no nasty surprises expected to arise.

The second is that most of the stocks are presently in the doldrums. Out of ten stocks, seven have given a negative return over the past one year. This implies that the expectations from the stocks are low and the risk of a downside is low.

The third is that Porinju has cleverly mixed up the stocks so that they represent different sectors. The selection has representatives of the FMCG, airline, sanitary ware, infra, Bank, real estate, Pharma, textiles, commodities trading and engineering sectors in it.

It is a perfectly balanced portfolio, designed to withstand the perils of demonetization.

The fourth is that none of the stocks (except, perhaps, Godrej Industries) involve customers paying in cash. So, the so-called ‘cash crunch’ that the economy is presently witnessing is unlikely to adversely affect the earnings of these companies.

Even in the case of Godrej Industries, the adverse impact of the cash crunch may have already been priced in and so there may not be further incremental damage.

Best case scenario for buying stocks

We have to also bear in mind the inspirational message offered by Kenneth Andrade a few days ago about how the demonetisation is a “huge positive” and “the best case scenario” to buy stocks. Andrade has conducted a masterful analysis of the situation and explained precisely what benefits will accrue due to demonetisation.

Conclusion

The bottom line is that we have to take a cue from the expert investors and load up our portfolio with top-quality stocks when they are available at rock-bottom prices. Then, when the economy stabilizes and demonetization becomes a distant memory, we will be able to bask in great riches!

Porinju saar is the rajnikanth saar of the stock market. Once he says something it is like he has said it a thousand timesss. Market goes up when he tells it to go up

seems like a good mix of stocks

No doubt i appreciate porinju .he is a whiz kid investor.. But having a luk at the stock picks it does not feel lik compelling investment. Comparing it with raamdeo agrawal ,ramesh damani ,prof sanjay bakshi style of picking stock where the important focus is on quality n growth, management pedigree, are always to look for. Myself with blind eye suggest investors to follow them makes more sense.

#Nivezareview :

Due to recent domenetisation and other global events the markets have corrected in last 2 weeks. However the effect of this demonetisation will slow down the overall business for 1-2 months only and post that the things will be normal again for organised players. But due to fear and panic some of the small and mid caps have corrected more than 30-40% in last 2 weeks, this gives good investment opportunity for long term players. The stocks from realty space such as Godrej properties, Sunteck Reality, Brigade Enterprises are strong fundamental stocks and they will emerge out of this all demonetisation so investors can look to buy into them. Banking names such as ICICI, SBI Federal bank are good buy here.

Long Term Investment

Thank you for the valuable information. But right now I am confused with one stock that is SUNIL HITECH. Before 1 month I go through it and I find that one of the promoter of Sunil Hitech is selling her stake since last couple of month and till date she had disposed all her take and it was appx 10% !. So kindly guide me regarding this that why promoter reducing 10%. Thank you

What happened to Porinju???

These are well known names in stocks are not his usual style…

Sunil hitech is at price of 11.13 while here you have mentioned CMP at 202 please correct it.

Bcz its undergone ex-bonus (1:1) and ex-split on the 2nd dec and he posted this article on 30th, So… just check it frnd.

MCX definitely is one of the best bets for now.